Reforming the Constitution to Reduce Government Debt: Creating A Balanced-Budget Rule In France

The Proposed Balanced-Budget Rule

This document proposes to include in 2010 a balanced-budget rule in the French Constitution and in the LOLF (Loi Organique relative aux Lois de Finances, the quasi-constitutional framework that governs the French national budget process). The rule is inspired by that adopted by Germany in 2009.

In essence, this means:

- A constitutional obligation to vote a balanced budget bill (on a structural basis, i.e. excluding the cyclical component), starting with the 2018 budget, with deficit reductions to be phased in as of 2011. A variant to the rule enshrines the possibility of preserving “investments in the future” and “climate investments” (at 1 to 2% of GDP), without altering the obligation to balance the budget.

- A constitutional obligation to vote a balanced budget (on a structural basis) for the social-security budget, starting in 2013.

- For local-authority budgets, a procedure is proposed to deal with excessive debt and to restructure excessive debt, along the lines of similar mechanisms in place for heavily indebted companies. This procedures draws from the Chapter 9 of the US bankruptcy code that deals with local government debt.

- A Budget Committee (either independent or attached to the Parliament) or the National Audit Office (Court of Accounts) will be in charge of estimating structural balances, as well as determining the macroeconomic scenarios underpinning the central-government and social-security budgets. This Budget Committee will also assess the long-term path of the budget deficit and of government debt, as well as general-government off-balance-sheet debt. The Parliament will debate these various projections and scenarios.

- If the budget is executed in deficit (i.e. if a deficit appears in the implementation of the budget), this deficit will be amortised in budget bills of the subsequent years. The same goes for the social-security budget.

- There are exceptions to the balanced-budget rule: during recessions; in the event of exceptional circumstances; if are implemented structural reforms that reduce off-balance-sheet debt (such as pension reform) or increase potential growth; in case of investments in financial assets; and if government debt falls below 40% of GDP.

Why should a rule of this nature be adopted? The dominant strategy in France has been, over the last 30 years, to make future generations pay today’s tax cuts or public expenditure. The main justification for a balanced-budget rule is to save future generations from having to shoulder such a debt burden, on top of the ‘climate’ debt they will inherit. Without a rule of this nature, France will not be able to restore its public finances to health. It will be very difficult for France to maintain its financial credibility without a major budgetary consolidation, at a time when Germany has adopted a similar rule.

The Proposed Balanced-Budget Rule

A balanced-budget rule shall be included in the French Constitution and in the LOLF (Loi Organique relative aux Lois de Finances, the quasi-constitutional framework that governs the French national budget process), in 2010. The rule would work as follows:

An article of the following type would be added to the Constitution:

“A constitutional law caps the general-government deficit, adjusted of the business cycle [i.e. the maximum structural deficit].”

Or alternatively:

“A constitutional law determines the conditions under which general-government budgets are balanced, adjusted of the business-cycle [i.e. structural balance].”

The LOLF would exhibit details of the budget rule with the following articles:

[§ 1 to § 4: definition of the balanced-budget rule]

- 1 )Balancing of the central-government budget: “As of [2018], the central-government budget must be voted at least in balance. The notion of balance is defined excluding the business cycle component.”

- 1b )A new heading is created for the budget law: “investments in the future”, which benefits from the asymmetrical fungibility of the headings of the LOLF.”

“The heading ‘investments in the future’ represents at least Y% of GDP [where Y ≈ 1 to 2% of GDP].”

- 2 )Balancing of the social-security budget: “As of [2013], the social-security budget must be voted at least in balance. The notion of balance is defined excluding the business cycle component.”

- 3 )Balancing of local-authority budgets: “Local authorities may only contract debt to fund investments.”

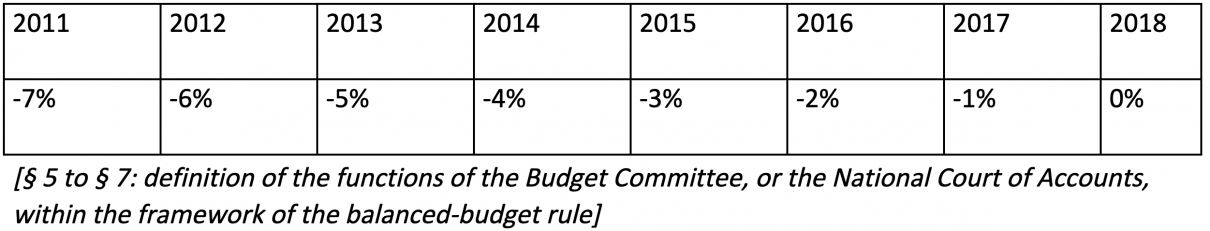

- 4 )Transitional arrangements: “From [2011 to 2018], general-government deficits (central government + social security), adjusted of the cyclical component, expressed as a percentage of GDP, are capped at: [broken down between the central-government and social-security budgets]

- 5 )“A Budget Committee (either independent of or attached to Parliament) or the National Court of Accounts shall provide the government, for the current year and for the subsequent years, with an estimate of the level of GDP and government deficits, both in nominal terms and adjusted of the business cycle component. It also provides the other economic assumptions [inflation, etc.]. The government uses [or examines] these estimates as assumptions in framing the central-government and social-security budgets, as well as its stability programmes.”

- 5b )“The Budget Committee (or the NationalCourt of Accounts) gives its opinion on the breakdown and the amount proposed under the heading ‘investment in the future’ in the central-government budget.”

- 6 )“The Budget Committee (or the National Court of Accounts) proposes solutions aimed at achieving the goals laid down in § 1 to § 4. The Parliament examines the proposed solutions during the annual budgetary framework debate.”

- 7 )Official and off-balance-sheet debt: “The Budget Committee (or the National Court of Accounts) provides, every year, the Parliament with long-term public-debt projections. It also provides an estimate of the amount of general-government off-balance-sheet commitments and receivables on an annual basis. The Parliament examines these estimates and projections during the annual budgetary framework debate.”

[§ 8 to § 10: action in case of deficits in the execution of Finance bills]

- 8 )Amortisation: “Should a deficit appear in the execution of the budget, it shall be recorded in a control account within the central-government budget. When the accumulated deficits, computed on the control account, total more than [1%] of GDP, amounts above this ceiling are amortised over the subsequent [5 to 10] years.” [Alternative text for the end of § 8: “[…] are amortised over a period determined by the Budget Committee (or the National Court of Accounts).”

- 9 )“Should a deficit appear in the execution of the social-security budget, it shall be recorded in a control account within the social-security budget. When the accumulated deficits, computed on the control account, total more than [0.5%] of GDP, amounts above the ceiling of [0.5%] of GDP are amortised over the subsequent [5 to 10] years.”

[Alternative text for the end of § 9: “[…] are amortised over a period determined by the Budget Committee (or the National Court of Accounts).”

- 10 )Local governments. Excessive-debt procedure. “If a local authority’s indebtedness is deemed excessive by the Regional Court of Accounts, the latter may initiate an excessive-debt procedure, placing the said authority under the budgetary supervision of the state.”

Procedure for debt restructuring. “A procedure for debt restructuring is created [similar to that prevailing for heavily indebted companies]. It applies when the excessive-debt procedure is deemed insufficient by the Regional Court of Accounts. The Regional Court of Accounts carries out the procedure. For the duration of the restructuring of its debt, the local authority is placed under the budgetary supervision of the state.”

[§ 11 to § 14: definition of exceptions to the balanced-budget rule]

- 11 )In case of recession: “The balanced-budget rule (i.e. § 1-4 and § 8-9) does not apply in case of recession and during the N years [N = 2 or 3 in general] following a recession. Cases of recession and the duration of N years are defined by the Budget Committee (or the National Court of Accounts). Deficits accumulated during recessions are amortised, in the central-government and social-security budgets, in accordance with a timetable laid down by Budget Committee (or the National Court of Accounts).”

- 12 )Exceptional circumstances: “The balanced-budget rule for central government (i.e.§ 1, § 4 and § 8 does not apply under exceptional circumstances. [But, the budget rule applies to the social-security and local-authority budgets even in the case of exceptional circumstances.]”

“Cases of exceptional circumstances are approved by Parliament, with a simple majority of the elected Members of Parliament. In such cases, deficits accumulated during exceptional circumstances are amortised in accordance with a timetable laid down by Budget Committee (or the National Court of Accounts) [or are amortised over the subsequent [5-10] years].”

“If cases of exceptional circumstances are approved by Parliament with a qualified majority of [60%] of the elected MPs, the amortisation of deficits accumulated during exceptional circumstances is not mandatory.”

- 13 )Structural reforms and deficits:“If the government implements policies that the Budget Committee (or the National Court of Accounts) deems liable to increase long-term growth [e.g. reform of the labour market, education, higher education and research, major sector reforms] or to reduce general-government off-balance-sheet debt [e.g. significant pension reform], a budget deficit is allowed in the year during which the reform is implemented and in the following year. The Budget Committee (or the National Court of Accounts) publishes an estimate of the impact of the relevant policies; it defines accordingly the acceptable budget deficit in the year during which the reform is implemented and in the following year.”

- 14 )Investments in financial assets are excluded from the calculation of budgetary balances (central-government budget in § 1 and social-security budget in § 2). Investments in financial assets are subject to independent review and assessment on an annual basis.”

- 15 )The balanced-budget rule (i.e. § 1-4 and § 8-9) does not apply when general-government debt is below [40%] of GDP. To this end, general government debt is calculated in accordance with European criteria [i.e. the Maastricht criteria], less financial assets on a mark-to-market basis.

No comments.