Economy of Knowledge

Introduction

Why practice nooconomics ?

Knowledge is infinite

The curse of raw materials

The dynamics of socio-technological revolutions

How to practice nooconomics ?

Social properties of knowledge

The three principales of noodynamics

The knowledge flow equation

What does it mean to practice nooconomics ?

Knowledge infrastructures

Disruption and silicon valley’s “Love can do” mantra

Biomimetics: an application of the knowledge economy

Abstract

Imagine an economy whose main resource is infinite. Imagine an economy endowed with an intrinsic form of justice, an economy that facilitates and rewards sharing, an economy where the unemployed boast greater purchasing power than those in work, an economy where 1 and 1 makes 3, an economy in which everyone is born with purchasing power and where, ultimately, each individual has total control over his or her purchasing power. Nooconomics – the economics of knowledge – captures the essence of sustainable development and may allow us, in just a few years, to trivialize problems that Humanity has considered unsolvable for millennia. This treatise will answer three questions: Why practice nooconomics?, How do we practice it?, and What is it exactly?

This is a practical treatise on nooconomics, the economics of knowledge, written for citizens and politicians alike. It describes in simple terms the issues surrounding this field, which has a crucial role to play in issues ranging from sustainable development, diplomacy and security, to poverty alleviation, economic development (on both local and national levels), and Silicon Valley studies. It will animate debate on public, educational and civil policies. Biomimicry, industrial ecology, the circular economy and Professor Gunter Pauli’s paradigm of The Blue Economy are all suggested topics for further reading.

Dr. Idriss J. Aberkane,

Affiliated scholar of the Kozmetsky Global Collaboratory at Stanford University, lecturer on the knowledge economy at the Ecole Centrale Paris and research engineer in neuroergonomics and biomimetics at the Edole Polytechnique (Paris-Saclay University), former intern of the department of experimental psychology at the University of Cambridge, ambassador for Unesco-Unitwin’s Complex Systems Digital Campus, professor on the knowledge economy at Mazars University in their “Next MBA” program.

Profanity adds spice to a Too much is indigestible, too little is bland, but the right amount can make a talk memorable. As Patton once said: “When I want my men to remember something important, to really make it stick, I give it to them double dirty. It may not sound nice to a bunch of little old ladies, at an afternoon tea party, but it helps my soldiers to remember. You can’t run an army without profanity, and it has to be eloquent profanity.”

Imagine an economy whose main resource is infinite. Imagine an economy endowed with an intrinsic form of justice, an economy that facilitates and rewards sharing, an economy where the unemployed boast greater purchasing power than those in work, an economy where 1 and 1 makes 3, an economy in which everyone is born with purchasing power and where, ultimately, each individual has total control over his or her purchasing power. Just like bullshit1, knowledge is infinite. This inherent potential of knowledge has very profound economic implications. Firstly, if knowledge is infinite then, by indexing growth to knowledge, the former also has the potential to be infinite. We know that this is not the case for growth indexed to natural resources which – even when they happen to be renewable – will always be finite, due to the finite nature of time itself. Infinite growth is impossible to achieve with finite resources. However, infinite growth linked to knowledge is not only possible, but rather simple. Consequently, nooconomics captures the essence of sustainable development, which is to say the immense richness of its applications.

Conceptually, the economics of knowledge is not a continuation of the classic economics of raw materials, work or capital. It represents a revolutionary change from the latter, a genuine paradigm shift. Although this notion appears ad nauseam in the world of mass marketing, it really does represents a return to the very roots of the word “economics”, to the age of the Physiocrats, for whom all economic value could be reduced to natural goods or services. The prefix “eco-” is, of course, common to both economy and ecology, and it is exactly this link that is emphasized by the economics of knowledge.

This treatise addresses three questions: Why ? How ? and What ? Why should we practice nooconomics? How do we go about this, and – in particular – on which theoretical basis? And finally, what are its essential applications? The latter includes biomimetics, probably its most spectacular application. This treatise addresses political and economic decision-makers. A citizen is both, entitled to vote both politically and – more importantly – economically, the latter being exercised via the citizen’s choice to grant money, attention and time to any given company, even if that citizen is only rarely conscious of such decisions nowadays.

Why practice nooconomics ?

Knowledge is infinite

Interestingly enough, France’s state-run schools for teachers, formed during the industrial revolution and historically known as a decisive rival of the Church, are still called “normal”, the “Ecole Normale Supérieure” being the most famous at the time this treatise is being written.

A significant part of Jobs’ genius was cultural, as well as Even if Jobs did not invent the PC, he still won the battle with Bill Gates as the first person to make – within a single generation– the concept of a computer in every home a reality. IBM, on the other hand, had long considered the very term “personal computer” to be an oxymoron, a natural consequence of their ‘B2B’ (Business to Business) culture (IBM of course stands for International Business Machines).

There is one simple and essential reason to practice nooconomics: because knowledge is infinite. And also because any resource or energy management issues can be reduced to that of managing a future knowledge in the making; that is to say, the issue of not thoughtlessly using up and wasting a resource in a trivial manner today, when tomorrow the knowledge will exist to use it in a better and more profitable way. As we will see in the third part of this treatise, biomimetics is a very elegant realization of this principle, the reason for its emergence as a global techno-industrial avatar of sustainable development.

Nooconomics captures the entire essence of sustainable development, because knowledge has the potential to render problems that Humanity has considered unsolvable for centuries redundant, in the space of one generation. One kilogram of mud contains enough mass energy to meet the entire annual demands of mankind, but it is due to a lack of knowledge (ignorance, or negative knowledge) that we are unable to realize its potential. Antimatter could be a revolutionary fuel for the aerospace industry, yet it is because of a lack of knowledge that it is not used on a mass scale today. The knowledge economy can underscore a healthy, infinite growth that absolutely no other paradigm can offer in today’s world. In order to prevail, however, it requires the creative destruction of our existing economic paradigms, based on scarcity, division and Malthusianism. In other words, paradigms still trivially grounded in material rather than immaterial realms of thought. Yet these paradigms, inherited from the industrial revolution, are proving to be very durable because they have normalized2 our very system of education, teaching yesterday’s ideas to tomorrow’s generations, measuring the possibilities of the future against the past. Ensuring that the ways of the past do not impinge on the future is a fundamental theme of sustainable development.

The toll taken as a result of the process of creatively destroying the economy of capital, work and resources in favor of nooconomics is represented by a protracted political struggle. Although its premise dates back further,

the modern beginnings of this struggle can be pinpointed to the year 1977 when Jimmy Carter, as part of a fascinating speech during which he declared the energy crisis to be the “moral equivalent of war”, made the following calculation: if we keep indexing the US dollar to raw materials, its potential is great but limited; were we to index our currency to knowledge, its potential would be infinite. We know beyond any doubt that this ideal has not been achieved over the following forty years. The proof is there to be seen in the millions of deaths resulting from various wars in central Africa and the Persian Gulf, still the world’s most volatile region due to its abundance of cheap hydrocarbons. The strategic doctrine pushing the United States to secure the Persian Gulf’s oil deposits at absolutely any cost is still ironically labeled “the Carter doctrine”, even though it diametrically opposes the vision outlined by the president vision in 1977. Indeed, every politician can tell the story of an ideal that has gone missing in action. Yet, while dreamers may be killed, their dreams never can be.

By way of a caricature, yet one with a strong grounding in truth, this profound political struggle between resource-based (material) and knowledge-based (immaterial) power could be reduced down to the opposing visions of Jimmy Carter and Dick Cheney – the latter easily caricatured as the partisan oilman, the embodiment of domination by resources. Today, the dollar remains the trading currency for all raw materials, and unfairly so. Whether you wish to trade wheat, frozen concentrated orange juice, gold, uranium, bauxite, cotton, crude oil, natural gas or lean hog futures, ultimately the purchase will be made in dollars. This is perceived as an immense economic injustice by the BRICS, and drove them to push for the advent of a new global reserve currency indexed to gold and special drawing rights held by the IMF, at the G20 summit in L’Aquila in 2009. Although Dominique Strauss-Kahn backed the BRICS at the time, their initiative has subsequently borne no fruit.

Only seven years after that 1977 speech, the emergence of the “Valley Heroes” – from Steve Jobs to Sergei Brin, from Mark Zuckerberg to Elon Musk – proved to just what extent knowledge had become the country’s most essential economic resource. In 1984 Steve Jobs, having launched the legendary Macintosh and sold the idea of the personal computer3 to the world, met with French President François Mitterrand who, in view of the investment of several hundred million dollars that Apple had just made in France, asked him if his country could witness the emergence of its own Silicon Valley. Jobs’ response, the epitome of clarity and conciseness (and which, as a Frenchman, I consider more valuable to the French economy than ten years’ worth of École Nationale d’Administration graduates), is now preserved in the audiovisual archives of the French national channel “Antenne 2” and available on Youtube. Most significant of all is his prophetic utterance: “Software is the oil of the 80s and 90s”. This idea had been considered inconceivable for at least a decade at IBM, who – following a now-legendary meeting between Bill Gates, Paul Allen and Steve Ballmer and the American company in the 1980s – famously claimed “we know there is no money to make in software”. Today, the man considered by the mass media to be the world’s richest is not an oil magnate but a software magnate. And today Apple, born in a garage, just like Amazon, Google, HP or Disney, is sitting on a pile of cash comparable to the entire GDP of New Zealand. So yes, software is indeed the new oil. And, more broadly speaking, knowledge is the oil of any given age, just as Richard Francis Burton described Paradise – in other words Eternity or the one true “end of history” – as the place “where every knowledge shall be known”. If time is indeed Plato’s mobile image of an immobile eternity, its mobility can only be traced in the evolution of human consciousness and, as a last resort, of wisdom (knowledge of the self) and knowledge (of the non-self). Nooconomics is itself a pragmatic and elegant branch of nooscience, the knowledge of knowledge, and its political challenge is to explore, exploit and distribute those two vast oils: wisdom and knowledge.

Barack Obama can be seen as something of a successor to what I call the “the true Carter doctrine”, that of nooconomics. Obama is actively courting the geeks of his country and has held meetings with Mark Zuckerberg. Facebook now holds more economic value than a Total or a BP, and the firm enjoys more influence over governments than the oil companies of yesteryear did when they went about funding coups d’état. The company also has a market capitalisation comparable to theirs and, although the latter is still largely speculative, it has achieved all of this with one hundred times fewer employees. It may justifiably be said that the productivity leverage of knowledge is colossal, and it is for this reason that mathematics could be a most wonderful instrument to drive development in Africa. Unfortunately Africa, as of early 2015, is still of all the continents the one least involved in nooconomics, although this is of course foreseen to change.

Obama also met with Elon Musk, the founder of SpaceX and Tesla Motors. The former company has been able to win over fans with its proposals for the private refueling of the International Space Station and the provision of mass space tourism, in just five years. The latter company concentrates all of its production in the USA and is valued today above the PSA-Peugeot-Citroën group. It has made a mockery of the low-cost, de-industrialization politics that have prevailed for too long among the strategies of the austerely and mechanically orthodox French automotive industry, which remains capable of predictable administration but intrinsically incapable of unpredictable disruption. It is to such a mentality that France owes the death of the “Watch Valley” in the Jura region, among other failures.

SpaceX, an exceptionally agile and visionary company, subject to relatively small levels of bureaucracy compared to its industry counterparts, is the nemesis of Arianespace. The two companies’ DNA are radically opposed, one being as fundamentally idealistic and disruptive as the other is the result of an upbringing rooted in rationality and predictability. It also bears mentioning that Tesla motors recently declared that it would not sue any competitors who choose to replicate its patents in good faith, something that would still be unthinkable for the European automotive establishment. Not only has the price of Tesla shares not dropped following the announcement but, from October 2012 to August 2014, it grew by a staggering 765%! When was the last time a French, or even European, business leader was deservingly referred to as disruptive? Is administration not diametrically opposed to disruption? Can the term “disruptive state” ever be anything other than an oxymoron? What can we say about the French “National School of Administration”, itself administered by the state? Must it not be the stage for the least disruptive thought on Earth?

Barack Obama is also courting Taylor Wilson, the young prodigy who produced a DIY deuterium fuser in his parent’s garage while he was still attending high school. Better still, the president has set in motion a tradition of entrusting the extremely strategic Department of Energy to geeks, such as Nobel prizewinner Steven Chu and professor Ernest Moniz. Originally created by Jimmy Carter, the position at the head of this department had traditionally been the reserve of seasoned intelligence or oil experts. Let us remind ourselves of the brilliant quote from Sheikh Yamani, Saudi Arabia’s legendary Minister of Oil and Mineral Resources from 1962 to 1986, at the time of the oil shocks: “The Stone Age did not end for a lack of stone, and the Oil Age will end long before the world runs out of oil.” We should avoid the fallacious interpretation here that “stones are abundant, and hydrocarbons will remain so”. Instead, it should be seen as an assertion that Humanity, through its ingenuity and cultural maturity, remains free to accelerate the advent of a technological revolution via a process of creative destruction, so dear to Schumpeter. Before the American Civil War, one of the essential economic consequences of the abolition of slavery in most northern states was a massive acceleration in the industrialization process, because the steam engine was more effectively adopted once the old model of slave-based manual production had been destroyed legally, ethically and then culturally. The American automotive industry was destined to flourish forty years later in the North rather than the South, whose industrialization had experienced a decisive delay. The end of the slavery model is an elegant precedent of the creative destruction needed in order to impose nooconomics. Let us just hope that this transition will not result in a conflict in any way comparable to the American Civil War.

The curse of raw materials

When Brazil discovered the subsalt oilfields of Tupi and Iracema, geologically similar to those of the Gulf of Guinea, President Lula da Silva declared that they were “Brazil’s second independence” (the Tupi oilfield has since been renamed “Lula”). However, the really noticeable trend among the BRICS is that the fewer raw materials they possess per inhabitant, the quicker they are to wholeheartedly embrace nooconomics. Let us compare, for example, the raw exports of the Russian Federation with those of the Republic Of Korea, which experimented with setting up a Ministry of the Knowledge Economy. Despite a territory 171 times smaller than Russia’s and a third of its population, South Korea exports more than the Federation because, instead of being held back by the mental sloth that an easy access to raw materials inevitably encourages, it is forced to export knowledge and expertise.

The export matrices of the BRICCA (Brazil, Russia, India, China, Canada and Australia) all demonstrate a great dependency upon raw, agricultural or geological materials, and this dependency is sentencing these countries to remain attached to the paradigm of material economics. These are also the world’s largest countries, with the exception of the USA, the only one to possess the geographical attributes of a superpower as of early 2015, namely both a large interconnected territory and population. China, precisely due to a notable lack of hydrocarbons per inhabitant, is, of all the BRICCAs, the most involved in nooconomics and as a result the one country that encourages its children, from kindergarten, to read the fables of Gunter Pauli, the father of Blue Economy.

Geopolitically it must be noted that sometimes, for an individual or for a country, “what doesn’t kill me makes me stronger”. By limiting China’s access to the hydrocarbons that it craves, the Organization for Economic Cooperation and Development (OECD), which is under clear American leadership, has actually made this nation more innovative and somehow saved it from the debilitating economic diabetes that an easy access to cheap raw materials would have otherwise caused, and which can be clearly observed in a few other countries, Russia and Algeria for example.

Consequently, in Brazil, the discovery of new oil fields could prove to be more of a disguised curse than a blessing, for it can prevent the country’s entry into the knowledge economy. In this sense, surely it does not represent “Brazil’s second independence”, as it renders the country more dependent upon the export of raw materials. For countries and individuals alike, two desires may coexist: that of the ego, demanding “give me what I want!”; and that of the true self, more quietly begging “give me what I need!”. It is strange to observe that states persist in behaving like children, coveting territories and resources out of a vain sort of greed, like children craving an overload of sweet treats that will inevitably make them sick, while they should instead be coveting wisdom and composure. I am dedicating a separate Noopolitik treatise to this fascinating observation.

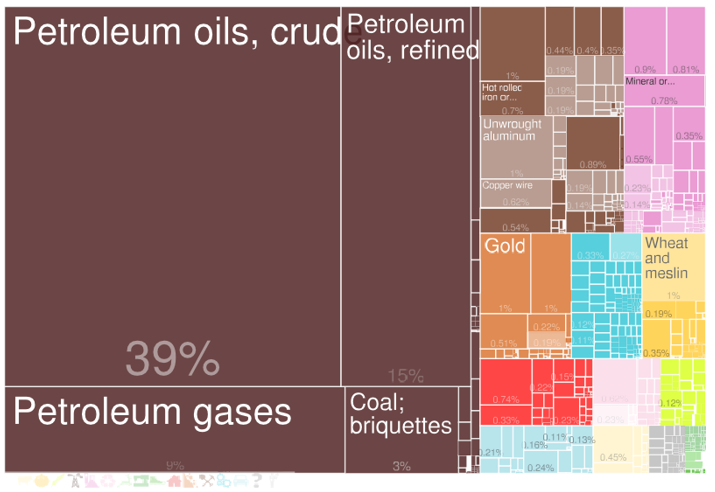

Figure 1: Raw exports from the Russian Federation in 2012 (total volume: USD 468 billion)

Source :

“The Atlas of Economic Complexity,” Center for International Development at Harvard University.

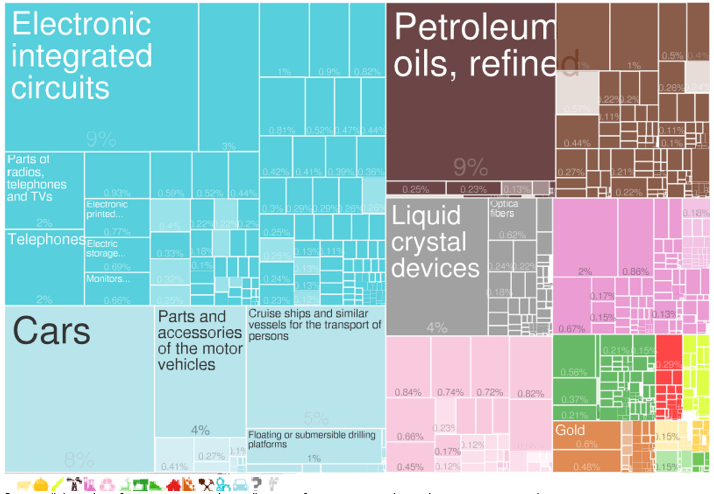

Figure 2: Raw exports from the Republic of Korea in 2012 (Total volume: USD 562 billion)

Source :

“The Atlas of Economic Complexity,” Center for International Development at Harvard University.

Comment: Please note that the overall volume of South Korea’s exports is superior to that of the Russian Federation in 2012, as is i ts proportion of technological exports. The contribution of mineral products to South Korea’s raw exports is largely made up of those products circulating and being transformed within i ts borders, rather than those originally mined there.

The fact that the French-Brazilian Artur Ávila was awarded the Fields Medal in South Korea in the summer of 2014, and that Brazil will host the 2018 International Congress of Mathematicians, are both somewhat discreet economic events that are nevertheless much more influential for Brazil’s economic potential than the discovery of deep sea oilfields or the painful soccer World Cup of 2014 (when the country was the generous host of its own humiliation).

Let us dwell for the moment on the notion that an abundance of raw materials is to states what candies are to children: sweet, yet harmful. A comparison of raw exports from Tunisia and Algeria once more demonstrates it beyond all doubt. Algeria’s economy is diabetic; the country suffers from a sort of hydrocarbon diabetes, the clearest symptoms of which are an absence of innovation a total lack of diversity in its exports.

The story of Johann August Sutter – the subject of Blaise Cendrars’ Gold and a possible inspiration for Sergio Leone’s Once upon a time in the West – perfectly illustrates how, for a smart entrepreneur, the discovery of raw materials can be a terrible curse. Although he had created a very valuable business in California thanks to his singular ingenuity and use of renewable locally-sourced materials, Sutter was ruined by the Californian gold rush of 1848 and the stupidity and injustice that it brought about. A few centuries earlier, the Spaniards had ruined themselves by attempting to exploit the Potosí silver mines (then in Peruvian territory, today in Bolivia) while later many states of the Persian Gulf, Saudi Arabia chief among them, would prove to be incapable of actively and effectively participating in the knowledge economy, because of the political and mental sloth that an easy access to raw materials inevitably encourages. Men and states alike must understand that the brain is a philosopher’s stone that is more valuable than all the world’s gold. It is better to be born poor and smart than rich and stupid; this is particularly true of states, and ably demonstrated by the adventures of Sutter, 16th century Spain or, in contrast, the successful “forges de Buffon” in 18th century France.

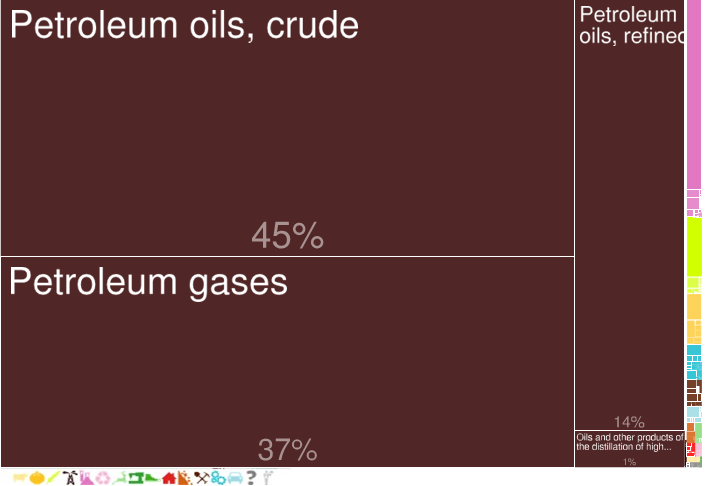

Figure 3: Raw exports from Algeria in 2012 (Total volume: USD 69.8 billion)

Source :

“The Atlas of Economic Complexity,” Center for International Development at Harvard University.

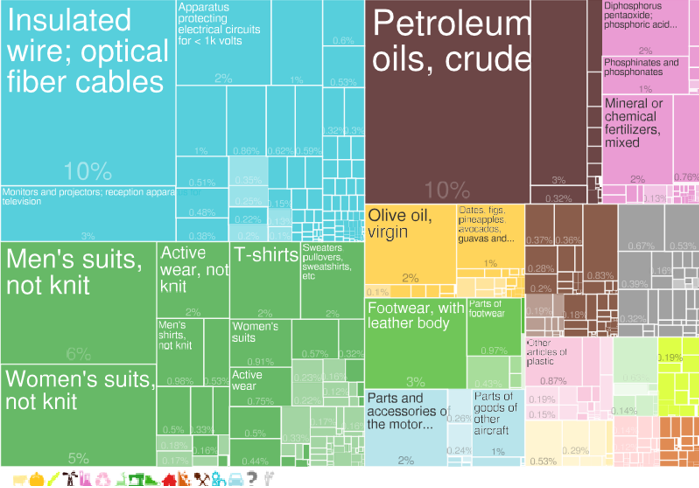

Figure 4: Raw exports from Tunisia in 2012 (total volume: USD 15.3 billion)

Source :

“The Atlas of Economic Complexity,” Center for International Development at Harvard University.

Comment: A much more diversified range of exports is in evidence in Tunisia, even though the country’s exports per inhabitant remain about 25% lower than Algeria’s, whereas South Korea’s were nearly three times higher than Russia’s.

The dynamics of socio-technological revolutions

Christian Borghesi et have proved that there is a statistical physics to voting crowds, with a simple empirical law regarding ballot participation: the more a voter feels that his/her vote will be diluted, the less likely he/she is to participate in the ballot. Hence in many countries from Israel to France, the mean abstention rates for municipal elections are positively correlated to the size of the city. C. Borghesi, J. Chiche and J.-P. Nadal, , “ Between Order and Disorder : A ‘Weak Law’ on Recent Electoral Behavior among Urban Voters ? ”, PLoS ONE 7(7), e39916, (2012).

When it comes to a socio-technological revolutions, the cultural dimension – which is to say, the unavoidable element of the zeitgeist – must not be underestimated. Mankind does not embrace new technology or a paradigm shift (the structure of scientific revolutions, according to Thomas Kuhn) because they are objectively better and more Such an act would imply rational humanity, which behavioral economics has clearly demonstrated to be a myth. Provided that the choice is available, a revolution is adopted only when mankind no longer fears it, which is entirely different and explains the success of Apple. Apple did not invent the PC, but was able to make it “cute” (or acceptable and, above all, harmless) in the eye of the public. Even today, the firm’s trademark designs preserve this culture. Yet we must remember that mankind already possessed the following technologies in the past: an analog computer, the Antikythera mechanism, in the 1st century BC (therefore more than 1,700 years before Blaise Pascal’s analog computer); Zhang Heng’s Houfeng Didong Yi seismographer in 132 AD; a working electric battery or a galvanoplastic device, the “Bagdad Battery”, in the 7th century at the latest; smallpox inoculation (variolation) in 16th century China at the latest; and a working steam engine, the Aeolipyle, in 1st century Alexandria.

Thus, as a prelude to the question “how to practice nooconomics?” we can already observe that the widespread acceptance of any revolution, of any ingenious idea in history, necessarily passes through three stages:

Stage 1: it is considered ridiculous, and above all unfeasible. This is a result of mankind’s natural instinct to measure the future against the past. Abolishing slavery and allowing women the right to vote were considered ridiculous and unfeasible in their times. Today the same applies to the eradication of pollution. However, Gunter Pauli shows that it is not only feasible but also highly profitable, in the same way that the abolition of slavery accelerated the Northern states’ industrialization and subsequent adoption of a much more economically profitable paradigm.

Stage 2: it is considered dangerous. The suffragettes, after having been ignored and ridiculed, were tortured, sectioned, imprisoned and, in some cases as a last resort, killed.

Stage 3: it is considered obvious. Nowadays women can vote. So what?

It should be noted, therefore, that a revolution is never actually considered as wonderful, but instead passes directly between the “dangerous” and “obvious” stages, which subsequently both encourages mankind to regard it somewhat cynically and prevents us from reacting more constructively to the next revolution: tomorrow’s reactionaries will base their certitudes on yesterday’s revolutions, without ever being aware of the origins or historical dynamics of these certitudes. Despite history being full of scientific and political revolutions that were once considered impossible but that are part of our everyday lives today, we are still incapable of anticipating the next ones, like the elimination of pollution. The latter will seem just as self-evident to our descendants as the abolition of slavery is to us nowadays. According to Cheikh Aly N’Daw, founding father of “economics via peaceful means”, the art of attaining a “crystal-clear subjectivity” may be a cure to this condition of collective human consciousness.

Any revolution elicits cognitive dissonance, and man will naturally react with denial and violence up until the point that the revolutionary ideas are assimilated into collective patterns of thought. As we have already seen, when faced with a paradigm shift, Man is effectively confronted by a cognitive dilemma: one choice is to disown his past and abandon his comfort zone by stepping into the unknown and embracing the truth, and the other is to remain in his comfort zone – which is to consciousness what a shelter is to a body – and to reject the truth. It is normal, and to be expected, that people tend to prefer the comfort of a lie to the discomfort of the unknown truth. However, the latter is better for them than the former: this is another case where the ego leads humans away from what is beneficial. Politicians and citizens alike can act to combat this harmful mechanism of the individual and collective ego; patience and exemplarity are the best weapons in this struggle, for the use of force and lies will antagonize the ego and strengthen its resolve, thus making it even more resistant to changes for the better. Eternal leaders are those able to subtly charm the ego, those motivated by a transcendent beneficial love of the unknown. In the words of Gandhi: “in a gentle way, you can shake the world”. Gandhi also very clearly outlined the fundamental stages involved in adopting a revolution, having himself experienced such changes at first-hand: “first they ignore you, then they laugh at you, then they fight you, then you win”.

It is for this reason that the deepest and most durable revolutions must be non-violent (as opposed to examples such as the Algerian and French revolutions, which were rushed, imperfect and the result of a historical fracture that leaves humanity with no other choice than that of violence), like Martin Luther King Jr.’s Civil Rights movement, which did infinitely more for racial equality than the Black Panthers or the Nation of Islam put together. Violence in support of a revolution is counter-productive because it antagonizes the ego and strengthens the public’s conviction that such change is dangerous, thus preserving a collective mindset that is stuck in the metastable state of “dangerous” rather than “obvious” (and therefore, consensual). There is nothing more counter-productive, in the context of a negotiation or a revolution, than to antagonize the ego of a person or a nation. Such a notion should be taught in the Middle East: let us consider the idea of a peaceful territory, with Palestinians and Israelis sharing one single multicultural, flexible and globally beneficial society, and constitutionally committing themselves to protecting each other. Today, this idea is considered somewhere between “ridiculous” and “dangerous” by both the Israeli and Palestinian elites. It is not angelism, but merely a simple observation in “social thermodynamics”4, to deduce that only through non-violence will we be able to change the status quo. This hints at the diplomatic interest of nooconomics, and in this case noopolitik, as applications of the economics and politics of wisdom. It is a serious oversight that nooconomics is not taught to decision-makers in the fields of diplomacy and administration, because the culture of transcendence, revolution and disruption that it presupposes is of exceptional diplomatic value.

In conclusion to this first section, let us remind ourselves why we should practice nooconomics. Because knowledge is infinite, and because infinite prosperity is an inherent feature of the knowledge economy, unlike any other economy. A culture of transcendence is also inherently present, which represents a genuine treasure for Humanity. Finally, it contains a universal protocol that transcends material, zero-sum conflicts and is instead concentrated on immaterial, positive-sum, outcomes, as we will see in the next section.

How to practice nooconomics ?

Social properties of knowledge

The Hypertext is considered to have been theorized by Vannevar Bush in his work as an administrator for the Manhattan Project and in a famous 1945 article in The Atlantic Monthly, entitled “As we May Think”.

At first the Internet was decisively influenced by the Arpanet project, a product of the US military- industrial Yet the World Wide Web had essentially been a civilian project, just like the earlier Transmission Control Protocol (which was adopted by the Arpanet).

It is essential to understand that this estimate does not take paradigm shifts into account, for they are qualitative and not quantitative. In The Technopolis Phenomenon. Smart Cities, Fast Systems, Global Networks, edited by David Gibson, Georges Kozmetsky, Raymond Smilor, Regis McKenna estimates that the time taken for world scientific knowledge to double is under ten years.

“Truth is the shattered mirror strown in myriad bits, while each believes his little bit the whole to own”, sings F. Burton in The Kasidah of Haji Abdu El-Yezdi, which is taken from Rumi.

Nooconomics differs from classic economics to the same extent that quantum mechanics differs from Newton’s mechanics. Yet its axioms are at once simple and elegant. First, knowledge has two fundamental social properties: it is collegial, and it is prolific.

Collegiality means that everybody possesses a share, and nobody possesses it all. A consequence of this property is that if we do not learn collectively, we will no longer learn at all: the hypertext5, the Internet6, the Web and wikis are technological manifestations of this collegiality. States and organizations who wish to increase their flow of knowledge and wisdom (an essential process) must ensure that their population is “group literate”. In other words, their education and activities must be focused on the group and on the ability to work as a group, rather than on the individual. However, the ego prevents human beings from cooperating and acting in a coordinated manner.

The second fundamental social property of knowledge is its prolificity. It is estimated that the quantity, but not the quality, of global knowledge – which is to say, the number of open problems that are closed – doubles about every seven to nine years7. It means that Humanity, at least in terms of quantity (as paradigm shifts, relating to transcendent knowledge and therefore qualitative in nature, are not taken into account), now produces the same volume of knowledge in seven to nine years as it has managed in the rest of its history.

The prolificity of knowledge poses one obvious logistical problem that all organizations around the world must address: knowledge is growing exponentially, but continues to be distributed in ways that are essentially linear against time (language, text, video). It does not take an expert in supply chains to identify the problem here. However, supply chains of knowledge are scientifically fascinating, and the problems they pose are probably just as significant as Monge’s transport theory.

Let us thus sum up the two fundamental social properties of knowledge:

Property 1: knowledge is collegial

This property means that “truth is a shattered mirror”8, everybody possessing but a small piece of it, and advances can only be made to mankind’s collective consciousness by pooling all of these pieces of knowledge. The force obstructing this process is the ego. Yet contemporary academic research, repeating the mistakes of the medieval scholastic method, has become a vast professional cult in thrall to the latter. Who knows what fascinating discoveries would await us, if only academics abandoned their egos?

Property 2: knowledge is prolific

This property is another way to say that knowledge production is self- driving: the more knowledge we have, the easier it is to obtain. The same is true of capital, the difference being that knowledge is infinite. While the “writable” volume of knowledge (i.e. the number of open questions that we answer) is currently doubling every seven to nine years, this growth does not include paradigm shifts and intellectual revolutions that could be summed up in one sentence, yet would equally be capable of disrupting millions of other existing phrases.

The three principales of noodynamics

In the start-up community, “scalable” is usually synonymous of “sublinear” and will mean here that doing ten things at once will take less time and resources than doing one thing ten Transferring possessions is fully scalable, since transferring one million dollars is faster than transferring one dollar a million times.

It is possible to define noodynamics – the dynamics of knowledge exchange – because all knowledge exchanges adhere to at least three simple principles, by which they are fundamentally opposed to the exchanges of capital and raw materials.

Principle 1: knowledge exchanges are positive-sum

Principe 2: knowledge exchanges are not instantaneous

Principe 3: the combination of knowledge is not linear

Principle 1: knowledge exchanges are positive-sum.

If I give you twenty dollars, that money is no longer mine. However, if I give you knowledge, I still possess it at the end of the transaction. “When a material good is shared, it is divided; when an immaterial good is shared, it is multiplied,” explains Serge Soudoplatoff, who also reminds us that the knowledge economy is an economy of flow, unlike the economy of work, capital and raw materials, which is an economy of stock. The economy of knowledge is also an economy of abundance, which is based neither on scarcity nor on speculation. This holds true in principle, although in reality the speculation of knowledge is extremely tempting, for example with degrees or patents. The chivalrous and visionary decision taken by Elon Musk to grant his competitors free access to all Tesla Motors’ patents, which flabbergasted the automotive industry around the world (particularly in France and Japan), is a specific example of this fascinating sign of the times. This will prove to be another idea that Musk transforms from “ridiculous” to “obvious”. People like him are economic treasures.

Principle 2: Knowledge exchanges are not instantaneous.

Above all, they are not scalable9, unlike property exchanges. Handing over the ownership of 20 dollars or 20 million dollars takes more or less the same amount of time, equal to that required for a written or electronic signature. The same goes for trading material goods: trading of 20 or 20,000 tons of rice takes virtually the same amount of time, which makes high frequency trading possible. Knowledge, on the other hand, cannot yet be distributed at high frequency, even if neuroergonomics and MOOCs (Massive Open Online Courses) will one day allow it to be exchanged at a much faster rate. But for the time being, I cannot give you the theory of quantum chromodynamics as fast as I can give you 20 dollars.

Principle 3: The combination of knowledge is not linear.

Possessing 20 dollars and 20 dollars means possessing 40 dollars. Yet knowing two things together means more than knowing two things separately. It is the definition of positive non-linearity, which we may express as: K(A and B) > K(A) and K(B), where K is the « know » operator. We can term the difference between knowing (A and B) and knowing (A) and knowing (B) separately as the serendipity of A and B. Thanks to this serendipitous quality, one manifestation of the prolificity of knowledge, we can affirm that, in a sense, in the knowledge economy 1 and 1 make 3. Here, we can once more note an essential difference between the economy of knowledge and that of capital and raw materials, even though ideas, knowledge and innovation may also be generated by the combination of two material objects.

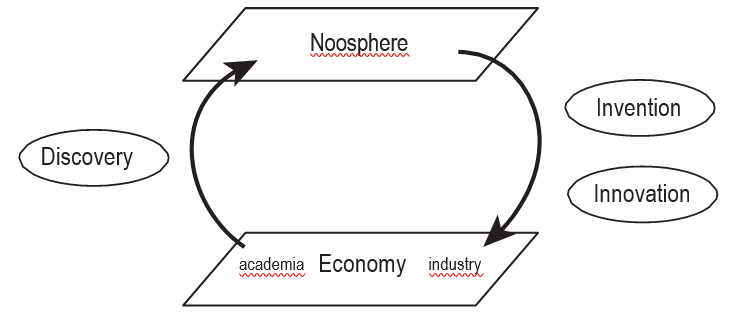

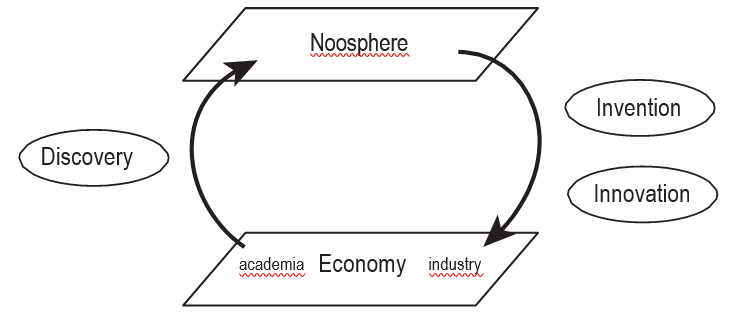

The interaction between the industrial economy and the knowledge economy can be illustrated as a water cycle featuring the “rain of innovation”. The noosphere is the sky of all fundamental knowledge which we may simplify as being open and accessible for everyone. In this metaphor, the publishing of discoveries as a result of fundamental research is akin to the evaporation of knowledge towards the noosphere. This knowledge is then precipitated from clouds in this sky, down onto the material economy, in two steps: firstly that of invention, or the prototype of an application of knowledge; secondly that of innovation, a product that is accessible to everybody in direct exchange for money, rather than for expertise or learning (the product of attention and time). Not all inventors are innovators, and vice-versa: Nikola Tesla struggled to commercialize his brilliant inventions, while Steve Jobs transformed non-ergonomic and clumsy prototypes of personal computers (inventions) into products that were simple, universal and user-friendly (innovations).

In a similar way, states do not always reap the returns from the fundamental research carried out on their territories. France can serve as an example: France discovered optical pumping, but is by no means at the forefront of the LASER industry as a result. The discovery of giant magneto-resistance, and important breakthroughs regarding liquid crystals, were made within its demosphere (the sphere of its people), on its territory and with its money, yet France is a world leader in none of their industrial applications (such as LCD screens, mass data storages, etc.). While contributing to the noosphere is an art in itself, there is also an art in reaping the benefits of such contributions. It is tragic that states are able to contribute so greatly to the creation of such brilliant clouds of fundamental knowledge, without ever the benefitting from the subsequent rainfall. France is a specialist at committing this costly error while, on the other hand, Silicon Valley appears to be out on its own as the place where the time-lapse between discovery, invention and innovation is at its shortest. China seems to have learnt its lessons, advancing from “Made in China” to “Innovated in China”, which is a clear strategy of knowledge politics (noopolitik). It had already been in a perfect position to do so, given the evidence of its numerous discoveries and inventions throughout history.

Figure 5: The nooconomic cycle

Source :

CC3 – Dr. Idriss J. Aberkane. 2014

The R&D cycle of nooconomics is comparable to the water cycle. Scientific discoveries evaporate from research sources into the noosphere, from where they are precipitated back on to industry in two stages: invention and innovation. However, the states and organizations from where discoveries and inventions originate are not necessarily those that reap their innovations, or the only ones that enter in direct contact with the markets. Xerox invented both the Graphical User Interface and the mouse, but did not commercialize their innovations. France discovered giant magneto-resistance and excelled in the field of liquid crystals, but never managed to attract the respective industries onto its territory. The evaporation produced by a discovery is the fruit of the Research (R), representing the exploration in the R&D cycle. The precipitation produced by innovation is the fruit of the Development (D) representing the exploitation. The slogan for Research should be “KICK” – standing for “Keep it Crazy, Kid!” – as Research should essentially be disruptive and explorative, to which creativity, craziness and a refreshing childlike mentality are all conducive. The slogan for Development should be “KISS” – standing for “Keep It Simple, Stupid!” – for it is all about exploitation, simplification, rigor and not pure creativity anymore.

The knowledge flow equation

In Peter Drucker’s “KID” paradigm, “Information (I) is Data (D) endowed with relevance and Converting Data into Information thus requires Knowledge (K)”.

One may agree upon the following simplification: starting from data, information is a perspective on data, knowledge is a perspective on information, wisdom is a perspective on Information is then comparable to a derivative of data against time, and knowledge the corresponding derivative of information (or an acceleration of data in a way). The exponential function being invariant by derivation, it follows that the transformation of information into knowledge theoretically preserves the doubling time, under the hypothesis, which is not at all met by reality, that any piece of data is indeed transformed into information.

The basic equation used to describe knowledge flow is equally simple and elegant, yet its social, political and economic implications are vast. Right now, we are carrying out a knowledge transaction: by reading a book or watching a video, by listening to someone or playing a game, you are receiving knowledge yet also giving something in return. Above all, you are spending your attention and your time. Knowledge exchanges are the inverse of attention exchanges (he/she who gives knowledge receives attention) and are therefore the result of a psychological consolidation which has some interesting social implications, since knowledge exchanges are also a means to social cohesion. The following equation illustrates this principle, according to which the flow of knowledge is proportional to attention multiplied by time:

φ(k) ∝ At

Which socio-economic implications can we infer from this equation? Firstly, as for Beck and Davenport, we can observe that, while data, information and knowledge are all very abundant nowadays10 (since their volume doubles every seven to nine years11), there is indeed an “attention economy” since attention (and time, for that matter) are not limitless commodities for each individual. The result is a global competition, particularly among mass marketing executives and above all on the Internet, to attract and captivate our attention. From a historical perspective, this competition is at the interface between the old economy, that of scarcity, and the new economy, that of flow and abundance.

It should also be noted that time and attention are intrinsically in flux, since they evaporate away (are spent) by default and cannot be stored. Their conversion into money induces a certain entropy – in the thermodynamic sense, meaning “non-recoverable energy” and thus “irreversibility” – for one can convert time into money but cannot buy raw time from money. At best, we can reduce the time taken up by a task in exchange for spending more money. Time, in fine, is more precious than money, and is spent by default. There is also an intrinsic compromise between wealth in time and financial wealth: the time-wealthy but financially poor individual is ready to spend a lot of time to earn a little money, while the time-poor but financially wealthy individual is ready to spend a lot of money to save a little time. It is also an extremely serious shortcoming for a state to force its citizens to spend their attention and time on its complex or inefficient administration: this bureaucracy will drain away two infinitely precious resources that would be much better invested in the real economy.

We must also present an approximate, although efficient, way to distinguish between information, knowledge and wisdom. Information, as in the case of military intelligence, is heavily dependent upon time and space. “The Allies will be landing in Normandy on June 6th” is a piece of information. Knowledge, in short, adheres to the fundamental laws of the universe and depends upon neither time nor space, remaining true in any era and in any location. Wisdom, finally, does not even depend on the universe but only on itself, for it is drawn only from self-knowledge, with the universe acting merely as an aid. The distinction between data, information, knowledge and wisdom is nevertheless not cut and dry, for the elements form part of a continuous spectrum. Progress along this spectrum is driven by integration, in the neurophysiological sense, which means transcendence: information integrates data, knowledge integrates information and wisdom integrates knowledge. The more we progress along the spectrum, the more we liberate ourselves from the constraints of ages, civilizations, time, space and the universe. This is why the fear, insecurity and exhaustion of the journalist, who handles information, are far worse than those of the wise man, who handles propositions that remain true at any place or time.

Let us also be clear that knowledge flow is proportional to the product of attention and time: if you read this treatise or listen to me with all your concentration, but only for one minute, then the transfer of knowledge will be relatively small. If you dedicate an hour of your time to a subject, but without properly paying attention, we know that the transfer will be similarly small.

In the sense that purchasing power in the knowledge economy is the product of attention and time, its structure is very particular. Individuals are not born into the world with 1,000 dollars in their pockets – which should nevertheless be a human right – but all human beings are born with both attention and time to spend. Even if access to knowledge remains unequally distributed throughout the world, we can still affirm that everybody is born with purchasing power in the knowledge economy (just not the same choice of stores to shop at, depending on one’s location). This is not at all the case in the economy of capital, work and raw material. In this sense, and assuming equal access, prisoners and the unemployed also virtually hold more purchasing power than those in work, having more spare attention and time to spend acquiring knowledge.

Another fascinating consequence of the structure of purchasing power in the knowledge economy emerges when we consider the conditions that lead an individual to freely spend that purchasing power. Put another way, under which circumstances do we give all our attention and all our time to a person or a subject? When we are passionately in love with it, of course! The flow of knowledge is not at its greatest when the objects of our attention and time are imposed upon us (by the state, for example, through compulsory education), but when a passionate appetite for the knowledge has already been developed. Thus, as well as boasting an intrinsically fair dimension, nooconomics also features a personal purchasing power that depends only on the individual, which sees those who are in love benefitting from an inherently greater purchasing power!

What does it mean to practice nooconomics ?

Knowledge infrastructures

We have looked at the fundamental rules of the knowledge economy, and why they make up a revolutionary paradigm. We have also seen that, at the beginning of the 21st century, the key for mankind and its organizations is to increase their knowledge flow (kFlow), something of much greater value to mankind than, for example, cash flow. If knowledge is indeed the new oil (and a lot more, besides), developing the ability to allow it to circulate faster is crucial, and knowledge pipelines will assume inestimable strategic importance.

Since Knowledge is collegial, it must be shared in groups, and education must therefore be built around the group rather than just the individual. This would represent a vital evolution of our educative system, which has been inherited from the industrial revolution and is focused on assessment rather than self-fulfillment, on the individual rather than the group. Given that purchasing power in nooconomics is equal to attention multiplied by time, two adjustment variables emerge by which society would be able to increase its knowledge flow: the first, time, regards the group; and the second, attention, the individual. Ultimately, the love of knowledge is the best way to circulate it, in the same way as the heart pumps blood around. The case of Massive Multiplayer Online Games (MMOG) provides a constructive example of how attention and time may be used to adjust the flow of knowledge. They involve remarkable levels of both attention and time and, without them, the popularity of Massive Online Open Courses (MOOC) would not have risen as sharply. From 2004 to 2014 for example, Humanity accumulated more than seven million years playing World of Warcraft, which is over fifty times greater than the overall amount of time that people spent working at Apple from 1976 to 2014. Video games are able to capture attention on a huge scale and, in this sense, MOOCs have a lot to learn from them because a MOOC that is unable to attract attraction is effectively dead. Furthermore, if we compare video game learning to compulsory learning, and if we metaphorically consider that our brain is a car running on the gas of motivation, in compulsory learning the car will consume gas when the key is turned in the ignition and then throughout the ride. With video game learning, the car will only consume to stop! Guess which out of compulsory learning or passionate, playful learning is more competitive in nooconomics? This is the importance of gamification in the knowledge economy.

As attention is an individual adjustment variable of the knowledge flow, cognitive neurosciences can contribute a lot to nooconomics, for they are the most qualified disciplines to understand the structure and, above all, the potential of human attention. For this reason, the fascinating field of neuroergonomics, which at this stage remains overly confined to military applications, should be studied in depth by states and organizations, because it has become evident that our individual and social cognitive abilities are under-employed in our knowledge exchanges. Put simply, the latter are not neuroergonomic enough. And why would they be? Our education methods, inherited from the industrial revolution, date back to a time when we knew next to nothing about the human brain.

Neuroergonomics, MOOCs and MMOGs – which can all be bracketed under the concept of gamification – are all contributors to knowledge infrastructures. As explained by Bruce Cahan, if knowledge exchanges are based on infrastructures then they must be subject to an infrastructural investment policy. As you will recall, there are two attributes of a superpower state, the first being geographic and the second demographic. A superpower must have a vast territory and a vast, interconnected population. This is why India is attempting to embrace the “Post-PC” era on a mass scale, and why tablets, smartphones and other instruments of this era are promising tools for development in Africa, along with mathematics, the science offering the highest returns on investment.

Its capacity to drive peace and development offers another application for nooconomics. It is interesting to note that Silicon Valley could only emerge long after the Californian Gold Rush, and that this socio-technological wonder sprung up between San Jose and San Franciso, rather than alongside NASA and a host of oil refineries in Texas, as expected. As has already been noted, natural resources can prove to be a decisive obstacle and public deterrent to the emergence of a technopolis.

Given that knowledge can enable what George Kozmetsky describes as “prosperity in zero time” (instant prosperity), its contribution to global peace is succinctly summarized in the Constitutive Act of UNESCO which declares that, in essence, increasing the knowledge flow between peoples is an instrument of peace, and perhaps even the most profound such instrument. It is for this reason that the Kozmetsky Global Collaboratory of Stanford University is experimenting with the idea of a Professional School for Shareable Prosperity.

Disruption and silicon valley’s “Love can do” mantra

The cultural identity of Silicon Valley is a perfect example of how nooconomics maximizes the purchasing power of those who are in love. All the companies that revolutionized the valley, having started out life in a garage, have had one subtle thing in common: a passionate and absolute love for what they do. Those companies that rise above leadership to a status “above the fray” in their industry, just like Apple at the time of writing, are those whose work involves what they both know and love. When are asked why they design their products and services, they never give the obtuse, commercially-driven answer “because there is a market”, but rather the sincere, visionary answer “because we want to change the world!”

Thus Apple initially prevailed over IBM, which was still one of the most powerful companies on earth, and the deceased French “Minitel” which, although not lacking the components or the means, was not similarly well-endowed in passion and vision. Google in turn beat AOL, a company with superior levels of capital and talent. At the end of the 20th century, the difference came down to two things: passion and motivation. The Google boys loved their job, before they even knew how to do it.

The evolution of disruptive companies in Silicon Valley is very often identical: entrepreneurs start out in a new industry not because they know how to do the job and have read the manuals, but because they have an immense desire to do so and because they love it, even without being experts. Only love can keep someone working in a garage, without any reward, for months on end. Disruption cannot be expected from those who excel at reading manuals and taking exams. While the follower reads manuals, the leader writes them. And above all, the leader is someone who, knowing comparatively little of the industry when he starts, can exclaim in the face of his competition: “sorry, I didn’t know it was impossible!” Elon Musk is one such leader. “Like David, he changes the rules without telling Goliath,” observes Gunter Pauli. The LCD Matrix (standing for “Love x Can-Do”) can be used to represent the cartesian product of the two most important entrepreneurial components of Silicon Valley: love for the job (Love) and the Can-Do attitude. This matrix attests to the fact that, when founding a start-up, someone who loves the job but has no experience is worth a lot more than a depressed expert. The former will still be able to learn, while the latter will not. Expertise acquired through love is much more valuable than expertise acquired through obligation. Finally, expertise that is acquired from scratch is necessarily more disruptive than that which is prescribed by schools and manuals. The latter is in essence conservative, since schools are the conservatories of knowledge. Leonardo da Vinci adeptly illustrates this principle.

Figure 6: The Love Can Do Matrix

Source :

CC3 – Dr. Idriss J. Aberkane. 2014

The LCD matrix features four distinguishable types of companies. The company found “above the fray” is the one that practices both what its people passionately love and do very well. In 2014, this is the case at Apple, Tesla and Hermès for example. Followers have essentially the same industrial know-how as those “above the fray”, but none of the same love of the product. Its products and services show this absence of love: they are less captivating, less sexy, they show much less attention to detail and do not glow with culture. They betray the reality: that their raison d’être is neither inspiration nor disruption, but profit. They were designed by administrators rather than by visionaries, which will never escape the attention of the connoisseur. Nowadays, Samsung typically falls within this category. Samsung certainly did not turn its attention from refrigerators to tablets with a view to changing the world, or out of a manifest love of the product. Consequently, people will never spend weeks camping out in expectation of the release of a new Samsung product. The same is true of Microsoft.

All those companies that started out in Silicon Valley garages and later became multinationals entered their industries out of passion and, just as importantly, with comparatively minimal know-how. These are essential conditions for disruption: the professor, limited by his dogmas and manuals, is necessarily less disruptive than the pupil. As the Chinese proverb goes, “in the beginner’s mind there are many possibilities, but in the expert’s there are few”. Because expertise, which is exploitation, is very often synonymous with confined thinking. The masters of the Russian martial art Systema are one such case in point. The essence of Silicon Valley was not created by valedictorians – the CEO of Apple before Jobs’ return, who insisted on being addressed as “Dr. Amelio”, amply demonstrated as much. Expect more disruption from an under-qualified former Hippie like Jobs, than from an administrator, civil servant or doctor.

The very worst position within the LCD matrix is that of the forced entrant. Unbelievably certain companies can be observed to occupy or have occupied this position, one of the most notable being STMicroelectronics in Europe. The forced entrant does the job out of obligation. The industry does not represent a burning passion but a chore. Of course, socio-economic dynamics will always ensure that such a company attracts a certain level of passion and talent, but its capacity to professionally fulfil them is very limited when compared with the leaders. The company ends up curbing that passion and creativity, crushing it rather than encouraging it to blossom.

These companies are born above all out of obligation. To take the case of STMicroelectronics (or Bull) the situation is as follows: Europe cannot afford to import all of its semiconductors, hence the need for a company to carry out this task. The company is thus born with very little experience, which is not bad in itself, but with no passion and no vision. This is tragic: today Taiwan boasts several major semiconductor manufacturers, such as UMC and TSMC, not to mention Silicon Valley with Intel, AMD or Nvidia. Transitions are still possible between the different states of the LCD matrix. If the follower wants to move “above the fray”, he must ask himself why he is doing his job, as Simon Sinek understood it, and the answer to this question must never be “because there is a market !” Those found “above the fray”, like Tesla and Apple, are extremely profitable because they think beyond profitability, with a panache that is unimaginable and, more importantly, illogical to their competitors. Such as when Tesla offered open access to all its patents free of charge, or free supercharging to all its customers. This is not irrational behavior, but behavior that transcends rationality and demonstrates a profound understanding of why the company is operating. The transition from forced entrant to follower is always the result of an external constraint: the choice of a state or an institutional investor who does not know anything about the business and only invests because it represents a market opportunity. Finally, the transition from garage to global cultural leadership – as was the case with Apple, Google or Amazon – is made when the acquisition of expertise is motivated by passion and nothing else. Not by a grade, a salary, a vain regional or municipal prize, not by the artificial attention of an incubator that will paternally administer the entrepreneur, not by the laurels of a Ministry, but only by the very love of the work. Such an entrepreneur is following what I term “the royal path”, from the name of Silicon Valley’s boulevard, El Camino Real.

Biomimetics: an application of the knowledge economy

A last fascinating perspective on the knowledge economy is that it captures the entire essence of Sustainable Development. The latter is all about teaching mankind the art of not wasting its future through the incorrect use of its resources: the art of not trivially spending goods today, if their absence will come to be felt in the future, when richer and more elegant uses may emerge. For there is a resource, plentiful and elegant, that mankind has been spending with infinite stupidity over the last millennia of its history. Thanks to the industrial revolution, which induced even faster and more irresponsible spending, today we are beginning to realize the extent of such wastage. The physiocrats, the first “economists” (for economics, before Adam Smith, was a term owed to the physiocrats), felt the most profound respect for this resource. It is of course nature. And if nature is a veritable library, biomimetics is the science that advises “read it, don’t burn it!”

Humanity indeed, from the moment it became urban (for this principle seems not apply to native civilizations), considered nature as a source of raw materials and spent it as such. We know today that nature, besides the ecosystem that it provides and that we are only now learning to appreciate, represents a source of knowledge rather than a source of materials. Biomimetics is a science founded on the extraction of knowledge from nature, something much more profitable than the simple extraction of raw materials.

Humanity has a propensity of spending precious resources in a trivial way. Nature is one such resource, and it should be spent not as a source of raw materials but as a high tech library, full of technologically delicate solutions: from nanotechnologies to material science, pharmaceutics, organization sciences, from dynamic and ergodic systems to fuzzy logic. Today when we consider, for example, French architect Jacques Rougerie’s visionary SeaOrbiter project, we observe that humanity is ready to develop not only platforms for the extraction of raw materials, but also for the extraction of knowledge from nature. Maybe our descendants, studying our oil rigs, will tell themselves that we spent our time and attention mining the wrong things from nature, that the flow of knowledge was actually more important than the flow of oil. A different treatise on biomimicry and policy will be dedicated specifically to this vision.

Of course, we are not defending the total abolition of the material use of nature. Case studies by Paolo Lugari and Gunter Pauli demonstrate the extent to which the latter, so long as it is elegant, can be decisive in the 21st century. We are simply advocating a better balance between the material and immaterial use of nature, a better equilibrium between the material and the immaterial economy. A constructive dialogue between the two must be established, in place of mutual exclusion. What is for certain, politically speaking, is that only the immaterial exploitation of nature can compensate for its excessive material exploitation. Let us conclude simply by observing, in agreement with 13th century Sufi poet Hakim Sana’I, that “Humanity is weaving a net about herself”, which is precisely the subject of sustainable development.

And regarding mass education which, inherited from the industrial revolution, continues to set the agenda for this era, its mistake is that it destroyed love which, according to the (although limited) teachings of the humanists, was the most sacred ingredient of learning. Our contemporary education system does not teach for the sake of gross domestic happiness, but for gross domestic product, hence the immense importance it puts on grades. We are no longer teaching for the purpose of being self-fulfilled, but to be economically useful, which is strictly inferior (any fulfilled man is economically useful, while any man that is economically useful is not necessarily fulfilled). If only we managed to reconcile the love revered by humanists with the mass education made possible by the industrial revolution – a reconciliation that neuroergonomics could very well enable, but only as a result of a collective choice made by our civilization – then surely we would start the construction of a marvelous economy of knowledge, and would bequeath to future generations magnificent nooducts, just as impressive and inspiring as the aqueducts of our ancestors.

Ultimately, adopting the economics of knowledge is just a matter of evolution: will Humanity be based on materiality or on wisdom? Will we be Homo sapiens materialensis, or Homo sapiens sapiens?

Visit our website (http://www.fondapol.org/fondapol-tv/le-progres-cest-nous- idriss-aberkane-toile-a-tisser/) where you will find the video of Idriss J. Aberkane’s speech at a Fondapol event held on 16th November, 2013.

No comments.