Big tech dominance (2) : a barrier to technological innovation ?

Introduction

The big tech cash hoarding : a symptom of a insufficiently competitive environment

From the symptoms to the cause

Market power and anticompetitive practices

Are the tech giants natural monopolies?

Astrong antitrust policy and a new regulatory framework to foster competion and innovation

Adapting antitrust legislation to the realities of the digital economy

Tougher enforcement of competition law

Beyond antitrust: the need for new regulations

General conclusion and recommandations

Appendices

References

Summary

Anti-competitive practices reveal that big tech companies no longer have any qualms about using their dominant position to oust competitors, preventing innovative firms from entering the market and thus consolidating their hegemony at the expense of the rest of society.

A vicious circle is clearly at work, whereby their huge cash reserves highlighted in the first section of this paper increase in proportion to these barriers to competition, while also facilitating them.

This alarming picture hints at the antitrust authorities’ chronic inability to act in a sector whose business models evade their usual analytical framework. Tougher, adjusted competition policy is needed to restore the conditions of an environment that is conducive to innovation in the tech industry. In addition to such changes, the administrative authorities’ resources and powers must be strengthened, as they are too often bamboozled by increasingly technical and complex anticompetitive practices.

. Finally, proactive policies such as measures on interoperability and opening-up of industrial property rights would be useful additions to the antitrust strategy, which is most of the time reactive.

There is a fine line between rewarding past innovators and supporting future innovators. However, it is clear that the laxity shown by the antitrust authorities and the passive approach taken by regulators in terms of devising standards and interoperability frameworks is jeopardizing promising new companies’ prospects. Hence, swift action is required to stop past champions from preventing the emergence of future champions.

The first section of this paper is entitled Big Tech Dominance (1): The new financial tycoons.

A French version of this study is also available on the website of the Foundation for Political Innovation.

Paul-Adrien Hyppolite,

Corps des Mines engineer and graduate of the École normale supérieure.

Antoine Michon,

Corps des Mines engineer and graduate of the École Polytechnique.

All the graphs and tables in this study were developed from the authors’ use of public data. The sources used are: companies’ regulatory statements to the regulatory authority for financial data (in most cases: the Securities Exchange Commission), the Center for Responsive Politics and the European Union Transparency Register for lobbying, the websites of the European Commission, the Federal Trade Commission and the U.S. Department of Justice for antitrust, and the U.S. Patent and Trademark Office for patents.

This text was written in French by Paul-Adrien Hyppolite and Antoine Michon for the Foundation for Political Innovation. The original version is available on our website. This version is a translation, by Caroline Lorriaux and Michael Scott.

For the past two decades, the American tech giants’ extraordinary commercial success has led to a colossal accumulation of cash on their balance sheets. While firms from other industries tend to invest their profits in capital expenditures or redistribute them to their shareholders, the big tech companies have opted to retain a significant portion as cash and marketable securities. In Part 1 of this study, we demonstrated that this is subsequently invested very cautiously, mostly in low-risk public or private bonds. While posturing as first-class innovators, the tech giants are in fact excessively prudent investors. We endeavored to illustrate the adverse effects of a situation that deprives the economy of productive capital, and considered various solutions for tackling this phenomenon. Giving shareholders greater opportunity to influence capital allocation, using financial regulation to monitor how cash is used, or imposing higher taxes on profits or revenues, are possible options in order to slow down the cash accumulation process.

However, before regulating the tech giants’ cash, it is first necessary to examine what we believe to be the root of the problem – namely the source of the profits that fuel them. Although it appears evident that these profits were initially generated by disruptive innovations such as the iPhone in 2007 or the Facebook social network in 2004, the current ecosystem raises more questions. More and more observers argue that a small group of tech companies have gained a collective stranglehold over technological innovation and are seizing an increasing share of added value. While we as consumers tend to experience a slowdown in major innovations, the iPhone has more than doubled in price since its launch ten years ago in 2007 and Facebook is routinely criticized for its scant consideration for users’ data. In this context, one may ask whether big tech’s cash hoarding is the result of less competition in the tech industry or, in other words, the consequence of structural market or government failures that are damaging to consumers.

In response to this question, we will firstly demonstrate that the most established firms of the tech industry, keen to maintain their hegemony, currently abuse their dominant positions at the expense of technological innovation. On this basis, we will examine what adjustments need to be made to antitrust law and its enforcement. Finally, we will highlight that proactive regulations compatible with antitrust policy could play an important role in developing a fair competitive ecosystem for the tech industry.

The big tech cash hoarding : a symptom of a insufficiently competitive environment

From the symptoms to the cause

See P/E ratios in Part 1 Section 1(c).

The tech industry currently exhibits all the symptoms of a significant decline in competitive intensity, namely persistently huge profits (combined with similar profits forecast for the future), a trend for market concentration, and finally a declining business dynamism and entrepreneurial activity.

a.Persistently huge profits.

As we have seen in the first section of this paper, the American tech giants’ profits have been unparalleled over the past twenty years. Moreover, the big tech companies’ current valuations indicate that the markets are expecting these profits to be maintained or even increase in future years1.

The fact that these levels of profitability have been maintained for such a long period might be a first indicator of a decline in competitive intensity in the tech market. Indeed, it is very rare that companies operating in a competitive environment are capable of sustaining such results in the long term due to downward pressure from competitors and new entrants.

b. A trend for concentration.

A second symptom of reduced competitive intensity can be seen in the trend for consolidation that has prevailed within the sector for a decade.

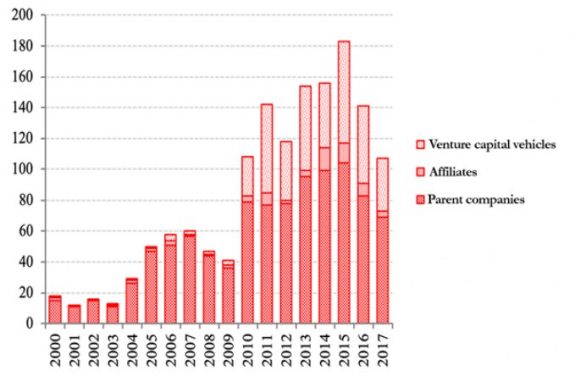

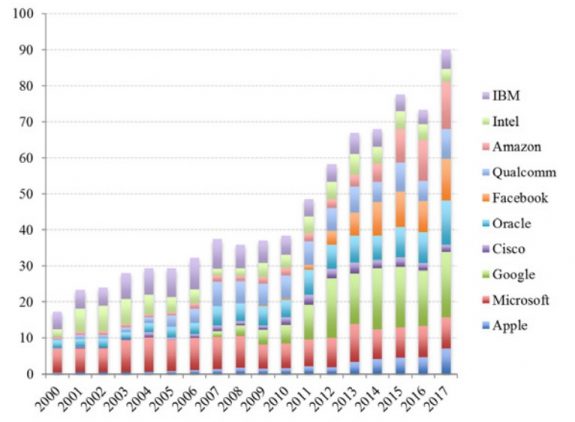

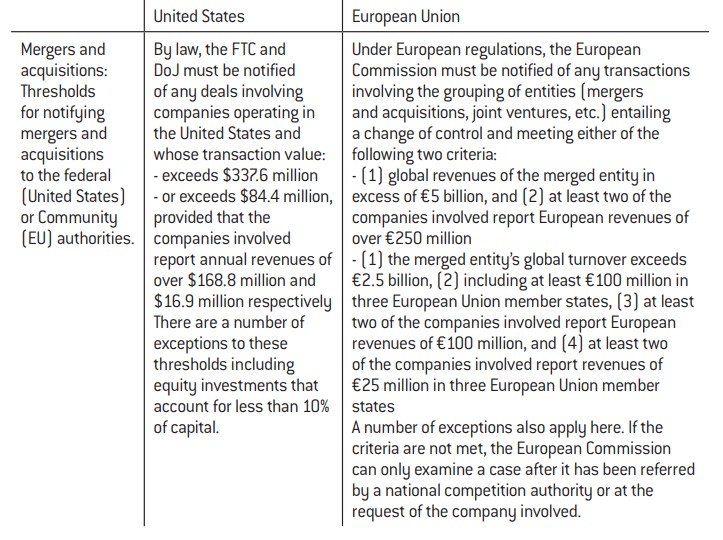

Indeed, it is apparent that the tech giants’ remarkable success over the past twenty years has been combined with multiple acquisitions of relatively young companies. An analysis of data extracted from the Mergermarket specialist platform reveals significant acquisition activity among the big tech companies, which has intensified since the end of the 2010s (see Graph 1).

Graph 1: Acquisitions and minority investments by acquirer type – Top 10 Tech US (number of deals)

© Fondation pour l’innovation politique, November 2018

See the work of Autor et (2017).

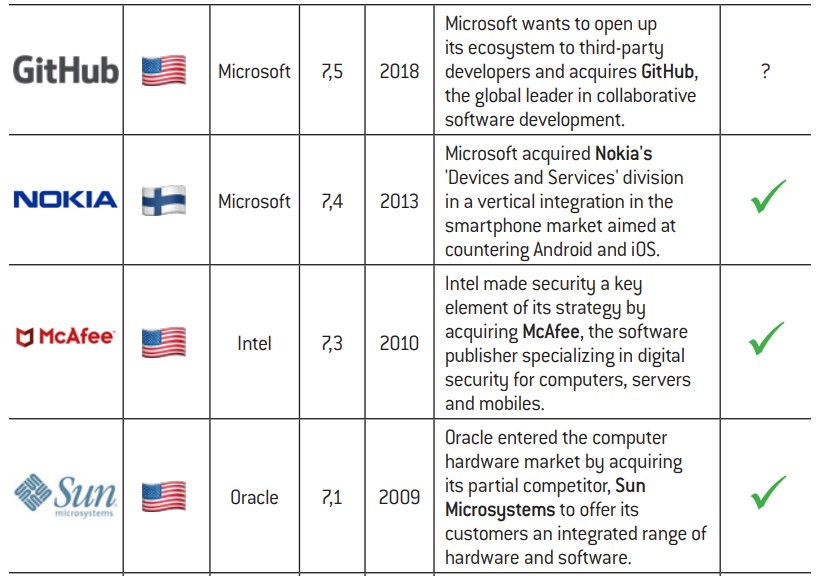

Acquisitions. We will firstly consider acquisitions resulting in takeovers of third-party companies by any of the big tech firms.

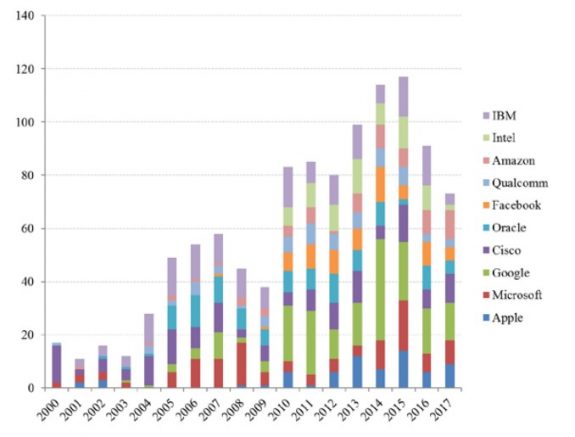

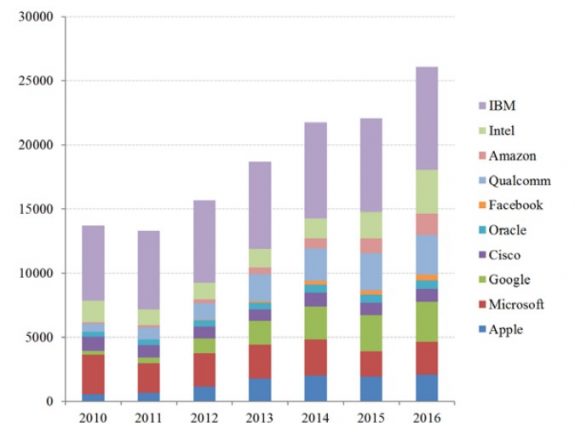

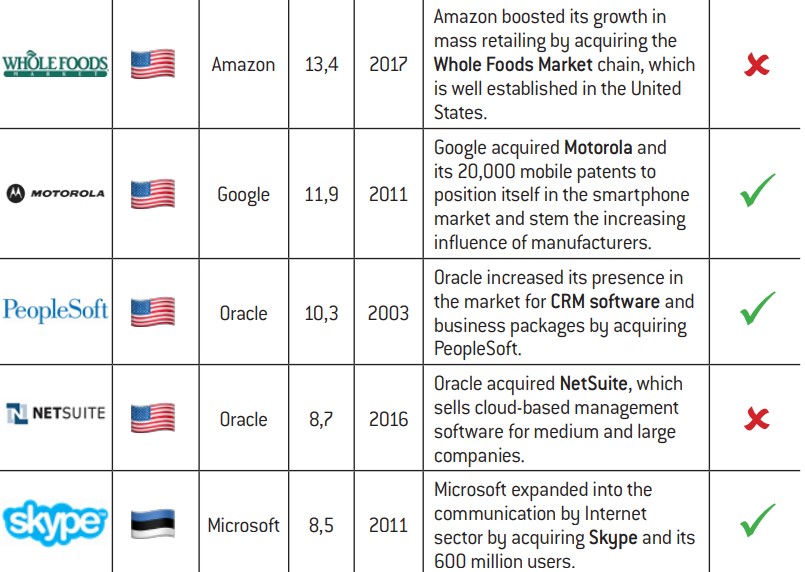

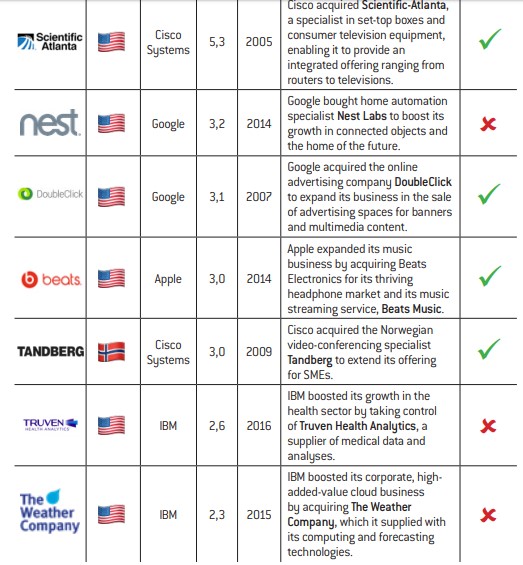

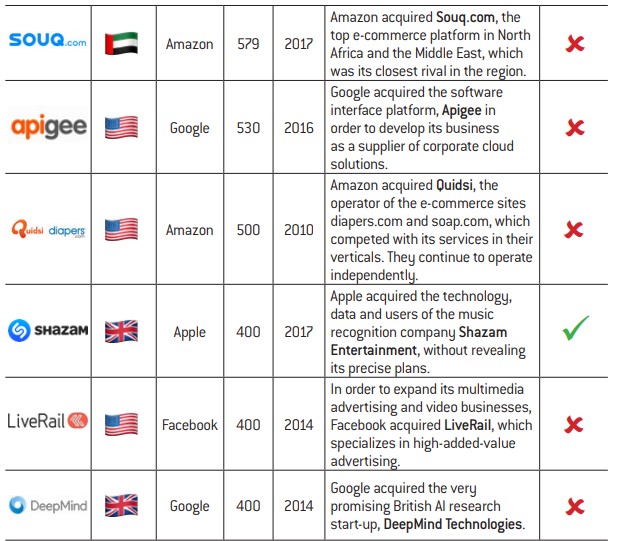

As indicated in graph 2 below, all the tech giants without exception have contributed to the process of consolidating the sector – each of them has performed over ten acquisitions on average per year since the start of the decade. A closer examination of these transactions reveals that the tech giants very frequently acquire new companies operating in similar or adjacent markets to their own (see Tables 2(a) and 2(b) in the appendices). This model was initiated by Google with the acquisitions of YouTube (2006) and Android (2007), followed by Amazon with Zappos (2009), Quidsi (2010) and Souq (2017), and Facebook with Instagram (2012) and To Be Honest (2017). Such consolidation also occurs at later stages in target companies’ development. Examples of this include the acquisition of WhatsApp by Facebook in 2014, Tandberg by Cisco in 2009, Skype and LinkedIn by Microsoft in 2011 and 2016 and Beats by Apple in 2014. The curve showing the sums invested in acquisitions shows that this phenomenon has gained momentum in recent years (see graph below). Whether in terms of ‘small’, strategic acquisitions or takeovers of more mature companies, the same observation applies: the tech industry is in the grip of increasing horizontal consolidation2.

Graph 1: Acquisitions and minority investments by acquirer type – Top 10 Tech US (number of deals)

© Fondation pour l’innovation politique, November 2018

Graph 3: Acquisitions by parent companies and affiliates in billions of dollars (US)

Copyright :

© Fondation pour l’innovation politique, November 2018

In parallel with these transactions conducted within their respective markets, the tech giants also focus their attention on promising technologies in radically new segments that are likely to jeopardize their domination by disrupting their markets and creating new verticals with high added value. Facebook’s acquisition of Oculus in 2014 is one such interesting example. Having transitioned extremely successfully from Internet on computer to Internet on smartphone, the social media operator decided very early to position itself in the virtual reality market to avoid missing out on a potential new trend. Google’s acquisition of DeepMind in 2014 was based on the same logic, with the company from Mountain View seeking to acquire talent and technologies related to artificial intelligence at the earliest possible opportunity, given that this could soon revolutionize the way we perform online searches.

Overall, an analysis of acquisitions performed by big tech companies in the past twenty years provides us with a glimpse of a recurrent tactical pattern. The tech giants acquire new companies that challenge them in their respective markets, with a view to taking over their customers, technologies and staff. In addition to these horizontal consolidation acquisitions, the big tech firms acquire highly innovative companies in burgeoning tech segments, thus securing access to promising new verticals in the sector.

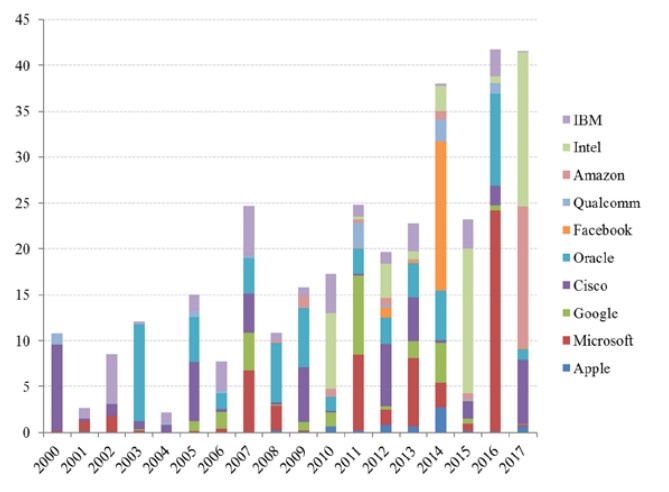

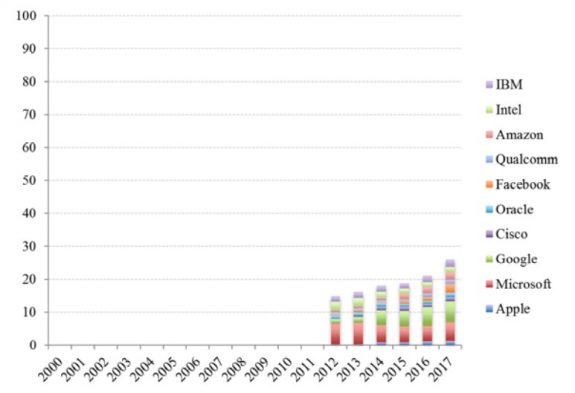

Venture investments

In addition to these takeovers, they also make minority investments mostly through their internal venture capital vehicles3. As the graph below shows, these are very frequent and their momentum increased considerably at the start of the last decade. We believe that this process is part of big tech companies’ efforts to monitor technological innovations. Anxious not to repeat their predecessors’ mistakes4, they secure special access to innovation through these investments. Consequently, they are able to closely monitor the emergence of any promising new technology from the earliest stages.

Graph 4: Minority investments by in-house venture capital vehicles (number of deals)

©Fondation pour l’innovation politique, November 2018

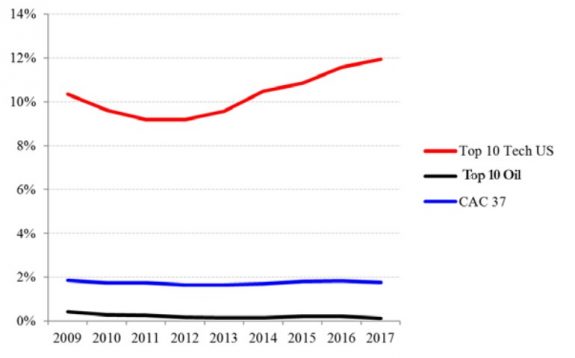

These venture investments supplement internal R&D work, which is carried out on a colossal scale. Indeed, the tech giants’ R&D spending ratios are five to six times higher than those of traditional industries (see the graph below). The strategy employed here is the same as that used to guide external investments: while allocating part of their R&D to their core business, the big tech companies also run research departments focused on completely new verticals. Examples include the Google X laboratory that notably worked on driverless cars (Waymo) and augmented reality (Google Glass) and Facebook’s defunct Aquila project aimed at developing a solar-powered drone.

Graph 5: Comparison of R&D expenditure in percentage of revenues

© Fondation pour l’innovation politique, November 2018

In particular, we recommend reading the excellent articles ‘Corporate America Hasn’t Been Disrupted’ (B. Casselman, FiveThirtyEight, 8 August 2014) and ‘Why Start-ups Are Struggling’ (J. Surowiecki, MIT Tech Review, 15 June 2016).

‘Waze Employees Clinch Most Lucrative Exit in Israeli History’, Teig, Haaretz, 13 June 2013.

Quoted by TechCrunch in ‘Facebook buys Vidpresso’s team and tech to make video interactive’ (J. Constine, 13 August 2018): ‘We will not be selling the company unless some insane WhatsApp-like thing We are building a forever biz, not a flip.’

‘After the End of the Start-up Era’, Evans, TechCrunch, 22 October 2017.

Venture investments contribute to the major consolidation of the tech sector, which has already been observed in terms of the big tech companies’ numerous acquisitions. In addition to the concentration of the businesses themselves, we want to shed light on the massive concentration of innovative capacity. Innovation is centralized within the hands of a very small group of companies which have secured a stranglehold over future technologies and markets through their R&D expenditure, venture investments, and acquisitions of current or emerging competitors.

After the big tech companies’ persistently huge profits, this growing market concentration is a second sign of reduced competitive intensity in the sector. It is worth noting the clear vicious circle that exists between these two processes, in that the concentration of innovation helps maintain abnormally high profits, while these earnings enable tech giants to acquire any emerging competitors or promising technology.

b. Declining entrepreneurial drive.

In France, which dreams of being a start-up nation and looks to Silicon Valley with envious eyes, declining entrepreneurial drive in the American tech sector may seem an odd idea. Nevertheless, it is in fact lamented by many observers5 and also documented by an increasing number of academic publications (in particular, see Haltiwanger et al. or Decker et al., 2014). We consider this to be a third sign of decreasing competitive intensity in the tech industry.

While the number of new, innovative companies entering the market and opportunities for ‘scaling up’ have objectively decreased, fewer entrepreneurs seem motivated by the prospect of outstanding success or possessed with what the Americans refer to as ‘moonshot thinking’. Where many entrepreneurs once dreamed of creating a ‘21st century Microsoft’, a growing proportion now seem more interested in a lucrative acquisition by a tech giant. This point is illustrated by abundant examples. When Google took over Waze in 2013, $120 million were distributed to the Israeli start-up’s one hundred employees. The media did not miss the opportunity to emphasize how much money these young developers had made6. The recent case of Facebook’s acquisition of Vidpresso is a further example. Although the start-up specializing in interactive videos had stressed the importance of its independence to its employees scarcely two years ago7, the opportunity of a lucrative buyout by the giant from Menlo Park ultimately outweighed their initial objective.

Consequently, the chances of a new tech giant emerging to overturn the established order of the big tech firms appears extremely remote. After the boom of companies focused on computers (Apple, Microsoft, IBM, Intel, Qualcomm, etc.), the Web (Google, Amazon, Facebook, AirBnb), and smartphones (Uber, Instagram, WhatsApp, Snapchat), it is unclear whether new tech titans will emerge in the coming years. Indeed, as some observers8 have quite rightly pointed out, the technologies that are currently considered most promising for the next decade are not really conducive to the emergence of new tech giants. Indeed, they all present significant barriers to entry: driverless cars (huge R&D expenditure), virtual or augmented reality (ditto), artificial intelligence (big data required), drones (small margins that are difficult to sustain for new companies), Internet of things (ditto).

Market power and anticompetitive practices

A further key difference lies in the existence of a mechanism in European competition law for tackling anticompetitive State aid within the European Union internal This mechanism notably enabled the European Commission to order Apple to pay back €13 billion to Ireland in 2016. In this study, we will refrain from conducting a more in-depth analysis of this component, which is specific to competitive distortions within the EU.

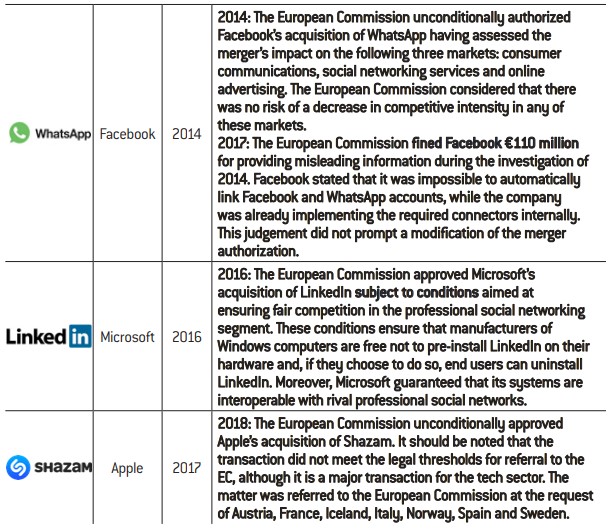

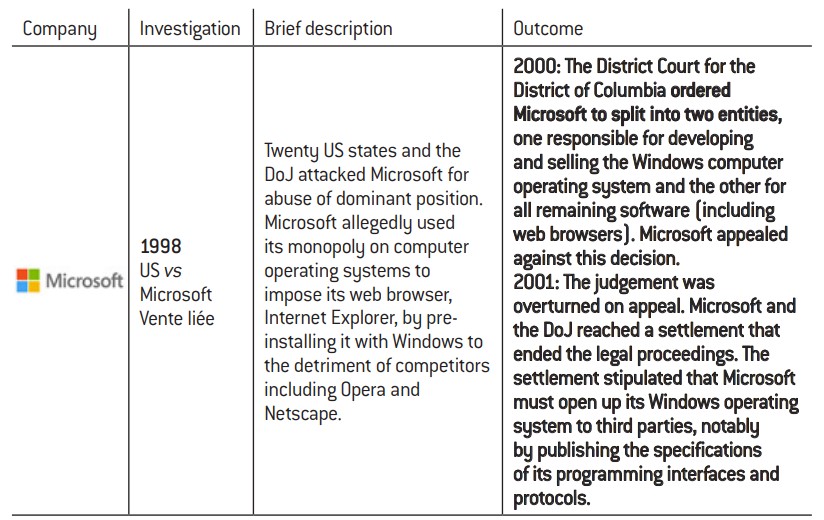

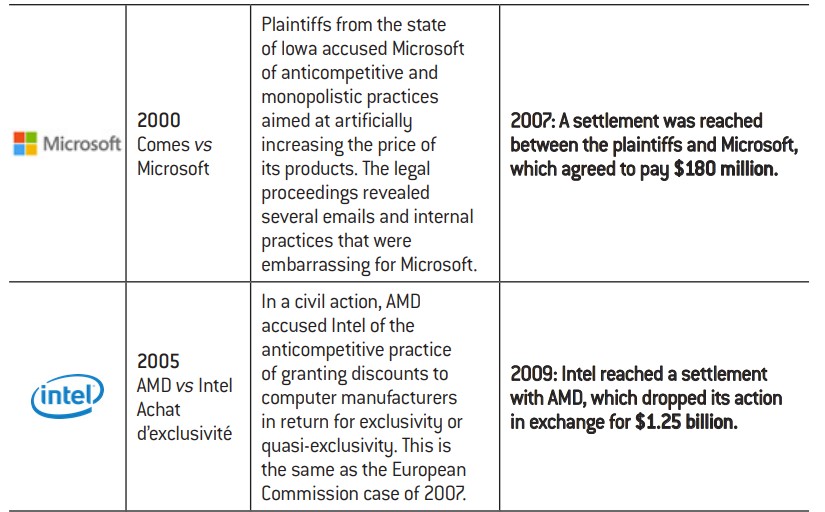

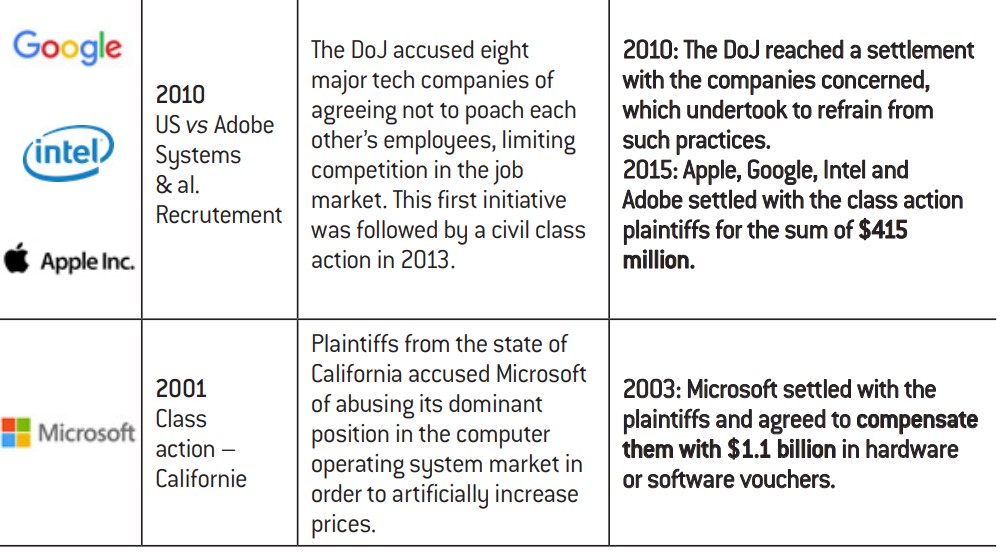

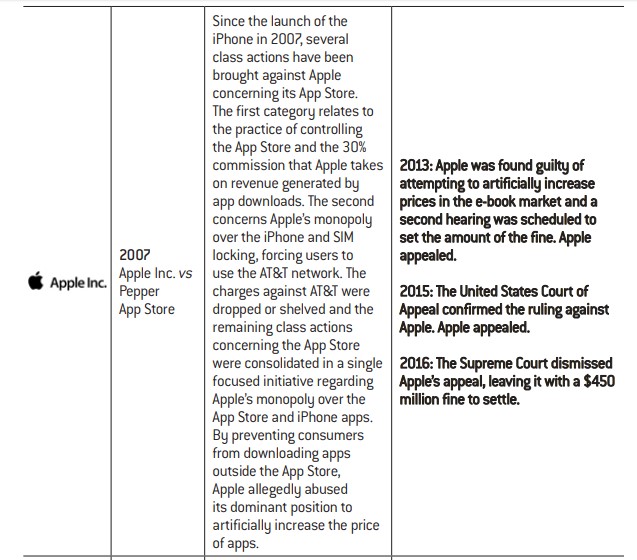

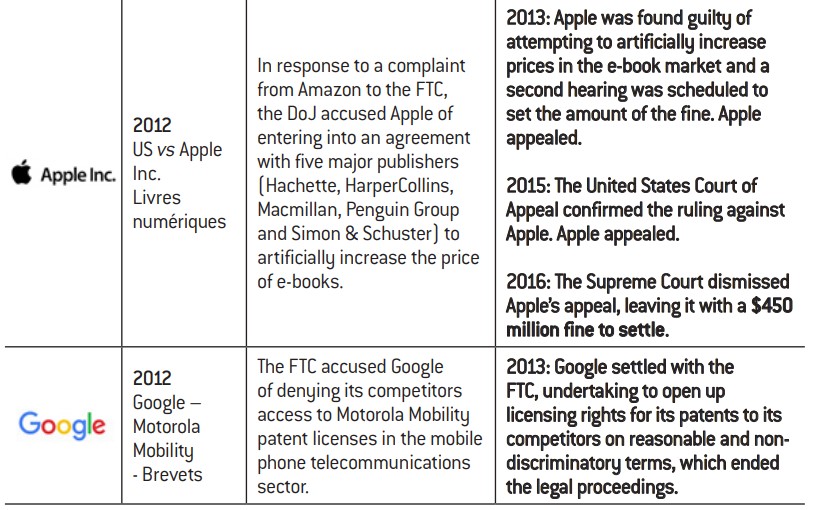

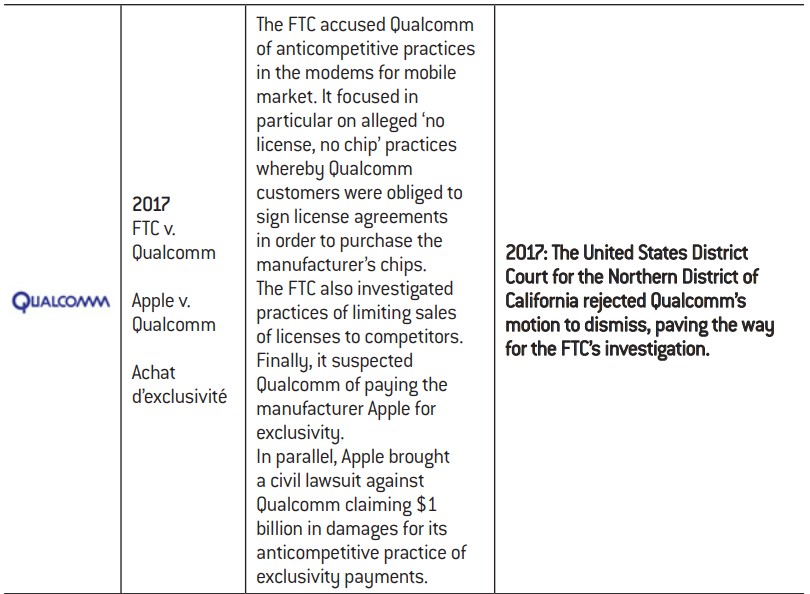

For further evidence of this, readers should refer to the selection of key European and US antitrust cases concerning big tech companies in the past twenty years presented in the appendices.

‘Amazon Doesn’t Just Want to Dominate the Market—It Wants to Become the Market’, Mitchell, The Nation, 15 February 2018.

‘Yelp’s CEO makes the case against Google’s search monopoly’, B. Lee, Vox, 3 July 2017.

The American data are provided by the Center for Responsive Politics, a non-profit organisation based in Washington (DC) that monitors the use of money in politics through an online open-access database (opensecrets. org). The lobbying expenditure listed in it is all sourced from the Senate Office of Public The European data are taken from the lobbyfacts.eu website, which draws on the archives of the European Union Transparency Register. Unfortunately, the data go back no further than 2012.

We have noted that the tech industry shows signs of reduced competitive intensity. We will now shed light on what this consistent evidence points to – namely the fact that the American tech giants have acquired dominant positions, which they now use to hamper competition.

a. Huge market shares.

Dominant position and tech industry.

A firm is in a dominant position if it has ‘market power’ and is therefore able to fix its prices rather than have them imposed by general market conditions.

Market share is generally a good indicator of such power. Unfortunately, the notion of ‘market share’ is sometimes difficult to define in the tech sector, especially where services are provided to users free of charge and revenue is generated by connected value propositions or third parties. For instance, performing searches with the Google search engine or setting up a profile on Facebook’s social networks costs users nothing (financially speaking) as these companies are remunerated by advertisers who use their media to post online ads. How can the notion of a market be conceptually defined if there are no financial transactions or price variations? Should we speak in terms of an online search, social media, or user data market? To further complicate things, is there an ‘online attention’ market that measures the proportion of time spent by users on each service?

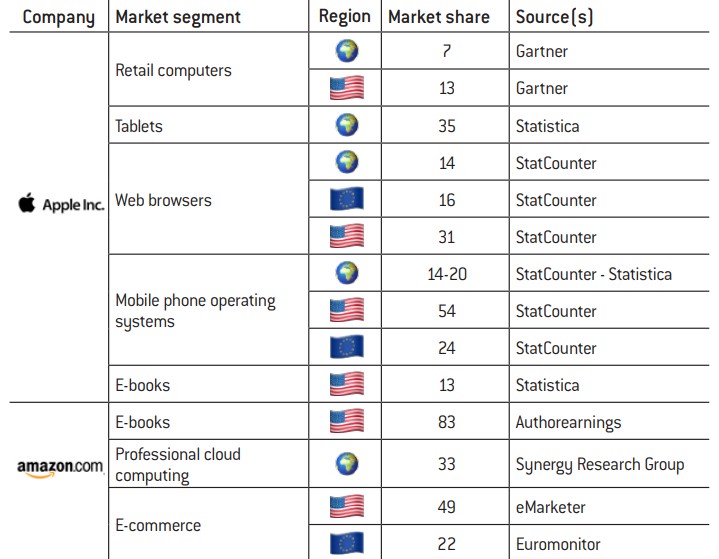

Big tech market shares.

Despite the conceptual difficulties raised by these questions, a pragmatic approach currently appears necessary. In its decision on the ‘Google Shopping’ case, the European Commission considered that an online search market exists and as such concluded that Google abused its dominant position in this market. In the same spirit, Germany amended its antitrust law in 2017 to take account of any connected usage of different services and the transfer of costs and profits between these (we will return to this later) when examining dominant positions.

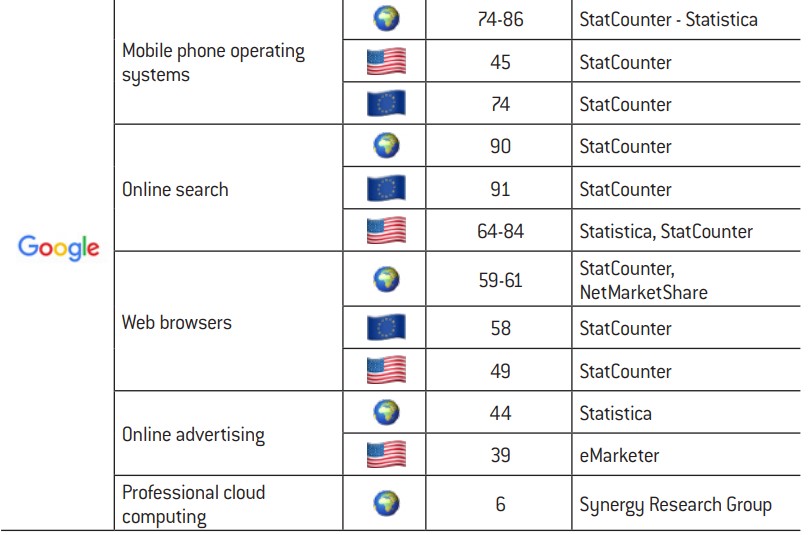

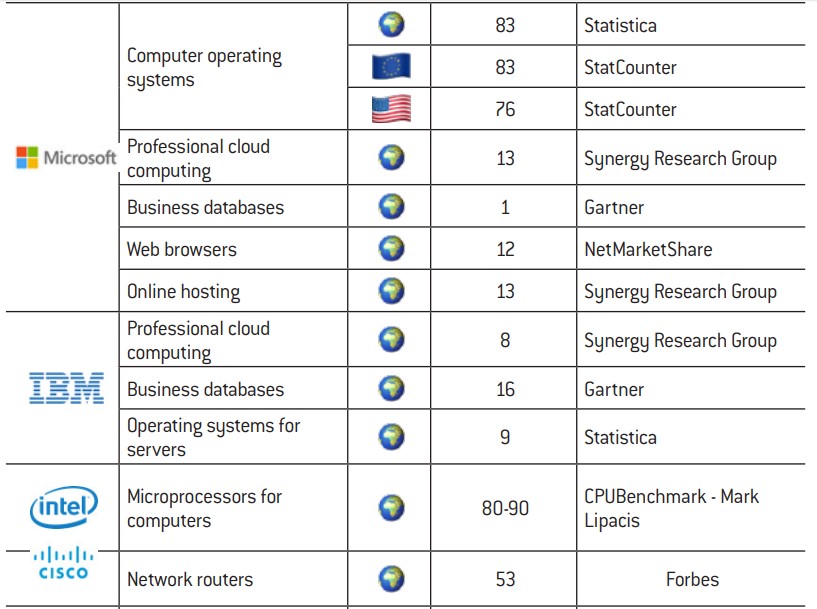

We have also opted to take a pragmatic approach to the notion of markets by basing our analysis on other factors than revenues. The data that we collected are presented in Appendix 2 (c). Market shares quoted by different sources vary as they are difficult to assess. Nevertheless, a general picture indisputably emerges of big tech companies holding ultra-dominant positions on a number of technologies and related businesses. The numerous examples of this include Google’s supremacy in online searching in Europe (90% market share), Microsoft’s global domination of operating systems for computers (80% market share) or Amazon’s hegemony on e-books in the United States (83% market share). As a guideline, the European Commission considers market share of over 40% to be a potential indicator of a dominant position, while the DoJ suspects businesses with a market share of 50% or above of holding monopolies. Beyond the static figures, it is worth also considering their dynamics. For instance, Google and Facebook absorb together around 90% of the growth in the US online advertising market9.

b. Anti-competitive practices.

The big tech companies’ dominant position entails a major risk of them using their supremacy to hamper competition in their markets. This leads us to the field of antitrust regulation, a branch of law aimed at ensuring that fair competitive dynamics are maintained in the market economy.

Proven abuses of dominant position. Big tech companies have crossed swords with the European and US competition authorities more than once. Before examining these legal battles, we will take a moment to discuss the differences between European and US antitrust laws.

In both Europe and the United States, antitrust law encompasses the laws of member states (or US states) and Community law (or federal law). The system on both sides of the Atlantic is based on two main tenets.

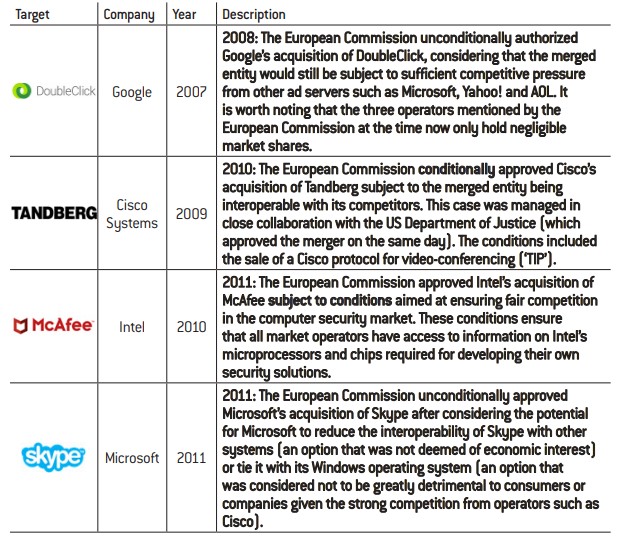

Upstream, the competent authorities monitor mergers and acquisitions. By law, they are entitled to prohibit or conditionally authorize deals likely to threaten the competitive balance of a market. To take an example from the tech industry: the European Commission ordered Intel, during its acquisition of McAfee in 2011, to guarantee free access to its chips’ security specifications after the merger. The aim was to prevent McAfee from benefiting from information that was inaccessible to its competitors, which would have directly distorted competition in the computer security market. In 2010, during the buyout of Tandberg, the European Commission ordered Cisco to sell its ‘TIP’ protocol in order to limit the resulting merged group’s control over video-conferencing technologies.

The second, downstream tenet is antitrust in the strict sense, namely tackling concerted practices, cartels, abuses of dominant position or other anticompetitive practices. Under this principle, the authorities are able to impose fines as a penalty for any violations and a deterrent against breaking antitrust rules. They can also order any necessary action for restoring fair competition in a market. Examples include the decisions to break up the Standard Oil in 1914 in the US or split Microsoft in 2000 (which was overturned on appeal in 2001).

In the EU, mergers and acquisitions are examined and anticompetitive practices tackled through administrative decisions, while in the United States, the authorities (FTC or DoJ) or individuals bring antitrust cases before the civil or criminal courts10. Appendix 2 (d) provides a more comprehensive overview of the specificities of European and US antitrust law.

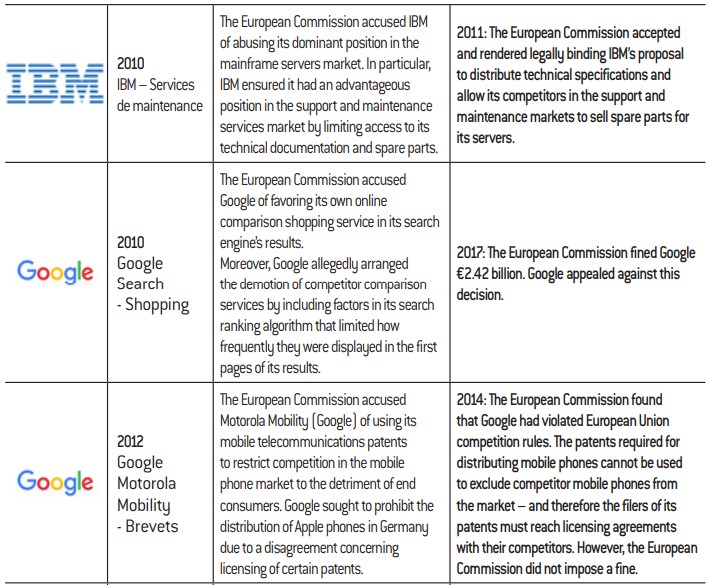

We have examined all antitrust cases involving the tech giants at Community level in the European Union and at federal level in the United States. Readers seeking a comprehensive overview should refer to Appendices 2(e), 2(f) and 2(g). In Europe, there have been increasingly frequent administrative decisions penalizing big tech companies for anticompetitive practices since 2014, the year in which the current European Commissioner for Competition, Margrethe

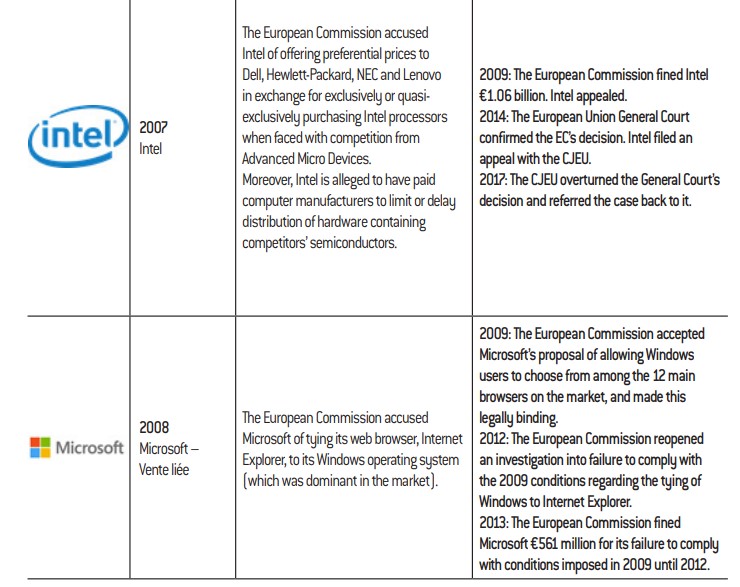

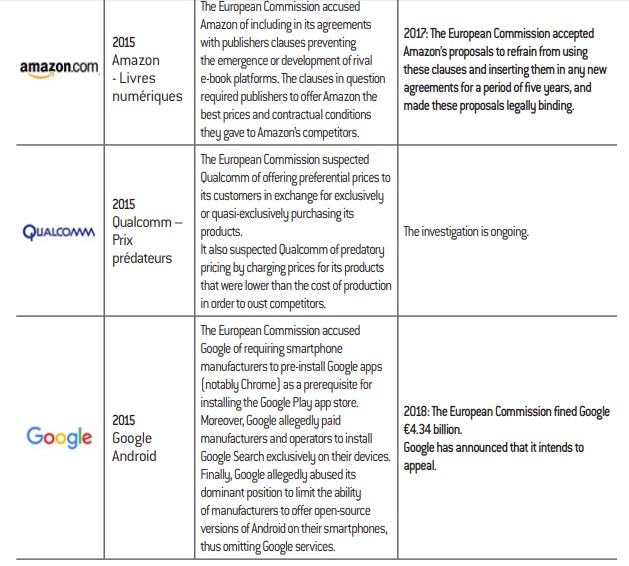

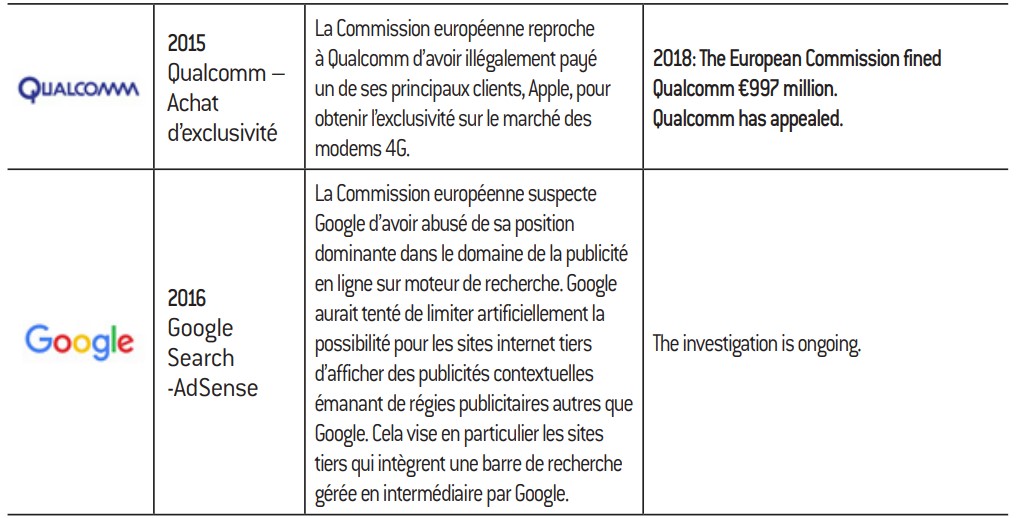

Vestager, took office. Google has been faced with a series of actions, which have regularly made the front pages. The company from Mountain View was first fined €2.42 billion in 2017 for favoring its own online comparison shopping service on Google Search over rival services. Then, in 2018, the European Commission fined Google €4.34 billion for anticompetitive practices concerning its licenses for the Android mobile operating system. The company required smartphone manufacturers to pre-install Google applications as a condition to be granted a license for the Google Play app store. Far from the spotlights and public attention, the tech giants have also been called out by the European Commission for anticompetitive practices concerning hardware – just this year, Qualcomm was fined €997 million for paying mobile manufacturers to exclusively use its modems. Intel still has a €1.06 billion fine from 2009 hanging over it for similar practices in the computer microprocessor market. We note that the penalized companies appeal these administrative decisions in most cases.

The situation in the United States is different. The end of the last century was marked by an explosive antitrust case in which the DoJ accused Microsoft of abusing its dominant position on computer operating systems to consolidate its hegemony in the web browser market. The Redmond-based giant pre- installed Internet Explorer in Windows, favoring its own web browser over its competitors such as Opera and Netscape. On 7 June 2000, the US District Court for the District of Columbia ordered Microsoft to split into two entities

– one responsible for operating systems and the other for development and sales of other software components. The overturning of this judgement on appeal and the settlement subsequently reached between Microsoft and the DoJ are considered by many observers to be symbolic of the public authorities relinquishing their antitrust battle against the tech giants. Indeed, two decades later, it appears that very little has been done across the Atlantic by the federal agencies with regard to cases that they have taken on11. The main lawsuits seeking enforcement of antitrust laws have instead arisen from private complaints. Examples include the class action against Microsoft in California in 2001 for abuse of its dominant position in the computer operating system market, which saw the Redmond-based giant pay €1.1 billion in damages, or AMD’s legal action against Intel in 2005 for exclusivity payments, which forced Intel to accept a settlement including the payment of $1.25 billion in damages.

A curious fact can be noticed: in some cases, legal action has only been taken on one side of the Atlantic against anticompetitive practices that have had an impact on both sides. Consider the example of the e-book market. In response to a complaint filed by Amazon for anticompetitive practices, the FTC took Apple to court in 2012 accusing it of forming a cartel with five publishers. Following an initial ruling and four years of legal wrangling, the Supreme Court eventually dismissed Apple’s appeal in 2016 and the firm paid a fine of

$450 million. Meanwhile in Europe, the European Commission investigated Amazon’s agreements with its publishers, which were alleged to prevent the emergence of a rival e-book platform. The European Commission and Amazon eventually settled and this was made legally binding in 2017. In a twist of fate, Apple was not publicly investigated in Europe regarding this matter and symmetrically, Amazon was not investigated in the United States. Even though competition laws differ in both economic areas, this example shows that some violations of competition rules have probably passed beneath the authorities’ radars.

Further suspected abuses of dominant position.

In addition to these proven anticompetitive practices, many suspected cases are reflected either in competent authorities’ ongoing investigations or in observations that have not, or not yet, given rise to public investigations.

In 2016, the European Commission announced that it had decided to launch an in-depth investigation of Google’s AdSense service. It suspected the company from Mountain View of favoring ads under its own management on third-party websites whose search boxes Google manages. In an investigation launched in 2015, the European Commission suspected Qualcomm of predatory pricing to oust competitors. In September 2018, Margrethe Vestager announced that she would be looking into Amazon’s data collection practices, although no investigation has, as yet, been officially initiated.

Other suspected anticompetitive practices by tech giants regularly emerge and in most cases no action is taken. We will firstly consider those raised by companies that are either direct competitors or have rejected buyout offers from a tech giant. The case of Amazon in the retail e-commerce market is one good example. In its efforts to acquire the online shoe selling website Zappos in 2009, the Seattle firm is alleged to have deliberately slashed the prices of the shoes it sells to the point of self-inflicting tens of millions of dollars in losses. This was reportedly done with the sole aim of imposing its buyout offer on Zappos which was unable to survive this unfair battle for long. The acquisition of Quidsi (diapers.com) in 2010 appears to follow on from similar schemes concerning the price of online nappies12.

A further example is Yelp, which was listed on the stock exchange in New York (NASDAQ) in 2012 after having rejected a half-billion dollar buyout offer from Google in 2009. Its CEO, Jeremy Stoppelman, repeatedly claimed that Google then proceeded to consciously reduce the visibility of Yelp reviews on its search engine to favor its own online review service13. The company was able to survive thanks to the reputation it had already acquired in the United States, with many users going straight to the mobile app or website and bypassing the Google search engine. However, Google’s actions might have significantly impeded Yelp’s growth in new markets, especially in Europe. The case of Snapchat is also interesting. Having rejected a $3 billion buyout offer from Facebook in 2013, the young company was listed on the New York Stock Exchange (NYSE) four years later at a market cap of $33 billion. However, drawing on its network effect, Facebook copied Snapchat’s innovations (stories and video filters) and applied them to Instagram, thus severely hampering its rival whose market cap has since halved.

In a more general sense, the platform economy, in which the technology giants play an absolutely central role, has done a great deal to fuel suspicions of anticompetitive practices. Amazon’s position, both as a retailer and a marketplace for third-party merchants, is controversial. This advantageous position gives Amazon access to precious purchasing, pricing and stock data from which it is possible to extrapolate consumer preferences and other merchants’ practices. So how can we ensure that Amazon will not use its dominant position on the platform to increase its share of the e-commerce market at the expense of its competitors and ultimately consumers?

Similarly, Facebook opened up its ecosystem through various interfaces enabling third parties to use the platform’s features. This is, for instance, the case of the ‘Graph API’ which provides developers with access to information about the social network or ‘Facebook Connect’, a feature added in 2008 allowing users to log into other sites via their Facebook account. With such control over third parties’ business, how can we ensure that Facebook does not discriminate against competitors?

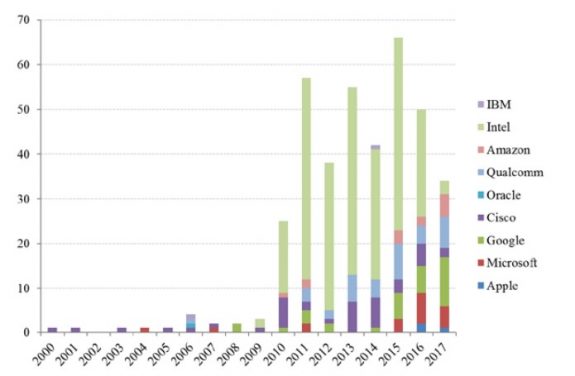

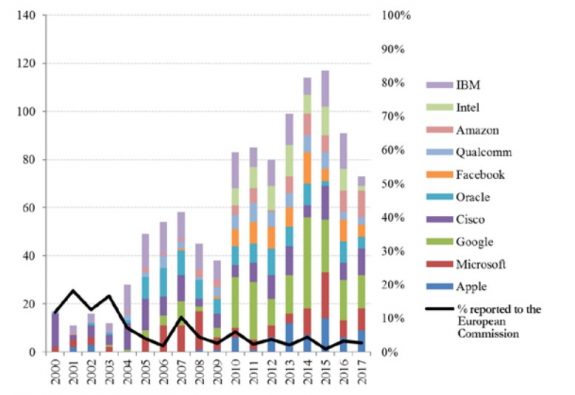

c. A sharp rise in lobbying expenditure.

In a context where stakes are high in the relations between the tech giants and antitrust authorities, we note a very sharp rise in lobbying expenditure among the big tech firms on both sides of the Atlantic (see graphs below)14. Admittedly, not all these efforts are aimed at influencing decisions relating to competition. It is clear that big tech lobbyists may also have been dealing with various other topics such as the GDPR in Europe.

We note that most big tech lobbying takes place in the United States: expenditure on lobbying European institutions is substantially lower. This may be due to the fact that the economic stakes are higher for them in the United States than in Europe. It may also be because the scope of the European authorities’ powers is narrower than that of the US authorities, given the prerogatives retained by member states in the EU. Finally, this discrepancy may be down to greater permissiveness shown by the US authorities toward the big tech firms, with a view to protecting US strategic interests.

Graph 6: Expenditure on lobbying US institutions in millions of dollars (US)

© Fondation pour l’innovation politique, November 2018

Undoubtedly, the tech giants have opted not to repeat Microsoft’s mistake of having little presence in Washington in the early 1990s when its troubles with the antitrust authorities began. We should finally note that the big tech firm’s influence in the political arena exceeds their lobbying capacity. Their direct access to the majority of citizens gives them considerable means of applying pressure. For instance, in 2012, during discussions on the ‘Stop Online Piracy Act’ and ‘Protect IP Act’ bills in Congress, Google added a black banner to its search engine condemning the ‘censorship’ that was about to be imposed on it.

Graph 7: Expenditure on lobbying European institutions in millions of dollars (US)

©Fondation pour l’innovation politique, November 2018

Are the tech giants natural monopolies?

Wismer, ‘“Competition Is One Click Away”’, Forbes, 14 October 2012.

Tinder dominates the US market with a 26% share followed by PlentyOfFish with 19%, OkCupid with 10%, then eHarmony, Match and Grindr with 9%, 7%, and 6% respectively (Statistica data, April 2016).

Facebook was able to overcome Snapchat through the sheer power of its network by merely copying and applying the same solutions (stories and filters) to the Instagram platform.

To recap, we have thus far revealed a decline in competitive intensity in the tech industry and observed that the big tech companies tend to use their dominant positions to maintain their hegemony at the expense of established companies and new entrants. So, how should they be regulated? Are the tech giants natural monopolies? If so, the standard framework of antitrust policy (monitoring of mergers and acquisitions, abuses of dominant position, and concerted practices) is inadequate. This would mean that regulations specific to natural monopolies such as electrical, rail and telecommunications networks could be required.

a. Natural monopolies.

As a reminder, a natural monopoly is defined as an economic situation in which demand in a market can be fully met by a single company at a lower price and higher quality than by several rival companies. The prerequisites for a natural monopoly should be assessed from two angles. Firstly, from the supply side, the company must present high fixed costs or economies of scale. Secondly, from the demand side, users must benefit from network effects or be indifferent as to whether one or more operators are available. In some respects, it appears that the big tech firms do indeed exhibit characteristics of natural monopolies, which explains the undeniable trend for concentration that exists in the tech industry.

In terms of supply, the digital economy tends to rely on economies of scale. Virtually no variable costs are generally incurred in addition to the fixed costs for creating algorithms or developing products or platforms. The marginal cost of an additional user for Facebook or Google, a new Windows license for Microsoft, or a new iTunes subscriber for Apple is almost zero. Moreover, additional users increase the quantity of data collected, thus improving statistics and behavioral analysis, allowing providers to deliver better products and services. Consequently, the tech industry and in particular the platform economy are conducive to economies of scale.

In terms of demand, network effects clearly contribute to concentration of the sector. Direct network effects are omnipresent. On an individual level, the value one gets by creating a Facebook or Instagram account or downloading WhatsApp increases in proportion to the number of friends who use it to communicate. However, indirect effects also contribute to this phenomenon. The Waze app platform (Google) becomes more relevant each time a new user is added, as this improves the quality of directions and traffic information. Amazon’s recommendation system is also further refined with each new customer, whose searches and purchases supply the algorithms with data. As numbers of App Store (Apple) and Play Store (Google) users rise, so does the diversity and quality of the service provided due to the resulting increase in popularity among app developers.

b. A trend for deconcentration.

Nevertheless, we believe that these ‘natural’ concentration dynamics are limited due to the existence of opposing trends (i.e. deconcentration) both in terms of supply and demand.

In terms of supply, the giants of Silicon Valley operate in an intrinsically dynamic environment where the potential for (non-incremental) disruptive innovation remains omnipresent. This is one of the main arguments that the big tech companies offer in their defense when criticized for their dominant positions. Larry Page, the CEO of Alphabet (Google’s parent company), has repeatedly stated: ‘On the Internet, competition is one click away’15. Moreover, experience shows that despite economies of scale and network effects, most multi-sided or platform markets do not necessarily follow a dynamic of extreme concentration, leading to the survival of just one operator. Markets in which platforms have co-existed for long periods suggest that the platform economy is not one of natural monopolies. Online travel agencies are a good example of this point. The American market is structured around a duopoly consisting of Booking Holdings (Booking.com, Kayak.com, Priceline.com with market share of approximately 45%) and Expedia (Expedia.com, Hotels.com, Trivago.fr with market share of approximately 30%). This is a highly competitive industry in which these two operators have co-existed and competed for many years. Online retail is a further example. Although Amazon has undeniably acquired a dominant position in this market (especially in the United States), other distribution platforms still manage to compete with Jeff Bezos’ company in some verticals. For instance, Zalando in Europe entered the online clothes and fashion retail sector following a business model similar to Amazon’s and was listed on the stock exchange in 2014 with a market cap of €5.3 billion.

In terms of demand, there is also a trend that encourages deconcentration of operators. The size of the market in which the tech giants operate approximately matches the population with Internet access (approximately 90-95% in Europe and 85% in the United States16). This market is in fact profoundly diverse since the plurality of users’ cultural, demographic and social origins naturally results in different preferences. This particularly encourages the emergence of companies that are able to adapt to the inclinations of a rather specific segment of the population. The online dating apps market is a good example. Its considerable degree of fragmentation17 reflects the requirements of users seeking different ways of dating and meeting people, different sexual practices, etc. The best way for users to maximize their chances of meeting a certain type of partner is not necessarily to join the platform with the most users if there is an alternative with fewer members but which is more likely to meet their requirements. This observation may be extrapolated to social relationships in general. Just as dating may be envisaged in several different ways, so too can social interaction, hence the need for diversity of social media. Before its acquisition, Instagram existed and prospered independently from Facebook. Twitter still offers different services to Facebook and many people have accounts on both platforms. And if Snapchat is currently on a downward trajectory, this is possibly due to laxity on the part of the antitrust authorities when monitoring mergers and acquisitions, which has enabled Facebook to carve out an ultra-dominant position in the market18. Finally, it is apparent that some western social networks struggle to penetrate Asian markets. While this is partly due to regulatory barriers (especially in China), we should not ignore the impact of cultural differences.

c. Beware of unfit regulations.

Furthermore, traditional regulation of natural monopolies appears particularly ill-suited to the digital economy. It is often implemented in two stages. Firstly, the regulator separates business elements that are in a situation of natural monopoly – generally infrastructure upstream of the value chain (e.g. electricity networks) – from downstream service elements (e.g. retail electricity distribution) which may be subject to competition. Monopolistic elements are then regulated by policies fixing the operator’s prices or margins.

However, in contrast to industries operating with relatively stable technologies (electricity, rail, etc.), it is not easy to separate ‘infrastructure’ and ‘service’ elements in the tech sector. Indeed, the boundary between the two is constantly evolving and is blurred by overlapping profits and costs. For example, should we consider the Gmail free email service as part of Google’s ‘infrastructure’ since it is funded by advertising and professional subscriptions? Can Amazon’s marketplace be separated from Amazon as a retailer without completely destroying the company’s business model?

Finally, we should note that it is by definition impossible to forecast the probability of a given innovation’s success, which de facto puts regulators in a very difficult position when defining regulations based on prices or margins in the tech industry.

In summary, a trend for concentration indisputably exists in the digital economy. It encourages the emergence of tech giants. However, since powerful dynamics of deconcentration also exist on both the supply and demand sides, we believe that the big tech companies should not be categorized as natural monopolies. It therefore appears essential to pursue an antitrust policy that is attentive to developments in the tech markets, monitoring and penalizing, where necessary, any abuses of dominant positions and mergers that are detrimental to fair competitive dynamics.

Astrong antitrust policy and a new regulatory framework to foster competion and innovation

Based on a number of alleged or proven acts, we have revealed that a small group of technology giants repeatedly or even systematically make use of various anticompetitive practices. In an industry that is incompatible with natural monopolies, this is a sign of a failing competition policy. The handful of antitrust lawsuits brought against the big tech firms in the United States and Europe in recent years have quite evidently not achieved their objectives.

We will now propose a number of potential solutions to these issues. Our argument is largely based on strengthening monitoring measures upstream of decisions and intensifying the deterrent effect of penalties downstream. The changes that we are recommending concern both the legislative authorities responsible for ‘making’ the law and the administrative authorities responsible for enforcing it.

Adapting antitrust legislation to the realities of the digital economy

For further details, please refer to the table in the appendices listing the main competition decisions concerning the big tech companies.

Representing daily penalty payments of €3 million during the period of the violation (i.e. until the end of 2007).

a. More robust monitoring

The emergence of the digital economy should prompt a thorough review of the ways in which we evaluate dominant positions and mergers and acquisitions. Indeed, we have seen that services offered to consumers are often free or are traded at prices that bear no relation to the actual costs incurred. The tech giants’ business models often take account of prospective indirect gains associated with the use of related products or revenue generated by adverts (remember the now famous saying: ‘if something is free, you are the product’).

Consequently, the administrative authorities’ assessments of dominant positions or mergers and acquisitions should take these realities into consideration. In practice, this requires an ability to conduct ad hoc studies taking account of the markets’ multi-sided structure, network effects, the interdependence of consumer services, and the type and quantity of data collected. A search engine typically operates in a three-sided market comprising users who perform searches, content suppliers whose products appear in the results, and advertisers who pay for their adverts to also be displayed on the screen. Administrative authorities must furthermore be capable of incorporating other dimensions than price, such as service (or product) quality, into their analyses. As such, companies that require more personal data to supply the same service should be perceived as reducing its quality.

In 2017, Germany decided to change its antitrust law to specifically mention these subtleties, which we believe is entirely appropriate19. At present, the principles governing the EC’s definition of markets and market segments are set out in a text which is not a law20. To increase clarity and give the European Commission appropriate monitoring powers, we suggest following the German model to enshrine in antitrust law the specific reference made to a list of criteria that are relevant for analyzing digital markets (network effects, access to data, etc.).

b. Abuses of dominant position

Limited impact of administrative penalties

As well as strengthening monitoring capabilities, it appears necessary to give the authorities more robust powers to penalize abuses of dominant position. Indeed, several historic examples undermine the credibility of European Commission sanctions’ deterrent effect.

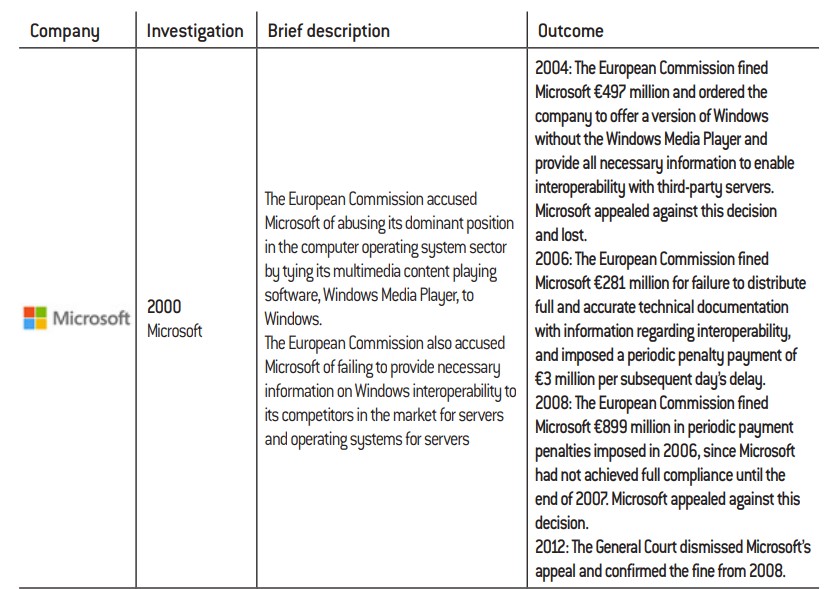

We will firstly consider examples relating to Microsoft, starting with the Windows’ interoperability case21. The European Commission fined Microsoft

€497 million in 2004 for two anticompetitive practices: failing to distribute technical documentation enabling interoperability of operating systems on Windows computers and servers, and tying Windows Media Player to Windows. It ordered the Redmond-based company to publish all technical specifications necessary for restoring fair competition in the servers and software-for-servers market. In 2006, the European Commission noted that its injunction of 2004 had not been observed and thus decided to impose a second fine of €281 million on Microsoft. However, the company was slow to comply and was therefore issued a third €899 million fine in 200822. Although Microsoft was ordered to pay a total of over €1.5 billion in fines, the conditions for fair competition in the market segment in question were only restored seven years after the administrative investigation was opened. The same pattern is evident in the 2008 case of Internet Explorer being tied to Windows. The investigation was completed quickly, and in 2009, the European Commission reached a settlement with Microsoft whereby Windows users would be guaranteed the option of choosing their web browser. However, in 2012, the European Commission reopened the case due to suspected non-compliance and fined Microsoft €561 million in 2013 for failure to adhere to conditions imposed between 2009 and 2012.

In these two scenarios, it is evident that the deterrent effect of the European Commission’s fines and periodic penalty payments did not cause appropriate competitive conditions to be restored promptly – the anticompetitive situation continued for several years even though the European Commission had established its existence. This is particularly damaging in the tech industry, which is characterized by extremely short innovation cycles. Taking this observation to the extreme, it would appear that the lack of deterrent effect shown by these sanctions enables the tech giants to ‘buy’ the right to continue with their anticompetitive practices.

The credibility of the European Commission’s penalties can also be measured in relation to variations in Google’s quoted market price following announcements of record fines imposed over the past two years (€2.42 and

€4.34 billion in 2017 and 2018 respectively). In theory, such fines should have adversely affected the company’s share price in two ways – firstly by reducing the size of its balance sheet in proportion to the fines imposed and secondly through a downward adjustment of projected future profits. In practice, between the European Commission announcing that it was about to impose a record fine on Google on 6 June 2018 and the actual announcement of this fine on 18 July 2018, Google’s share price rose by +0.04%. It fell by just -0.46% and -0.06% on 6 June and 18 July. As a proportion of the company’s market cap, the sum of these two decreases does not even represent a loss in value equivalent to the amount of the fine actually imposed (€4.34 billion). Although it is conceivable that the markets had already anticipated this penalty before the announcement of 6 June or expect the European Commission’s decision to be overturned on appeal, it seems that the anticompetitive penalty had considerably less deterrent effect than foreseen.

Restoring credibility to the administrative authority

In short, the public authorities’ credibility is at stake. So, should the upper limit for fines be raised or minimum fines introduced? European legislation currently allows the European Commission to impose administrative penalties of up to 10% of a company’s annual global revenues, which appears to give it sufficient room for manoeuvre. Moreover, it seems important to leave the administrative authority the discretion to judge the seriousness of violations and the amount of the resulting fines based on the merits of each case. For that reason, minimum fines are not an adequate option. Instead, we suggest two other options.

The first relates to the amount of periodic penalty payments. This is currently limited to 5% of the offending company’s global daily revenues. Given the importance of immediately restoring fair competition encouraging innovation in the tech industry, we believe that it makes sense to align the upper limit of these daily penalty payments with that of fines (i.e. 10% of global daily revenues).

Our second potential solution is more controversial and concerns the possibility of criminalizing antitrust penalties. As such, company directors could be held criminally liable for violations of competition law. This second solution is evidently faced with numerous barriers, the first being a lack of European criminal law. Nevertheless, a discussion may be foreseen at Community level on the issue of harmonizing the criminal component of national antitrust laws, combined with a mechanism for automatically referring administrative investigations to the competent national courts.

a. Mergers and acquisitions

Although Europe appears to be gradually realizing just how important increased monitoring of big tech abuses of dominant position is, it seems to have made much less progress on examining mergers and acquisitions in the tech sector.

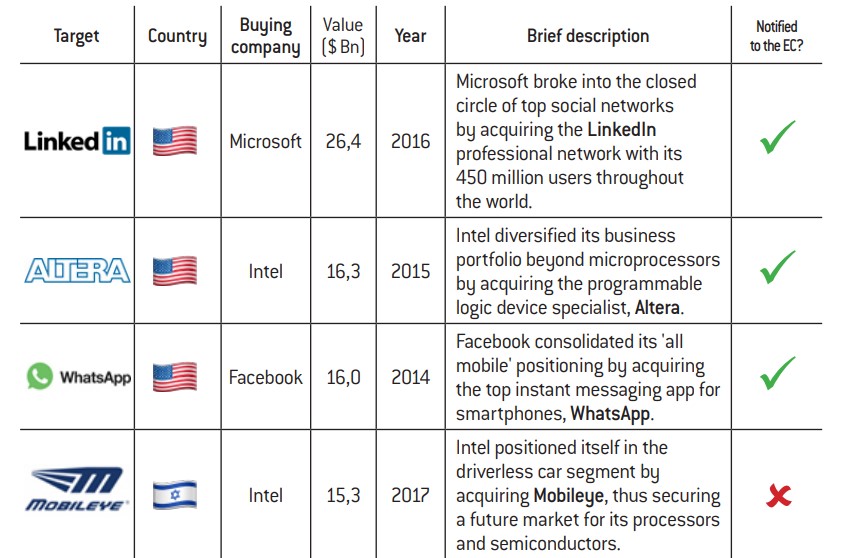

Reviewing thresholds for reporting mergers and acquisitions

In evidence of this, Tables 2(a) and 2(b) in the appendices reveal a striking fact – most strategic acquisitions performed by the big tech firms are not even examined by the European Commission. Why is this the case? These mergers and acquisitions are not notified to the European authority as they do not meet threshold criteria for reporting. The graph below shows a clear downward trend in the percentage of deals reported to the European Commission since the early 2000s.

Graph 8: Identified mergers and acquisitions versus those reported to the European Commission (number of deals)

© Fondation pour l’innovation politique, November 2018

Germany opted to introduce thresholds linked to the deal value for the same reason in 2017.

The table below provides a brief comparison of the rules for reporting mergers and acquisitions at federal level in the United States and Community level within the European Union. One major difference emerges – the European criteria are based on entities’ revenues while the American thresholds are based on the deal value. It is therefore no surprise that Facebook’s acquisition of Instagram in April 2012 was not reported to the European Commission despite its strategic importance, as the social network simply did not yet generate any revenue at the time. Google’s acquisition of Waze is a further example of a major horizontal acquisition (since the Israeli start-up was a direct and serious competitor of the navigation app offered by Google Maps) that could not be examined by the European Commission for the same reason.

This demonstrates the limitations of thresholds based solely on revenues. In the tech sector, promising companies’ growth prospects are often defined much more by numbers of users or quantities of data in their possession than by revenues from their sales. The value of a transaction incorporates all available information and reflects investors’ forward analyses: it can legitimately considered from an external perspective to be the best possible forecast of a target entity’s growth prospects. We therefore suggest revising European law to take account of the deal value in reporting thresholds in line with the American model23.

Table 1: Notification thresholds for mergers and acquisitions (United States and European Union)

Copyright :

© Fondation pour l’innovation politique, November 2018

A buyout that nevertheless raised major issues in terms of competition in the online music The European Commission authorized it unconditionally on 6 September 2018 after a six-month investigation.

‘Why Facebook Shouldn’t Be Allowed to Buy tbh’, Thompson, stratechery.com, 23 October 2017.

However, reporting exemptions exist: acquisitions solely for the purpose of investment of ten percent or less of the outstanding voting securities are for instance exempt from premerger notification.

‘Toshiba chip business set for $18B sale to Bain-led group backed by Apple’, TechCrunch, 28 September 2017.

Giving the Commission the power to act on its own initiative

Cases that do not have to be reported to the European authorities can, under the national laws of some member states, be reported to and reviewed by national authorities. The European Commission does not have jurisdiction over mergers and acquisitions that do not meet European turnover thresholds – cases must be referred to it by national authorities or reported by the company itself (although it is not legally obliged to do so). It is worth noting that the European Commission would not have been able to investigate Apple’s buyout of Shazam had the case not been referred to it by seven national authorities24.

It may be very politically sensitive for the European Commission to take action on its own initiative with regard to all mergers and acquisitions cases, as it does with antitrust matters, especially if its intervention automatically prompts the relevant national authorities to be withdrawn from cases. Many states would probably take a dim view of Brussels meddling in cases that they could, in some instances, legitimately consider to be national affairs. We believe that the European Commission should at least be able to examine any mergers and acquisitions that is not examined by a national authority.

This amounts to giving the Directorate General for Competition discretionary rights to investigate any transaction below the above-mentioned thresholds, provided that a competent national authority has not already taken on the case. Through these powers, the European Commission could investigate certain transactions that may seem small or even insignificant in terms of the target’s revenues or the deal value, yet may in reality prove highly strategic for the acquirers if they strengthen or help create dominant positions. A recent example is Facebook’s buyout of the American social network To Be Honest for a sum probably approaching $80 million25. After just three months in existence, ‘tbh’ had several million active users but had not yet generated any revenue. The network’s meteoric rise prompted some observers to describe it as a potential new Snapchat. Less than a year after acquiring it, Facebook announced that it would stop developing ‘tbh’. With the benefit of hindsight, we may ask ourselves whether this acquisition was conducted with the sole aim of preventing the emergence of a potential competitor and, therefore, whether the regulator should have blocked it upstream.

Monitoring minority investments

We also note that European law only requires transactions to be reported in the event of change of control. This constitutes another major difference with US antitrust law, whose reporting thresholds do not take account of the degree of control acquired in the target company26.

However, some minority investments may nevertheless raise competition issues. For example, in 2017, a consortium including Apple acquired part of the memory cards business owned by Toshiba, which happens to be the second biggest global supplier of computer and smartphone manufacturers27. Naturally, minority shareholders can influence companies’ strategic priorities and also have special access to relevant information. Consequently, we suggest adapting European legislation to take account of minority equity investments, following the example of US law. In practical terms, this would mean that the reporting requirement would be extended to transactions that do not involve a takeover. To avoid inundating the administrative authority with information of limited interest, it seems appropriate to define a threshold of acquired voting rights below which reporting would not be compulsory, as is the case in the United States.

Tougher enforcement of competition law

‘In terms of whether Instagram may have the potential to compete with Facebook’s photo sharing app for advertising revenue, one third party told the OFT that it does not consider that Instagram provides significant marketing ’, cited in John Constine, “Why The OFT And FTC Let Facebook Buy Instagram: FB Camera Is Tiny, IG Makes N° Money, And Google”, techcrunch.com, 23 August 2012.

It is worth noting that this concentration did not need to be reported to the European Commission (as it did not exceed the turnover thresholds). The company from Menlo Park opted to report it on its own initiative to avoid a review process involving three different national authorities.

‘We will ‘actively’ watch Google’s remedies’, Valero, Euractiv, 28 September 2017.

See Table 2(e) in the appendices, which provides a list of antitrust administrative decisions in Europe concerning the technology giants.

We should however point out that there appears to be a growing challenge to this paradigm, notably through the work and initiatives of free market think tanks and research centres (Stigler Center, Open Markets Institute, The New Center) and intellectuals including Luigi Zingales and Guy Rolnik.

See Robert Bork, The Antitrust Paradox, The Free Press, 2nd , 1993.

Although the exact sum was not revealed, it is estimated to be over $500 million (source: ‘Google Acquires Artificial Intelligence Start-up DeepMind for More Than $500m’, Shu, TechCrunch, 27 January 2014).

‘Google Trusts DeepMind AI To Manage Data Centre Cooling’, Shead, Forbes, 18 August 2018.

See Appendix 2(f) summarising the EC’s decisions on This selection includes all conditional authorisations granted by the European Commission concerning transactions involving the tech giants. It should be noted that the situation is similar in the United States, since some major concentrations have not even been formally investigated by the FTC or DoJ (e.g.: Google’s acquisition of YouTube in 2006).

In this specific instance, most of the anticompetitive practices preceded Google’s Nevertheless, we believe it would have been legitimate to make approval of the merger subject to conditions.

See Tables 2(e) and 2(g) in the appendices summarising competition decisions concerning the technology giants in Europe and the United States.

Although it is essential to adapt antitrust regulation to challenges presented by the digital sector, this will only close some of the loopholes in the competition framework. Indeed, it is also necessary to examine the way in which the law is interpreted and enforced.

a.Tackling asymmetry between regulators and regulated parties

To ensure appropriate enforcement of competition law, there is a need for in-depth and complex analyses, often involving advanced technical studies of the relevant industries. The speed of technological change inherent in the tech sector therefore makes the work of the competition authorities considerably more difficult.

Technical complexity

The digital revolution and its extensive use of new computer technologies, big data, and innovative exchange protocols stretches the expertise of the antitrust authorities, which might be more accustomed to dealing with legal or administrative matters than technical issues. This is illustrated by three examples.

In the findings of its investigation endorsing Facebook’s acquisition of Instagram in 2012, the UK Office of Fair Trading made it clear that as a mere photo publishing app, Instagram offered very few features and characteristics specific to social media and was therefore unlikely to eventually rival Facebook28. The level of misinformation and the degree of misunderstanding of how social media works revealed by these comments suggest that the administrative authority lacked the necessary expertize to effectively perform this analysis.

During the review of the acquisition of WhatsApp in 201429, Facebook assured European Commission officials that it was technically impossible to automatically link Facebook and WhatsApp user accounts. The clear inconsistency between the information provided to the authority and the technical reality, which was well known to the company’s engineers, only emerged two years later when Facebook started to integrate the two platforms and link user accounts with an algorithm based on telephone numbers. In 2017, the European Commission responded by fining the company from Menlo Park €110 million for submitting incorrect information during the investigation. While this fine appears derisory given what was at stake, the key takeaway from this example is the administrative authority’s lack of autonomy with regard to technical matters.

In a similar vein, the European Commission needed to commission two auditing companies to monitor Google’s implementation of its decision concerning Google Shopping over the five subsequent years30. The Competition Commissioner, Margrethe Vestager herself admitted: ‘It is important for us to have very good people on board to help us with the monitoring’.

In other words, it seems that the antitrust authorities are needing technical skills to handle cases concerning information and communication technologies. To resolve this, we suggest that the European Commission set up a tech task force composed of specialist engineers and professionals from the sector. European Commission departments could call on this team to assist them with their investigations.

Moreover, this team could mitigate a further weakness exhibited by the antitrust authorities in terms of insufficient proactive monitoring. Due to the complex and instant nature of transactions in the digital age, abuses of dominant position can be subtle, fleeting, and therefore very difficult to spot. As illustrated by the examples of predatory techniques allegedly used by Amazon to facilitate buyouts of its competitors (Zappos, Quidsi) or discriminatory methods that Google appears to have used to display its results (Yelp), real- time monitoring capabilities and an ability to respond very quickly are vital for identifying anticompetitive practices in the new and web-based tech sectors. In many cases, the ability to detect abuses therefore appears to rely on web scraping techniques or monitoring algorithms. Subsequent analyses require powerful data processing and visualization tools. A tech task force could help the European Commission Directorate General for Competition with such matters.

Resources

Besides the issue of its technical competence, the administrative authority is also faced with problems in terms of resources. A brief analysis of the latest European Commission investigations that led to administrative penalties31 reveals a mean period of several years between investigations being opened and administrative decisions. Part of this period is required for legal formalities and therefore cannot be reduced. For example, before making legally binding a settlement reached with a company suspected of anticompetitive practices, the European Commission must publish the draft agreement and give third parties at least one month to submit any comments. However, these legal periods only account for a part of the time between the opening and completion of an investigation. Most of the time is taken up by the investigation itself. Since the tech sector is characterized by very short innovation cycles, anticompetitive situations are particularly damaging as they potentially block the emergence of numerous innovations. As such, lengthy investigations are particularly problematic. We therefore believe it is necessary to increase the number of people working on these cases. Given the cost of abuses of dominant position to the economy, this would undoubtedly be a worthwhile investment for taxpayers.

We should also add that administrative penalties issued to the big tech companies are almost systematically appealed. These appeals to the General Court (of the EU) or even the European Court of Justice take several years and continue to generate work for the teams of the Directorate General for Competition. For example, the case of Intel, which was ordered by the European Commission to pay a €1.06 billion fine in 2009, has still not been closed. After the General Court confirmed the European Commission’s penalty in 2014, the CJEU (Court of Justice of the European Union) decided to overturn the judgement and refer the case back to the General Court. We believe that this is a further reason for increasing the administrative authority’s resources in order to speed up its decision-making processes.

b. Putting innovation at the heart of antitrust policy

In parallel with increasing the authorities’ resources for monitoring and issuing penalties, conceptual work must also be carried out on adapting antitrust analyses to the realities of the digital sector. This leads us to the actual content of investigations.

An authority that is armed with legal weapons but fails to use them wisely would be ineffective. We believe that modern antitrust action is guided by an overly cautious interpretation of regulation that does not take sufficient account of the importance of innovation. Particularly in the United States, the interpretation of antitrust laws by legal experts and economists from the Chicago School (some of the most famous figures include Robert Bork, Richard Posner, George Stigler and Harold Demsetz) still carries significant weight32. In The Antitrust Paradox (1978), Robert Bork sets out to demonstrate that the original spirit of laws and economic analysis encourage us to focus solely on maximizing consumer welfare without considering that of competitors33. Therefore, some supposedly exclusive practices such as vertical agreements and price discrimination should not be prohibited if it cannot be proven that they directly penalize consumers.

As such, impact studies of mergers and acquisitions and dominant positions have always tended to focus excessively on consumers, which tends to thwart any prospect of intervention in a digital market where services are often provided to users free of charge. We believe that consumer welfare should at least be considered prospectively or, in other words, dynamically and in the long term. Purely static analyses can be deceptive, especially in an industry as dynamic as tech. Any offer to buy out a company includes a vision of its future, which regulators must take into account. Google’s eminently strategic acquisition of DeepMind in 2014 is a good example of this, since the ultra- innovative company on the cutting edge of AI research, with its seventy-five employees, was certainly in no financial position to justify a buyout for over $500 million34. Google’s offer banked on significant growth of the fledgling company and considerable future profits. They have already materialized as the Mountain View giant is using the British start-up’s techniques to optimize cooling of its data centres35.

Moreover, this forward-looking approach would encourage the authority to consider adjacent markets as connected verticals rather than distinct parallel markets. Firstly, this would prevent dominant positions from being easily transferred from one market to another (as achieved by Google from the search engine market to the market for online reviews of shops and restaurants). Secondly, it would enable any of the big tech firms’ competitors to grow in adjacent markets, which is an essential step before facing the technology giants in their key segments. For example, Google is now able to compete with the Apple-Microsoft duopoly in the computer operating systems market with its Chrome OS is because it has a prominent position in the adjacent web browsers market (through its Chrome software).

Finally, prospective analysis would encourage regulators to consider ‘innovative potential’, especially when investigating mergers and acquisitions. If a transaction is likely to substantially impede innovation in the medium to long term, one could argue that it can be legitimate to block it even if the deal would not harm consumers in the short term. Let us consider Facebook’s acquisition of Instagram in 2012. At the time, the antitrust authorities did not foresee Instagram becoming a major social network and therefore did not consider the transaction to be potentially detrimental to competition in the social media market. Six years later, this has proved to be a clear error of judgement. However, regulators are ostensibly in a very poor position to predict the future of the tech market. This makes assessing companies’ ‘innovative potential’ extremely difficult and risky. Without even taking the risk of blocking transactions, the European Commission would benefit from using its power of conditional authorization. Conditionality clauses may, in fact, constitute a powerful safeguard in instances where it is suspected that a potential decline in competitive intensity may eventually occur. Judging by the very low number of big tech acquisitions that have been made subject to such clauses in recent years36, it would seem that the European Commission is making too little use of this power. Our argument is supported by Google’s acquisition of Motorola Mobility in February 2012. Two months after authorizing the merger, the European Commission opened two formal investigations of Motorola Mobility’s alleged violation of antitrust law. The company was accused of using its patents to limit competition in the smartphone market. The European Commission completed its investigation two years later, announcing that Motorola Mobility (now Google) had indeed violated European competition law. This begs the question of why, when authorizing the merger in February 2012, the European Commission failed to add a conditionality clause on the use of patents acquired by Google37.

c. Greater collaboration with the United States

Despite all the areas for improvement that we have raised thus far, Europe currently appears to be ahead of the United States when it comes to adapting antitrust policy to the realities of the digital sector. A comparison of key rulings against the big tech firms for anticompetitive practices on either side of the Atlantic provides ample proof of this38. The United States does not come close to the record penalties imposed on Google in Europe. However, Europe cannot address the entire problem alone. Although there are abundant users in the old continent, most big tech acquisitions target non-European companies. We note that European and American antitrust authorities have occasionally collaborated in the past. For example, the DoJ and European Commission jointly handled the merger of Cisco and Tandberg, which had serious implications in terms of competition. However, such collaboration seems currently undermined by some mutual distrust. Europeans are inclined to suspect the American authorities of deliberate laxity in view of the race for technological domination between their champions and Chinese companies. In parallel, American observers are keen to interpret the European Commission’s actions as an attempt to intentionally penalize the American giants in a sector where European firms have been left far behind. Although both economic areas’ antitrust authorities pursue the same goal of ensuring maximum benefit to society, this lack of understanding might be to some extent paralyzing public action. To remedy this, we believe that Europe should play a key role in this necessary collaboration through the International Competition Network.

Beyond antitrust: the need for new regulations

Margrethe Vestager menace de démanteler Google’ [Margrethe Vestager threatens to break up Google], N. Certes, Le Monde Informatique, 10 April 2018.

Quote from Jason Furman (former chairman of the US Council of Economic Advisers) “Beyond Antitrust: The Role of Competition Policy in Promoting Inclusive Growth”, Searle Center Quote from Jason Furman (former chairman of the US Council of Economic Advisers) “Beyond Antitrust: The Role of Competition Policy in Promoting Inclusive Growth”, Searle Center Conference on Antitrust Economics and Competition Policy, 16 September 2016.

‘Amazon Grabs 55 Percent of Consumers’ First Product Search, Set to Dominate 2016 Holiday Shopping’, PR Newswire, 27 September 2016.

‘A Way to Own Your Social-Media Data’, Zingales and G. Rolnik, The New York Times, 30 June 2017.

‘How to Transfer Twitter Followers to Instagram’, Cordwainer, It Still Works.

This may seem odd since Android is an open-source However, the Google Play Store is not. The American giant is using its dominant position in the mobile operating systems market to secure favourable conditions for the pre-installation of its apps.

We commend the fact that technology giants seem to be moving in this direction, with the recent creation of the “Data Transfer Project” initiated by Facebook, Google, Twitter and The project aims to develop an open source platform for data portability. However, it is important to ensure that such a project take into account the interests of emerging players. Source: “Facebook, Google and more unite to let you transfer data between apps”, July 20, 2018, TechCrunch.

We have highlighted loopholes in competition law applied to the tech industry and suggested measures to remedy this, both in terms of the law and its enforcement. Nevertheless, we are convinced that the problem of big tech dominance requires a comprehensive political response of which antitrust is just one aspect. In our view, complementary measures on interoperability and opening up industrial property rights are essential.

a. Reasons for moving beyond antitrust

Effectiveness of antitrust in doubt

Thus far, we have not considered the risks of an excessively aggressive antitrust policy enforcement. Amongst them are notably legal uncertainty and limits on entrepreneurial freedom.

With regard to mergers and acquisitions, overzealous interpretation of the law may discourage some companies from conducting deals that may have a potentially positive socioeconomic impact.

The effectiveness of penalties in relation to abuses of dominant position seems also debatable. Some believe that they help release creative and innovative forces. Others suggest that the authority always takes action too late, embarking on lengthy, uncertain and costly proceedings that involve highly asymmetrical information and risk impeding innovation. History provides us with a number of interesting examples illustrating this point. Consider, for instance, the DoJ’s landmark case against IBM in 1969 for violating the Sherman Act through an alleged monopoly of the market for computers with integrated circuits. A thousand witnesses were asked to testify, millions of pages of documents were submitted and examined, and the government eventually dropped the case thirteen years later. It is impossible to remain indifferent to such a waste of resources. Thirty years later (1998), an equally significant lawsuit was brought against Microsoft for tying the Internet Explorer browser to the Windows operating system, which led to the DoJ securing a minimalist settlement. Critics of antitrust penalties draw on these examples to portray a legal and administrative machine that is unfit to keep up with the pace of change in the tech market. In contrast, their opponents respond that although the legal actions were either totally or partially ineffective, they nevertheless forced IBM and Microsoft to focus on their respective markets (computers with integrated circuits and software), enabling the emergence of new champions such as Microsoft (in the case of IBM) and Google (in the case of Microsoft) in promising market segments.

Are the giants already too big to be challenged?

Given the levels of domination attained by the big tech firms in their markets, one can ask whether the antitrust policy is sufficient to tackle these issues. In other words, aren’t the big tech firms already at a stage of development that quite simply puts them out of reach of the antitrust authorities’ initiatives? If this is the case, we must consider what regulations need to be devised.