Europe in the face of American and Chinese economic nationalisms (3)

Defending the european economy through trade policyTrade defence: more harm than good?

Strengthening the European Commission’s powers on trade defence in order to guarantee the unity and firmness of the European Union

Allocate more resources to European trade defence to better combat predatory foreign subsidies.

Towards a reform of the World Trade Organization?

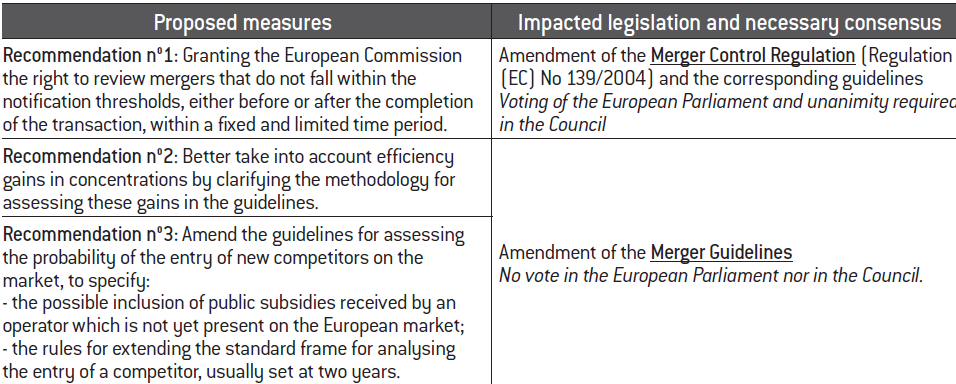

Conclusion and recommendations

Appendices

Summary

While the main commercial partners of the European Union adopt non- cooperative strategies, inaction or lack of firm policy would be fatal for the single market. The European Union should lead a coalition willing to bring about an ambitious reform of the World Trade Organization (WTO) but it will take, at best, several years for this endeavour to succeed.

In the meantime, we make concrete proposals to strengthen our trade defence capabilities in order to better protect our economic interests and gain credibility on the international stage.

Emmanuel Combe,

University Professor, Professor at the Skema Business School, Vice-President of the Competition Authority.

Paul-Adrien Hyppolite,

Corps des Mines engineer and graduate of the École normale supérieure.

Antoine Michon,

Corps des Mines engineer and graduate of the École Polytechnique.

Europe in the face of American and Chinese economic nationalisms (1)

Europe in the face of American and Chinese economic nationalisms (2)

Big tech dominance (1): the new financial tycoons

Big tech dominance (2) : a barrier to technological innovation ?

Towards personalised pricing in the digital era ?

Trade defence: more harm than good?

See Michael Finger, Anti-dumping. How it Works and Who Gets Hurt, The University of Michigan Press, 1993.

In the language of economists, this is referred to as a demand’s price elasticity being higher in the export market than in the domestic market

Provided that companies do not prevent customers from carrying out arbitrations from one Member State to Many cases of geographical blockage, particularly in the automotive industry, have thus led the European Commission to impose sanctions, on the grounds of a violation of Article 101 TFEU (agreement between a producer and its distributors to prevent parallel trade).

It should be noted that cost savings based on the learning curve refer to the fact that the cost of production decreases with the cumulative quantity: the more a company has produced large quantities in the past, the more its production cost is weak.

If the selling price is lower than the total average cost (the company creating losses) but is above the average variable cost, antitrust authorities must demonstrate that this pricing strategy is part of an overall plan to eliminate equally effective competitors.

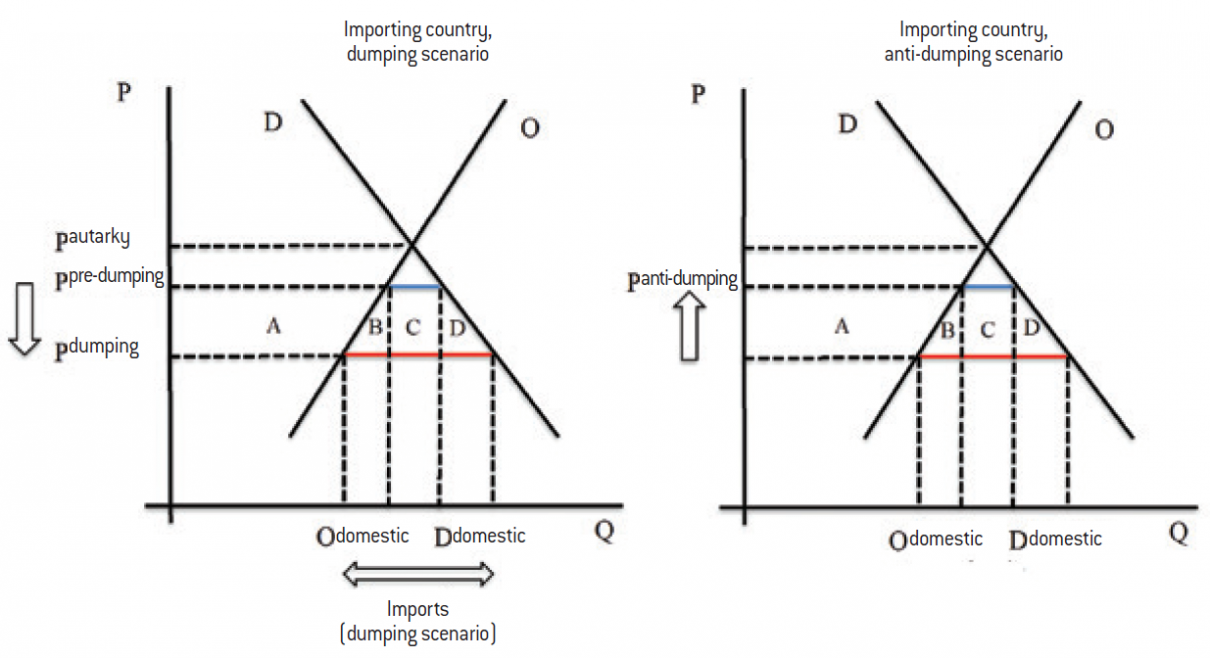

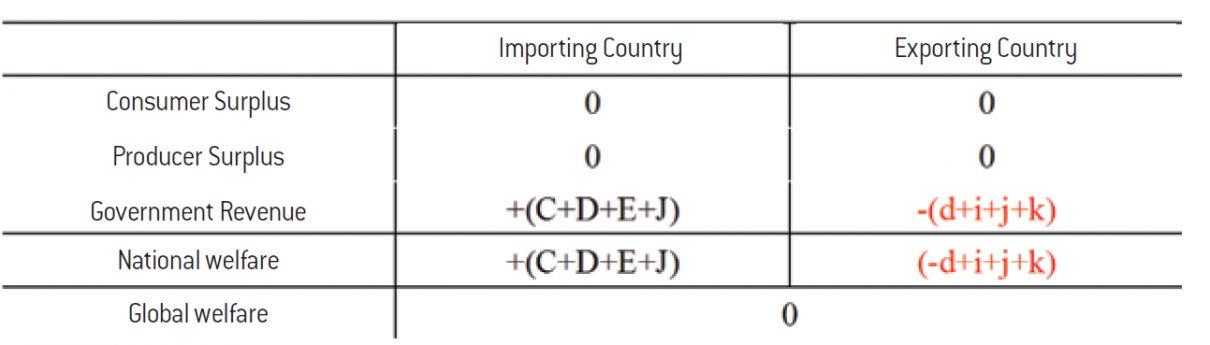

What can we learn from economic analysis on the impact and opportunity of trade defence policies? At this stage of reasoning, a detour to economic theory seems necessary in order to understand the stakes at hand. We will separately study the issues of dumping and foreign subsidies because, despite some similarities, their logic and economic effects differ significantly.

Dumping would (almost) not be a problem! In the fight against dumping practices from foreign exporting companies, standard economic theory calls for the utmost caution. Indeed, only one particular case of dumping justifies a priori the intervention of the public authorities: predatory dumping. In other cases, dumping would be beneficial for the country to which it is targeted.

According to this approach, one of the risks of the anti-dumping procedure is that it would be exploited by domestic companies to prevent more efficient competitors from entering the domestic market. Anti-dumping would then be similar to “ordinary protectionism, wrapped in a beautiful message1”.

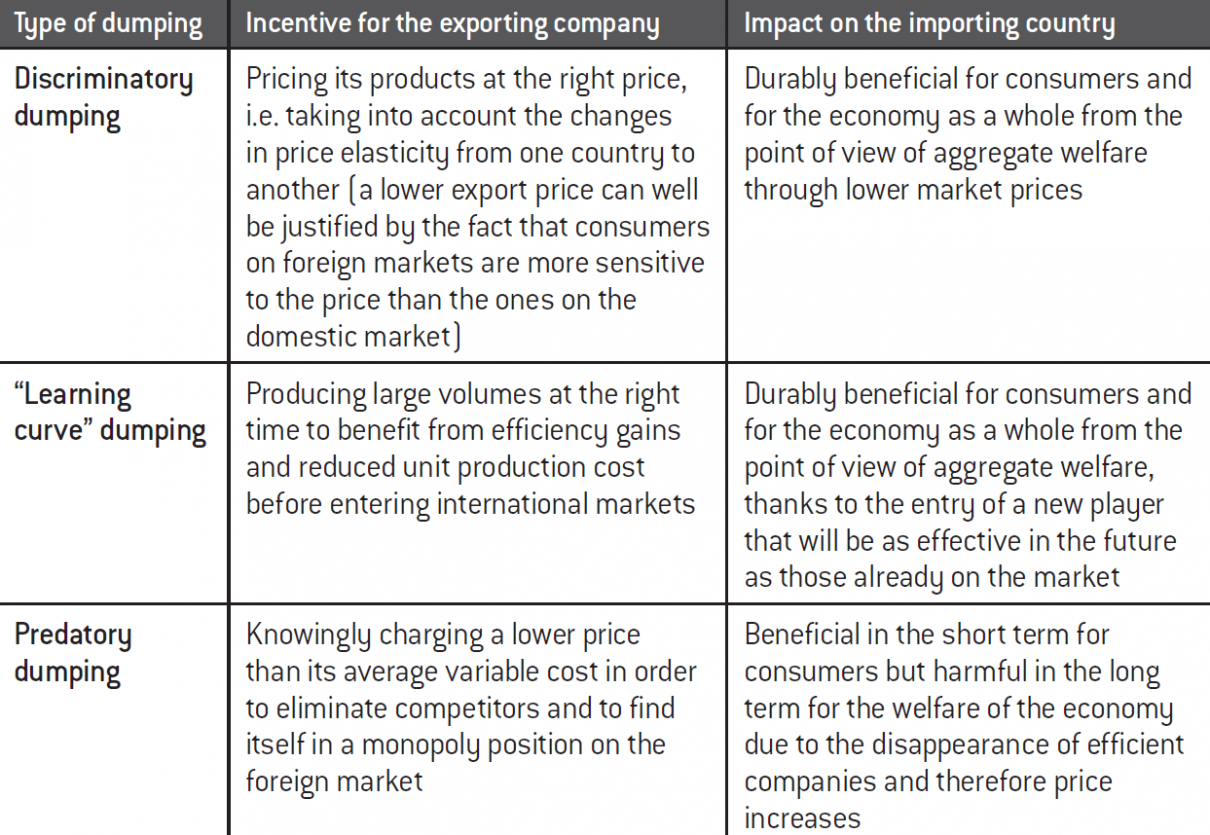

It should be recalled that in economics, the notion of “dumping” refers to when a company sells the same product at a lower export price than on its domestic market. At this stage, no normative conclusion can be reached as to whether or not such a practice is harmful. All depends on the motivation underlying the dumping practice. In this respect, several scenarios can be distinguished for the sake of the analysis.

A first one is when a company exports goods at lower prices simply because the price sensitivity of its foreign customers is higher2. This is particularly the case when the competitive intensity is relatively stronger in foreign markets than in the domestic market or when consumer preferences differ from country to country. In such a situation, it is perfectly normal to observe different prices from one market to another. Moreover, price sensitivity is often less pronounced on the domestic market as local customers tend to prefer national brands. This form of price discrimination is sometimes found within the European Union, without anyone being critical of it3. For example, car manufacturers are happy to charge higher prices on their domestic market for certain car models than on foreign markets, despite transportation costs.

A second scenario is that of a young growing company that wants to enter the global market and needs to “climb the learning curve” to reduce its production cost4. This one may then decide to use a short-term price reduction strategy, in other words, dumping, to increase its volumes and thus “learn to produce” to be able to compete with incumbent companies. By allowing new firms to enter mature markets without major risk of foreclosure of existing competitors, dumping can be a vector of pro-competitive dynamics.

A third case, which indeed may prove to be problematic, is the one in which companies sell products at a loss for export, with the sole purpose of eliminating competition, finding themselves in a monopoly position and eventually raising prices. This strategy is based on an inter-temporal arbitration between short-term profit reduction and high (expected) profits in the long term. This type of dumping must be condemned since it will lead, in addition to the disappearance of efficient producers, to price increases that will reduce aggregate welfare. This strategy is well-identified in competition law under the name “predatory pricing”, as one of the forms of the abuse of dominant position. To detect predatory pricing practices, the competition authorities use a “cost test” (also called the Areeda and Turner test or Akzo test), based on a comparison of the cost structure of the company with the price observed on the market. If the latter is lower than the company’s average variable cost, predatory behaviour is assumed by the antitrust authorities5.

Summary of the different types of dumping

Source :

Fondation pour l’innovation politique.

If correcting the distributive effects of dumping becomes a public policy objective, it would seem preferable to imagine a policy of internal redistribution of winners and losers in However, this theoretical view of the optimal policy response has two important limitations: on the one hand, it is based on the ability of the public authorities to correctly identify the losers and winners, which, as recent historical experience in developed countries shows, is not evident; on the other hand, it does not take into account the tax-induced distortions that should be put in place to finance the redistribution mechanism.

It should be noted that these distributional effects are greater than the net gains.

Globally, aggregate welfare is declining due to the losses induced by the subsidy.

Transfer, the cost of which will then be supported by consumers or producers in the exporting country depending on the impact of the tax put in place to finance the subsidy.

Thus, taxpayers in the exporting country benefit indirectly from the tariff barrier established by the importing country.

See Barbara J. Spencer and James A. Brander and, “International R&D Rivalry and Industrial Strategy”, The Review of Economic Studies, vol. 50, N°. 4, pp. 707-722, October 1983, and Avinash Dixit, “International Trade Policy for Oligopolistic Industries”, The Economic Journal, vol. 94, Supplement: Conference Papers, pp. 1-16, December 1984.

This requires that the public authorities have a sufficient level of information regarding the markets in question and the gains associated with each strategy.

Signed in 1993 by the United States, Canada and Mexico.

See Shushanik Hakobyan and John McLaren, “Looking for Local Labor Market Effects of NAFTA”, The Review of Economics and Statistics, Vol. 98, N°. 4, pp. 728-741, October 2016.

See David H. Autor, David Dorn and Gordon H. Hanson, “The China Syndrome: Local Labor Market Effects of Import Competition in the United States”, NBER Working Paper Series, Working Paper 18054 ; David H. Autor, “Trade and Labor Markets: Lessons from China’s Rise”, IZA World of Labor, N°. 431, February 2018

The “Chinese shock” refers to the phenomenon of China’s rapid integration into world trade in the 1990s followed by its accession to the WTO in 2001.

See Ragnhild Balsvik, Sissel Jensen and Kjell G. Salvanes, “Made in China, Sold in Norway: Local Labor Market Effects of an Import Shock”, Journal of Public Economics, vol. 127, pp. 137-144, July 2015.

See Olivier J. Blanchard and Lawrence Summers, “Hysteresis in Unemployment”, European Economic Review, vol. 31, n°1-2, p. 288-295, March 1987. It should be noted that these researchers themselves have borrowed this notion from physics, where hysteresis makes it possible to characterise the persistence of a phenomenon whose determinants have disappeared.

Given the reduced fluidity of the labour market, this hysteresis effect of trade shocks could be relatively greater in Europe than in the United States.

See David Dorn, Gordon H. Hanson and Kaveh Majlesi, “Importing Political Polarization? The Electoral Consequence of Rising Trade Exposure”, NBER Working Paper, n°22637, December 2017 ; Id, “A Note on the Effect of Rising Trade Exposure on the 2016 Presidential Election”, Working Paper, January 2017

See Christian Dippel, Robert Gold and Stephan Heblich, “Globalization and Its (Dis-)Content: Trade Shocks and Voting Behavior”, NBER Working Paper, n°21812, December 2015 and Clément Malgouyres, “Trade Shocks and Far-Right Voting: Evidence from French Presidential Elections”, RSCAS Working Papers, 2017/21, European University Institute, March 2017

Italo Colantone and Piero Stanig, “Global Competition and Brexit”, American Political Science Review, vol. 112, N°. 2, pp. 201-218, May 2018.

Rafael Di Tella and Dani Rodrik, “Labor Market Shocks and the Demand for Trade Protection: Evidence from Online Surveys”, NBER Working Paper, N°. 25705, March 2019

Especially when the competing country identified as the cause of the shock is a developing country.

On the other hand, it would be appropriate to seek limiting dumping to predatory dumping in the context of bilateral free trade agreements between economic areas where competition policies have a tendency to converge, for example between the European Union and Canada or the United States.

Applying the strict “predatory pricing” approach to anti-dumping analysis, dumping should only be sanctioned in Europe when two conditions are met:

- the company involved in dumping practices must hold a dominant position on the global market in order to be able to eliminate competition;

- the price charged in Europe must be below the average variable cost of the

Would it be sufficient to take these two conditions into account in the anti- dumping analysis to maximise the aggregate welfare of the importing economy?

Surprisingly, this is still not evident in a perfectly competitive environment. To understand this, let us look for a moment at the economic impact of a practice of dumping, including a predatory one. By reducing the current market price of the importing country, dumping certainly reduces the welfare of domestic producers but simultaneously increases, and more than proportionally, that of consumers, so that for the importing economy as a whole, the gains are greater than the losses. An anti-dumping duty properly calibrated to correct the price differential before and after dumping makes it possible to return to the previous equilibrium, in other words to erase the loss inflicted on domestic producers and thus the gain from which consumers have benefited. In this case, revenues are generated for the government of the importing country but these are lower than the net gains in the scenario without anti-dumping duty (see Annex). In sum, the correction of the distributive effects linked to dumping can only be made at the cost of a decline in the aggregate welfare. In fact, the government has no interest in introducing an anti-dumping duty from the point of view of economic efficiency, even when dumping is said to be “predatory” within the meaning of the two conditions mentioned above6.

This leads us to add a third condition: the predatory dumping of a foreign company should only be sanctioned if the latter is able to sustainably increase prices after eviction of its domestic competitors without fear of their return. This condition is explicitly required in the United States in antitrust cases, through the so-called “recoupment test”. It is then necessary to show that once out of the market, domestic competitors will face difficulties to come back. This could be the case in some sectors in which network, experience and reputation effects are strong, or in which significant economies of scale due to high fixed costs exist (e.g. capital-intensive industries such as manufacturing or tech).

In summary, standard economic theory teaches us that dumping should be assessed by reference to the company’s production costs and not by simply comparing current domestic and foreign market prices. Moreover, as long as the goal of the government is to maximise aggregate welfare of the economy (producers, consumers and government combined), there is no reason to condemn dumping practices in general, with the exception of predatory dumping as defined by the three previously stated conditions. Nevertheless, it is undeniable that any form of dumping induces major distributive effects between domestic producers and consumers, a point on which we will come back later7.

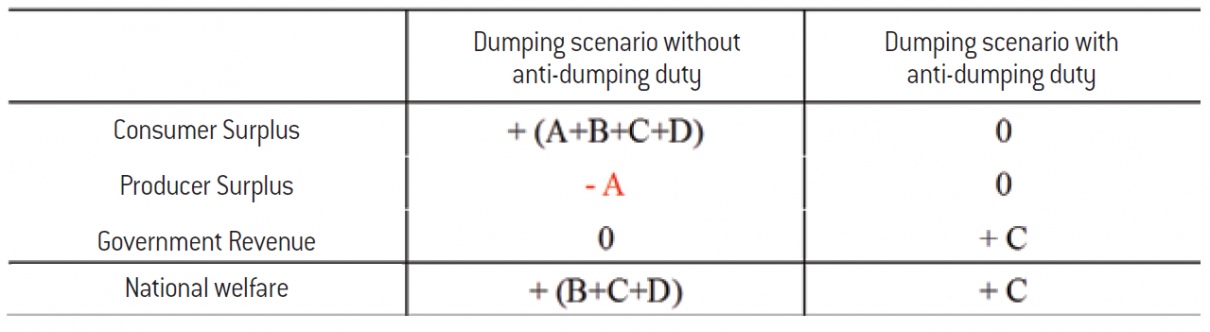

Export subsidies: often a miscalculation. What about foreign subsidies in the standard analysis framework? Consider the case of a subsidy set up by the government of a major exporting country like China on a given product. In a simple model with two countries, this has the immediate effect of raising the price of the product on the domestic market and of concomitantly decreasing its price on the foreign market, the difference between these two prices being equal to the amount of the subsidy. The welfare impact differs depending on the country’s position. From the exporting country’s perspective, the subsidy causes a decrease in consumer welfare in parallel with a more than proportional increase to that of the producers. Nevertheless, the cost of the subsidy supported by the government being greater than the net gain of the producers ultimately has a negative impact on the aggregate welfare of the exporting economy. Conversely, the welfare of the importing country’s producers decreases due to lower market prices, while that of consumers increases more, so that a net gain in efficiency comes about as a result for the entire importing economy8. If the export subsidy causes reverse distributive effects between producers and consumers in the two countries, these are not national zero-sum games since it also operates a net transfer of public funds from the exporting country’s government to the importing country’s consumers9.

That being said, the decline in the producers welfare in the importing economy resulting from the foreign subsidy translates into a decrease in domestic production, a destruction of jobs, the potential closure of industrial sites, or even the liquidation of some companies. To counteract this, the government can decide to introduce a countervailing (or anti-subsidy) duty. As with the antidumping duty studied above, the countervailing duty has the effect of forcing prices in both markets to converge towards the price that would prevail in a free trade regime. The effects on consumers and producers are in fact opposite to those initially caused by the introduction of the subsidy, so that the cumulative impact of the subsidy and countervailing duty on the welfare of producers and consumers in each country is zero. On the other hand, the government of the importing country now collects customs revenue, while the government of the exporting country sees its budgetary expenditure related to the subsidy decrease as a result of the contraction in trade caused by the countervailing duty10.

At this stage, what conclusions can be drawn from this analysis? Beyond the interests of domestic producers, the government of the importing country may have an interest, in due time, in establishing a countervailing duty from the perspective of maximising aggregate welfare, to the extent that government revenues can theoretically exceed consumers’ net gains in the baseline scenario (see appendix). However, this approach stems from a purely static vision, as the implementation of the countervailing duty should logically lead to the complete removal of the subsidy by the exporting country, and thus to the loss to the importing country’s initial net gains. Indeed, a subsidy with a countervailing duty only operates as a transfer from the government of the exporting country to the government of the importing country without any distributive effect on producers and consumers of both countries. The taxpayers of the exporting country no longer have any interest in accepting a scheme that is unable to generate the expected benefits for the domestic producers.

Ultimately, the standard model of international trade teaches us that an export subsidy in a competitive market improves the aggregate welfare of the importing country even if the domestic producers suffer as a result. This often leads economists to say that the optimal response for an importing country to the introduction of an export subsidy by one of its trading partners should be to send a thank you note to the authorities of the exporting country. However, we may identify, as for dumping, a particular case of so-called “predatory subsidies” specifically designed to drive out foreign competitors in order to create monopoly situations with barriers to entry and therefore raise prices. These foreign subsidies would ultimately be the only ones against which it would be legitimate to fight using tariff barriers.

A paradoxical situation. At this stage, economic theory calls for a certain mistrust of trade defence and suggests, from a normative point of view, to reduce it to its smallest portion. This scepticism is reinforced by the difficulty in empirically distinguishing between the “good” vs. “bad” dumping practices and foreign subsidies. In other words, understanding the underlying motivation for the dumping or subsidy is a necessarily delicate exercise for the administrative authorities given the asymmetry of information they face. The qualification of the predatory nature of dumping or a subsidy being highly problematic, public authorities may condemn dumping practices and foreign subsidies that are actually beneficial to their country.

However, there exist a plethora of anti-dumping proceedings. Besides, governments of exporting countries make extensive use of export subsidies and importing countries regularly seek to protect themselves from it. How can we explain such a discrepancy between the normative prescriptions of standard economic theory and government policies? A first obvious answer refers to the possibility of a systematic regulatory capture. According to this approach inspired by public choice theory, the authorities would be primarily sensitive to the interests of domestic producers, which would lead them to implement policies in their favour despite the resulting loss of efficiency for the economy as a whole. Another explanation is that the canonical model on which we have so far based our analysis relies on assumptions that are too restrictive and unrealistic, which prevent us from understanding the economic complexity. We will now see how some deviations from the standard analytical framework make it possible to better understand trade defence policy.

The rehabilitation of trade policy by economists. First of all, it is necessary to move beyond the perfect competitive framework to study the models of the “new trade theory” which investigate trade impacts of oligopolistic market structures and increasing returns to scale. In particular, the research field of “strategic trade policy” has focused on the implications of this new class of models in terms of trade policies. Authors such as Dixit, Brander and Spencer11, among others, have particularly demonstrated that properly targeted export subsidies to companies competing with foreign producers on global oligopolistic markets can lead to an increase in the aggregate welfare of exporting countries – and thereby reduce that of importers – by facilitating the capture of all or part of the superprofits from these markets12. Thus, the use of export subsidies, or by extension tariffs on imports, can be justified by their ability to influence the outcome of strategic interactions between companies and thus the geographical distribution of value added. In fact, most technology-intensive industries are oligopolies. So these models make it possible to better understand the role that export subsidies can have. Economic theory then offers the prospect of rationalising the massive use of subsidies by Chinese authorities and allows us to understand, on the other hand, the need for the European Union to have robust anti-subsidy instruments at its disposal to address the negative effects of strategic trade policies. In a non-cooperative world in which binding WTO-type agreements are inherently fragile and regularly violated by some trading powers, it becomes rational to preserve and use trade defence instruments.

Second, a substantive objection to the partial equilibrium framework of analysis on which all our arguments have so far been based is that it leads us to underestimate the costs of trade integration. Free traders and most economists have long neglected the importance of “adjustment costs” related to a sudden exposure to foreign competition, whether or not its intent is predatory. Only a handful of recent empirical studies using natural experiments have shown that a rapid change in the exposure of domestic producers to competition from imports from developing countries could permanently penalise entire geographical areas of developed countries, to the extent that some territories do not ever succeed in bouncing back completely. For example, researchers have looked at the consequences of the North American Free Trade Agreement (NAFTA)13 on the American labour market, which is reputed to be particularly fluid and flexible. They found significant geographical disparities in the distribution of integration costs as well as low worker mobility in the most affected areas, both geographically and sectorally14.Far from being limited to manufacturing companies directly competing with Mexican producers, the downward pressure on wages and rising unemployment tend to spread to the entire local economy also affecting service activities and local businesses. In the same vein, Autor et al.15 studied the local effects of the “Chinese shock16” on the U.S. labour market and found that the decline in employment in the most exposed regions was not offset by a sectoral reallocation phenomenon or by an increase in the geographical mobility of the affected workers. They note that the regions in question have faced long-term economic difficulties and do not seem to have fully recovered from it, even ten years after the shock materialised. The fact that these localised effects persist for at least a decade suggests that adjustment costs for trade shocks can be significant. Comparable work on Danish, Norwegian and Spanish data during the period from the late 1990s to 2007 indicate the existence of similar dynamics in Europe17. Therefore, the main limitation of the analyses that have held our attention until now lies in the fact that they are all implicitly based on the assumption of a perfect reallocation of the factors of production. However, in reality, this reallocation never takes place without frictions due in particular to the imperfect nature of the labour market, barriers to labour mobility and regulatory barriers to capital movement. The notion of the hysteresis effect, initially put forward by researchers in the late 1980s to explain structural unemployment in Europe, could help shed light on the time-persistence of local trade shocks18. By affecting all surrounding economic activity (services, local shops, etc.), the slowdown or even closure of production sites profoundly alters the structure of the labour market in exposed areas. The resulting local environment of low wages and even long-term unemployment thus transforms a shock that could have only been cyclical into a structural shock19.

All these elements therefore invite us to take a step back on the framework of perfect competition and partial equilibrium analyses to integrate, in a broader perspective and as close as possible to economic reality, the interactions between countries and the “hidden costs” of trade integration. As we have seen, the latter can be particularly high in territories where one or more industries are important employment providers and draw with them a whole ecosystem of services and local shops. In a context where more caution is required regarding the local economic impacts of trade shocks, the relevance of anti-dumping and anti-subsidy instruments becomes clear.

The issues of equity and political acceptability. Before concluding, it is important to complete the analysis based on the criteria of maximising economic efficiency by taking into account issues related to fairness for producers and the political acceptability of trade openness for exposed workers. To illustrate this point, let us return to the example of the dumping at the beginning of this study. Let’s assume that only fighting “predatory dumping” practices – and not other forms of dumping – maximises the aggregate welfare of an importing country – even when fully taking into account the “adjustment costs”. In this context, would the European Union have an interest in changing its anti-dumping legislation in this direction? The answer is still not evident. Indeed, as soon as the conditions of competition differ structurally from one economic zone to another due solely to differences in design and enforcement of competition policies, producers active in the most lenient countries have, all other things being equal, greater market power on their domestic markets that leads them to export, by virtue of a pure economic logic and independently of any predatory will, at lower prices than those prevailing on their domestic markets. In theory, Chinese producers can typically be in this situation vis-à-vis their European competitors. The risk is then to witness the eviction from the latter to the former in many markets. In the long run, the danger is that this could lead to a questioning of the European competition policy followed by its convergence towards the Chinese model. Even worse, the very principle of openness to international trade may no longer be a consensus if the proportion of exposed workers becomes too important.

The advantage of the current period is that it allows us to easily grasp, thanks to recent history, the political consequences, and thus the delayed economic costs, that can result from insufficient control of trade openness. In a 2017 article, economists looked at the impact of increased competition on imported products on electoral preferences and political polarisation20. By analysing the results of the 2002 and 2010 U.S. Congressional elections and the 2000, 2008 and 2016 U.S. presidential elections, they noted, well before the election of Donald Trump in 2016, a clear ideological shift against economic openness in the employment areas exposed to trade shocks. These same authors have established that in a counterfactual scenario where the penetration rate of Chinese exports to the United States would have been, all other things being equal, 50% lower between 2000 and 2016, three key states of the 2016 vote, namely Michigan, Wisconsin and Pennsylvania, would have voted in favour of the Democratic candidate, allowing her to obtain a majority in the Electoral College and win the presidential election. Similar work confirms that trade shocks increase political polarisation and support for far-right parties in Europe. Other researchers have found that the French and German regions most exposed to trade with low-wage countries have seen a more significant increase in the share of the vote for the far right21. In the same vein, another study shows that the British regions most exposed to trade with China voted disproportionately for the United Kingdom’s exit from the European Union22. That being said, is trade policy the most appropriate tool to mitigate the distributive effects of dumping and foreign subsidies? As a survey developed by Rafael Di Tella and Dani Rodrik based on American data23 shows, a larger proportion of the population is in favour of a correction of labour market shocks through trade policy when trade openness is identified as the cause of these shocks24. This proportion remains lower than that of citizens who want the implementation of a sort of compensation through internal redistribution policies. Even if the latter would be more desirable, they nevertheless encounter major practical difficulties, linked to the difficulty of identifying early enough the “winners” and “losers” from trade openness, and then defining the right level of redistribution and appropriate instruments. In our view, therefore, they alone cannot solve the problem.

In short, if it is important to be technically right, it is above all essential not to be politically wrong. The need to guarantee public opinion’s support to the project of European integration and openness should lead us to make, in some cases, decisions on the trade-offs at the expense of economic efficiency.

Also, the reduction in dumping solely in the case of “predatory dumping” seems premature to us as long as competition policies are not aligned to a minimum25. It is also in the European Union’s best interest to promote an upward alignment, rather than the other way around. At this stage, we see the use of trade defence instruments as a “lesser evil” solution to restore a level playing field for European companies which must comply with strict antitrust, merger and State aid controls. In other words, maintaining our anti-dumping arsenal, even while it is questionable in some cases from the point of view of economic efficiency, constitutes an important pressure instrument in a non- cooperative game.

The optimal solution (first-best) to fight unfair foreign competition would of course be a set of supranational rules of competition, coupled with clear and enforceable rules governing public subsidies. However, to the extent that they are unlikely to come to fruition, trade defence instruments are a good alternative (second-best). The difficulty then lies in the need to strike a balance, which is inherently delicate, between economic efficiency on the one hand, and equity for exposed European producers and workers on the other. In any case, the scepticism against trade defence that may arise when studying the canonical model of international trade does not resist a thorough analysis of all of the issues at stake. Despite their limitations, trade defence instruments are, in our view, powerful and valuable tools to intelligently regulate international trade and increase its political acceptability. It therefore seems essential to us to strengthen them at the European level. We will now look into how.

Strengthening the European Commission’s powers on trade defence in order to guarantee the unity and firmness of the European Union

A single leader for European trade defence policy. The European decision- making procedure in the field of trade defence suffers in our opinion from three intrinsic weaknesses. First of all, the deep ideological divisions between Member States regarding trade defence pose the risk of suboptimal political trade-offs within the Council, or even the paralysis of decision-making, to the detriment of the primacy of the European Commission’s analytical rigour. Therefore, the possibility that Member States have to influence the final outcome of anti-dumping proceedings and anti-subsidies via qualified majority voting in the Council can affect the coherence and, ultimately, the firmness of the decisions being made.

Secondly, pressure from industrialists is more easily exerted at the level of the Member States in which they have their head offices and production sites than at the level of the European Commission, which works in the general community interest. Restricting the role of States in the decision-making process could thus make it possible to curb the risk of the usage of trade defence instruments for protectionist purposes, and could therefore improve the efficiency and fairness of the decisions being made.

Finally, the possibility of a “veto” by Member States on the European Commission’s decisions to impose definitive anti-dumping and countervailing measures introduces an institutional weakness that can easily be exploited by a foreign power capable of manipulating the particular interests of each Member State. As a result, Europe is on its own allowing for an exploitation, by its trading partners, of the divergent interests within the Union itself.

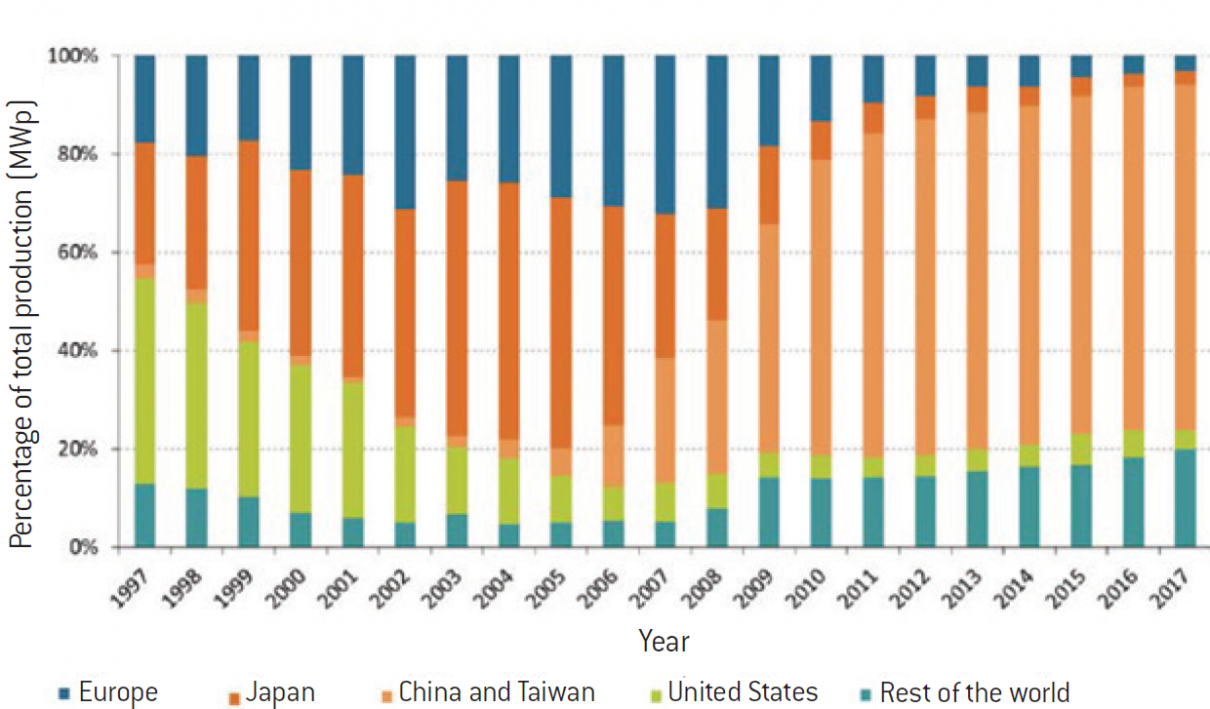

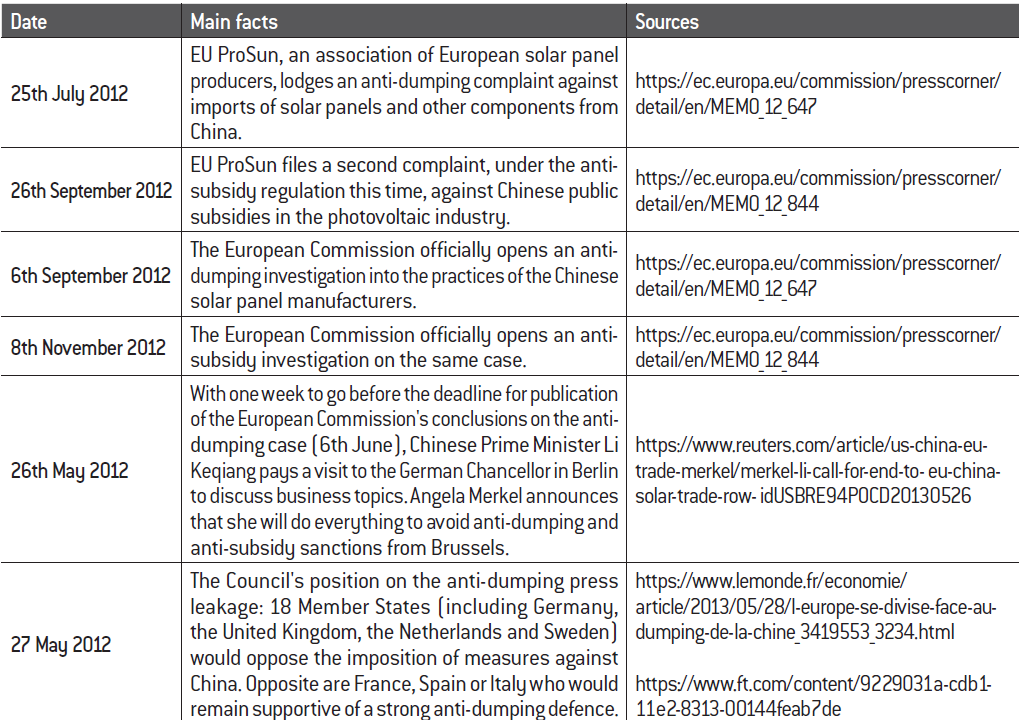

Unfortunately, this institutional flaw is not only theoretical and has had practical consequences, notably in 2013 when Europe failed to protect its emerging photovoltaic industry from Asian dumping. In June 2013, after ten months of investigation, the European Commission proved the existence of dumping by Chinese solar panel manufacturers, resulting in sales prices almost half those that should have prevailed in a situation of fair competition. Brussels introduced provisional anti-dumping duties with a custom rate of around 50% against these imports. Yet China, having anticipated these conclusions from Brussels, had prepared its defence by exerting pressure on the northern states of the European Union with a surplus trade balance with the People’s Republic. Even before the European Commission’s announcement, German Chancellor Angela Merkel declared in May 2013 that she disapproved of the imposition of anti-dumping duties against Chinese producers. Seventeen other Member States immediately joined Germany in its opposition to the European Commission’s approach. Some countries, such as France, Italy and Spain were still in favour of a firm and proportionate response. However, they eventually capitulated when China declared, the day after the European Commission’s announcement, that they were considering setting up anti-dumping duties on exports of European wine, which are particularly crucial for the three countries in question. The European Commission, then certain to be vetoed by Member States under Chinese pressure, signed an agreement at the end of July 2013 that was deemed by observers significantly less unfavourable to Chinese interests than the one originally planned.

A few years later, it is clear that European photovoltaic industry has seen its global market share plummet over the last ten years from a quarter to just a few percent. Of course, the competitiveness of industrialists should be accurately assessed because this decline is probably not entirely due to Chinese dumping. However, this case illustrates the weakness of European governance.

By allowing the Council to block the initiatives of the European Commission, the European Union exposed itself to a strategy well-known to political power theorists: divide to better rule (the interested reader may refer to the appendix for a detailed presentation of the Chinese photovoltaic case).

Historical production of photovoltaic modules worldwide (1997-2017)

Source :

Fraunhofer ISE, “Photovoltaic Report”, p.12, 14 November 2019

In sum, these three elements show that interference by Member States in anti- dumping and anti-subsidy investigations undermines the consistency, efficiency and firmness of the decisions made. It also has the effects to complicate and lengthen the procedure, in other words creating uncertainty and delaying the recovery of fair competition for European producers.

On the basis of this observation, we propose to strengthen the European Commission’s power in the field of trade defence by granting it complete independence from Member States. This reform would require a thorough review of the current decision-making procedure. For example, Member States could retain a right of scrutiny over the investigation of trade defence cases but would no longer be able to oppose the imposition of definitive measures by qualified majority voting. In this way, Europe would acquire a real leader in trade defence, guaranteeing the protection of our common interests. In this regard, the analogy is clear with the current governance of European competition policy.

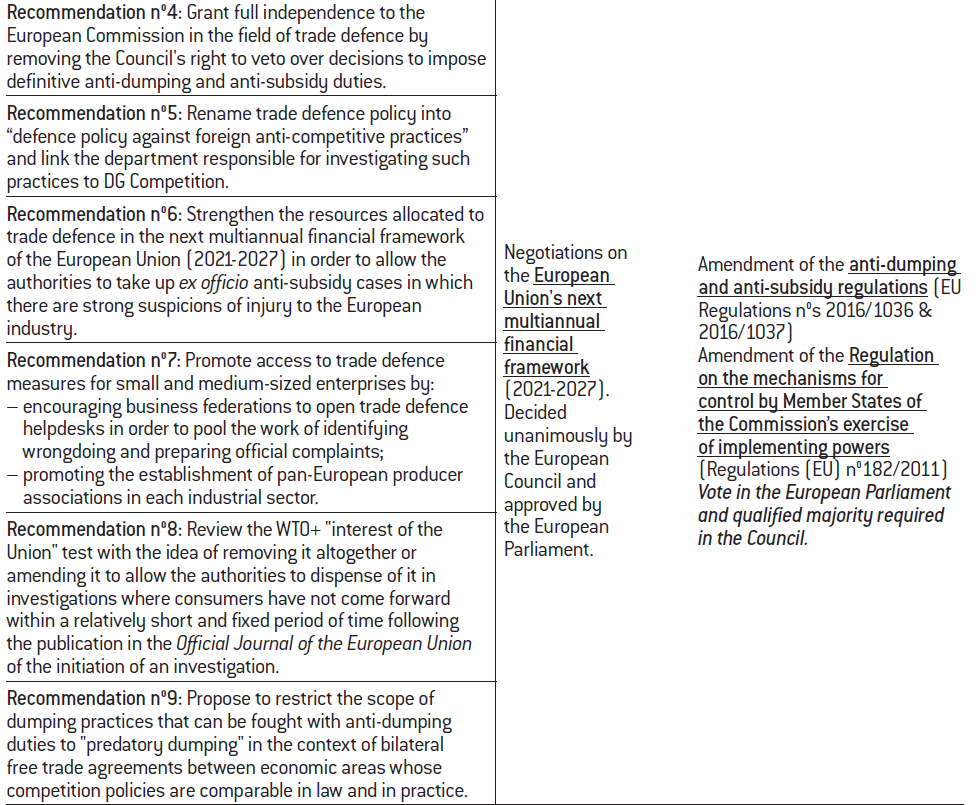

Recommendation nº4 : Grant full independence to the European Commission in the field of trade defence by removing the Council’s right to veto over decisions to impose definitive anti-dumping and anti-subsidy duties.

An integrated Directorate-General for Competition. This naturally leads us to our next point. Beyond the internal problems of governance, we consider that trade defence policy at the moment suffers from a lack of clarity outwardly- speaking. In order to remedy this, we suggest that a transfer of the trade defence teams from the Directorate for Trade to the Directorate for Competition, so as to create an integrated Directorate-General for Competition, responsible for investigating and combating all anti-competitive practices, whether they take place inside or outside the European Union. After all, why is it that a policy that is truly about the repression of anti-competitive practices is now functionally attached to the department in charge of trade policy? Isn’t the fight against subsidies the counterpart of State aid control in the European Union and anti-dumping the counterpart of antitrust in its “predatory pricing” aspect? It is therefore important to note that this proposal for the transfer of competences is not primarily motivated by internal political considerations – many DG Trade case handlers have passed through DG Competition and vice versa – but by sending a clear signal and in particular to European producers. This completion of European competition policy could contribute to remove a large part of the unfair criticism levelled against it. Such a transfer would also potentially facilitate sharing information and would encourage foreign subsidy considerations in the treatment of domestic merger control or State aid cases.

In addition, we propose to rename trade defence policy to explicitly reflect the idea of combating foreign anti-competitive practices. Although symbolic, it seems essential to us not to overlook the importance of the political signal sent to European industries, and more generally to those who are opposed to the current European competition policy.

Recommendation nº5 : Rename trade defence policy into “defence policy against foreign anti-competitive practices” and link the department responsible for investigating such practices to DG Competition.

Allocate more resources to European trade defence to better combat predatory foreign subsidies.

See European Parliament, “Balanced and Fairer World Trade Defence. EU, US and WTO Perspectives”, note commissioned by the European Parliament’s Committee on International Trade at a seminar organised by the European Union’s Directorate-General for External Policies, June 2019

It should be noted that the United States has increased the overall number of defence personnel in their relevant jurisdictions over the past ten years, which is correlated with the increase in the number of anti- dumping and anti-subsidy cases in force.

And, incidentally, the determination of dumping margins or the amount of subsidies

Emmanuel Combe, Paul-Adrien Hyppolite and Antoine Michon, Europe in the face of American and Chinese economic nationalisms (2) foreign anti-competitive practices, Fondation pour l’innovation politique, March 2020.

Emmanuel Combe, Paul-Adrien Hyppolite and Antoine Michon, op. cit.

It should be noted that since the lesser duty rule has recently been substantially amended, it does not seem appropriate to us to reopen this case.

Canada is also one of these exceptions.

Beyond the issues of governance, we wish to propose avenues for work and reform to improve the effectiveness of European anti-dumping and anti- subsidy legislation. The overall objective is to give the authorities the necessary means to more systematically fight against foreign anti-competitive practices, including predatory subsidies.

Strengthen the resources allocated to trade defence. First of all, the decision- making autonomy of the European Commission that we have mentioned above should, in our opinion, go hand in hand with the strengthening of the resources allocated in the European Union to trade defence. Indeed, the European Commission currently has significantly fewer resources than its American counterparts to conduct the same types of investigations (anti-dumping and anti-subsidy), even though the European Union imports almost as much from the rest of the world as the United States. The gap in this area is evident. According to the latest available estimates26, the European Commission’s Directorate-General for Trade records 125 staff, while the relevant U.S. administrations employ more than 400 people, including about 350 at the International Trade Administration (U.S. Department of Commerce) and 75 at the International Trade Commission (an independent agency)27. Beyond this considerable difference of means, it is striking to note that more than 80% of human resources are allocated to the work of identifying dumping practices or subsidisation28 (ITA’s area of competence), rather than the determination of injury and causality (ITC’s area of competence).

It seems to us that a balance should be struck by the European Union between the current situation and the American extreme. The opacity of the public subsidy systems of some of its trading partners such as China undoubtedly complicates the identification of subsidies and undermines the European Union’s capacity for action. Anti-subsidy procedures are highly complex and their success depends on the ability to deploy significant resources – including case handlers with specific language skills – to investigate foreign companies and administrations. Despite these difficulties, an examination of trends over the past ten years (see the second study in this series29) has shown a significant increase in the usage of the anti-subsidy instrument. However, it is much more pronounced in the United States than in the European Union. It is time to catch up and this will probably not be possible with constant resources. We believe the European Commission should have the means to investigate on a larger scale and in a more systematic way. For example, a better equipped directorate could initiate ex officio procedures – i.e. on its own initiative, without having been approached by companies – which has never been done until now even though European legislation allows it.

The French Economic Analysis Council (Conseil d’analyse économique) study n°51 published in May 2019 and the joint report of the French Inspectorate General of Finances (IGF) and the General Council for the Economy (CGE) published last June proposed to introduce a form of “presumption of subsidies” for certain foreign companies, which would in practice mean reversing the burden of proof. We question the relevance of such an approach in the short term as it is incompatible with current WTO rules. We therefore prefer to propose increasing the resources of the directorate in charge of the repression of foreign anti-competitive practices so that it can carry out its own ex officio investigations when such presumptions exist.

We therefore suggest resolutely increasing the firepower of the directorate in charge of fighting foreign anti-competitive practices by increasing the budget allocated to it in the new multiannual financial framework of the European Union (2021-2027).

Recommendation nº6 : Strengthen the resources allocated to trade defence in the next multiannual financial framework of the European Union (2021-2027) in order to allow the authorities to take up ex officio anti-subsidy cases in which there are strong suspicions of injury to the European industry.

Facilitate access to trade defence for SMEs and mid-caps. This increase in the overall level of resources mobilised to combat foreign anti-competitive practices is however far from exhausting the subject. A necessary condition for lodging an anti-dumping or anti-subsidy complaint is the ability of the complainants to gather the support of at least 25% of the European production of the good(s) affected by the unfair practices being complained about. Depending on the degree of market fragmentation, it may be more or less difficult to reach such a threshold and a SME will, as a general rule, have more difficulties than a large company. However, as this threshold is contained in the WTO agreements, it is binding on the anti-dumping and anti- subsidy legislation of each of its members. It would therefore be illusory to aim to modify or modulate it according to the degree of concentration of each industry in the short-term. In any event, this confirms the need to pursue a proactive policy in favour of SMEs, in order to facilitate their access to trade defence instruments so that they can, if necessary, defend themselves on an equal footing with large companies.

So how can SMEs be offered the same defence opportunities as large companies? It should be recognised first and foremost that the European Commission has been aware of this issue for years. Since 2004, it has created a special helpdesk to help SMEs overcome challenges with which they are confronted during investigations due to their limited resources. This system was strengthened in 2018 with the creation of a dedicated website bringing together various business advice and a guide for SMEs.

Efforts are therefore already moving in the right direction, but we believe that they need to go further. Indeed, our review of European cases of anti-dumping and anti-subsidy measures over the last ten years (see the second study in this series30) found that the complainants are almost systematically either large companies (if not giants such as Saint-Gobain or BP), or pan-European associations of producers such as the European Steel Association (Eurofer) or the European Chemical Industry Council (Cefic). The anti-dumping and anti-subsidy complaints reaching the European Commission therefore seem to essentially come from well-represented and organised companies. In other words, SMEs often depend on associations, federations or ad hoc committees to send their demands to the European Commission. Their ability to form and join such structures is therefore decisive for protection.

States, regions and business federations may play a crucial role in supporting the development of these professional networks. A first task would be to identify industries who are insufficiently organised and thus underrepresented at the European level. In view of the analysed data, it seems that there is, for example, a significant effort to be made in France on this point. In addition, the creation by the public authorities of national or regional relays could be envisaged in order to make anti-dumping and anti-subsidy instruments known to SMEs and to support them in the creation, often long and costly, of complaint files reaching the European standards. Business federations could usefully contribute to this effort, with a division of tasks to be jointly determined with the authorities. Beyond the issues specific to the size of companies, the challenge is to ensure the geographical and sectoral representativeness of the industry in anti-dumping and anti-subsidy cases.

Recommendation nº7 : Promote access to trade defence measures for small and medium-sized enterprises by:

- encouraging business federations to open trade defence helpdesks in order to pool the work of identifying wrongdoing and preparing official complaints;

- promoting the establishment of pan-European producer associations in each industrial sector.

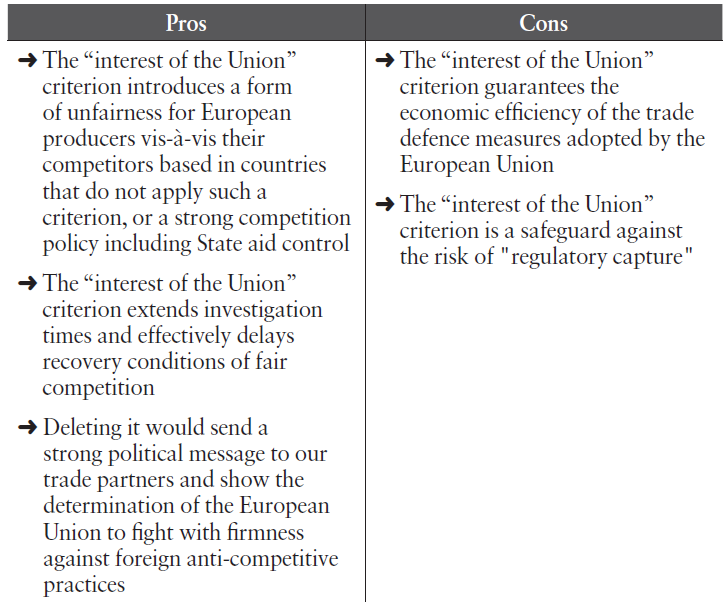

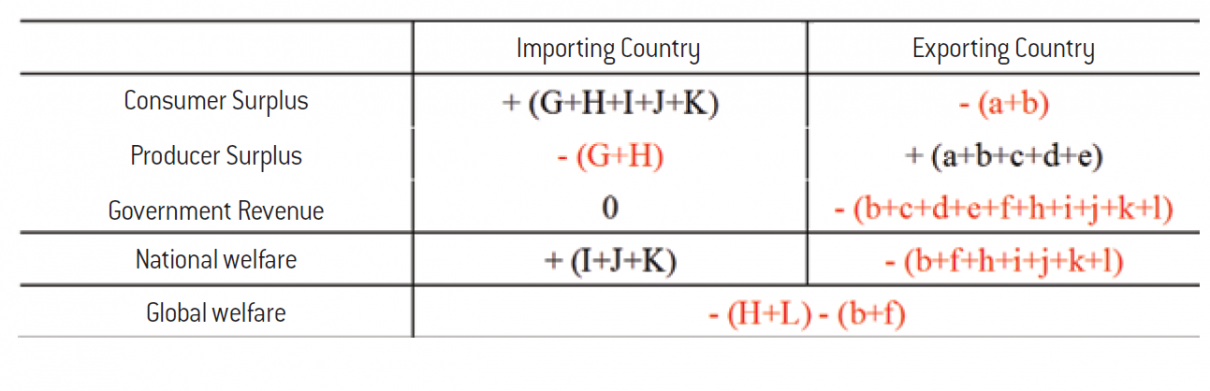

Revise the “interest of the Union” criterion. Finally, the discussion cannot end without mentioning the question of the “interest of the Union” criterion. This criterion requires the European Commission to prove that the introduction of anti-dumping or countervailing duties would not be to the detriment of the aggregate welfare of the European economy (see the second study in the series for a detailed description of this criterion)31. Currently, the European Union is an exception since very few WTO members include a public interest clause in their anti-dumping and anti-subsidy regulations32.

First of all, it must be noted that it is very difficult to grasp the relevance and real impact of this criterion. In practice, it is barely used to block the introduction of trade sanctions. We have observed, by studying the new investigations opened by the European Commission over the last ten years, that it has never been mentioned to justify the non-introduction of customs duties. For some, this suggests that consumer interests are not sufficiently being taken into account in the European Commission’s analyses. At least three elements can help put this observation into perspective. Firstly, it is impossible to estimate the degree of “self-censorship” that the criterion induces on industrial companies affected by foreign dumping or subsidies. Secondly, we do not observe the number of complaints filed by industrial companies which do not lead to the initiation of an anti-dumping or anti-subsidy proceeding by the European Commission and it cannot be ruled out that the “interest of the Union” criterion helps to block some of them. Thirdly, we do not know the reason for the withdrawal of complaints by European manufacturers in the course of the proceedings. As a reminder, 60 to 70% of anti-dumping and countervailing investigations that do not eventually lead to the imposition of definitive measures are withdrawn and closed before the publication of the European Commission’s conclusions.

In short, does the existence of the public interest test generate a form of self-censorship, sometimes of the European Commission, sometimes of complainants? It could mean that the cases in which consumer interests are only marginally put at risk are overrepresented in the definitive measures. This could well be the case, but unfortunately it is impossible to answer this question with the data at hand. While the three factors mentioned are likely to have a non-negligible impact, it has never been proven that the introduction of this general interest clause in the European legislation led to the non-imposition of anti-dumping or anti-subsidy measures which would have prevailed in its absence.

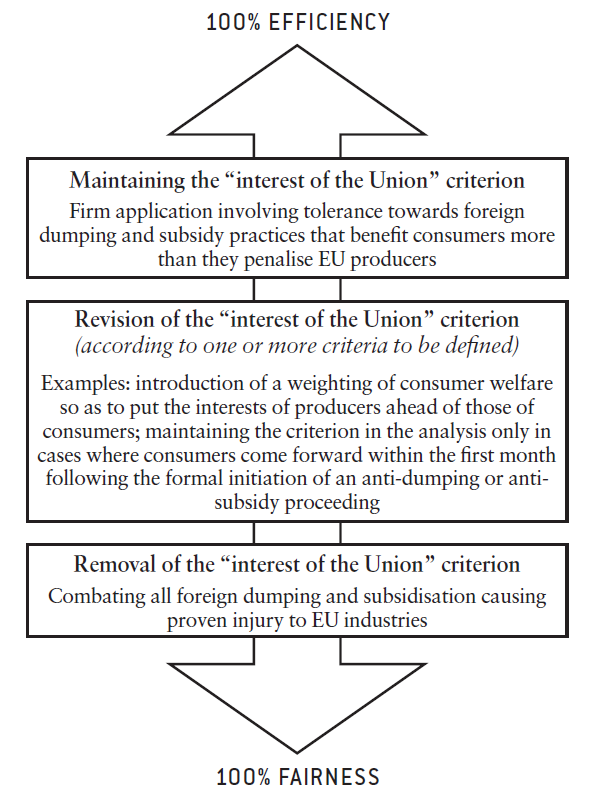

We therefore can only have a theoretical debate on the subject. Conceptually, different approaches may prevail depending on whether we consider the purpose of trade defence policy to be economic efficiency or fairness vis-à-vis European producers. The situation can then be summarised as follows:

Even if some may argue that it is necessary to arbitrate between efficiency and fairness regarding European producers, the correct approach is to find the right balance. We attach importance to not neglecting the fairness aspect insofar as the acceptability of a strong competition policy within the borders of the European Union seems to inevitably be based on the same degree of firmness towards anti-competitive practices from foreign companies or public entities. It should be noted that fairness as the sole aim should in principle lead to the sanctioning of any proven foreign anti-competitive practice, irrespective of considerations relating to the welfare of consumers and the economy in general.

It is true that beyond the issue of positioning the cursor in arbitration between efficiency and fairness, the “interest of the Union” criterion increases the administrative burden that lengthens anti-dumping and anti-subsidies investigation and therefore delays the restoration of conditions of fair competition for producers. It mobilises resources from DG Trade that could be deployed on other cases. A revision or even the deletion of the EU’s interest criterion would have the merit of sending a strong political message to our trading partners regarding the determination of the European Union to fight firmly against unfair foreign competition.

Arguments for or against the removal of Union interest criterion

Source :

Fondation pour l’innovation politique.

Regulation (EC) 139/2004 and Regulations (EU) 2016/1036, 2016/1037 and 182/2011.

We therefore propose to open a discussion on the relevance of the criterion of interest to the EU so that it can be deleted if necessary or amended to be applied only to cases where stakeholders (importers, consumers, etc.) would come forward within a given timeframe; for example, one month after the publication of the notice of initiation of an anti-dumping or anti-subsidy investigation in the Official Journal of the European Union.

Recommendation nº8 : Review the WTO+ “interest of the Union” test with the idea of removing it altogether or amending it to allow the authorities to dispense of it in investigations where consumers have not come forward within a relatively short and fixed period of time following the publication in the Official Journal of the European Union of the initiation of an investigation.

It should be noted that, unlike the merger rules reform which would require unanimity in the Council, that of the anti-dumping and anti-subsidy regulations would only require a qualified majority.33

No protectionist leeway. If the resurgence of economic nationalism calls on the European Union to strengthen its trade defence instruments, it must be ensured that this shift does not result in protectionist deviation, the consequences of which we would pay a high price for. In this respect, trade defence policy cannot be diverted in order to erect artificial tariff barriers that would only have the effect of protecting domestic producers from international competition. Thus, the rebalancing of trade policy that we advocate for should under no circumstances lead to a lowering of the standards of proof and rights of defence. In addition, we believe it is appropriate to propose to the European Union’s trading partners with comparable competition policies to limit dumping practices that are reprehensible to “predatory dumping” which, as we have seen, is the only form of dumping that is really harmful to the economy as a whole.

Recommendation nº9 : Propose to restrict the scope of dumping practices that can be fought with anti- dumping duties to “predatory dumping” in the context of bilateral free trade agreements between economic areas whose competition policies are comparable in law and in practice.

In parallel with the establishment of the strategic agenda that we have just outlined, the European Union would benefit from preserving the achievements of trade multilateralism. It should therefore initiate an international dialogue with the aim of adapting the rules of multilateralism through a reform of the WTO.

Towards a reform of the World Trade Organization?

Source: WTO (document G/SCM/W/546, Rev.10)

See Chunlin Zhang, “How Much Do State-Owned Enterprises Contribute to China’s GDP and Employment”, worldbank.org, 15 July 2019

The only exception is the Ping An insurer. The other nine, controlled by the State or other public bodies, are, in order of market capitalisation: Industrial and Commercial Bank of China, China Construction Bank, Kweichow Moutai, Agricultural Bank of China, Bank of China, PetroChina, China Life, China Merchant Bank and Bank of Communications (source: tradingview.com, accessed November 2019)

See in particular WTO, “China’s trade disruptive economic model”, communication from the United States to the WTO, 16 July 2018

While it is important for the European Union to strengthen its trade defence in the current context, we believe that its long-term objective should remain the restoration of an effective and credible multilateral framework. In this perspective, an institutional reform of the WTO is necessary because the organisation is now unable to offer to its members a forum adequate for negotiations and dispute resolution.

An international organisation that will soon be inoperative. In the absence of reforms, the multilateral framework inherited from the 1990s will soon lapse. Indeed, the three main pillars of the WTO are considerably weakened.

The negotiation pillar has not allowed substantial agreements to be concluded since 1994. The rules for unanimous decision-making and the principle that “nothing is agreed upon until everything is agreed upon” makes it very difficult to reach a consensus. The Doha Round, which began in 2001, ended in failure in 2008 with disagreements over agricultural trade, particularly between India, the United States and China.

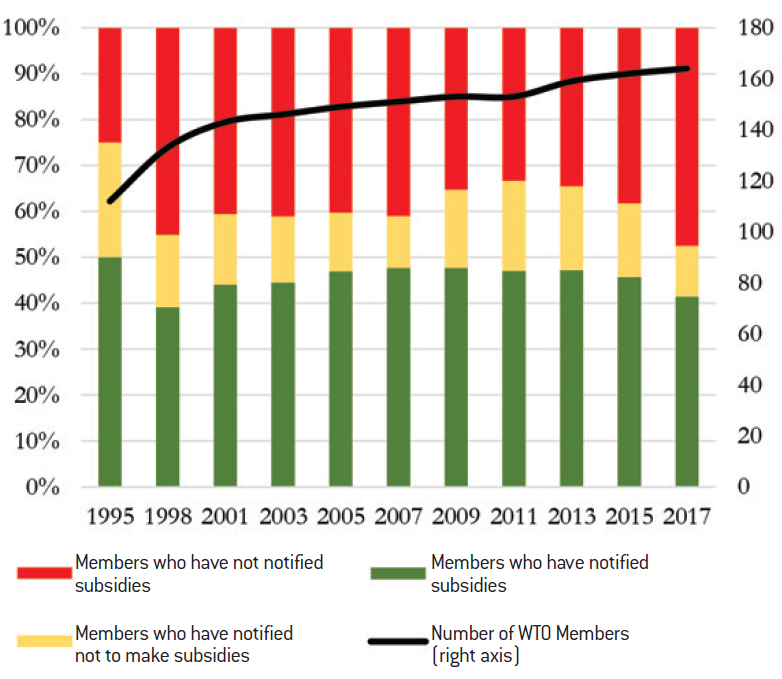

The supervisory pillar is undermined by the opacity of the policies of some Member States. In particular, the non-binding nature of subsidy notification requirements is problematic: the share of WTO members that do not comply with this notification requirement increased from 25% in 1995 to 48% in 201734. The role of the Chinese state-owned enterprises is regularly blamed: public companies contribute a quarter of GDP35 and nine of the ten largest listed companies in China (excluding Hong Kong) are state-controlled36. The strong influence of the Chinese Communist Party in economic affairs blurs the border between the public and private spheres37, which rightly fuels the concerns of China’s trading partners.

WTO Member States notifying their subsidies

Source :

WTO.

In particular, the United States criticises the Dispute Settlement Body for its very strict interpretation of the agreements on safeguard measures (making their use very difficult), its challenge of the zeroing practice in the calculation of anti-dumping margins and case law relating to public entities on cases of anti-subsidy sometimes preventing the prosecution of state-owned enterprises.

As WTO rules require a minimum of three judges on each case; the Appellate Body is as of December 2019 fully blocked.

See “Concept paper: WTO Modernisation”, European Commission document, September 2018

For example, the United States have imposed anti-subsidy duties on imports of Chinese manufactured goods that have benefited from favourable raw material (including steel) prices from state-owned Chinese companies. China contested that these companies constituted as “public entities” (see “DS437: United States- Countervailing Duty Measures on Certain Products from China”, December 20, 2019

See “DS523: United States-Countervailing Measures on Certain Pipe and Tube Products”, 25 January 2019

See OECD, “Measuring distortions in international markets: the aluminum value chain”, Trade Policy Papers, N°. 218, 7 January 2019

See IMF, “People’s Republic of China: Selected Issues”, August 2019

Refers to the first part of the second study in the series detailing WTO measures.

Such as the exceptions that exist in the European State aid control regime

This is a subject of growing interest in the business community. See, in particular, Mark Wu, “Re-examining ‘Green Light’ Subsidies in the Wake of New Green Industrial Policies”, International Centre for Trade and Sustainable Development (ICTSD)/ World Economic Forum, August 2015

The three G20 countries are South Korea, Mexico and Turkey. The seven countries among the ten richest in GDP per capita on a purchasing power parity basis are Brunei, Hong Kong, Kuwait, Macao, Qatar, Singapore, United Arab Emirates (source: “Memorandum on Reforming Developing-Country Status in the World Trade Organization”, whitehouse.gov, 26 July 2019)

For a summary of these grievances and the situation in China for European companies, see Commission European, “Significant distortions in the economy…”, art. cit

See, for example, the joint communication of China and the European Union (with ten other countries) at the WTO, 26 November 2018

See WTO, “World Trade Report 2019. The future of services trade”, chap. A, p. 12-19

See WTO, “Schedules of specific commitments and lists of Article II exemptions”, wto.org

See WTO, “World Trade Report 2019. The future of services trade”, chap. E, pp. 152-197

The dispute settlement pillar is no better. Considering that the WTO has exceeded its mandate on several important cases38, the United States has refused since the summer of 2017 to validate the appointment of new judges to the WTO of the Appellate Body. This resulted in a total blockage of the WTO Appeals Management Mechanism at the end of 201939.

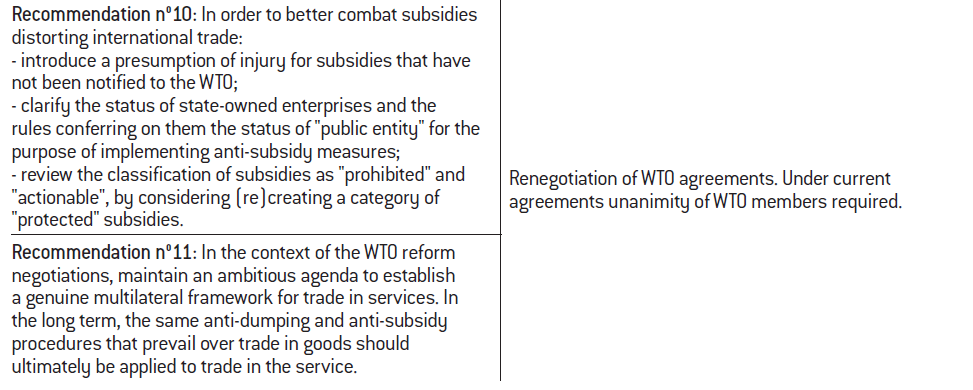

Promote transparency in public subsidies. To compensate for these difficulties, the introduction of greater transparency in the area of subsidies and more effective means of combating unfair practices should become a priority. The recent proposals made by the Commission on this subject40 seem to us to be going in the right direction.

The European Commission first of all suggests a strengthening of the transparency requirements on subsidies through a possible presumption of injury from subsidies not declared to the WTO. In practice, it would mean that the standard of proof for anti-subsidy investigations would be significantly reduced for grants that have not been the subject of prior notification to the WTO. This would allow Europe to impose countervailing measures as soon as a non-notified foreign subsidy exists, i.e. without having to demonstrate the injury suffered by the European industry and the causal link between the latter and the subsidy. This sword of Damocles should encourage States to better declare their subsidies to the WTO.

In addition, the status of state-owned enterprises is the subject of heated debate. The rules for the introduction of anti-subsidy measures impose, as a prerequisite, to prove the existence of a transfer from a State or “public entity”. However, decisions by the WTO Dispute Settlement Body41 have ruled that a state-owned controlling shareholding stake is not sufficient to qualify a company as a “public entity”. There needs to be proven that the company “owns, performs or is vested with a government function42“. This additional requirement, which is sometimes difficult to meet in a case law still in flux, is the subject of fierce legal battles at the WTO. In any case, the work of the OECD and the European Commission have demonstrated the existence of indirect subsidies carried out on a large scale via public companies in certain sectors such as steel, aluminium or chemicals43. In addition, IMF data on Chinese state-owned enterprises reinforce Western countries’ suspicions as to the existence of significant market distortions in China: while only 12% of the private companies are not profitable in the country, more than a quarter of the public companies are unprofitable44. In response to this situation, Europe and the United States propose to review the criteria for defining “public entities” in order to clarify the role of state-owned enterprises and thus to be able to more easily fight against so-called “indirect” unfair practices.

Finally, the European Union wishes to amend the classification of subsidies in the WTO framework. In the official terminology in effect, these are either “prohibited” or “actionable”45. “Prohibited” subsidies, considered as more serious, are the easiest to thwart through an accelerated dispute procedure. Currently, this category includes grants that require recipients to meet certain export targets, or to use domestic goods instead of imported goods. The European Union proposes to add to the prohibited subsidies category other types of subsidies that cause very high distortions in international trade such as unlimited state guarantees to companies or aid granted to “zombie companies”. We also believe that this review of the typology of subsidies could be an opportunity to design a new category of “authorised” or “protected” grants,46 against which it would be impossible to set up compensatory measures. In reality, such a category of “non-actionable” grants has already existed in the past. It covered, under certain conditions, R&D and development aid and some environmental aid. In the absence of agreement on a renewal of these exceptions, this category disappeared in 2000, after five years of existence. In view of the environmental challenges, a specific protection regime for green subsidies would send an excellent signal to WTO members and could initiate a virtuous circle in which a climate grant calls for another, and so on47.

Recommendation nº10 :In order to better combat subsidies distorting international trade:

- introduce a presumption of injury for subsidies that have not been notified to the WTO;

- clarify the status of state-owned enterprises and the rules conferring on them the status of “public entity” for the purpose of implementing anti-subsidy measures;

- review the classification of subsidies as “prohibited” and “actionable”, by considering (re)creating a category of “protected” subsidies.

Beyond the question of subsidies. International rules adopted in the mid-1990s are now proving outdated in areas other than public subsidies.

First, the GATT and then the WTO have historically included favourable provisions for members with self-reported “developing country” status. Many observers, most notably the United States, rightly point to the abuses of some developed countries that claim to be “developing”. Included in the list of developing countries are three G20 members and seven of the world’s ten richest economies in terms of GDP per capita at purchasing power parity48. A reform of the criteria for granting developing country status therefore seems necessary.

In addition, the development in recent decades of new forms of barriers to international trade through indirect control mechanisms for foreign investment is problematic. Forced technology transfers, obligations to create joint ventures, difficulties to obtain operating or marketing licences, or the weak protection of intellectual property are very often highlighted, particularly in the commercial disputes of the Western powers with China49. The mixed success of multilateral provisions on these subjects suggests that the most pragmatic approach in attempting to address it remains at this stage the bilateral negotiation. There is a good chance the United States will eventually obtain commitments from China in the context of the current trade war. Europe could also obtain concessions in the framework of the China-EU bilateral investment treaty expected in 2020. It is hoped that these bilateral agreements will then pave the way for an adaptation of the multilateral framework.

On these issues, as on the more general issue of reforming WTO institutions, it is essential that the European Union allies itself on a case-by-case basis with its trading partners who share similar interests. On subsidies and investment barriers, the United States and Japan are valuable allies. An extension of the EU-U.S.-Japan “trialogue” to other countries close to Western interests could increase the impact of these discussions. On the other hand, China seems to have positions consistent with the European approach to the reform of dispute settlement body and is generally more inclined to support the multilateralism than the United States since the election of Donald Trump50.

International trade in services. Defence instruments mentioned so far in this study are derived from the General Agreement on Tariffs and Trade (GATT), which deals only with the international trade of goods. Unfair practices occurring in the trade in services are de facto excluded from its scope. The services, however, are becoming increasingly important in international trade. While they represented only 9% of trade in 1970, they now constitute 22% and the WTO considers that they will represent one-third of world trade in 205051. Historically, the opening of trade in services was not a priority for the signatory members of the GATT 1947. There are two reasons for this. First of all, the services accounted for a small share of world trade at the time, since basic services are generally not exportable (e.g. local services such as hairdressing, hotels, or restoration). In addition, other service activities were often closely related to the State, as are the public services (education, health) and natural monopolies in network infrastructure (railroads, electricity, telecommunications).

This situation has changed significantly over the past thirty years. The globalisation of trade has seen a number of services grow strongly, such as air transportation, maritime transportation, or financial services. At the same time, the rise of digital technology and the gradual arrival of the Internet has disrupted or even created a large number of value chains in services: for example, advertising, software and media.

These developments have prompted GATT member countries to negotiate within the framework of the Uruguay Round a General Agreement on Trade in Services (GATS), which came into effect at the time of the creation of the WTO in 1995. The purpose of this agreement was simple: to contribute to the opening and liberalisation of world trade in services, on the model of what GATT had achieved for goods.

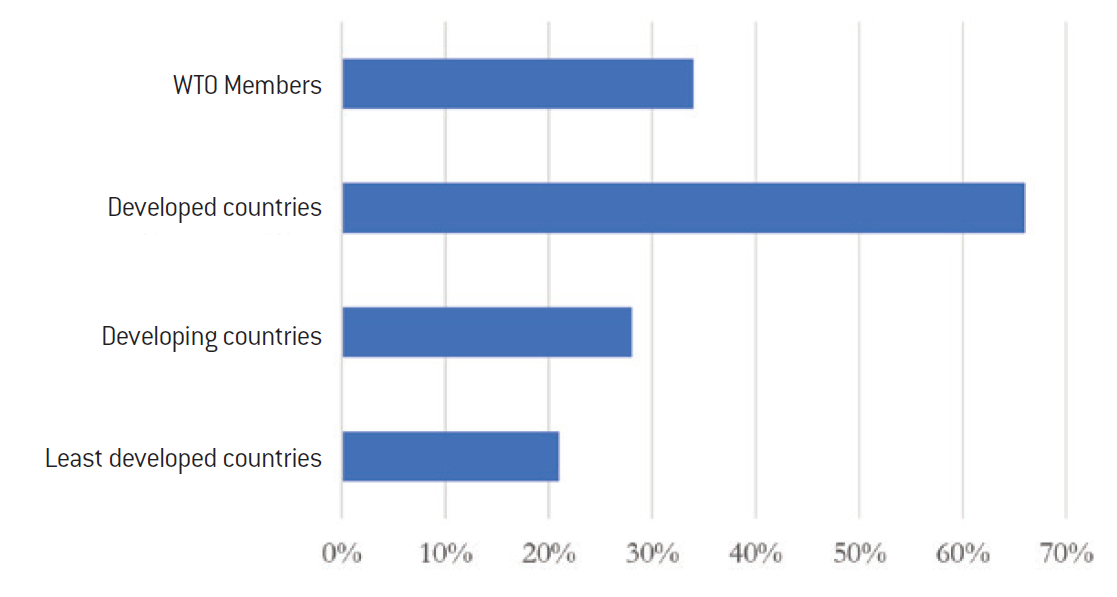

An analysis of the main provisions of the GATS agreements (see annex) shows that it operates mainly on the basis of Member States’ voluntary commitments. Countries can therefore maintain very strong restrictive measures on international trade in certain sectors. Thus, the analysis of the commitments made by the European Union52 reveals a strong reluctance to open up services in the field of culture, healthcare, education or media. The functioning of the GATS agreements therefore means that the main topic of negotiation is the list of services opened to trade in each country. To measure the success of these negotiations, it is necessary to study the content of the commitments made by WTO members. This is a delicate exercise, because the conditions of liberalisations or exemptions appear to vary greatly from one country to another. However, we can look at the number of sub-sectors (out of 155 in the WTO services nomenclature) subject to specific commitments, as well as the degree of openness granted by countries in each of these sectors.

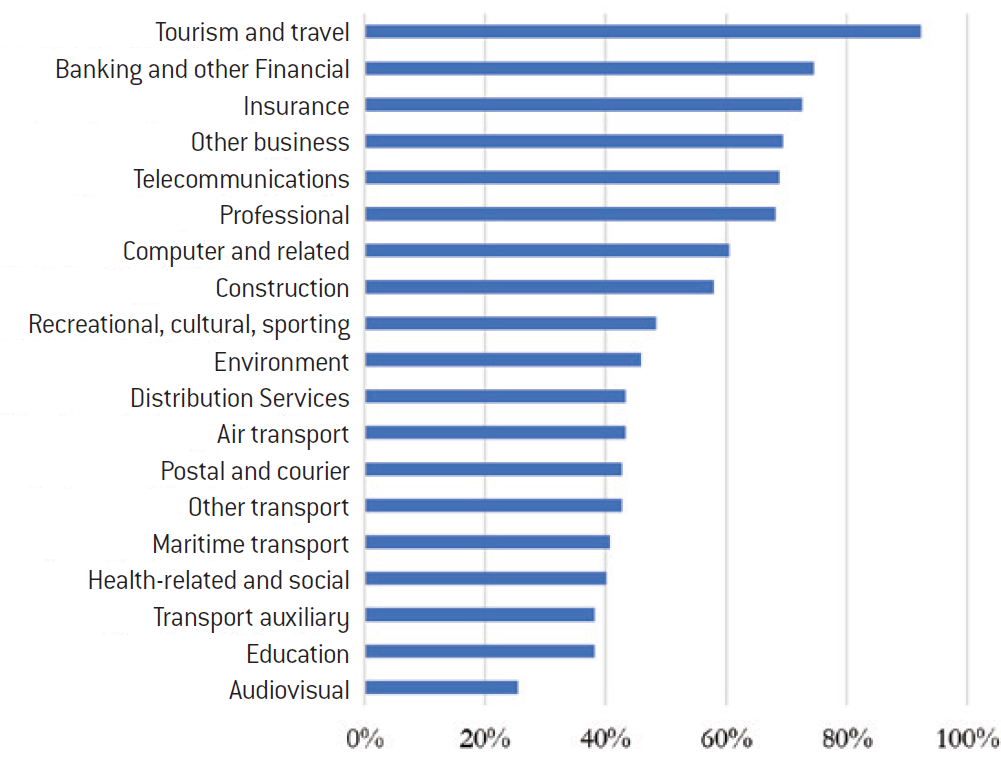

WTO data53 reveal that only 34% of the services are on average subject to a trade opening commitment. In addition, it can be seen that developed countries have gone further in the opening up of their trade in services: on average, they have made commitments on 66% of their sub-sectors, compared to only 28% for developing countries and 21% for the least developed countries. We can assume that developed countries enjoy comparative advantages in high value- added services, such as financial services or IT services, which are more easily exported. Finally, we note that finance and tourism are the subjects of most trade opening commitments (with respectively more than 90% and more than 70% of countries with commitments in these sectors), while transportation (less than 40%), education (less than 40%) and the audio-visual sector (around 25%) remain extremely closed.

GATS commitments by group of WTO Member States, May 2019 (proportion of service sub- sectors with specific commitments from these groups of countries)

Source :

WTO

WTO Members’ GATS Commitments by Sector, May 2019 (% of Countries with Specific Commitments)

Source :

WTO

See WTO, “Dispute settlement activity – some figures”, wto.org

It should be noted that, at the same time, disagreements on the application of the GATT accounted for 464 disputes, or 81% of the total.

Source: European Commission.

In reality, so-called “Open Skies” agreements (independent from the WTO) partly govern states’ interference in air traffic. The dispute also concerned the degree of subsidy allowed in these agreements (see David Shepardson and Yara Bayoumy, “U.S. and UAE sign pact to resolve airline competition claims”, reuters.com, 11th May 2018,

See Andreas Heinemann, “La nécessité d’un droit mondial de la concurrence”, Revue internationale de droit économique, vol. XVIII, n°3, pp. 293-324, 2014

In short, these data reveal that GATS have not really succeeded in reducing international barriers to trade in services, and that trade in services is therefore still regulated either locally or by bilateral agreements. This virtual absence of multilateral rules results in a small number of disputes that can be brought before the WTO. Between 1995 and 2018, the GATS have only been the subject of 77 disputes at the WTO54, or 13% of the total number of 573 proceedings handled by the court during this period55. Actually, since the failure of the Doha Round, very little has been done to build rules more effective in services. Negotiations on a new agreement, the Trade in Services Agreement (TiSA) were launched in 2013 with twenty-three WTO members. However, they are now at a standstill and will be resumed, according to the European Commission, “when the political context allows it56“.

How can this failure of the GATS be explained? First of all, it should be noted that a system of negotiation based on the voluntary participation of Member States, coupled with the most-favoured-nation clause, can give rise to “free- rider problem”: a country is better off letting third countries negotiate the opening of their respective service markets amongst themselves (from which it will then benefit through the most-favoured-nation clause), while keeping its own domestic service markets closed to international competition. Secondly, the decoupling of the negotiations on the opening of goods (GATT) and those on services (GATS) may have had a detrimental effect. Countries with a comparative advantage in the production of services have voluntarily opened up to trade in services, while other countries with a comparative advantage in the production of goods have not made commitments to open their services markets. This can be observed by the percentage of services opening according to the level of development of the country.

So what about the fight against unfair competition practices in services? At the time of the signing of the GATS, WTO Member States committed themselves to starting negotiations on ways in which to combat subsidies that distort international trade in services. These negotiations have never been concluded since. Thus, there is no multilateral trade defence instrument in services. This may seem problematic at a time when certain service sectors, first and foremost digital, are considered major sovereignty issues and can therefore be the subject of unfair competition practices. In practice, countries unilaterally decide how they treat these strategic sectors. For example, the conflict between American airlines and their Persian Gulf counterparts, suspected of receiving massive government subsidies, has been resolved directly between the U.S. Department of Trade and the Gulf countries57. On another level, China has set up the “Great Firewall of China” to protect its Internet network from many Western digital service providers.

In any case, the absence of a strong multilateral framework on trade in services does not seem to be appropriate for the economic revolutions of the 21st century. The competitiveness of industries is strongly linked to that of services to companies, and the boundary between the secondary and tertiary sectors is increasingly blurred in the contemporary economy where many goods are sold with associated services. Moreover, in the absence of multilateral rules, the law of the strongest tends to prevail in the context of bilateral agreements. Such a scenario is neither economically desirable – because it is not conducive to trade in services beneficial to the global economy – nor politically desirable – because it does not guarantee fair treatment of developing countries. Therefore, it seems important to us to stress that any ambitious reform of the WTO will have to address the issue of trade in services.

Recommendation nº11 : In the context of the WTO reform negotiations, maintain an ambitious agenda to establish a genuine multilateral framework for trade in services. In the long term, the same anti-dumping and anti-subsidy procedures that prevail over trade in goods should ultimately be applied to trade in the service.

Trade policy or competition policy? Let’s imagine for a moment that an ambitious reform of the WTO succeeds in equipping the international community with an effective multilateral framework for regulating international trade in goods and services for which the transparency of public policies would be required. In such a scenario, access to data from foreign companies would be facilitated. What would trade defence policy look like?