Biotechnologies in China: a state of play

Introduction

Biotechnology, one of the Chinese government’s priorities

National strategies and public financial support

Talent recruitment

Technology transfers

Biotechnologies in China : a state of play

Biomanufacturing and its ecological appeal

Consumers favour organic but reject GMOs

Developing national seed champions

The Sino-American rivalry in the field of biotechnology

The race for genome editing

Controversies and future prospects

The controversies surrounding Chinese biotechnologies

What prospects for the future?

Conclusion

Summary

In this study, Aifang Ma presents China’s national biotechnology strategies and programs and provides an overview of the country’s progress in the medical, industrial, energy and agricultural sectors. As a new challenger on the international stage, China is stepping up its efforts to compete with the United States, the leader in the field.

Having become an inescapable power, China will however have to decide between two options: to continue prioritising technological advances by downgrading the regulation of biotechnologies to a secondary position, or to give itself time to reflect on how to cultivate an alternative model of scientific and technological development in order to curb possible ethical abuses.

Aifang Ma,

Doctoral student and lecturer at the Centre for European Studies and Comparative Politics at Sciences Po, with a degree in French Language and Literature. Having simultaneously completed two Masters Degrees at Beijing Foreign Studies University and Sciences Po Paris in European Affairs, she worked successively at UNESCO in Paris and at the French Embassy in China in Beijing. She is the author of L’intelligence artificielle en Chine : un état des lieux, Fondation pour l’innovation politique, November 2018.

Huo Shi Chuang Zao [an influential Chinese company specialising in bio-economics], Blue Book on the Development of Biomedical Industry in China 2017, 2017, 24.

See Gryphon Scientific and Rhodium Group, “China’s Biotechnology Development: The Role of US and Other Foreign A report prepared for the U.S.-China Economic and Security Review Commission”, 14 February 2019, p. 14.

Ibid.

On 5 October 2015, Tu Youyou, a Chinese scientist from the Peking University Health Sciences Centre, was awarded the “Nobel Prize in Physiology or Medicine” for her discovery of artemisinin, a particularly effective remedy against malaria. After being awarded the prestigious Albert-Lasker Prize for Clinical Medical Research in 2011, she became the first Chinese woman to receive the Nobel Prize. This exploit has once again drawn the world’s attention to China. Although Tu Youyou’s research is more in the field of traditional medicine, it demonstrates the excellence of Chinese researchers’ training in biology and pharmacology, which explains, among other things, the spectacular progress that the country has been able to make in recent years in the field of biotechnology.

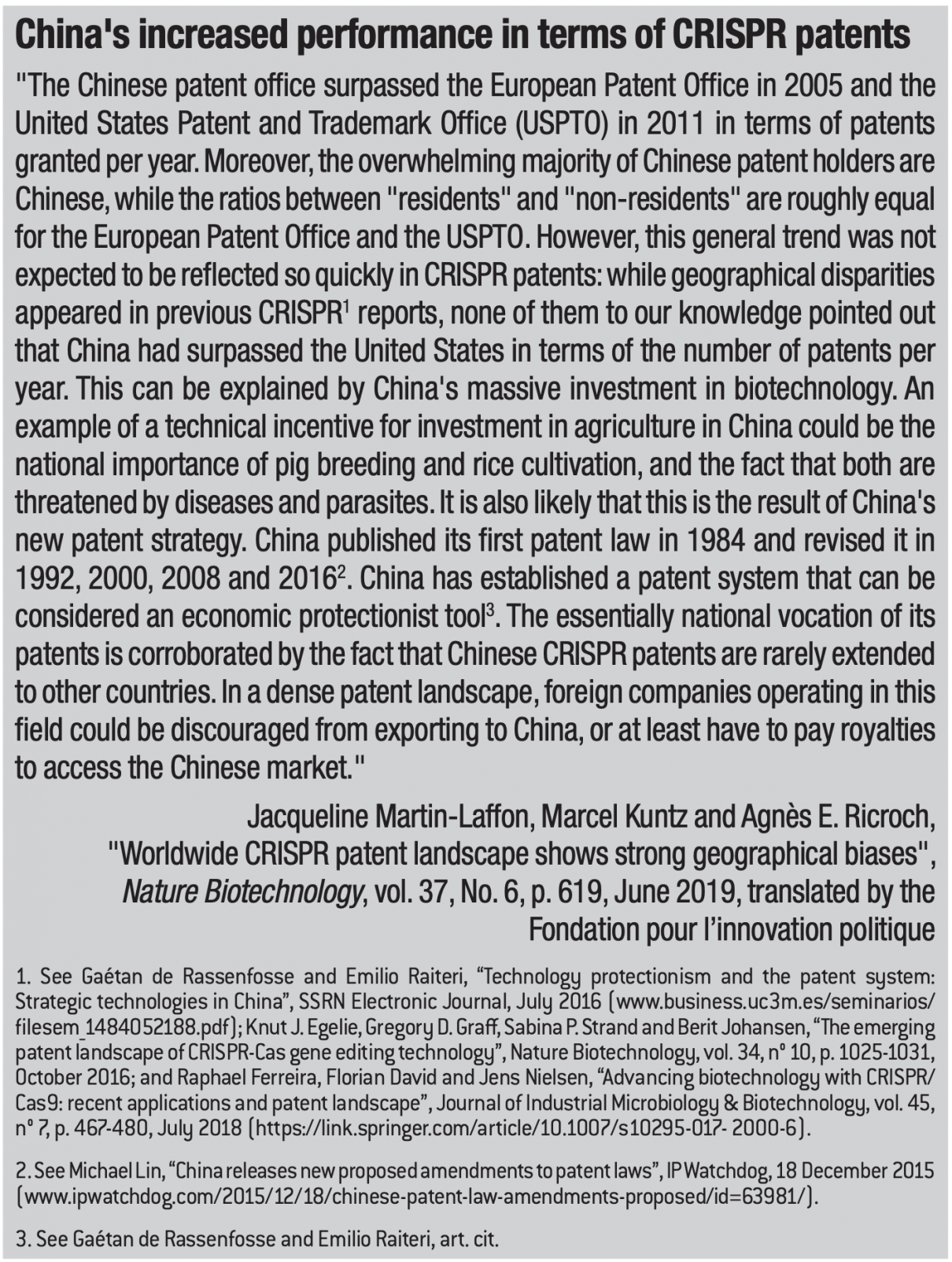

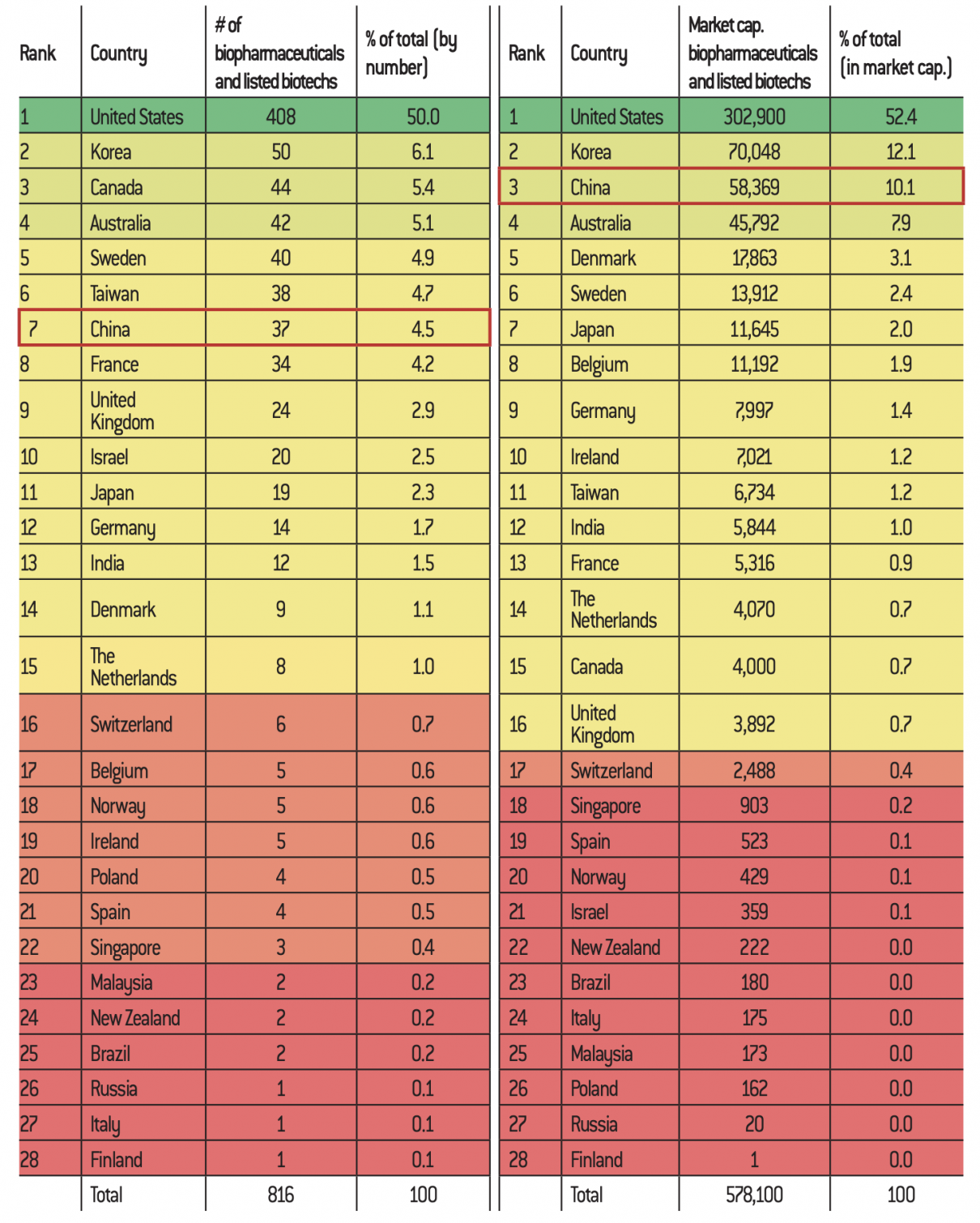

In the 1980s, the start of Chinese research in biotechnology took place against a backdrop of increasing global competition in scientific research. Having fallen considerably behind the industrialised countries during the first two industrial revolutions, China, impoverished by the Great Leap Forward and the Cultural Revolution, wishes first of all to make up for its shortcomings and aspires one day to surpass its Western competitors. More than thirty years of relentless efforts later, China has partly succeeded in realising its ambitions by building itself up as a true technological power. Today the country has even taken a considerable lead in human genome editing and can boast a privileged position in PD-1, CAR-T cells, iRNA, stem cells and IDO1 inhibitor. As a report prepared for the U.S.-China Economic and Security Review Commission in February 2019, the volume of scientific publications by Chinese researchers grew at an annual rate of 20% between 2007 and 20172. The number of biotechnology patents granted to China surpassed that of the United States between 2011 and 2012 to become the world’s largest3.

In the same report, biotechnology is defined as the scientific and technological progresses that result from discoveries and advances in the life sciences. This definition includes the application of biotechnology in medicine, agriculture and industry. This study begins by presenting China’s national biotechnology strategies and programmes. Comparisons with other countries in the world are made to capture China’s progress in this area. An overview of China’s progress in medical, industrial, energy and agricultural biotechnology is then presented. Since the United States currently has the largest market and the strongest capacity for biotechnological innovation in the world, special attention will be paid to the Sino-American rivalry. Lastly, recent controversies and scandals are analysed in order to better understand the future of the sector of biotechnology in China.

Biotechnology, one of the Chinese government’s priorities

Since the implementation of the policy of reform and openness in 1978, the development of advanced technologies has been one of the priorities of the Chinese government. Its aim is to catch up with the industrialised countries. This period marks the de facto official start of biotechnology.

National strategies and public financial support

See Guillaume Levrier, “Un scientifique chinois a-t-il fait naître les premiers bébés CRISPR ?” com, 26 November 2018.

Contrary to what some researchers have long suggested4, China did not wait for the Ninth Five-Year Economic and Social Development Plan (1996-2000) to begin its biotechnology research.

In the 1980s, many industrialised countries set up ambitious scientific and technological development plans, such as Japan’s Fifth Generation Computer Project (FGCS) in 1982, the U.S. strategic defence initiative in 1983 and the European Eureka initiative in 1985. In order to respond to these foreign initiatives and to place China in a favourable position in the international high-tech competition, in March 1986, Deng Xiaoping, then-Chairman of the Central Military Commission of China, made 863 Program, supported by several leading Chinese scientists: Wang Daheng, Wang Ganchang, Yang Jiachi and Chen Fangyun. This programme, implemented starting in March 1987, covers fifteen scientific and technological fields, including biotechnology. In the latter area, Chinese scientific work is focused on research and development (R&D) of biotechnology in medicine and agriculture, including genetic engineering, vaccination, genotherapy and the development of new high- yielding animal and plant varieties.

Logo of the 863 Program in China

Wuhan Coronavirus (2019-nCoV) Global Cases by Johns Hopkins CSSE, 4 February 2020.

These numbers have been updated since the original publication of this study on 7 February.

See “13th Five-Year Economic and Social Development Plan (2016-2020),” adopted by the 4th Session of the 12th National People’s Congress, March 2016, 39-40.

Ministry of Industry and Information Technology (MIIT), National Development and Reform Commission (NCDR), Ministry of Science and Technology, Ministry of Commerce, National Health and Family Planning Commission, and China Food and Drug Administration (the CFDA now falls under the jurisdiction of the State Administration for Market Regulation, an institution created on 21 March 2018), “Pharmaceutical Industry Development Guide“, 7 November 2016.

Ministry of Science and Technology, National Commission on Health and Family Planning, China Food and Drug Administration (CFDA), National Administration of Traditional Chinese Medicine, and Department of Logistics Provision of the Central Military Commission, “Specific Plan for Scientific and Technological Innovation in Health under the 13th Five-Year Plan Period“, May 2017, number 147.

See National Commission for Reform and Development, “11th Five-Year Biotechnology Development Plan“, April 2007.

See UBS, China’s biotech revolution, August 2018, p. 11.

Conseil des affaires d’État, “Several measures to accelerate the development of organic industries“, June 2009.

Huo Shi Chuang Zao, cit., p. 4.

UBS, cit., p. 7.

Apart from international competition, this intense attention to biotechnology is also due to the need to protect the Chinese people from public health crises. Seventeen years after successfully controlling SARS (Severe Acute Respiratory Syndrome), since December 2019, China is once again in the eye of the storm. Originally from Wuhan, the capital of the Hubei province, the coronavirus has spread to several of the country’s megacities. As of 25 February 2020, 2,563 deaths and 77,660 infections have been recorded in China5. Carried by international travellers, cases of contamination have already been reported in some 37 countries*. In view of the seriousness of the current situation, the World Health Organization has considered the threat from coronavirus to be at “very high” in China, and “high” at the regional and global levels.

The development of biotechnologies, especially biomedicine, would enable China to be better equipped to combat epidemics and reduce the human damage they cause.

Biotechnology is thus becoming a recurring subject in a large number of national plans. The importance of the sector is officially stated in the Ninth Five-Year Plan and the Long-range objectives to the year s2010, which specify that China must implement the “great power through science and education” (ke jiao xing guo zhan lüe). The aim is to make significant progress in the industrialisation of high-tech sectors such as bioengineering. Biotechnology is on the list of emerging disciplines in which the State plans to provide significant financial support. The importance of organic farming as a contribution to the national seed project (zhong zi gong cheng) is particularly emphasised.

While China is emulating the biotechnologies of industrialised countries until the period of the 11th Five-Year Plan (2006-2010), it has been investing in new product innovation for several years. In the twelfth Five-Year Plan (2011-2015), biotechnology is one of the seven strategic emerging industries. Development priorities include drugs, biomedical engineering, agriculture and biomanufacturing. Moreover, China is encouraging mergers and acquisitions in the biotechnology sector to form large, internationally competitive enterprises. The twelfth Five-Year Plan for the development of strategic emerging industries, published by the State Council in December 2012, sets quantifiable objectives in the fields of medical, agricultural and industrial biotechnology for 2015 and 2020. For example, in the field of medical biotechnology, China is expected to be among the more advanced countries by 2020, especially in genetic engineering, vaccination, antibody engineering and R&D of high- performance diagnostic and treatment equipment. For organic agriculture, again by 2020, one or two Chinese seed companies should be among the top 20 global seed companies. In addition, ten to fifteen Chinese organic agricultural enterprises need to be internationally competitive. As for biomanufacturing, the percentage of biomanufactured products in total chemicals is expected to rise to 12% by 2020. It is expected that the technological level and turnover of the Chinese bio-fermentation industry will be among the highest in the world.

The thirteenth Five-Year Plan (2016-2020) marks the strengthening of the country’s capacity for innovation in biotechnology, achieved through the implementation of several large-scale strategic programmes such as “Innovation such as Leitmotiv” (chuang xin qu dong), “Entrepreneurship and innovation by all” (da zhong chuang ye, wang zhong chuang xin), “Talents first” (ren cai you xian), “Great power in manufacturing” (zhi zao qiang guo) and “Healthy China” (jiang kang zhong guo). The budget for scientific research is set to increase from 2.1% of GDP in 2015 to 2.5% in 2020. The biotechnology sector is considered a strategic national industry and its objectives include the development of synthetic biology and regenerative medicine, the large-scale application of genomics, the construction of basic platforms such as gene and cell banks, and the scale-up of a new generation of organic products and services, including personalised medicine, innovative drugs and organically raised livestock6. A November 2016 guide states that the pharmaceutical industry’s priorities are the development of organic drugs, new types of vaccines, cell therapies and 3D bio-imprinting7. Similarly, quantifiable targets were set in a document published in May 2017: China must complete R&D of 20-30 innovative medicines and create 20-30 drug brands with international influence8.

The importance of biotechnology is fundamental. In the 21st century, it is highly likely that they will replace digital technology as the new pillar of the global economy. According to the Eleventh Five-Year Biotechnology Development Plan, the biotechnology sector is expected to reach 4% of China’s GDP by 2020, becoming one of the dominant industries of the national economy9. Due to their strategic importance, biotechnological research projects are seeing an increase in the state budget allocated to them. Starting with the Twelfth Five- Year Plan, China has established specific funds to support strategic emerging industries, including biotechnology. Government support is also reflected in the fact that the state gives priority to purchasing organic products manufactured by Chinese companies, in accordance with the Government Procurement Law.

Organic businesses receive preferential treatment in terms of fiscal and tax policies. In April 2017, the Department of Finance announced the removal of tariffs on cancer therapies imported from abroad10. According to Chinese regulations, the costs that organic companies incur in R&D of new products, technologies and their processes are deducted from their taxable incomes. Moreover, where an organic enterprise is considered a high-tech enterprise, the tax rate applied to it is 15%11, whereas this figure rises to 25% for non-tech enterprises, regardless of the sector in which they are engaged.

China’s extensive state support for biobased industries is a decisive advantage over the United States and European countries because the biological sector is characterised by high risks, a long R&D period and, above all, a low success rate. Let us take the example of biopharmaceuticals. It is estimated that companies generally invest 23.8% of their budgets in R&D of organic medicines, a figure that is much higher than generic companies, which invest on average 7.6%. The cost of developing a new product is approximately $300 million. While the R&D time for an organic drug is ten to fifteen years, the success rate stabilises at between 5% and 10% only12. In addition to public financial support, private investment is booming. By 2016, venture capital and private equity in the health sector reached $20 billion in China. This figure was estimated at $30 billion in 201713.

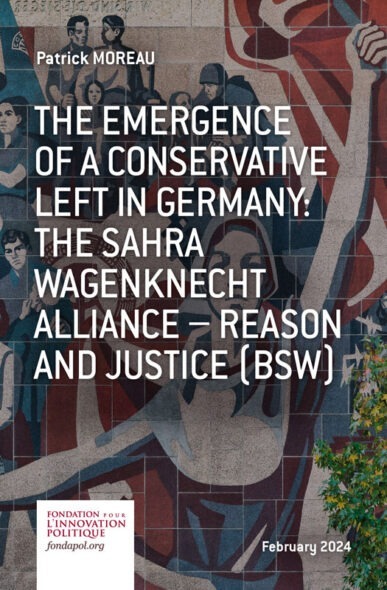

China’s ambition is to take a qualitative step forward over the period of the Thirteenth Five-Year Plan, believing that the conditions for doing so are in place. The table below presents quantifiable objectives that the country must achieve by 2020.

Quantifiable targets for the biotechnology sector by 2020

Talent recruitment

The exchange rate used is based on the exchange rate from 24 October 2019, e. $1 = 7.07 yuan.

Haigui (海龟) means “sea turtle” in the Chinese language. This term refers to Chinese students who study abroad and return to China upon completing their studies.

- Central Committee of the Communist Party of China, State Council of Affairs, “National Medium-and Long- Term Talent Development Plan”, 2010.

See “What is the treatment Chang Jiang researchers receive? A Look at the Income and Salaries of Chang Jiang Researchers in 2018” (translated from Chinese), com, 22 November 2018.

UBS, op. cit., p. 12.

China aims to establish itself as a major power in the bio-economy. Its objectives are set out in the national plan for the development of biotechnology in the medium and long-term (2006-2020). By 2020, technology contributions to GDP should reach at least 60% and China’s dependence on foreign technology should not exceed 30%. The country also plans to be among the top five most patented countries in the world. Chinese scientific works must be at least the fifth most cited in the world.

In order to be able to achieve these objectives, the recruitment of high-level talent is essential. Many national and regional policies have been proclaimed to encourage Chinese students to return to China and pursue careers there. According to data revealed at the 2014 International Forum on Organic Medicine in Wuhan, the capital of Hubei province, the Haigui14 account for 30% of Chinese researchers working in biotechnology.

In order to attract talent in biotechnology, a large number of incentive initiatives have been successively made public, such as the “One Hundred Talent Plan” (bai ren ji hua) in 1994, the “National Science Fund for Distinguished Young Researchers” (guo jia jie chu qing nian ke xue ji jin) in 1994, the “Chang Jiang Scholars Program” (chang jiang xue zhe jiang li ji hua) in 1998, the “Global Expert Recruitment Programme” (qian ren ji hua, hai wai gao ceng ci ren cai yin ji hua) in 2008, the “Young Talent Development Plan” (qing nian ying cai kai fa ji hua) and the “Innovation Talent Promotion Plan” (chuang xin ren cai tui jin ji hua) in 2011, and the “10,000 Talent Plan” (wan ren ji hua) in 2012. Responding to national initiatives, similar projects are being proclaimed at the provincial level. The ultimate goal is to train more than 5 million talents by 2020 in sectors of strategic importance to China, including biotechnology15.

Under these programmes, the selected researchers work in comfortable conditions and benefit from privileged treatment in terms of housing, transportation or research funds. For example, the East China Transport University recruited researchers from the Chang Jiang programme, jointly launched in 1998 by the Ministry of Education and the Li Ka Shing Foundation, with an annual salary of 1.6 million yuan (approximately $232,600), grants housing and facilities for 3 million yuan (about $436,100), a start-up research fund of 4 million yuan (about $581,500), free housing for two years, and assistance to spouses in finding employment16.

The attractiveness of these incentive initiatives is evident and can be seen in the numbers. Over the period 2012-2018, it is estimated that out of the 2 million students returning to China to work, 250,000 will work in the biological sector17. In addition, a large number of biomedical professionals, such as Tong Youzhi, CEO of Souzhou Kintor Pharmaceuticals, have returned to China to establish their own start-ups.

Certain incentives also apply to foreign researchers. Recent talent introduction projects, such as the Global Expert Recruitment Programme, are open to them. Moreover, if they obtain a permanent residence permit, foreign researchers become eligible for the “10,000 Talent Plan”. The same applies to researchers from Taiwan, Hong Kong or Macao who have worked in China for more than a year. Chinese companies do not hesitate to recruit high-level foreign researchers and offer them attractive salaries. Steven Schweller and David Howe, respectively specialising in regenerative medicine and stem cell therapies, are valued advisors to the Chinese company RE-Stem Biotech, located in Suzhou, Jiangsu Province. Among the 20 new talent policies implemented by the Zhongguangcun Science Park, also known as China’s Silicon Valley, one of them offers that foreign experts invited by the park’s institutions can apply for a five-year, multiple-entry visa. China is counting on this synergy of Chinese and international researchers to take the development of biotechnology to the highest level.

Technology transfers

See Gryphon Scientific and Rhodium Group, cit.

UBS, cit., p. 4.

Natalie Chiu, “China Contract Research Organization (CRO) Industry Report 2017”, Global Newswire, 23 October 2017.

Research in China, “China Contract Research Organization (CRO) Industry Report (2019-2025)”, March 2019.

Ibid.

Ibid.

Gryphon Scientific and Rhodium Group, cit. p. 21.

See WuXi Biologics, “WuXi Biologics Reports Outstanding Interim Results”, com, 20 August 2019.

Although China has made spectacular progress in biotechnology, especially in terms of genome editing, CAR-T cells, immunotherapy and stem cell research, the size of the Chinese market is only 10% of the American market18. While China has the second largest pharmaceutical market in the world, organic medicine accounts for only 12% of the Chinese drug market19. In this context, the country has an immense need to strengthen its capacity for innovation, especially since the demand for organic products or products manufactured using organic processes is particularly strong. Technology transfer is an effective way to achieve this. It can take on many forms. In addition to national initiatives to bring back students who have studied abroad, China encourages the transfer of biotechnology through mergers and acquisitions, Contract Research Organizations (CRO) and Contract Manufacturing Organizations (CMO). These new forms of technology transfers are retained because, with the adoption of the new Foreign Investment Law on 15 March 2019, it is now forbidden to use administrative measures to force foreign companies to make technology transfers to their Chinese counterparts.

M&A is a practice officially encouraged in China, with the aim of developing world-leading national biotech champions and raising the technological level of Chinese companies. In the thirteenth Five-Year Biotechnology Development Plan, one of the objectives is to form at least 20 biotechnology companies with annual sales in excess of 10 billion yuan (about $1.4 billion). By 2020, it is expected that pilot provinces and flagship industrial bases will have been formed. The year 2017 saw the acquisition of Syngenta, a Swiss company specialising in crop protection products and seeds, by the state-owned China National Chemical Corporation (ChemChina) for a total of $43 billion, the largest acquisition to date in China. This not only gives China access to the European market, but also allows the use of Syngenta’s patented seeds, which are particularly important for Chinese farmers’ yields. The adoption of the M&A strategy by the Chinese government is motivated by international practices and the positive results of these practices. The merger of Sanofi and Aventis thus resulted in the formation of the largest European drug manufacturing group, and the global leadership position of the U.S. company Pfizer in the pharmaceutical sector at the beginning of 2010 is explained by a number of major acquisitions (Warner-Lambert in 2000, Pharmacia in 2003, Wyeth in 2009).

Technology transfers can also take place in the form of CROs and CMOs. CRO organisations, solicited by many pharmaceutical companies and medical device manufacturers, offer outsourced services for preclinical and clinical studies. Most of the world’s CROs are based in the United States, but the Chinese market is growing rapidly. Approximately 400 of the world’s 1,100 CROs are located in China20, with a market size reaching 68.7 billion yuan (about $9.9 billion) in 201821. The team “Research in China” estimates that this figure could rise to 242.5 billion yuan (about $35 billion) in 202522. The country has several reputable CROs, including WuXi AppTec, Pharmaron, Medicilon, Shanghai ChemPartner, Tigermed and Joinn Laboratories. Among these, WuXi AppTec is particularly competitive at the international level. Specialising in R&D of small molecule chemical drugs, the company achieved a 10.1% share of the global market in 201823. China is likely to see its CROs occupy even larger market shares in the future due to reasonable R&D costs, favourable public policies, a flexible regulatory environment and growing research capacity.

With regard to CMOs, dramatic progress has been happening since February 2016, when China introduced the Marketing Authorization Holder System (MAH) to bring the country into line with international practice. Initially tested in ten provinces and municipalities, the MAH was rolled out across the country in 2018. Under this system, production and marketing authorisation are managed separately. The marketing authorisation holder may choose to produce a medicinal product by themselves or to use other producers. Whereas before 2016 Chinese companies could not use CMOs, the introduction of the MAH has given a real boost to the development of biomanufacturing. Today, China has become the second most important country in CMOs, just behind the United States24. Over the past few years, a large number of Chinese CMOs have emerged and have expanded at an astonishing rate. Created in 2011 and based in Beijing, AutekBio is thus the first CMO in China and WuXi Biologics, specialised in vaccine production and listed on the Hong Kong Stock Exchange, recorded a 52.4% increase in revenues from 2018 to 201925. Other companies, including North China Pharmaceutical, Tasly Pharmaceutical, WuXi AppTec, ChemPartner, JHL Biotech and 3S Guojian, have also developed significant biomanufacturing capabilities.

Biotechnologies in China : a state of play

See Laura, “La Chine va améliorer la lutte contre le cancer, l’augmentation du nombre des cas coûtant plus de 220 milliards de yuans par an“, org.cn, 27 February 2019.

Huo Shi Chuang Zao, cit., p. 20.

Huo Shi Chuang Zao, cit. The exchange rate used is based on the exchange rate from 20 January 2020, where 1 dollar is equal to 6.86 yuan.

Gryphon Scientific and Rhodium Group, cit. p. 13.

David Cyranoski, “CRISPR gene editing tested in a person”, Nature, 539, n° 7630, 15 November 2016, p. 479.

UBS, op. cit., p. 17.

Ibid.

See Aifang Ma, L’intelligence artificielle en chine : un état des lieux, Fondation pour l’innovation politique, November 2018

Eurnet, “The strong push of Chinese pharmaceutical companies: a census of 30 innovative pharmaceutical companies in China” (translated from Chinese), baidu.com, 26 January 2018.

In China, innovative medicines are those that have not been approved anywhere in the world, those whose production sites are to be transferred to China, those used to treat AIDS, viral hepatitis and rare diseases, and newly launched generic drugs.

See UBS, cit., p. 7.

See Bill Wang and Davidson Alistair, “An overview of major reforms in China’s regulatory environment”, Regulatory Rapporteur, vol.14, N°. 7-8, July-August 2017, p. 5-9.

Biomedicine appeared in the second half of the 19th century, with the production of the first attenuated vaccine by Louis Pasteur against chicken cholera. The discovery of penicillin in 1928 by Alexander Fleming marked another major step in the human exploration of biomedicine. Using an organic source as raw material for the active ingredient or organic processes in production, biomedicines are expected to be more precise and with optimised quality. They are especially effective in the treatment of age-related diseases.

The development of biomedicine is of particular importance to China today mainly for two reasons. On the one hand, the cancer incidence rate of Chinese people is much higher than that of industrialised countries and life expectancy for people with cancer is much lower. Until 2015, the relative five-year survival rates of individuals with breast, thyroid, and prostate cancer in China were 82, 84.3, and 66.4%, respectively, compared to generally above 95% in industrialised countries26. The development of biomedicine can therefore enable the country to meet the needs of the population at an affordable price, reducing dependence on foreign organic drugs. On the other hand, China announced in 2016 a national plan called Healthy China 2030. In that document, it set a target of reducing the number of deaths from chronic diseases by 33% by 2030. With the rise in the number of elderly people, biomedicine has the potential to help the country meet this challenge.

Biomedicine remains the most important component of biotechnology in China, with a growth rate of +16%, the fastest in the world27. The value of China’s organic medicine market was 121.1 billion yuan ($17.6 billion) in 2015, 134.4 billion yuan ($19.6 billion) in 2016, and 145.8 billion yuan ($21.2 billion) in 201728. Taking into account that the total value of the organic market (all biotech sectors combined) was only $2.8 billion29, it is even easier to see how rapidly China’s biomed is expanding. In fact, the country has succeeded in creating several biomedicine centres where organic enterprises form a complete ecosystem. Examples include the Zhongguancun Science Park; Zhangjiang Pharmacy Valley in Shanghai; BioBay in Suzhou; Wuhan National Bio-industry Base (Biolake) in Wuhan; Guangzhou International Biotech Island; and Tianfu Life Science Park in Chengdu. This concentration of biomed companies has produced beneficial effects, such as optimisation in the use of natural resources, improved expertise or economies of scale.

The fruit of several years of development, several avant-garde biopharmaceutical companies have been created: BeiGene, Hengrui, Fosun Pharma, WuXi App Tec, GenorBio, Qilu Pharmaceutical, 3SBio, Innovent Biologics, Hisun Pharmaceutical, Zhangjiang Biotech, to name a few. China has seen its companies and research institutes develop cutting-edge expertise. While Legend Biotech and CARsgen Therapeutics are known for CAR-T cells, Shanghai-based Fosun Pharma specialises in the diagnosis and treatment of viral hepatitis, diabetes, cancer and malaria. In October 2016, a group associated with Sichuan University used CRISPR in a human clinical trial. This is the first time, worldwide, that the CRISPR technique was applied to humans30. The level of development of human genome editing is very high in China. It is thus no surprise that it has the second largest genomics market in the world. According to data from the China Food and Drug Administration (CFDA), 171 monoclonal antibodies are under development in the country, representing more than 20% of the world total31. The CFDA has also reported that there are 171 monoclonal antibodies in development in China. Moreover, the exploration of sixteen out of fifty immune checkpoint inhibitors is also taking place in China32. Inhibitor R&D is of particular significance in containing the development of cancers since inhibitors can block proteins that prevent the immune system from attacking cancer.

In China, the five priority areas of biomedicine are:

- the development of new types of vaccines and the improvement of traditional vaccines;

- the industrialisation of antibody drugs and protein drugs;

- the development of technologies for the diagnosis and detection of serious diseases;

- genotherapy and cellulotherapy;

- R&D in regenerative medecine.

The country is likely to make significant progress in these areas in terms of the increased ease with which Chinese companies can obtain financing on the stock market and the establishment of an institutional framework that is conducive to innovation. In terms of making it easier to obtain financing, the rise of Chinese CROs and CMOs has reduced the number of risks incurred by companies and investors. Indeed, the application of artificial intelligence and robots for medical purposes has attracted investment from digital giants33. In recent years, in addition to Hengrui, which, as a pioneering biopharmaceutical company in China, has a market capitalisation of more than $28.29 billion, smaller companies have also managed to secure large investments. In January 2018, Zelgen, Kintor and Henlius all attracted investments of more than $14.14 million34. Small companies such as Akesobio, Antengene, MicuRX Pharmaceuticals, which stand out for their outstanding performance, are likely to gain support from financial institutions.

As for the optimisation of the institutional environment in China, it is clear that significant policy changes have taken place to facilitate the marketing of innovative medicines. Following the publication of the national plan Made in China 2025, a large number of concrete policies were announced. In February 2016, the CFDA introduced a new classification system to prioritise the analysis of innovative medicines. The time limit for examination is shortened by six months35. As a result, 9 out of 35 innovative medicines approved between January and October 2017 were launched on the market much faster than usual36.

At the same time, the number of examiners increased from 60 to 200 in 2016 and will increase further in the coming years37. Since March 2017, innovative drugs imported from abroad are likely to be approved in China without having to go through all the stages of clinical trials. In order to improve their accessibility for patients, the State has opted for a system of subsidies. In 2017, among the 340 new drugs added to the national list of reimbursable medicines, there were many expensive organic products, demonstrating, among other things, the Chinese government’s willingness to promote biomedicine, even if it means footing a large bill.

Biomanufacturing and its ecological appeal

See Dabo Guan et , “Structural decline in China’s CO2 emissions through transitions in industry and energy systems”, Nature Geoscience, vol. 11, n°8, August 2018, p. 551-555.

See Éric de La Maisonneuve, Les Défis La révolution Xi Jinping, Éditions du Rocher, 2019.

Renewable energy derived from the chemical transformation of biomass (e.g. from organic waste, production of organic matter by trees, conversion of certain agricultural products, photosynthetic conversion of solar energy or algoculture).

Tim Buckley, Simon Nicholas and Melissa Brown, China 2017 World’s Second-Biggest Economy Continues to Drive Global Trends in Energy Investment, Institute for Energy Economics and Financial Analysis, January 2018, p. 47 (https://ieefa.org/wp-content/uploads/2018/01/China-Review-2017.pdf).

International Renewable Energy Agency (Irena), Renewable Power Generation Costs in 2017, January 2018, p.26.

According to the Thirteenth Five-Year Biotechnology Development Plan (2016- 2020), the manufacture of products using organic processes will save between 20 and 50% of energy and reduce environmental impact by 20 to 60%. In the current context marked by a high level of environmental pollution in China, the usefulness of biomanufacturing is indisputable. A study conducted by the Department of Science at Tsinghua University showed that after signing the Paris Climate Accord in 2015, China’s greenhouse gas emissions decreased each year from 2014 and 2016. Researchers believe that if China wants to continue on this path, industrial structural changes are needed38. Given the immense ecological potential of biomanufacturing, the industrial use of organic processes on a larger scale is bound to contribute immensely to China’s sustainable development. As China is the world’s largest emitter of greenhouse gases (28% of global CO2)39, China’s emission reductions must contribute to the improvement of the planet as a whole.

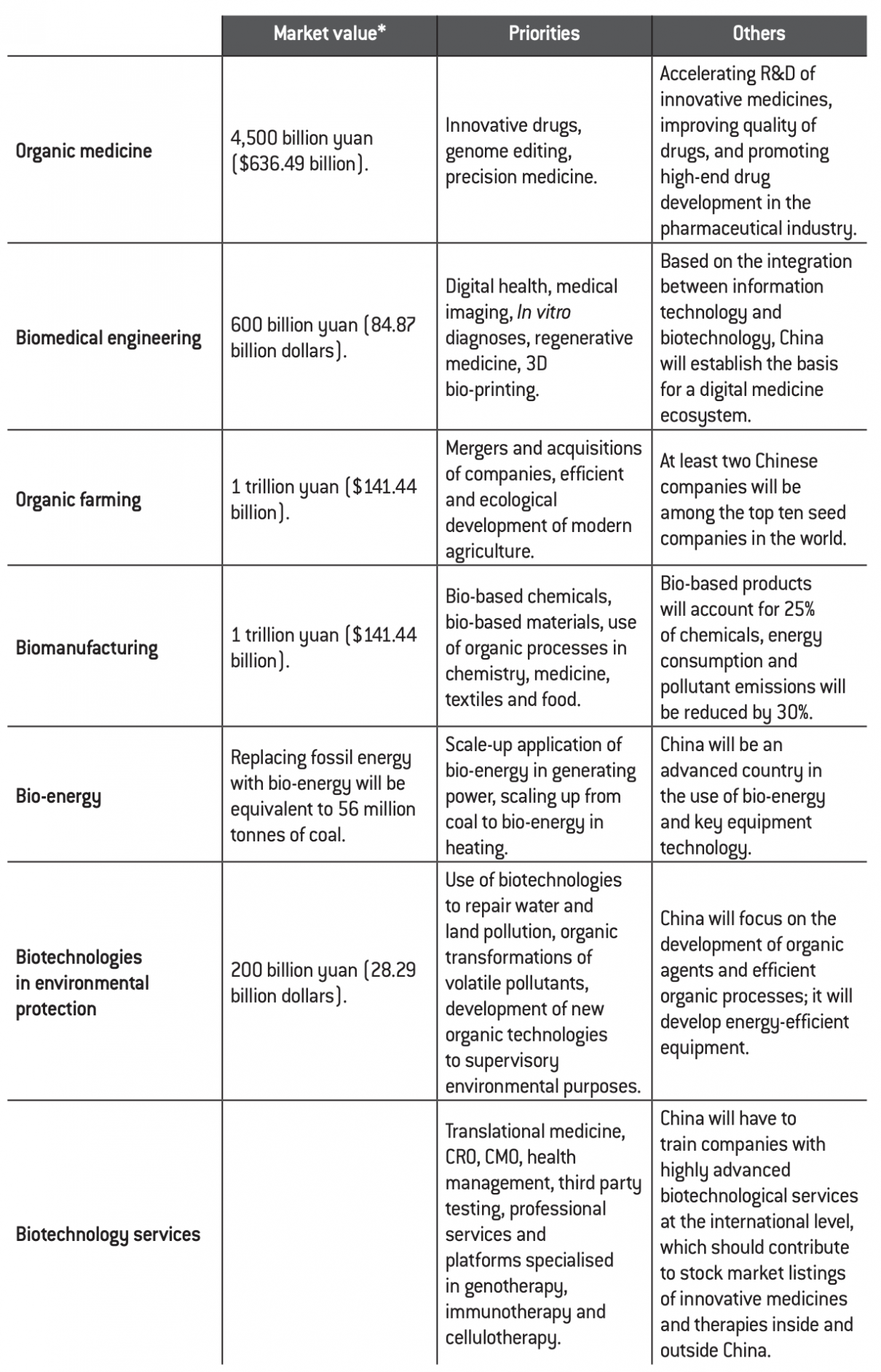

The 13th Five-Year Plan plans to increase the share of non-fossil fuels in primary energy production from 15% in 2020 to 20% in 2030. The development of bioenergy plays a key role in achieving this goal, especially as China is now showing itself capable of engaging in the production of bioenergy40. The replacement of fossil fuels by organic energy is now reaching the equivalent of 33 million tonnes of standard coal. In addition to technological advances in this area, the country is constantly increasing its public financial support for the development of renewable energy. According to a report published by the Institute for Energy Economics and Financial Analysis (IEEFA) in 2017, the Chinese government invested $44 billion in clean energy production, an increase of $12 billion compared to 201641. Chinese bioenergy production also benefits from a reduction in production costs. According to the International Renewable Energy Agency (Irena), by 2020, the production of renewable energy will be at the same price as that of fossil fuels, or even cheaper42.

Total bioenergy production capacity in China between 2008 and 2018 (in megawatts)

See Ruiyan Wang et al., “Bioindustry in China: an overview and perspective”, New Biotechnology, 40, Part. A, January 2018, p. 46-51.

See “La Chine veut étendre l’usage de l’éthanol carburant d’ici 2020“, fr, 13 September 2017.

Council of State Affairs, “12th Five-Year Plan for the Development of Emerging Organic Industries” (translated from Chinese), 9 July 2012.

See Gryphon Scientific and Rhodium Group, cit. p. 34.

Ibid., p. 35.

By developing microbes that produce chemicals at a lower cost and with a lower environmental impact, biomanufacturing is emerging as an industry of the future. The Chinese government is promoting the development of bio- based materials, including industrial microbes, industrial raw materials – such as polylactic acid (used in food packaging, surgical sutures or 3D printing) and polybutylene succinate (used in film and packaging) -, degradable plastics, biomass fibres and biosolvents. The objective is to equip China with a more efficient industry in order to achieve the sustainable development of its economy. According to the Twelfth Five-Year Plan for the development of new strategic industries, the share of bio-based products should reach 12% of total chemical products by 2020, and 30% of production in the chemical, dyeing and tonnage sectors will be carried out using organic methods. To reduce the ecological footprint, organic processes will be used in chemical production, light industry and the textile sectors.

China is now a world leader in several organic production processes. This is particularly the case with organic fermentation: in 2015, it is estimated that 24.3 million tonnes of products based on this process were produced43. In 2017, China became the third largest producer of ethanol fuel, behind the United States and Brazil, although consumption remains less vast with only 2.6 million tonnes per year. In a document unveiled by the National Reform and Development Commission on 13 September 2017, it is expected that China will have an annual production capacity of 4 tonnes of bioethanol in 2020 and expand the use of ethanol fuel throughout the country44. The use of biomass is expected to produce 30 million kilowatts of electricity by 2020 and 50 billion cubic metres of biogas will be used annually45.

China has also made major progress in the production of biochemicals, including enzymes, organic acids and vitamins. The production capacity of industrial enzymes in China was 1.2 million tonnes in 201446 but still has a long way to go in this respect as the world enzyme market remains dominated by foreign companies such as BASF (German), Novozymes (Danish), DowDuPont (American), Associated British Foods (British) and Amano Enzyme (Japanese). In the relatively new field of synthetic biology, China has not hesitated to get involved but remains a beginner. In addition to the 250 million yuan that has been devoted to the development of synthetic biology through the 973 Programme, China provides an annual government budget of about 260 million yuan to synthetic biology47. In this context, the Synthetic Biology Laboratory of the Chinese Academy of Sciences is an important research institute for taking Chinese R&D to the next and highest level.

Evolution of the number of CRISPR patent families by geographical area (as of the earliest priority date, 2002 to 2016)

Source :

Jacqueline Martin-Laffon, Marcel Kuntz and Agnès E. Ricroch, “Worldwide CRISPR patent landscape shows strong geographical biases”, Nature Biotechnology, vol. 37, N°. 6, p. 619, June 2019.

A patent family is “a collection of patent applications which cover the same or similar technical content” (definition from the European Patent Office).

See “The output of China’s biological industry will reach 5 trillion U.S. dollars in 2022”, ilbioeconomista.com, 10 November 2017.

Ibid.

See Kaidi Eco’s official website : (www.china-kaidi.com/en/about-us-the-company/).

See “ZhongliangZhenghua: China’s largest ethanol fuel company – one of the world’s first Chinese pilot alcohol fuel production companies” (translated from Chinese), eastmoney.com, 16 September 2017.

In recent years, a large number of Chinese industrial biology companies have attracted worldwide attention due to their advanced expertise. Among the indicators that can be used to measure the level of development of the bio- industry, the number of scientific articles published and patents48 filed is quite revealing. In 2016, 11,266 scientific articles on the subject were published in China49, thanks in particular to the Chinese Academy of Sciences, Zhejiang University and Jiangnan University, which have become pioneering research centres. Between 2014 and 2016, Chinese scientists filed a total of 57,559 biotech patent applications, accounting for more than 30% of patent applications worldwide50. Kaidi Eco, based in Wuhan, is a company specialising in biomass power generation. As the undisputed leader in renewable energy in China, the company now has 40 biomass power plants in 22 provinces and autonomous regions of China51. Zhongliang Zhenghua, part of the Zhongliang Group (China National Cereals, Oils and Foodstuffs Corporation, COFCO), is the largest ethanol fuel producer in China. In addition to an annual production capacity of 1.2 million tonnes of ethanol fuel, Zhongliang Shenghua can also produce 2 million tonnes of corn starch, 1 million tonnes of starch sugar, 100,000 tonnes of lysine and 200,000 tonnes of citric acid52. At the same time, China has many organic companies producing industrial enzymes, such as BlueStar Adisseo (BlueStar International Group is the third most competitive organic silicon and amino acid company in the world).

Consumers favour organic but reject GMOs

Gryphon Scientific and Rhodium Group, cit. p. 35.

Kai Cui and Sharon Shoemaker, “Public perception of genetically-modified (GM) food: A Nationwide Chinese Consumer Study”, npj Science of Food, n° 2, art. 10, 5 June 2018, p. 2.

See Zhang Zhulin, “Double jeu chinois sur les OGM”, Le Monde diplomatique, N°. 767, February 2018, 10-11.

See “Sanlu powdered milk” (translated from Chinese), baidu.com, s.d.

Ibid.

See Le Petit Journal Shanghai, “Où acheter du Bio en Chine ?” com, 6 March 2018.

See Olivia Guerry, “Chine : l’essor de l’agriculture biologique”, com, 11 September 2015.

Ibid.

The concept of organic farming dates back to the 1920s. It was at this time that new currents of thought based on ethical and ecological principles were born. The term organic farming has both economic and ecological dimensions. In economic terms, it refers to a wide variety of genetic engineering or artificial breeding techniques aimed at improving the profitability of agricultural production, increasing productivity per unit of output, making plants and animals more resistant to disease or forming new species to bring economic benefits. In ecological terms, organic farming refers to cultivation and rearing methods that are harmless to the environment and human health, such as the non-use of herbicides or chemical fertilisers, or slaughter techniques that reduce animal suffering. In China, the development of organic agriculture includes several sectors, such as breeding through genetic modification, animal vaccines, organic fertilisers, organic fodder, organic insect control, organic pesticides and herbicides. At present, selection through genetic modification is the most developed and widely used technique and has the greatest potential for future development.

China began to pay special attention to organic agriculture, especially its economic dimension, in the 1970’s. After the Great Leap Forward movement from 1958 to 1960, China’s agricultural production was severely damaged due to excessive exploitation of arable land and poor preservation of agricultural resources. The Cultural Revolution did not help to redress the situation, with the consequence that many households were then running out of food on a daily basis. One of the major challenges for China in the 1970s and 1980s was to ensure food security for the Chinese population. Yuan Longping, nicknamed the “father of hybrid rice”, brought some exceptional contributions thereupon. In 1974, he succeeded in creating the first hybrid rice species in the Hunan province, by introducing a male sterility gene discovered in wild rice into a cultivated rice species, thus allowing crossbreeding between pure lines. This experimentation led to a colossal increase in the harvest per hectare. Hybrid rice production in China reached 700, 800, 900 and 1,000 kilograms per hectare in 2000, 2004, 2011 and 2014, respectively, enormously helping to solve the famine problem.

The improvement of animal and plant species and the formation of new species through genetic modification have made significant progress in China. Today, the country is able to create a large number of GMO varieties such as cotton, soybean, papaya, rice, corn, tomato, pepper, tobacco, petunia, poplar, etc. The Chinese government has made significant investments in the production of transgenic seeds. Through the Key Scientific and Technological Grant of China for Breeding New Technology, the Chinese government has invested 24 billion yuan (about $3.7 billion) in GMO projects, including 585 seed projects, to develop new traits such as resistance to insects, disease and stress in animals and plants53. Nevertheless, the cultivation and breeding of GMO plants and animals is a controversial issue in China. Civil society remains very reticent towards GMO products: the results of a survey show that only 11.9% of Chinese people have a positive perception of GMO products, while 41.4% and 46.7% declare themselves neutral and unfavourable towards these same products respectively54. Chinese society’s reservations explain the State’s caution in promoting GMO species, despite the government’s desire to advance scientific research. On 11 January 2018, a rice genetically modified by Chinese researchers was validated by the U.S. Food and Drug Administration (FDA), but it cannot be grown on Chinese soil because of the difficulties in getting GM rice accepted by the Chinese population55.

People’s concerns about GMO products are part of the ecological dimension of organic farming. In recent years, several food scandals have outraged Chinese consumers. In September 2008 it was revealed that the milk produced by the Sanlu group was adulterated. As of December 2008, some 294,000 infants have suffered from urinary system dysfunction as a result of taking contaminated milk powder56. Melamine has been identified in the products of twenty-two other equally recognised national dairy groups such as Yashili, Yili, Mengniu, Guangming, etc.57. More recently, in March 2015, another scandal erupted in the Fujian province. Several individuals bought pigs that died of disease and resold the sick pigs at a bargain price. This type of business thus helps explain the growing popularity of organic farming. An alternative mode of consumption is emerging among the inhabitants, especially those living in large metropolises and those with high socio-economic status.

Today, the ecological dimension of organic farming seems to exceed the economic dimension. Responding to the concerns of Chinese citizens about food hygiene and safety, the government has established organic certification institutions such as the China Organic Food Certification Center (COFCC) and the Organic Food Development and Certification Center (OFDC). The Certification and Accreditation Administration of China has accredited many organisations58 and can also award organic product labels. Subsequently, two labelled systems were created, “organic products” (you ji shi pin) in 2002 and “green products” (lü se shi pin) in 2006. It is prohibited to use chemicals in the production of food bearing these two labels. Total organic food production in China is estimated to have reached 6.73 million tonnes in 2013, 2.4 times higher than in 200559. A wide variety of agricultural food products available for consumption maintain this label: rice, wild rice, soybeans, tea, honey, wine, Chinese cabbage, ginger, etc.60. Organic fruits are relatively rare, as their rustic appearance does not always attract Chinese consumers.

Two problems still need to be solved. On the one hand, given the high cost of organic farming, access for the Chinese to green products remains very unequal. On the other hand, organic farming remains small in relation to total agricultural production in China.

Logos of the “organic” (left) and “green product” (right) labels in China

Developing national seed champions

Graduate Institute of Science and Technology, “L’Agriculture en Chine“, July 2016, IHEST media library files, p. 36.

“La Chine, plus grand marché de la graine en 2015“, CCTV.com, 27 May 2014.

China’s difficult experiences with grain shortages prior to the 1980s also explains the importance the country places on growing high quality seeds. Several official documents were successively published, including “The State Council’s Opinions on Accelerating the Development of the Modern Cereal Seed Industry in 2011”, the “National Plan for Increasing the Seed Production Capacity to 100 Billion Kg. 2009-2020”, the “National Plan for the Development of Modern Agriculture (2011-2015)”, the “National Plan for the Development of the Cereal Seed Industry (2012-2020)” and the adoption and amendment of the Seed Law in 2000 and 2015 respectively. The importance of the seed industry is also highlighted in the Twelfth Five- Year Plan for the development of new strategic emerging industries as an important component of the biotechnology sector. With the aim of developing national champions in the seed sector, the Chinese state is encouraging corporate mergers and acquisitions, with the aim of increasing the market share of the top 50 companies from 30% in 2012 to 40% in 2015 to 60% in 202061. Large Chinese seed companies have also been encouraged to carry out international mergers and acquisitions. In addition to ChemChina’s acquisition of Syngenta in 2016, ChemChina acquired Makhteshim Agan Industries in 2010 and Adama in 2011. In June 2018, China announced the merger between ChemChina and SinoChem, creating a new giant in organic agriculture. The high concentration of the domestic seed market has enabled China to be extremely competitive on the international scene. In 2014, Chinese television announced that China would surpass the United States in 2015 by becoming the world’s largest agricultural seed marketing market62.

The Sino-American rivalry in the field of biotechnology

See Gryphon Scientific and Rhodium Group, cit, p. 2.

See Sacha Pouget, “La place des biotechs Européennes dans le Monde en 2019“, biotechbourse.fr, 27 June 2019.

Ibid.

See “Le secteur des biotechs pèse désormais 1,000 milliards de dollars en Bourse“, tradingsat.com, 2 July 2019.

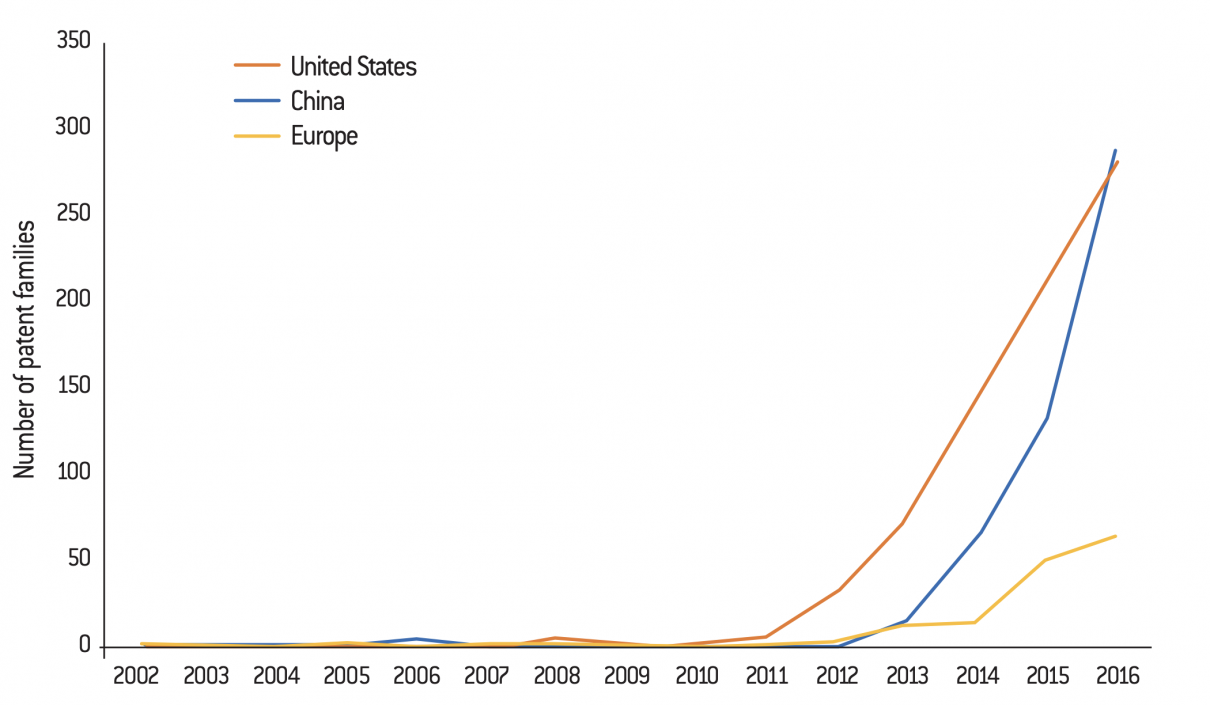

There exists strong global competition in the biotechnology sector. Many countries have adopted ambitious plans: the “National Bioeconomy Blueprint” by the Obama administration in the United States in 2012, “A Sustainable Bioeconomy for Europe: Strengthening the links between economy, society and environment” by the European Commission in 2018, “A Bioeconomy Strategy for France” by the French Ministry of Agriculture in 2016, the “National Policy Strategy on Bioeconomy” by the German Ministry of Food and Agriculture in 2014, etc. Since the United States is the world leader in biotechnology, the Sino- American comparison is essential to acquiring a more accurate idea of the level of biotechnology development in China. Among the strengths of the Americans are the size of their biotech market and their level of corporate concentration. Despite the strong growth of the biotechnology sector in China, the size of the Chinese market is less than 10% of the U.S. market63.

According to a recent study, 820 biotech companies worldwide are listed on the stock exchange, with a market capitalisation of $1,060 billion. Of these, 408 companies are American, accounting for 52% of the total valuation. The ten American giants alone account for $482 billion64, which shows an extreme concentration of the American market. Within this framework, their companies benefit from a favourable ecosystem in order to share resources and infrastructures. In comparison, only 37 Chinese companies appear on the list with a market capitalisation of 10.1% of the global level65, lower than that of South Korea. Nevertheless, compared to European companies, Asian companies seem to perform better: Korean and Chinese companies represent 1.5 times the total value of the 159 European biotech companies66.

Distribution of the 10 countries with the largest number of listed biotech companies

Source :

Factset, InFront – Données compilées par Sacha Pouget (http://biotechbourse.fr/les-biotechs-francaise-europe-dans-le-monde-en-2019/).

See “To promote interventional medicine, they came together and did something important!” (translated from Chinese), com, 4 August 2019.

U.S. companies are outpacing China’s innovation capacity in interventional medicine and medical implants. The firms Johnson & Johnson (1886), Medtronic (1949) and Boston Scientific (1979), some of which were founded a long time ago, can boast advanced expertise in this field. On the other hand, China’s experience in interventional medicine is recent and the competitiveness of domestic enterprises still needs to be improved. In 2006, the first Interventional Medicine Forum was held in China and it was only in the late 2000s that Chinese hospitals began to use the minimally invasive intervention technique on a widespread basis, thanks to the relentless efforts of several Chinese experts such as Xinwei Han, Director of the Department of Interventional Medicine at the No. 1 Hospital affiliated with the University of Zhenzhou. The manufacture of interventional medicine products in China remains low and 95% of products are imported from abroad67. Today, Chinese companies, including Lepu Medical Technology and Neusoft, are capable of producing equipment for CT scanning, superconducting magnetic resonance imaging (MRI), digital subtraction angiography (DSA), ultrasound, etc., but China still has a long way to go before it is a world leader in these fields.

The race for genome editing

Shu-Jing Jean Chen, “Genomic Dreams Coming True In China”, forbes.com, 28 August 2013.

Ibid.

Gryphon Scientific and Rhodium Group, cit., p. 25.

Ibid., p. 26.

Huo Shi Chuang Zao, “Current Development of Molecular Diagnostic Technology in China” (translated from Chinese), 15 October 2018.

See “Day 2 continued on a great note: 9th Molecular Diagnostics Technology Conference successfully concluded” (translated from Chinese), com, 10 November 2018.

“Nature: China Uses Precision Medicine on a Large Scale”, 29 November 2017.

See Gryphon Scientific and Rhodium Group, cit, p. 25.

See UBS, cit., p. 15.

See Serge Soudoplatoff, Le numérique au secours de la santé, Fondation pour l’innovation politique, January 2019.

David Baverez, Paris-Peking La nouvelle Chine racontée au futur Président, Éditions François Bourin, 2017, p. 121.

See Philippine Robert, “Chine : son incroyable percée dans les technologies d’avenir”, fr, 25 June 2018.

However, thanks to a strong capacity in human genome sequencing, China is taking the lead in genome editing by CRISPR-Cas9 technology, cancer treatment by CAR-T cells, molecular diagnostics and precision medicine. Established in 1999, the Beijing Genomics Institute (BGI) is one of the world’s most advanced institutions for human genome sequencing, having contributed to the Human Genome Project. Recognising the importance of DNA sequencing, the Chinese government granted a $1.5 billion loan to the BGI in 2010 through the China Development Bank68. It is estimated that with 25% of the world’s genome sequencing services (not only human but also plant and animal), the BGI is ahead of its American competitors Illumina, the Broad Institute of Harvard and MIT69. Other important players that China has trained in the genomics sector include WuXi NextCode, Novogene and CloudHealth Genomics, which demonstrate a high capacity in terms of market capitalisation. Concerning the CRISPR-9 technology, until February 2018, 9 clinical studies to test the performance of cells edited via CRISPR in the treatment of cancer and HIV have been conducted in China, and 80 Chinese patients have received the treatment. In comparison, over the same period, there is only one CRISPR clinical trial in the United States70.

These exceptional advances in genomics have enabled China to achieve encouraging results in precision medicine, including molecular diagnostics. It is estimated that the Chinese molecular diagnostics market has grown faster than the world market71.

While the world market is growing at an annual rate of 11%, the figure is 24% for the Chinese market72. Chinese companies such as Haplo X Biotechnology, Singlera Genomics and CapitalBio Corporation have developed great expertise: the first two in cancer diagnosis using liquid biopsy and ctmDNA (circulating tumor methylated DNA) and CapitalBio Corporation in biochip technologies. In addition, since its first edition in June 2010 in Beijing, the Molecular Diagnostics Technology Conference has been meeting yearly to promote the exchange of experiences and best practices.

In recent years, the State Food and Drugs Administration (SFDA) has approved the use of several molecular diagnostic tools, including a microarray to detect the gene responsible for hereditary deafness, microarrays to identify mycobacterial species, and microarrays to detect genes resistant to tuberculosis drugs. China’s National Center for Drug Screening has established a list of 35 standard product types for the detection of pathogenic microorganisms73. China’s performance in precision medicine, especially in molecular diagnostics, is closely linked to government support in this field. In March 2016, one year after the Obama administration publicised the Precision Medicine Initiative, China launched a similar initiative called the China Precision Medicine Initiative. An investment of $9.2 billion over 15 years is envisioned to support the purchase of clinical data and genome sequencing research. This is an investment far greater than the U.S. public investment of $215 million74.

China’s rise is also reflected in the application of nanotechnology, big data and 5G to biotechnology. In early 2019, the Harbin Institute of Technology developed nanobots with a diameter of 500 nanometers, thinner than a single strand of hair. These spiral-shaped nanorobots are capable of detaching themselves from the patient’s organic compounds and moving collectively from the vitreous body of the eye to the retina to deposit drugs. In the same year, China achieved the world’s first remote operation using 5G technology. Thanks to the cooperation between Huawei, China Unicom, the Suzhou-based robot company Kangduo, Beijing’s Hospital No. 301 successfully conducted a liver lobule resection operation for a piglet at the Mengchao Hepatobiliary Hospital, part of the Fujian Medical University. The first 5G operation on humans was performed in March 2019 in China. A patient with Parkinson’s disease, who was hospitalised at the Chinese General Hospital of the People’s Liberation Army, was operated on from Sanya, a town in Hainan province more than 3,000 kilometres away.

The question arises as to how this Sino-American rivalry may evolve in the future. Although the United States still dominates the global biotechnology market, China is likely to occupy a leadership position in the coming years. Several factors play in its favour. Firstly, it must be noted that Chinese companies benefit from a regulatory environment that is considerably more flexible than that of their American counterparts. For example, genetic manipulation of the human genome is not banned in China, and several trials are in progress there. American regulators are extremely cautious about genome manipulation, which explains why they are lagging behind in this field75. Another example is that Chinese companies are allowed to mobilise a large amount of data, which offers them great potential in terms of technological breakthroughs. Their American counterparts often have to go through long administrative formalities in order to get approval from the Food and Drug Administration for trials, which can put a damper on their enthusiasm.

Secondly, China is experiencing a growing demand for biotechnology. The country currently has the highest cancer incidence rate and the largest number of cancer patients in the world. Since 2010, cancer has been among the leading causes of death in China. In 2014, China recorded 3.8 million new cases of cancer, representing 27% of the global total. The number of lung cancers in China represents 36% of the global level76. The ageing of the population is likely to increase the prevalence of cancer even more so according to World Health Organization (WHO) estimates. The development of this type of disease, coupled with the continuous increase in the standard of living, will create a strong demand from the Chinese population for high- quality, organically based medicines and therapies. This demand will be all the stronger as the Chinese state does not hesitate to reimburse organic drugs. As the biopharmaceutical sector is the main component of Chinese biotech, the demand for organic drugs will strongly drive the expansion of the Chinese biotech market. In comparison, the fact that American patients generally have to bear expensive medical costs on their own may weaken their willingness to purchase these medications. Overall healthcare costs are higher than the average of the OECD. The high cost of drugs and medical equipment is one of the most important factors in explaining the high medical expenses of American households77. With regard to organic farming, there is a general awareness among the Chinese who are increasingly using green agricultural products. This trend is a major contributor to the growth of organic agriculture in China.

Thirdly, financial support from the Chinese state is a crucial factor in the sustained development of biotechnology in China and possibly in surpassing the United States. Since biotechnology became a strategic emerging industry in 2012, the Chinese government has not hesitated to grant strong financial support to Chinese companies involved in this sector. According to David Baverez, a French investor based in Hong Kong, “Chinese buyers benefit from financing in the form of practically unlimited loans, as long as their operations are in line with the strategic objectives of the Chinese government78“. This led to the acquisition of Syngenta in 2016 by ChemChina, then heavily indebted. Combined with the proclamation of voluntary national policies, fiscal and tax policies have a beneficial long-term effect, particularly on R&D in new technologies. While in 1996 China spent 0.56% of its GDP on R&D, this figure rose to 2.12% in 201779. In comparison, the dynamics of development of the biotechnology sector in the United States come primarily from private actors who are more vulnerable to unpredictable market fluctuations, which corresponds perfectly to the case of the biotechnology market, which is marked by an extremely high degree of risk.

Lastly, unlike the United States, Chinese public opinion is very favourable to biotechnology, with the exception of GMOs in food. Having suffered from China’s technological backwardness before the establishment of the People’s Republic of China in 1949, the population considers new technologies and scientific advances more as a progress and a symbol of modernity than as a threat. In Chinese philosophy, Evil and Good, represented by the yin and yang of Chinese Taoism, can coexist, and are even inseparable. The Chinese are more accepting than Westerners of the fact that a risky technology should not immediately be censored or nipped in the bud. Chinese society appears confident in the face of high-tech, fond of technological innovations, and considers itself capable of managing their undesirable effects. This mentality explains the mad rush to new technologies that we are seeing in China today.

Controversies and future prospects

Interspersed with scandals related to the quality of medicines and food products, the development of biotechnology in China is not without obstacles. From Changchun Changsheng’s faulty vaccines in July 2018 to the birth of the first GMO babies announced by researcher He Jiankui in November 2018 in Hong Kong, China still has a great deal of work to do to reassure foreign investors, win the respect and trust of its partners, and establish itself as a reliable and respectable biotech powerhouse.

The controversies surrounding Chinese biotechnologies

See Hugo Jalinière, “Bébés CRISPR : l’enquête révèle les dessous du scandale“, sciencesetavenir.fr, 21 January 2019.

See Xinzhu Wei and Rasmus Nielsen, “CCR5-∆32 is deleterious in the homozygous state in humans,” Nature Medicine, 25, No. 6, June 2019, pp. 909-910.

See Qing Xia and Leo Cai Yang, “Contract BioManufacturing in China: Creating a New Segment”, com, 4 October 2018.

“Alimentation: pourquoi la Chine recule sur la production d’OGM“, challenges.fr, 17 November 2018.

See Aifang Ma, op. cit.

Presently, the vast majority of controversies surrounding Chinese biotechnology are linked, on the one hand, to the failure to comply with ethical standards and, on the other, to the questionable quality of products and services. In November 2018, the declaration of the existence of the twins Lulu and Nana, genetically modified by He Jiankui using the CRISPR-Cas9 technology, shocked public opinion and drew fierce criticism from the international scientific community for neglecting ethical considerations. In January 2019, the Chinese press confirmed the pregnancy of a second woman with a genetically modified baby80. The Chinese government accuses He Jiankui of having carried out his project without official approval. Although the Chinese researcher said that the CCR5-∆32 gene mutation would make babies resistant to HIV, smallpox and cholera, scientists doubt the real usefulness of the trials, citing the availability of several other effective methods against AIDS. Moreover, according to a recent study, not only are GMO babies two years less likely to live than babies who have not undergone genetic modification, but they are also more vulnerable to several infectious diseases such as influenza81.

Moreover, following the introduction of the MAH reform in 2016, CMOs have taken off in China, so much so that Li Zhiliang, CEO of AutekBio, has declared that China-made pharmaceuticals are destined to be as ubiquitous as the iPhone made in China82. However, behind this exceptional growth in production capacity, the revelation of several cases related to the quality of children’s vaccines not only undermined the confidence of Chinese consumers but also raised doubts among international partners. In July 2018, the National Medical Products Administration denounced the biotech company Changchun Changsheng and revealed that the company had falsified data in its manufacturing process for a lyophilised rabies vaccine for human use. While the vaccines concerned were confiscated by the authorities before they were placed on the market, this is not the case for 252,600 tetanus vaccines, also manufactured by Changchun Chansheng using dubious methods and almost all of which have been sold in Shandong province. The Shandong Centre for Disease Control reported that these vaccines caused an increase in abnormal reactions in the children to whom they were administered. The remaining 186 vaccines have been confiscated and the Shandong provincial authorities have requested that the children concerned be revaccinated against tetanus.

The final controversy is related to the consumption of GM food. With the rapid spread of the idea of organic farming, the consumption of organic food is gaining popularity among Chinese families. GMO products, for their part, have great difficulty finding their place in their kitchens. “According to Nature magazine, 45% of Chinese people are opposed to GMOs. Nearly one in seven citizens believe that GMO technology is ‘bioterrorism targeting China’83”: taking into account the public’s reluctance towards GMOs whose consequences on human health and biodiversity remain uncertain, the Chinese government does not particularly encourage the planting of GMO agricultural products for human food use. That is why the marketing of GM foods is very low compared to the United States, where public opinion is more favourable. The cultivation of GMO products is one of the few areas where China is not in a hurry to surpass the country of Donald Trump. For example, in May 2017, the U.S. FDA approved the marketing of a pink fuchsia pineapple, something unimaginable in China.

Recent controversies around biotechnology reveal several societal problems that persist in China. The enormous commercial gains that the biotechnology industry promises to companies sometimes leads them to engage in irresponsible behaviour that can be detrimental to consumers. The phenomenon is all the more widespread as the Chinese government has set up a relatively lax regulatory environment for biotechnology. While weak regulation of high- tech may encourage scientific innovation, which is the case in the artificial intelligence sector, for example84, it is also likely to give rise to controversial practices. The Changchun Changsheng toxic vaccine scandal illustrates the need for the Chinese authorities to tighten regulations on the biotechnology sector.

Moreover, the desire to see China establish itself as a world leader and break away from the technological dependence of foreign countries, especially the United States (which is the case for certain medical equipment such as implants), is widely shared by the Chinese scientific community. This is why the pursuit of innovation is becoming the primary objective and the dominant outlook in Chinese enterprises and research laboratories. Although such competition is in many ways conducive to scientific advances, it unconsciously pushes some researchers to go beyond ethical considerations in order to achieve sensational results and become the world leader in a particular field. He Jiankui’s research that led to the creation of the world’s first GMO babies is partly motivated by this kind of imbalance between the will to innovate and respect for ethical standards. In order to not have his project refused, he went so far as choosing to continue his research without notifying the competent authorities. This scandal highlights the fact that the ethical dimension is, if not more important, at least as important as the will to innovate.

The last controversial factor is closely related to the changing mentality of Chinese consumers. Shocked by the food and medical scandals that have taken place in recent years, the Chinese public is beginning to question the very nature of scientific advances. The latter are no longer seen exclusively as a symbol of progress but also, to some extent, as a source of social problems. This mentality is becoming more widespread as the last thirty years of economic growth have led to a scarcity of natural resources and an unsustainable level of environmental pollution. Awareness of the importance of ecological preservation has become widespread in Chinese society. It is therefore not surprising that the Chinese, especially those living in cities and with relatively high socioeconomic statuses, are paying more and more attention to what they eat every day. Among the inhabitants of severely polluted regions, one could almost speak of a certain paranoia about food security. This vigilance affects both agricultural products to which pesticides, herbicides or chemical fertilisers are applied, as well as GMO foods. Uncertainty about the consequences of the use of GMOs has not helped to improve their reputation in China.

What prospects for the future?

The development of the food and medical scandals invites China to think about how it should optimise its future in the biotechnology sector. After the digital revolution, biotechnological innovation is also likely to cause a considerable number of upheavals in society. It could not only become a new dynamic for economic growth, but also greatly influence the quality of life and of life expectancies for billions of people. As the world’s most populous country, and as it faces the challenge of an ageing population, the development of the biotechnology sector is of strategic importance to China. As mentioned earlier, the advantages that the country is acquiring today will undoubtedly enable it to achieve better results in the years to come. However, in order to secure and sustain its progress, China must remain vigilant so that its development is protected from international vicissitudes.

Foreign countries feel both great admiration and deep concern about China’s technological prowess. Impressed by the speed at which China has successively taken global leadership in e-commerce, mobile payment, artificial intelligence and genome editing, the international community is concerned about the consequences that this rise in power could have for existing international order. Will China use its technological power to establish global hegemony? Will it spread, or even impose its authoritarian model on the whole world? Should European countries maintain their alliance with the United States or throw themselves, enthused or unenthused, into the open arms of the red dragon? While these issues may still be left unresolved for the moment, the time will come when East and West will have to decide.

In this sense, one of China’s priority tasks is to reassure its many foreign partners. It is not a question of convincing the West of the perfection of Chinese socialism, but of making people understand that China, like all the countries of the world, has its own dilemmas and equations to solve. Thus, many Haigui, having studied abroad, express more a patriotic feeling than a sympathy for democracy in the Schumpeterian sense of the term. Indeed, their stays abroad seem to make Chinese students aware of the difficulty of governing a country as vast as their own85. Moreover, the media treatment of China in the Western press is often portrayed with exaggeration and demagoguery. As Jean-Louis Rocca points out, the protagonists in the neo-conservatism, marked by Manichean judgements and sometimes strong sinophobia, often fail to take a reasonable comparative approach when comparing China to the West: “China is never compared to democratic societies as they actually function. The Chinese are manipulated by the government (implying this never occurs in democracies), the Chinese are awful capitalists (implying the others are not), the Chinese want to dominate the world (implying the others do not), the Chinese regime is authoritarian (implying that others are not), and so on. What should be demonstrated, the specificity and, so to speak, Chinese malignancy, becomes the starting point of the analysis. China may be dangerous for peace, the prosperity of populations, the happiness of the world, but in what way is it more dangerous than the United States or France? Can it be demonstrated that China is more capitalist, imperialist, unequal, militaristic than the other dominant countries?86“.

In addition, particular attention must be paid to the continuity of investment in biotechnology R&D. Despite significant advances in recent years, notably in CAR-T cells and CRISPR-Cas9, China’s dependence on the United States in terms of essential biotechnologies remains unchanged and the innovative capacity of Chinese research teams is still weak compared to that of their American counterparts. It is therefore a question of strengthening the security of biological information of Chinese citizens. Indeed, the risk of usurpation of individuals’ personal data exists not only in artificial intelligence but also in the operation of processing health data.

The regulation of the national biotechnology market is another major challenge for China. Given the considerable economic gains and the attractiveness of biotechnology, it is very likely that new scandals will occur if the Chinese state fails to quickly adopt dissuasive regulations and enforce them on all stakeholders in the sector. With the widespread awareness of Chinese society regarding food and medical safety, pharmaceutical companies and agricultural producers are under great scrutiny. One false step can be very costly, as shown by the exceptionally rapid repudiation of the creator of GMO babies, He Jiankui, who was nevertheless selected in the top 10 scientific personalities of the year 2018 by the magazine Nature. Pressure from civil society and the state can help to regulate corporate behaviour.

Legislation on intellectual property in biotechnological innovation also needs to be strengthened and rigorously enforced. Efforts are currently being made in this regard. In 2018, the Chinese Supreme Court ruled in favour of Novozymes, a Danish company representing 44% of the world enzyme market. For six years, the company engaged in litigation against two Chinese companies, Shandong Longda Bio-products and Jiangsu Boli Bioproducts, accusing the latter two of infringing its intellectual property rights over a species of enzyme. China’s Supreme Court ruling instills confidence in foreign investors in the country. Strengthening the legal framework will improve the foreseeability of the Chinese market and increase the willingness of international partners to invest.