The new wave of emerging countries

Introduction

BRICS: symbol of the notion of economic emergence

From Asian Tigers to Asian Cubs

2001: The revival of economic emergence with the BRICS

After the BRICS, the proliferation of classifications for emerging countries

BRICS between economic success and social challenges

The new wave of emerging countries: BENIVM

The criteria for economic emergence

BENIVM: the challenge of sustainable growth

New candidates for economic emergence

France, a country not sufficiently present economically in BENIVM countries

Résumé

In 2001 an economist at Goldman Sachs introduced the acronym BRICS to mark the entry of emerging countries into the global economy. The idea of emergence is experiencing a conspicuous revival that reflects a profoundly altered international context. Since the appearance of this notion, classifications with wide and sometimes vague criteria have emerged to try to identify the new emerging countries. Ten years later the BRICS countries have emerged and are facing the challenges of societies that are almost developed. Meanwhile, new emerging countries, defined by five economic criteria, are making their appearance. These criteria are: a large population of over 100 million people, a potential 10-year growth rate hovering around 5%, an urbanization rate of 50% and still growing, infrastructure needs to accompany the economic boom and political stability to implement long- term projects.

According to these criteria, the next emerging countries are the BENIVM states: Bangladesh, Ethiopia, Nigeria, Indonesia, Vietnam and Mexico. After the BENIVMs, other countries with smaller populations and economies more related to the exploitation of raw materials are ready to pick up the torch of global growth, or at least to participate strongly in it. But France is economically hardly present in BENIVM countries and does not (yet?) make the necessary efforts to reorient its economic and commercial means to these forthcoming economic powers.

Laurence Daziano,

Lecturer in economics at Sciences Po Paris, member of the scientific board of the Foundation for political innovation.

Laurence Daziano, graduate of sciences po paris, ESSEC, the Freie Universität Berlin and the University Paris IV sorbonne, has been a lecturer in economics at sciences po since she publishes regularly in the french national press and works in particular on economic issues in emerging countries.

Brazil, Russia, India, China and South Africa

The World in 2050: HSBC projection for the world economy in 2050, January 11 2012.

World in The BRICs and beyond: prospects, challenges and opportunities, pricewaterhousecoopers, January 2013.

RoBert Azevedo, Director General of the WTO, took office in september 2013, and was previously permanent representative of Brazil to the WTO.

«By 2050, 19 of the top 30 world economies will be the ones known today as emerging economies. How will this new world organization affect your business?” This advertisement from the British bank HSBC, published in May 2013 in the French business daily Les Echos, shows the way the global economy has evolved. In the early 21st century a new wave of countries is appearing on the international economic scene, influenced by the double- digit growth of the BRICS2 countries. Newly emerging countries are not waiting for Western economies, paralysed by the sovereign debt crisis and difficulties in effecting reforms, to take advantage of their economic strengths and capture new markets.

Yet the definition of these emerging countries remains unclear. Asian Tigers, BRICS, BIICS, Next Eleven, E7, CIVETS: many categories have emerged, most of them in recent years, bringing together countries whose characteristics are sometimes very different and often without any overall cohesion. However, most economic studies of the period up to 2050, including both that of HSBC3 and that of PricewaterhouseCoopers4, agree in expecting the economic rise of so-called «Southern» countries.

Already the so-called BRICS emerging countries are no longer really «emerging» and can now be described rather as «emerged» countries. When a state like China masters advanced technologies and is ready to export nuclear power plants and high-speed trains, can it still be described as «emergent»? When Brazil manages the largest fund-raising operation in the world with its public oil company Petrobras, hosted the football World Cup in 2014 and plans to build a high-speed line between Sao Paulo and Rio de Janeiro, can we still consider it to have the characteristics of a developing country, except for high inequality? This has been the debate for some years now at the World Trade Organization (WTO) when developed countries refuse to open their markets to the BRICS, considering that they are no longer eligible for benefits granted to developing countries5. In fact, the new «emerging» countries are elsewhere.

This «elsewhere» is primarily in Asia and sub-Saharan Africa, in areas where French influence is undergoing considerable diminution or is little developed. This «elsewhere» progressively reduces Europe, in the words of Paul Valery, to the status of «small tip of the Asian continent,» remote from future global growth and on the margin of the next major trade routes.

BRICS: symbol of the notion of economic emergence

The criteria used to define economic emergence are diverse and relatively imprecise. Most classifications do not carry out a rigorous economic analysis, and countries can figure in several acronyms. Among the current definitions, that of Professor Christophe Jaffrelot, of Sciences Po Paris, embodies the notion of emergence in the following criteria: a strong and sustainable economic growth, a stable and interventionist state, and a wish to participate in the world’s governance.

From Asian Tigers to Asian Cubs

Attempts to classify emerging economies appeared in the 1970s, when the oil crisis of 1973 put a sudden end to the economic supremacy of the North and when the first Asian emerging countries, the famous «tigers», sometimes known as “dragons”, appeared. Subsequently, emergence was a concept taken up by American and British banks, first among them Goldman Sachs and HSBC, to seek to provide investors with high returns in some markets and present business opportunities.

In the 1970s, the emergence of four «tigers» in Asia (South Korea, Taiwan, Hong Kong, Singapore) drew attention to countries that had been experiencing since the 1960s a period of economic expansion and rapid modernisation. These four countries (including two city-states) are of very different sizes, but with very high population densities, among the highest in the world. South Korea has 49 million inhabitants, Taiwan 23 million, Hong Kong 7 million and Singapore 5.6 million6. Singapore and Hong Kong are among the most densely populated places on the planet with respectively 7,700 and 6,400 inhabitants per square kilometre7.

To grow, these countries have taken advantage of the Japanese market and investment and of economic aid from the United States, present in the region for strategic reasons. The four «tigers” took advantage of the low cost of labour and specialised progressively in industrial activities with high added value (automotive products, consumer electronics). Hong Kong and Singapore focused on port activity and the presence of commercial capital to expand. South Korea developed large firms known as «chaebols»8, which accelerated the development of the economy. Taiwan based its economic prosperity during this time on American aid and on the activities of exporting and innovative small and medium-sized enterprises (SMEs). These four «tigers» followed the business model developed by Japan: a strong state, priority to exporting (entailing low labour costs), a protected domestic market, considerable efforts in savings and education. This model allowed them a spectacular economic boom with growth rates of 10% per year.

After the four «tigers», the «tiger cubs» appeared in the 1980s. According to the time periods and definitions, these «tigers» include Thailand, Malaysia and Indonesia and sometimes the Philippines and Vietnam. These countries have seen their economies boom, with growth rates above the global average, strong export growth, and the rise of a vibrant middle class.

2001: The revival of economic emergence with the BRICS

Jim O’Neill, born in 1957, is a British economist, who holds a phd in economics from the University of Surrey. He joined the investment bank Goldman Sachs in 1997 and became chief economist. He retired in early 2013.

United States, Japan, Germany, United Kingdom, France, Italy and Canada.

For BRIC, nations meeting a milestone, interview with J. O’Neill, moneycnn, June 17 2009.

Since the discovery of diamonds in the Kimberley region in 1866, South Africa has become a major mining producer in the world, with 10 of the top 20 global mining companies.

In November 2001, after the fall of the Berlin Wall and the beginning of the triumph of globalisation, but also in the aftermath of the September 11 attacks, Jim O’Neill9, then chief economist of the American bank Goldman Sachs, published a paper in which he defined new emerging countries. He presented the concept of BRIC to describe Brazil, Russia, India and China as economic powers set to challenge the dominance of the rich countries in the world economy.

O’Neill began from a simple dimension: the impact of population on the economic sphere. The least populated country (until South Africa was added in 2011) is Russia with 140 million people. He concluded that if these countries increased their productivity, they would soon become economic giants because of the size of their domestic markets, of the growth of world trade and of globalisation. His calculations showed him that in 2037, the combined gross domestic product (GDP) of these four countries could be higher than the combined GDP of the G7 countries10. Today, the BRICS represent 16% of global GDP, China has become the second largest economy in place of Japan. Brazil and Russia have surpassed Canada, and India is not far off11.

In 2011 South Africa joined the group of BRIC, despite its modest population size (48 million people) compared with the Brazilian, Russian, Indian and Chinese giants. But thanks to the efforts of the South African business community which is very influential and integrated into the Anglosphere economy and to the Johannesburg Stock Exchange, it is a trade hub for raw materials12.

After the BRICS, the proliferation of classifications for emerging countries

World Bank, current dollars.

The acronym CIVETS refers to the civet, a carnivorous mammal with stocky body, short legs and ash spotted coat, in Appetizing CIVETS, courrier international, August 10, 2010.

“From West to East”, Michael Geoghegan, HSBC group CEO, speech of April 27 2010 to the American Chamber of Commerce in Hong Kong.

BRICS and BICIS, The economist, november 26 2009.

The BRIC Debate: Drop Russia, Add Indonesia?, Bloomberg Businessweek, November 18 2010.

In 2005, O’Neill published a new note for Goldman Sachs where, following up on the success of the BRIC thesis, he tried to create a new concept for emerging countries, in developing the Next Eleven (the next 11 emerging economies), these being Bangladesh, South Korea, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, Turkey and Vietnam. The criteria he used included macroeconomic stability, political maturity, openness to trade, investment policies and the quality of education. In 2009, these 11 countries accounted for 7% of global GDP, against 16% for the BRICS13. A fan of acronyms, O’Neill added in 2011 «MIKT» for Mexico, Indonesia, South Korea and Turkey. These four countries already belong to the Next Eleven group, and the criteria for this new classification are not very explicit. Indeed, the economic or demographic similarities are hard to find in respect of two countries as diverse as South Korea and Indonesia. This classification is used primarily in the financial sector where it relates to bonds issued by the governments of these countries.

In its first report on the World in 2050, PricewaterhouseCoopers highlighted the countries called E7, embracing the most important emerging economies (hence the «E») in 2050: China, India, Brazil, Russia (i.e. BRIC), Indonesia, Mexico and Turkey. These countries are opposed to the countries of the «G7», i.e. the first seven world economies such as the United States, Japan, Germany, Britain, France, Italy and Canada.

In 2010, there appeared the CIVETS14, an acronym invented a year earlier by Robert Ward of the Economist Intelligence Unit. This concept was outlined by Michael Geoghegan, CEO of HSBC Group, in a speech before the Chamber of Commerce in Hong Kong in April 2010. The classification includes Colombia, Indonesia, Vietnam, Egypt, Turkey and even South Africa, which was to join the BRIC group a year later. With the exceptions of Colombia and South Africa the CIVETS are among the Next Eleven. The criteria used to define CIVETS remain unclear. These countries have a «dynamic and diversified economy,» «a large, increasing and young population» and «a certain political stability.»15

In 2009, Nouriel Roubini, a professor at the Stern School of Business, and Morgan Stanley proposed to replace Russia by Indonesia among the BRICS, which thereby became BIICS or BICIS16. Noting the authoritarian tendencies of the Russian political system, demographic atrophy, and endemic corruption, they preferred the fiscal prudence of Indonesia’s economic growth of 6% and its improving social and political institutions17. But this finding is not sufficient to define the emerging countries, although in terms of population and economic growth, Indonesia meets the first criteria that O’Neill had set when he created the acronym BRIC.

After the BRIC(S), countries that seem most promising include, all classifications combined (Next Eleven, E7, MIKT, CIVETS), and in alphabetic order: Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, South Africa, South Korea, Turkey and Vietnam.

These emerging countries have followed the same path in globalisation: an economic catch-up with low wages, an undervalued currency to support exports and the accumulation of foreign exchange reserves that make it possible to finance infrastructure. But the inflation of acronyms and rankings, often combining the same countries, had the effect of blurring a clear vision of the next emerging markets. These rankings seem to be more like journalistic concepts than to be supported by specific economic and demographic criteria. Recent economic developments demonstrate that these concepts are poorly defined or quickly overwhelmed.

BRICS between economic success and social challenges

2013 Est., CIA World Factbook 2014.

Arthur Lewis, an economist originally from st. Lucia, received the Nobel Prize for Economics in 1979 for his work on development economics. his article “economic development with Unlimited Supplies of Labour,” published in 1954, is considered as one of the founders of development economics articles.

“From West to East”, Michael Geoghegan, CEO of HSBC group, April 27, 2010, speech to the American Chamber of Commerce in Hong Kong.

The first countries classified in the 1970s as emerging are now developed. South Korea ranked 43rd in the world in 2012 with a GDP per capita of USD 32,400. By comparison, France occupies 40th position with a GDP/capita of USD 35,500 dollars. Since 1996 South Korea has also been a member of the Organisation for Economic Co-operation and Development (OECD), a body often called a «club of rich countries.»

Other Asian tigers were also called «newly industrialised countries» and have been regarded, since the 1990s, as developed countries. They now have a standard of living comparable to, or even higher than, that of the countries of the European Union or Japan. Their human development indices (HDI) are among the highest in the world. In 2013 Singapore and Hong Kong were ranked among the world’s richest countries, with a GDP per capita of USD 62,400 for the first (seventh in the world) and USD 52,700 dollars for the second (15th in the world). They are definitely to be regarded as developed countries. More recently, in the last decade, the BRICS also underwent development. They now account for 20% of global GDP, 42% of the population, 15% of trade and 40% of currency reserves. These economies have accounted for 30% of global growth since 2001 and they now produce high-value goods that compete directly with those of developed countries, such as the nuclear power plants of Chinese manufacturers (CGNPC and CNNC), the aircraft of Embraer or oil exploitation systems in oceanic shale by Petrobras.

BRICS must now face challenges related to development: balance of pensions, implementation of effective social protection including health insurance, reducing inequalities, a soft landing for their model of growth, diversification of their economies, massive pollution caused by manufacturing industries… In the coming years, China will face a shortage of labour because of an ageing population. Over 30 years, China has been creating 350 million jobs that have allowed it to build the low-cost «workshop of the world». The great migrations from the interior of the country to the coast (including Guangdong), which ensured the success of China’s exports, are already declining. This labour surplus peaked in 2010, with a flow of 151 million people. The same flow is expected to be 57 million in 2015 and 33 million in 2020 before reducing gradually. There are several causes. During the last decade, the average income of workers has increased by 15% per year. That shift moves China towards an economic model more comparable with that of developed countries.

Among the Next Eleven and MIKT classifications, naming South Korea and Turkey seems to be a nonsense as both countries appear to have already emerged. In its World Factbook, CIA classifies Turkey under the heading of «developed countries» (17th in the world for GDP, despite a 90th-highest GDP/capita18). Economists and political scientists see it as a new industrial country.

The process of becoming a developed country was conceived by Arthur Lewis 19, a Nobel laureate in economics, as the «Lewis turning point». This defines the moment when abundant labour is becoming scarce, resulting in a rapid increase in income, a decline in profit margins and a fall in investment. The BRICS are currently at that turning point. This economic shift has the effect of creating a new middle class, which switches the engine of growth from exports to domestic consumption. In 2000 the middle class in emerging countries amounted to 250 million people. It will represent 1.2 billion people in 203020.

“From West to East”, Michael Geoghegan, CEO of HSBC group, April 27, 2010, speech to the American Chamber of Commerce in Hong Kong.

This economic tilt is also the source of new trade routes. Exports are greater now in emerging markets than imports. To meet demand, recruitment increases. And these exports are not directed towards the West. From India, two-thirds of exports go to markets other than the United States or Europe. In 2009 China became the largest importer of Brazilian goods. This South-South trade route will continue to grow. China has become the largest trading partner of Africa.21

The new wave of emerging countries: BENIVM

Meanwhile, new countries with a strong population growth and the foundations of dynamic economic growth need to be considered as emerging. The very notion of economic emergence must be fundamentally revised. There should be a more accurate classification of new emerging countries to identify the greatest potential growth and development.

The criteria for economic emergence

The economic growth of the BRICS countries in the last 10 years.

Born in 1924, Nobel Prize in Economics in 1987.

It should be noted that Bangladesh has an urbanization rate of 33% but also the greatest population density in the world, and Ethiopia has 17% but very strong growth.

It should start from the first analysis by O’Neill, that combined the two key factors in development: the economic and the demographic. Five criteria can be used to identify the next big emerging countries. These five structuring cumulative criteria define precisely economic emergence.

The first criterion is population. It must be large enough, at least 100 million people, to constitute an important domestic market, which is both the largest outlet for local industry, but also the outlet for the imports necessary for balanced trade. This population should experience significant growth. The younger and better educated it is, with a high female literacy rate, the more it will contribute to economic development.

The second criterion is a potential economic growth, or in other words, a path of long-term growth combining labour input and capital input, of up to 10 years, hovering around 5%22. According to the model developed by the American neoclassical economist Robert Solow23, the interaction of an increase of capital stock, of the amount of work and of technical progress influences the level of activity.

The third criterion is major or highly dynamic urbanization as this is a key factor in economic development. The city allows the development of transport, access to drinking water and electricity. It facilitates trade. In this sense, urbanization is a prerequisite for emergence.

The fourth criterion is a need for infrastructure to support an economic take-off. Travel is facilitated by the construction of roads, bridges, railways, airports and energy infrastructure. The balance of the energy mix makes it possible to reduce dependence vis-à-vis external suppliers and also to ensure access to piped and treated water for better health and reduced child mortality.

The fifth criterion is a political stability (regardless of the type of political regime) that allows implementation of long-term projects. The example of China shows that economic development does not necessarily go hand in hand with a democratic opening up. But it shows that a stable power, equipped with a long-term vision and permanent tenure in institutions, makes possible the implementation of policies of large-scale works, such as construction of energy infrastructure, high-speed rail lines or airports, necessary for the economic development of a country.

Under these criteria, and with few exceptions in the selected countries 24, the next emerging countries are Bangladesh, Ethiopia, Nigeria, Indonesia, Vietnam and Mexico. These countries can be grouped under the new acronym of BENIVM.

BENIVM: the challenge of sustainable growth

The purchasing power parity is a method used in economics to make a comparison between countries in terms of purchasing power of national currencies, which a simple use of exchange rates does not do.

World in The BRICS and beyond: prospects, challenges and opportunities,PricewaterhouseCoopers, January 2013.

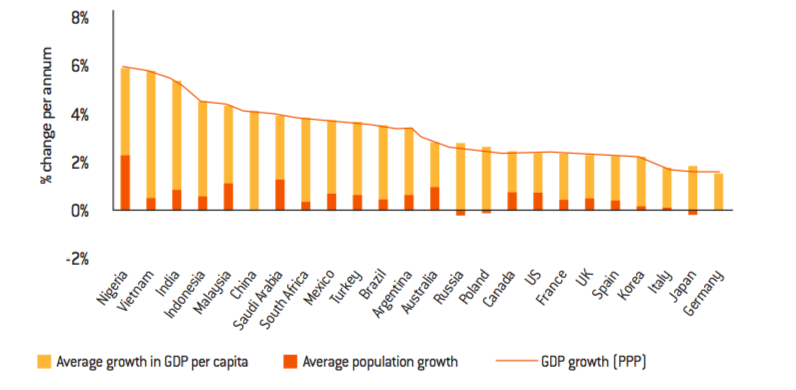

According to the latest World in 2050 published by Pricewaterhouse Coopers, the financial crisis has accelerated the shift of the centre of gravity of the world economy. China, the United States and India should consolidate their leadership in 2050, but emerging markets still face huge challenges in the period to sustain their recent strong growth. According to the report, by 2050 Indonesia, Nigeria and Vietnam could experience dramatic economic growth. In terms of growth rate of GDP in purchasing power parity (PPP)25, Nigeria ranks highest in the period 2012-2050 (6%), followed by Vietnam (slightly less than 6%) and Indonesia (5.5%)26.

Chart 1 : Breakdown of components of average real growth in GDP at PPP (2011-2050)

Source :

PwC, January 2013

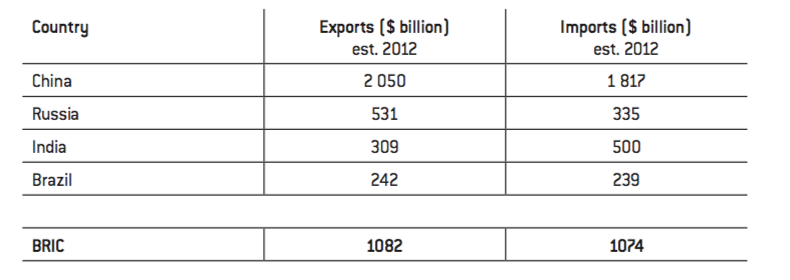

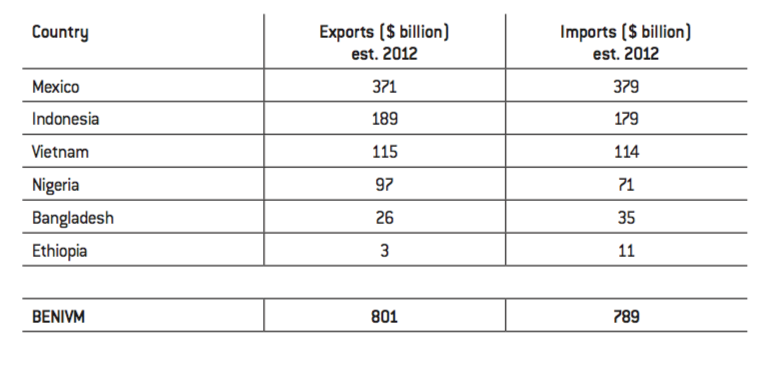

In terms of trade, BENIVM had in 2012 a trade surplus estimated to be slightly more favourable than that of the BRICS.

CIA World Factbook 2013 and INSEE, population projection in 2030 and 2050.

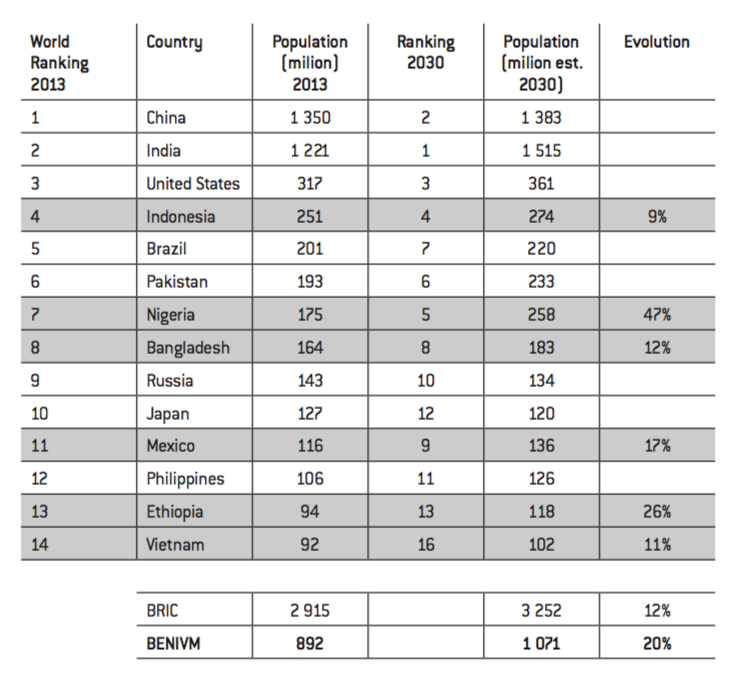

In population terms, the BENIVM represent a set of one billion people, mainly in Asia and Africa. They are among the 14 most populous countries in the world27.

As showed by the accident in April 2013 near Dhaka where more than 1,000 people, mostly women, were killed.

Website of the French Foreign Ministry.

Website of the French Foreign Ministry.

Website of the Directorate of the Treasury, French Ministry of Economy and Finance.

Bangladesh is the fourth muslim country in the world in terms of population and Islam is the state religion.

The reformasi refers to the Indonesian economic and political liberalisation that followed the fall of dictator Suharto in 1998 during the Asian financial crisis.

The latest election, in July 2014, was won by Joko Widodo.

Indonesia is the largest Muslim country in the world in terms of population.

Les investisseurs continuent de parier sur l’Indonésie, Michel de Grandi, Les Echos, April 23 2013.

Đổi mới, “new (mới) change (đổi)” or “renewal” in Vietnamese, is the name of the economic reform initiated by Vietnam since The market economy has been authorised and encouraged by the Vietnamese Communist Party. This economic liberalisation can be compared to that initiated by China in the late 1970s. Unlike the soviet perestroika, the reform was not immediately followed by political liberalisation.

The richest man on the African continent is the Nigerian Aliko Dangote, whose assets total more than €16 billion.

Eko is the name of the city of Lagos in the Yoruba language of Nigeria and the ancient city of Ife.

Except in 2008 (1.3%) and 2009 (-6.5%), CIA Factbook 2013.

L’économie égyptienne minée par les divisions politiques, Raphaël Proust, l’Opinion, May 17 2013.

More importantly, BENIVM have significant population dynamics. The population growth of BENIVM should be nearly two times that of the BRIC by 2030.

Already mentioned in the Next Eleven, Vietnam, Nigeria, Mexico and Indonesia also appear regularly in the rankings of new emerging countries published by the Boston Consulting Group (BCG) or banks in English-speaking countries. They have a sustained economic growth, a dynamic manufacturing sector and highly significant development prospects. Bangladesh is already identified among the Next Eleven. Ethiopia is, however, a completely new entrant in this new category of emerging countries, far from the traditional image of a poor country. In fact, both countries have high population growth combined with rapid urbanization, a strong growth potential and economies that are already diversified and industrial. They also have a significant energy potential, including hydropower.

In Asia, China’s growth is expected to make a soft landing. Bangladesh, Indonesia and Vietnam are currently already taking over some activities, while several manufacturers have relocated from China to these countries. Situated between two renowned senior partners India and China, Bangladesh (166 million inhabitants in 2014) is experiencing an economic dynamism that seems not to be perceived by the so-called «developed» countries, which retain the image of a country that is victim of the monsoons in the deltas of the Ganges and Brahmaputra and affected by extreme poverty. With a growth rate of 6% in 2013, the advance of Bangladesh can be explained by a dynamic private sector and cheap labour. The textile industry is highly developed and accounts for three quarters of the country’s exports, although physical and safety conditions are still inadequate28. Bangladesh is the world’s fourth largest producer of clothing products. Services are already 54% of GDP. The business benefits system is furthermore very attractive to foreign manufacturing investment29. After the 2008 elections, an ambitious public investment in energy and infrastructure programmes was decided, including the construction of a bridge over the Padma River. The economy, however, has strong external structural vulnerabilities, particularly because of the concentration of three quarters of its exports to the European Union and the United States. Its economy also depends heavily on remittances (11% of GDP in 2010)30. Nevertheless, the Asian partners have recognised the emergence of Bangladesh. They are developing their business presence at a steady pace and are relocating manufacturing investment. Similarly, international financial institutions, rating agencies and analysts of large banks are noticing the economic potential of the country that has a major asset in its human capital, whose educational standards are improving31. Nevertheless one factor might affect the economic development of the country: religion. Indeed, regular clashes taking place between the different religious communities could impede the economic development of the country and inhibit the presence of foreign capital32.

Indonesia, described as an «archipelagic state» and with 254 million inhabitants, is becoming a new centre for major growth in Asia. Indonesia has entered a democratic transition since 1998, the reformasi33, and has since undergone four presidential elections34 and known real political and religious stability35. Simultaneously, the economy was liberalised. Moreover, Indonesia is in the centre of a region with high potential growth, with big partners such as China and Japan. This country is a major producer of energy commodities – oil is running out but has been replaced by gas and tomorrow shale gas offers tremendous potential – the largest producer and exporter of palm oil and among the major exporters of rubber. Some 40% of world maritime transport, in particular oil and gas, passes through the Strait of Malacca between Sumatra and Malaysia, the Sunda Strait between Sumatra and Java, and the Lombok Strait between Bali and Lombok. Indonesia is also benefiting from the wave of relocations from other Asian countries as well as much foreign investment36. For 10 years, the country has been experiencing an average growth of 6% per year and has reduced its debt from 80% to 25% of GDP.

Vietnam also illustrates this new class of emerging countries that are successors to the BRICS. Since 2002, GDP has tripled, and the country’s population grows by a million a year. Vietnam plans for the next 10 years an annual increase in GDP of 7% to 8%. This strong growth is rooted in the policy of Doi Moi37 launched in 1986, based on a rapid economic opening up embodied in the country’s accession to the WTO in 2007. Since the early 1990s, Vietnam has been experiencing a dramatic decline of poverty. The percentage of the Vietnamese population living below the poverty line decreased from 58% in 1993 to 14.5% in 2008, with some 25 million people moving out of poverty in 15 years.

In Africa, Nigeria and Ethiopia will be the biggest growth drivers, after the emergence of South Africa and demographically smaller countries (Mauritius, Botswana).

Nigeria, Africa’s most populous country with and estimated 177 million inhabitants (2014) and the largest oil producer on the continent, became the largest economy in Africa mid-2014 and will have about 250 million inhabitants in 2050. Nigeria’s growth is mainly based on the high price of oil, the rise of the mobile phone sector and financial services, as well as a vibrant entrepreneurial middle class38.

At the forum in Davos in January 2013, Nigeria, traditionally criticised for its instability, its corruption and violent ethnic conflicts, emerged as the next Eldorado of globalisation. Nigerian President Goodluck Jonathan, a Christian native of the oil-producing south of the country, said his main goal for the next decade was to become the China of tomorrow with sustained double-digit growth. Nobody contradicted him.

The Governor of the Central Bank of Nigeria, Sanusi Lamido Sanusi, a respected and influential economist, and the Minister of Finance, Ngozi Okonjo Iweala, former Executive Director of the World Bank, have also emphasised this prospect, in the hope that Nigeria becomes the new «workshop of the world». On February 21 2013, Bill Clinton travelled to Lagos to inaugurate, alongside Goodluck Jonathan, the «Eko Atlantic» project which has the modest aim of building the “Dubai” of Africa. This is an island in the lagoon of Lagos, dedicated to business districts and residences of Nigerian millionaires. It will accommodate 250,000 residents and will also have an environmental mission: to protect Lagos from the assaults of the ocean and the rising water. Drainage works and dredging are being carried out by the China Communications Construction company, China’s largest construction company, specialised in this sector, not by a Western company. «Eko Atlantic»39 will feature luxury apartments, three marinas, shopping malls and offices. Crossed by a 30-metre wide waterway, the city will be self-sufficient in both energy and water supply. The city of Lagos is subject to tremendous population pressure: the 15 million inhabitants are joined each year by 600,000 more people. Far from falling, the population of metropolitan Lagos is expected to reach over 25 million people by 2015, according to UN projections.

Ethiopia, the former Abyssinia, a country of an estimated 97 million inhabitants in 2014, is a little known emerging power. However, the country is becoming an «African Lion», taking advantage of its many water resources to supply the region with electricity, earn foreign exchange and become an agricultural and industrial workshop. In recent years, economic growth has been around 10% per year. The political determination of the regime has led it furthermore to undertake major projects, the most spectacular being a large hydroelectric dam on the Blue Nile near the border with South Sudan. This colossal work should make it possible both to satisfy the electricity needs of the country, and therefore to reduce oil imports, and make it a substantial exporter, bringing in new resources. While France still remembers the famines of 1984 and 1985, and although one of three Ethiopians still lives below the poverty line, a middle class is emerging in this country that offers real opportunities. Education is also one of the major achievements of Ethiopia, while its population growth rate is high.

Mexico, the largest Spanish-speaking country, is the most advanced of these emerging countries, with a demographic transition almost complete, a 70% service sector economy and growth of more than 3% a year since 200540, driven largely by the phenomenon of a return of Asian outsourcing, thanks to the common border with the United States. The major macroeconomic factors are promising: solid growth rates, controlled inflation, attractive currency, modest debt, abundant international investment and high domestic savings. Its geographical location also allows it to take full advantage of the American economic recovery, the United States being its largest trading partner. A member of the North American Free Trade Agreement (NAFTA), Mexico has turned into a producer of manufactured goods, that is to say, into a major «workshop» of the American continent. Nevertheless, it should remain vigilant about the growing importance to the economy of drug trafficking and about rising inequality. The war against trafficking could slow down or even permanently hinder Mexico’s ability actually to «emerge.»

Other countries could claim to be part of BENIVM but have not been selected for various reasons, which are mainly related to political instability. Egypt, which is part of the Next Eleven, is not included in BENIVM because of the uncertainty caused by the «revolution» of 2011. With 87 million inhabitants, half of whom are under 25, its economy has collapsed, with a GDP growth of 1.8% in 2013 against 5.2% in 2010. While tourism is a vital source of revenue for the Egyptian economy, the number of tourists dropped by a third between 2011 and 2012 from 14 million to 9.5 million41.

Another member of the Next Eleven, Pakistan has not been listed, despite its population estimated at 196 million (2014) and its growth rate of above 3% per year for 10 years, reaching 6% per year between 2004 and 2006. The political instability coupled with the Taliban rebellion make it difficult to predict real economic growth that would make this country an economic power by 2025.

Iran is also penalised by its older revolution that still strongly affects he economy. The sanctions have a severe impact on the growth of this country of 81 million inhabitants (2014 estimate), with negative growth since 2012 (-1.9%) and 2013 (-1.5%).

New candidates for economic emergence

Angola is the second largest oil producer in Africa after Sonangol, Angola’s public oil company is the second largest African company.

Rapport 2013, les entreprises françaises et l’Afrique, CIAN, French Council of Investors in Africa, December 2012.

Angolans already hold an estimated 3% to 5% of the market capitalization of Lisbon.

Rapport 2013, les entreprises françaises et l’Afrique, CIAN, French Council of Investors in Africa, December 2012.

Côte d’Ivoire is the world’s largest producer of cocoa and coffee.

Named after the “first” Ivorian miracle in the 1960s, under the presidency of Félix Houphouët-Boigny of Côte d’Ivoire, experiencing a GDP per capita higher than that of South Korea.

Rapport 2013, les entreprises françaises et l’Afrique, CIAN, French Council of Investors in Africa, December 2012.

Second world reserves of manganese, 30% of the world’s chrome, first world producer of uranium, one of the largest exporters of potassium.

CIA-World Factbook 2013.

CIA-World Factbook 2013.

The BENIVM are, mainly because of their large population and the diversity of their economies, leading emerging countries for the next decade. However, a group of emerging countries, demographically smaller (whose population is between 10 and 40 million), can be described as «BENIVM junior.» These are Angola, Ghana, Côte d’Ivoire, Mozambique, Malaysia, Kazakhstan, Azerbaijan and Colombia. These countries are also much more dependent on their raw material resources, including oil and gas.

In Africa, the two largest Portuguese-speaking countries come to the fore. Angola registered a growth rate of 5.6% in 2013, thanks to the oil sector42. The government has created a sovereign wealth fund, with USD 5 billion for infrastructure and diversification of the economy43. Gradually, Angola has been buying up the companies of its former colonial power, Portugal, deeply affected by the economic crisis44.

Mozambique will become, in the next decade, the Eldorado of raw materials: oil and gas recently discovered in the Rovuma Basin, coal mining off the Zambezi. Within 15 years gas production in Mozambique is expected to exceed that of Qatar. Both countries are especially appreciated by investors for their political stability, which is uncommon on the African continent.

In Ghana, the annual growth rate was 7.9% in both 2012 and 2013 (15% in 2011). This growth is based on a diversified economy, stimulated by oil and mining. It is a country with great political stability. After the death of the president, the vice president handled the transition ahead of presidential elections and was elected, barely, but without electoral contestation. Construction of the first desalination plant in Africa began in 2012 and was contracted out to a Spanish company45.

Despite its precarious political and security context, the Côte d’Ivoire experienced a growth rate of 9.8% in 2012 and 8% in 2013 thanks to its natural resources (gas, oil), and its production of cocoa46, coffee and cotton. President Alassane Ouattara has set a goal for his country: to be an emerging country by 2020, and has called for a «new Ivorian miracle47.» Significant investments are being made in transport infrastructure (port of Abidjan, construction of the third bridge in Abidjan), energy (thermal power plant of Abatta) and telecommunications (the «optical fibre» project)48. Air France plans to put into service the A380 on the line Paris-Abidjan in late 2014.

In Central Asia, Kazakhstan has a number of advantages. Its economy is heavily dependent on raw materials (oil, gas) and the country has impressive mineral wealth49. Kazakhstan experienced between 2000 and 2006 an annual growth rate of 10%, which dropped to 5% in 2013.

In Southeast Asia, Malaysia has also benefited from the price of oil and gas to develop its growth, which reached 5.6% in 2012 and 4.7% in 2013. This strength is also its weakness, since its GDP depends on its exports (palm oil and electronics) and would suffer from a global slowdown50.

Similarly, in Latin America, growth in Colombia (4.2% in 2012 and 2013) is largely based on oil revenues. Challenges to maintain its economic development lie in infrastructure development, the fight against drug trafficking and the fight against inequality51.

Exports from developing countries already account for 48% of world trade. The strong growth of BENIVM countries will continue to increase the share of emerging countries in these exchanges. In addition, the demand is shifting to the South with the creation of a new middle class of more than 1 billion people that will develop to nearly 2.5 billion in 2030. In this sense, the failure of negotiations in the WTO Doha Round poses a risk to global growth. Indeed, trade multilateralism must avoid two pitfalls in the coming years: first, the creation of a homogeneous block of BRICS which want to develop their own institutions, like their own multilateral bank created at their annual summit in July 2014 in Brazil; on the other hand, the proliferation of bilateral agreements. In this sense, the WTO will have a major role to play in the coming years to avoid a trade and currency war between North and South, and to recognise the rightful place for emerging countries in multilateral organisations.

France, a country not sufficiently present economically in BENIVM countries

French woman jailed in Mexico.

Référé of the court of auditors concerning the evolution of the diplomatic network, May 2, 2013.

Référé of the court of auditors concerning the evolution of the diplomatic network, May 2, 2013.

Answer of the French Minister of Foreign affairs to the court of auditors, April 13, 2013.

Set in 113 countries, they depend on the ministry of economy and finance and are responsible for the collection and analysis of information about the market in which they operate.

France is nevertheless present in Mozambique thanks to CIS, a Marseille based SME led by rRgis Arnoux, in charge of catering in residential camps of the Brazilian mining group Vale ($50m contract).

CAC 40 means the 40 biggest French capitalisations on the Paris Stock Exchange.

The exception in this regard is Pascal Piriou, CEO of Piriou yards, which is based in Ho Chi Minh City, where 40% of sales are made, and in Nigeria.

The committee was created for the Year of Mexico in France, and chaired by Jean-Paul Herteman, CEO of Safran. It was dissolved after the remarks of president Nicolas Sarkozy about justice in Mexico related to the Florence Cassez affair.

In august 2014, the Minister of Foreign Affairs created a “deputy secretary general” to lead this “economic diplomacy”.

France is little present in the markets of BENIVM. Among the truly emerging African countries, only Côte d’Ivoire speaks French. Angola and Mozambique are former Portuguese colonies. Nigeria speaks English. So does Ethiopia, the only African country not to have been colonised, not even by the Italians. The French economic presence in Mexico is low and was overshadowed in recent years by the bilateral dispute over the Florence Cassez case52. In Asia, Bangladesh was part of the British Empire. Vietnam experienced a long French presence of nearly a century, which was characterised by significant commercial activity (textiles, tea, coffee, and rubber in particular). Unfortunately, these old ties could not be transformed into economic and commercial influence. Today the French market share in Vietnam is about 1%. But with trade valued at €3.3 billion, our economic relations are insufficient in terms of the economic potential of this country. They are also unbalanced, with a bilateral deficit which widened to €2.1 billion in 2012.

France has not yet redeployed its diplomatic and commercial resources to countries that will be the economic powerhouses of tomorrow.

The French diplomatic network is unfortunately not immune to efforts to reduce public spending. As highlighted in the référé (judgment) of the Court of Auditors concerning the evolution of the French diplomatic network on May 2, 2013, «required to reduce its control, the Ministry has in the end attempted to preserve the network without really adapting it to the new issues.»53.

Paradoxically, the French presence was reduced in Africa (-8% in South Africa), Indian Ocean (-14%), Asia (-1%) and Brazil (-6%)54. Posts in sub-Saharan Africa have even accounted for two-thirds of the downsizing in recent years. Certainly the French presence has increased in China (+11%) and India (+14%), two markets already saturated with foreign presence. However, during his first trip to Asia in October 2012, the French Prime Minister avoided giants such as China, India and Indonesia, to go to… Singapore and the Philippines. In its response to the Court of Auditors, the Ministry of Foreign Affairs insisted that diplomats will be redeployed in more economically strategic areas, such as emerging countries, without, however, mentioning the countries under consideration55.

A few examples illustrate the lack of interest of French diplomacy in these new emerging countries called BENIVM. In Bangladesh, the last French ministerial visit was that of Jean-Louis Borloo in 2009, when he was Minister of Ecology, Energy, Sustainable Development and Maritime Affairs. In Vietnam, the last presidential visits took place in 1993 (20 years ago!), 1997 and 2004. In 2009 the French Prime Minister went to Vietnam, and in 2013, the French Foreign Minister did travel to Vietnam as part of France- Vietnam Year 2013-2014. Since then contacts have occurred depending on international meetings in the region. In Ethiopia, the last presidential visit was in 2011 for the summit of the African Union. Early in 2013, the Minister of Foreign Affairs travelled to Addis Ababa, but for a conference on the financing of Mali! In Mozambique France closed its economic mission56 at the moment that the discoveries of oil and gas deposits were described by Italians and Russians as the «biggest… in this field for a decade». It has since reopened but the gas fields are operated by ENI and the China National Petroleum Corp. Total is not present57.

France must urgently make significant efforts in the future emerging economies of the BENIVM. The French strategy could be based on three distinct pillars:

- The establishment of strategic partnerships with BENIVM. These partnerships would be based on bilateral political relationships at high level, with frequent exchanges at ministerial level. They would include political, military (fundamental for powers such as Vietnam and Nigeria which are emerging militarily), industrial, commercial, technological, energy and culture components.

- The creation of bilateral committees of high level businessmen in order to develop a common business culture between France and each BENIVM Which CEO of a CAC 40 quoted company58 or of a large French SME can really claim today that he is familiar with the business community in Dhaka, Ho Chi Minh City59, Lagos or Addis Ababa? In fact, France has experienced resounding failures in this area, as evidenced by the collapse of the committee of French and Mexican high-level businessmen, which was dissolved as a result of the «Florence Cassez»60 case. These business committees could also do work in structuring the French export effort in the BENIVM, prioritising sectors and having a coherent and cohesive French «offer», as the German and Italian exporters do. In this respect, France has particular strengths in urban issues (water, transport…) and energy.– The priority given in our tools – embassies, trade missions, Ubifrance and the offices of the French Development Agency – and our instruments

– COFACE, Emerging Markets Reserve (RPE), Study and Private Sector support Aid Fund (FASEP) – for economic and industrial projects in BENIVM. The Minister of Foreign Affairs and the Minister of the Economy are primarily concerned with this61.

These proposals, although general, require in fact a Copernican change of mentality in France. Indeed, they assume that the government and the administration are now able to change the diplomatic and business priorities, and to understand that some countries still considered as «developing» are in fact our priority partners of tomorrow. In this respect French disinvestment in Africa is alarming and must immediately call into question our diplomatic network, and the ability of our companies to seize opportunities in Lagos, Luanda or Maputo.

The main French CEOs, who have a special responsibility given their capital and public weight, should, because their interest lies in the future in BENIVM, focus on these countries and our bilateral relationships.

The BRICS, now emerged, will be gradually replaced over the next decade by new emerging countries: BENIVM. These countries, like the BRICS, will not only be significant figures in the global economy, but will also want to take part in the political dimension of major international relationships and will have, in this respect, the necessary funding.

In this sense, France is expected to conclude with these countries political and strategic, in particular diplomatic and military, partnerships. These partnerships should aim to accompany the economic and political emergence of BENIVM and be, for the future, a valuable ally for these upcoming «champions» of globalisation. The interest of France would be, in this context, to develop a new economic diplomacy in favour of BENIVM and mobilise CAC 40 companies and SME exporters towards these new horizons.

No comments.