Towards personalised pricing in the digital era ?

Introduction

Digital technology reveals the most common forms of price discrimination

E-commerce has not put an end to spacial price discrimination

Digital technology makes price differentiation more visible over time, even if it remains complex to decipher

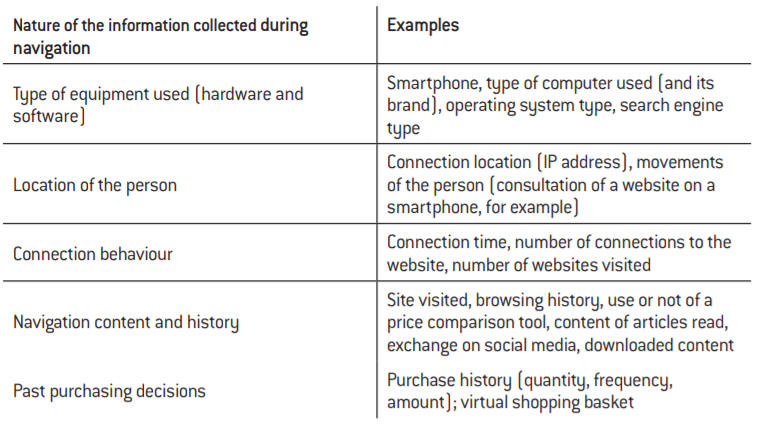

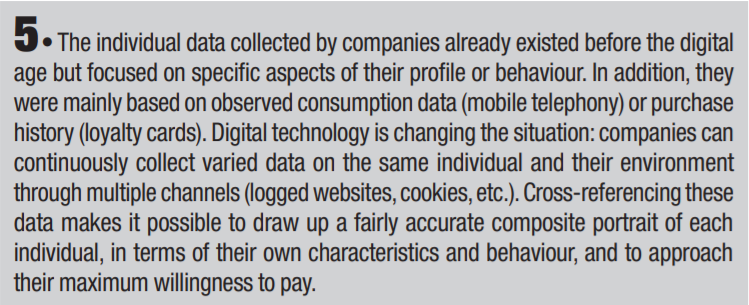

Big data could lead companies to evolve towards personalised prices

Thanks to Big Data, companies can better understand their customers’ willingness to pay and offer personalised prices

Yet personalised prices also present some risks for companies

Should consumers be concerned about personalised prices?

Conclusion

Summary of the study in eight points

Summary

Setting different prices for the same product is a practice as old as the retail trade: we see this everyday, whether through price reductions for youths, air ticket prices varying ccording to the dates they are booked, or prices differentiating depending on the store location. These practices of “price discrimination” have so far been accepted by consumers because they remain fairly simple to justify: young people pay less for certain services because they are on average less wealthy than adults; similarly, when buying an airline ticket, everyone knows that the consumer can benefit from a low price by booking early. Previously, the usual price discrimination did not concern the characteristics of individuals but rather broad statistical categories such as age or location.

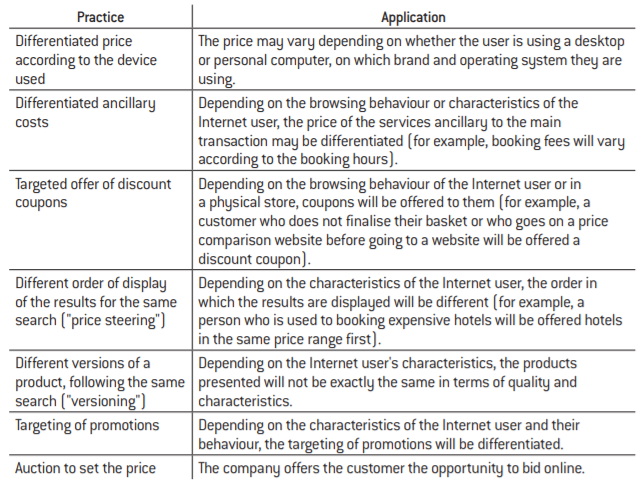

However, with the development of digital technology, price discrimination could take a decisive step forward tomorrow, by encouraging firms to charge personalised prices: thanks to Big Data, each customer will be offered a specific price depending on their individual willingness to pay. The era of uniform pricing, on which all retail trade has been based for more than a century, could gradually give way to a world of personalised prices. While this practice would be very profitable for businesses, it could nevertheless lead to customer distrust: customers often do not know which criteria were used by the algorithms to establish pricing. It is therefore with caution that companies should explore personalised pricing, through subtle and indirect practices, such as targeted discounts or a differentiated display of the results of an internet search (“price steering”).

Emmanuel Combe,

University Professor, Professor at the Skema Business School, Vice-President of the Competition Authority.

The author would like to thank Jehanne Richet and Etienne Pfister (French Competition Authority) for their valuable assistance. The author remains solely responsible for the content of this study.

See “Profitero Price Intelligence: Amazon makes more than 2.5 million daily price changes”, profitero.com, 10 December 2013.

Ibid.

See Le Chen, Alan Mislove and Christo Wilson, “An empirical analysis of algorithmic pricing on Amazon marketplace”, in Proceedings of the 25th International Conference on World Wide Web, International World Wide

Web Conferences Steering Committee, 2016, p. 1339-1349.

We do not refer to “second-degree discrimination” in this study, consisting in differentiating the price according to the quantity purchased (“package”, tied sales, pair rate with subscription).

We are therefore not dealing with differentiated pricing practices in B-to-B relationships, which often result from over-the-counter negotiations between a supplier and a buyer.

In economics, it is said that the company has “market power”, i.e. the ability to sustainably increase its prices above its costs.

We therefore adopt a company-centred approach, notably in regards to its incentive to differentiate prices. The impact of these practices on global welfare and on their possible regulation by consumer or competition law is not discussed here. See, in particular, for a discussion on these topics: OECD (2018).

Everyone browsing the Internet in order to buy tickets for a flight or Nespresso capsules has experienced the multiplicity of prices displayed online for the same product or service. Thus, the price of a camera is not always the same on the same e-commerce website, depending on whether the Internet user connects from France or another European country. Similarly, prices on the Internet can change frequently: for example, during the month of December 2013, Amazon reportedly made 2.5 million price changes each day1 . Other websites such as Bestbuy or Walmart also made more than 50,000 price changes daily during the same period2 . This practice of varying prices is even spreading to smaller distributors: analysing the history of successful products sold by 30,000 merchants on Amazon’s marketplace3 shows that some of them use algorithmic price software. Moreover, two people going to the same website with different profiles will not always be offered the same price for the same product. Faced with this multiplicity of prices on the Internet, we could be tempted to give up understanding the rationality of it. Indeed, as prices are set by increasingly complex algorithms, they include many variables of different kinds: it is very difficult for an external observer to learly and exhaustively identify them to know their exact use. For example, an algorithm can make the price of a product vary according to the prices charged by competitors, the prices applied in the past on the website, the evolution of the company’s costs and stocks, contextual information (for example, weather conditions for a clothing sales website) or the characteristics and behaviour of the individual who navigates the website. Price differentiations can then become difficult to decipher, especially because the companies that make and/or use price algorithms do not reveal their internal functioning.

However, this multiplicity of prices on the Internet is not a coincidence: price algorithms do not fall from the sky. They have been designed by companies that use or market them for a specific purpose: to increase profits, by using price discrimination.

“Price discrimination” refers to the practice of charging different prices for the same good or service, even though the cost of production is the same, with the main purpose of attracting new customers or making them pay more. It is an old strategy in the physical retail trade. For a long time it has taken on a fairly transparent and simple form: for example, a young or unemployed person knows that they can benefit from a reduced fare when going to the cinema or using public transportation. Similarly, customers who book their flight or hotel room late are aware that they may pay more. The personal characteristics or behaviour of individuals are not relevant. Personalised prices were applied on rare occasions: for example, when the customer negotiates the (lower) price of an apartment with the seller or via targeted promotions (loyalty cards).

Price discrimination can take on more or less sophisticated forms: a company can differentiate its prices according to the categories of individuals (“third degree discrimination”); for example, by offering a lower price for young people or retirees; it can also vary the price according to the geographical location of the store or Internet user (“spatial discrimination”) or over time (“dynamic pricing”). It can also set different prices according to the individual characteristics of the customers or their behaviour: in extreme cases, it may offer a personalised price for each customer (“perfect discrimination” or “first degree”4). Whatever form it takes, price discrimination has one objective: to increase the company’s profit. However, it is not always to the detriment of all consumers.

The purpose of this study is to assess the extent of price discrimination practices in B-to-C5 trade in the digital era and to highlights the main consequences for companies.

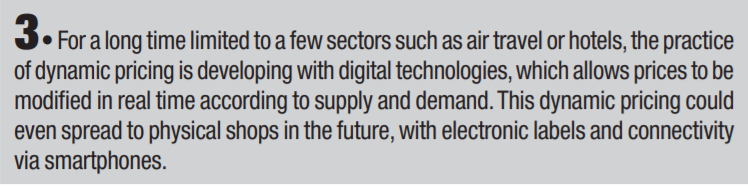

The first part of this study looks at two long-standing practices of price discrimination and examines their evolution in the digital age. First of all, spatial discrimination consists in applying different prices for the same product according to the location of the store or customer, without differences in transportation costs or competition. We show that digital technology, particularly through price comparators, has highlighted the practices of price discrimination from one geographic location to another, particularly between countries, without eliminating them. Second, companies can vary the price of a good or service over time, depending on fluctuations in supply and demand. This practice, which has long existed in the airline and hotel industries, is experiencing a renewed interest in the digital era, allowing for real-time price changes. This “dynamic pricing” has sometimes become more transparent thanks to the Internet, especially when all possible prices (around a reservation date) are displayed. However, it also sometimes leads to price movements that are undecipherable by the customer, who does not have a clear reading grid – when Amazon changes the price of the same product several times a day,the customer can only notice this price volatility, without understanding the underlying reasons.

The second part of this study deals with recent personalised pricing practices, which are still not widely used in the retail sector (with the exception of loyalty cards): in the digital and Big Data era, personalised pricing is becoming possible in many sectors. Indeed, the collection of increasingly voluminous and varied data on individuals allows companies to more accurately approach their “maximum willingness to pay”, i.e. the maximum price they are willing to pay. Once this willingness to pay is known, the company may charge a differentiated price for the same good or service for each customer. This practice presupposes that the company’s products are sufficiently differentiated so that customers do not switch to the substitutable products of competitors6.

If personalised prices were to develop, they would challenge an essential principle on which the retail distribution has been based for more than a century: the existence of a price reference system (which can be, for example, an average observed price or a maximum recommended price), on which customers make their choices. We could see the disappearance of the reference price system: for the same product (good or service), the number of prices would become equal to the number of customers. The risk is that customers will lose trust in companies engaged in this type of practice. This study questions the opportunities and risks for a company to embark on such a pricing strategy7.

Digital technology reveals the most common forms of price discrimination

E-commerce has not put an end to spacial price discrimination

See Jennifer Valentino-DeVries, Jeremy Singer-Vine and Ashkan Soltani, “Websites Vary Prices, Deals Based on Users’ Information”, wsj.com, 24 December 2012.

See Alberto Cavallo, “More Amazon Effects: Online Competition and Pricing Behaviors”, National Bureau of Economic Research, Working Papers n° 25138, October 2018.

Companies sometimes apply different prices depending on the location of their customers or stores, for the same good or service. These price differences are explained by a number of factors, and in particular by the varying intensity of local competition: less competition in a local area will lead, all other things being equal, to higher prices. For example, a study showed that several retail

chains such as Staples charged different prices on their websites depending on the location of the customer, even within the United States8. In particular, when the Internet user is located near a physical store of a Staples competitor, Staples offers them an online discount voucher. Similarly, price differences between two locations may result from differences in transport costs: a product sold in an isolated region, far from storage facilities, will be sold at a higher price.

A differentiated pricing policy dependent on geographic location can also result from a strategy of spatial discrimination, taking advantage of differences between consumers’ locations. For example, the price of a coffee in a coffeeshop will generally be higher in a touristy area. Similarly, in a country where consumers show a strong preference for a product, its price will be higher, all other things being equal. For example, in the automobile sector, consumers often prefer “national” brands: the French mainly buy French cars, with Renault and PSA accounting for 60% of new car registrations in France in 2018, even though their market share is 26% at the European level. There is then a temptation for French car producers to charge a higher price on the domestic market compared to export markets.

In order to be effective, however, this policy of differentiated prices dependent on geographic location presupposes that customers will not use their ability to arbitrate between locations, meaning that they will not buy a given product where its price is lower.

Before the Internet, arbitration was limited by the existence of high transaction costs: for example, in order to buy a car in another European country, it was necessary for the customer to physically travel. Today, there are many websites who perform this arbitration on behalf of the client. Moreover, before the Internet, information on the different prices of the same product was difficult to access due to the lack of price comparators. Arbitration behaviour therefore concerned a minority of informed customers (or those living in a border area) and few very expensive products such as cars. In addition, companies have occasionally discouraged their own distributors from supplying customers from abroad. These practices of restricting “passive sales” have long been sanctioned by the competition authorities in Europe. Thus, Peugeot was fined 49 million euros in 2005 by the European Commission for preventing French customers from buying top-of-the-range models from the Netherlands where these vehicles were sold at a lower price than in France.

With the development of e-commerce, one might think that price differentiation strategies dependent on geographic location will disappear, especially within the eurozone. Thanks to Internet price comparators, it is now possible to almost instantly know the price of a product in another country, especially when it is part of the same currency zone; it is also possible to buy directly, in one click, on a foreign website, without having to travel physically.

Moreover, the possibility of differentiating prices between countries is challenged by the “Amazon effect”: fearing that customers will go to the e-commerce giant, small retailers (both physical and online) are forced to align their prices with Amazon. This leads to a uniformity of prices (decreasing) from one place to another. This phenomenon was observed9 in the United States: the products sold on Amazon are in 97% of cases sold at the same price at Walmart, regardless of the geographical location of the store.

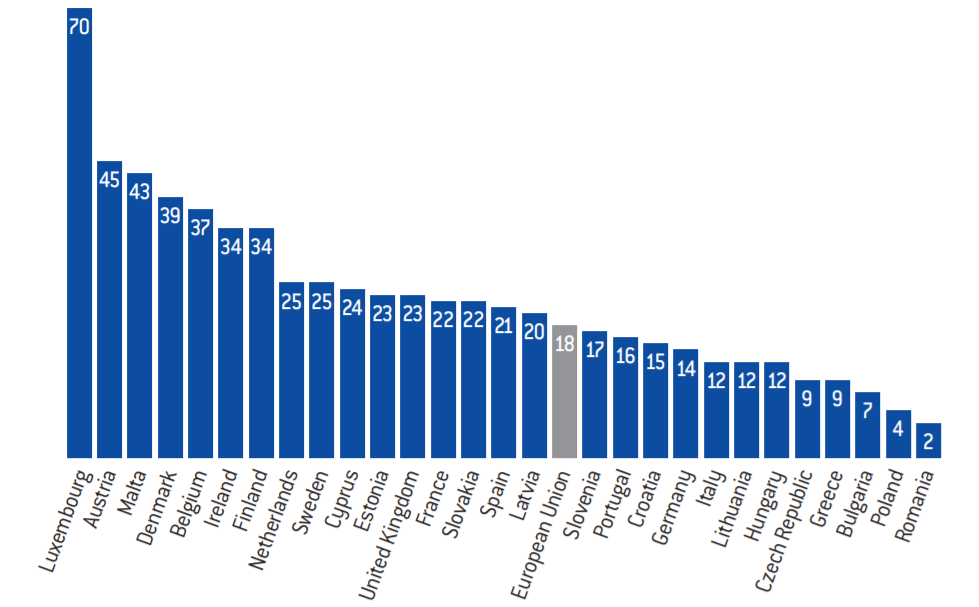

Yet, in reality, we can see that digital technology, while reducing physical distances, has not abolished them: geographical borders still count in e-commerce. It should be noted that in Europe, with the exception of small countries such as Luxembourg or Malta, only 18% of customers in the European Union who buy online do so on a foreign website.

Purchases from foreign websites according to the countries of the European Union in 2016 (in %)

Source :

European Commission, 2017

Jakub Mikians, László Gyarmati, Vijay Erramilli and Nikolaos Laoutaris, “Detecting price and search discrimination on the Internet”, Proceedings of the 11th ACM Workshop on Hot Topics in Networks, HotNets-XI, October 2012, p. 79-84.

See Ali Hortaçsu, F. Asís Martínez-Jerez and Jason Douglas, “The Geography of Trade in Online Transactions. Evidence from eBay and MercadoLibre”, American Economic Journal, vol. 1, n° 1, February 2009, p. 53-74.

In 2012, researchers noted that, even within the United States, there are significant price differences for the same product, depending on the geographical location of the Internet user: for products such as digital video games, these differences can reach 166%, even though there is no difference in transportation costs (since the games are downloaded online)10. It is therefore possible, even in the age of e-commerce, to charge differentiated prices according to location, without the risk that all customers will arbitrate from one place to another.

How can it be explained that customers do not systematically engage in arbitrage practices from one place to another, when digital technology technically allows it?

First of all, customers, even when they buy online, are still reluctant to buy far from home. Studies have shown that geographical distance plays a role in e-Bay transactions within the same country (in this case the United States), even if its influence is less than in physical commerce: when the distance between an eBay seller and their customer increases, the volume of sales automatically decreases11. The customer may fear not being delivered on time or able to claim if the product is damaged by transport. In addition, a customer will be reluctant to buy from a foreign website, which is not translated into English or their native language. Lastly, online sales websites often remain relatively unknown outside their own domestic market and therefore do not have sufficient trust and reputation to encourage foreign customers to buy: with the exception of Amazon, the leaders in generalist e-commerce are not the same from one country to another. For example, Fnac.com or Cdiscount.com are among the most visited websites in France, while their audience remains limited in Germany (where actors such as Otto or Zalando dominate).

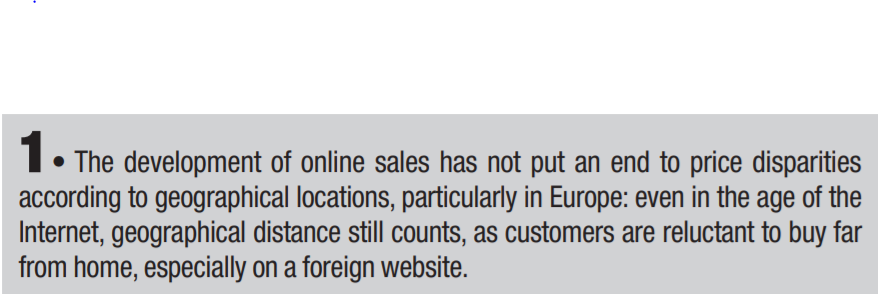

Beyond the natural reluctance of customers, the development of online sales could be hampered by companies’ practices that limit the possibilities of buying on a foreign website. This is particularly true in Europe: a European Commission survey from 2016 showed that only 37% of sales websites allowed a customer from another European country to complete their online purchase. This is due to the presence of different obstacles at each stage of the online shopping process. In particular, some of the websites refuse to deliver to certain European countries (51% of cases) or refuse payment by credit card, given the domiciliation of its holder (58%). In some cases, the customer is automatically redirected to the website of their country, a practice known as “rerouting” or “geoblocking”.

These geoblocking strategies are now the subject to particular attention by the European Commission, since they violate the market integration objective, which is at the heart of economic union. The principle of free trade into the European Economic area implies that a company cannot construct artificial barriers to trade between countries: in particular, it cannot limit or prohibit “passive sales”, consisting for the customer of one country to make purchases in another.

Firstly, in December 2018, the European Commission imposed the first sanction on a company that had carried out geographical blocking on the Internet. Guess, a company that designs and distributes fashion clothing and accessories, was fined €40 million (with a 50% reduction to take into account its cooperation) for preventing its authorised retailers from selling to customers located outside their allocated territories. According to the European Commission, these agreements have enabled Guess to partition European markets, in particular by depriving customers in Central and Eastern European countries of the opportunity to benefit from more attractive prices in Western European countries.

Secondly, Regulation 2018/302, which entered into force in December 2018, aims to fight against excessive geoblocking practices in Europe: it is prohibited to prevent a European consumer from buying abroad.

How will companies react to this new regulation? The answer is not obvious and several options are open to companies.

– A first option would be to continue to charge different prices in different countries, because the arbitrage will naturally be limited by consumers’ fears of buying abroad.

– A second option would be to offer to deliver online purchases only to certain countries or to charge extra for delivery costs: Regulation 2018/302 does not require an online seller to deliver the product throughout Europe. If they do not offer it, the customer must ensure the delivery themselves or pick up the product in the country where the online store operates.

– A third option would be to harmonise prices between countries, to make arbitrage obsolete. This standardisation of prices can lead, for example, to price increases in countries where they were set at a lower level. This situation would be unfavourable to some consumers, who would see a price increase, leading some of them to give up consuming certain products.

Obstacles to online shopping on foreign websites in the European Union (in %)

Among the online shopping websites in the 28 countries of the European Union….

Source :

European Commission,”Geoblocking study in the EU”, May 2017

Digital technology makes price differentiation more visible over time, even if it remains complex to decipher

Another common form of price differentiation – called “dynamic pricing” – is the variation of the price over time, depending on parameters such as supply and demand or the reservation date. This form of discrimination has long been applied in the sale of perishable food products, through price reductions at the end of a market, for example, or when the product’s expiration date is approaching.

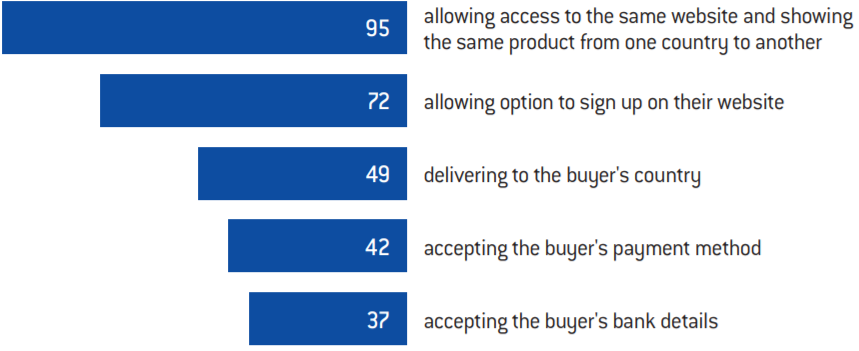

Dynamic pricing is also found more systematically in sectors such as hotel and airline reservations. Thus, in air transportation, the “revenue management” or “yield management” technique consists, on the same flight and for the same travel class, in changing the price of tickets so that the plane is full on the day of takeoff, while obtaining the highest possible total revenue. The price at a given time depends in particular on the reservation date in relation to the departure date: the earlier the customer makes a reservation, the more likely they can obtain an attractive price, even if this rule is not systematic. As the flight departure date gets closer and/or the plane fills up, the ticket price increases. It reaches its maximum the day before departure: indeed, if a person books their ticket on D-1, it is because they could not anticipate their trip, and is most likely someone travelling for a business-related motive or who had an emergency. They will therefore pay a high price. A study from 2009 showed that the price of a Ryanair ticket, for the same flight, increases almost continuously over time. The magnitude of the price increase seems quite high: the price of a ticket can reach 180 euros on the day of departure, i.e. six times the price observed three months before (30 euros).

Evolution of the price of a Ryanair ticket according to the reservation date (in euros)

Source :

: Paolo Malighetti, Stefano Paleari and Renato Redondi, “Pricing strategies of low-cost airlines: The Ryanair case study”, Journal of Air Transport Management, vol. 15, n° 4, July 2009.

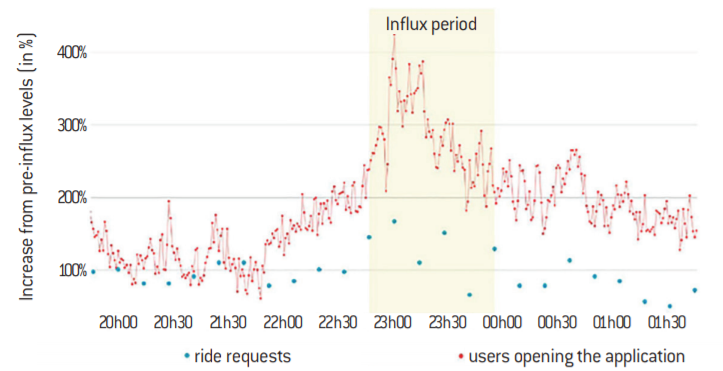

Beyond the air transport sector, dynamic pricing practices are developing today in industries characterised by capacity constraints and strong fluctuations in demand, such as ride hailing services. Thus, a company like Uber varies the fare from a given location, depending on supply and demand at a given time, with a surge pricing system. For example, on 21 March 2015, when Ariana Grande’s concert in Madison Square ended at 10:30 p.m., demand for ride hailing services suddenly increased, leading to a very sharp increase in price, reaching up to 400%. This increase in demand has also led to an increase in supply, with new drivers entering the market.

Variation in the price of a Uber trip from Madison Square after a concert on 21 March 2015 (in %)

Source :

Jonathan Hall, Cory Kendrick and Chris Nosko, “The effects of Uber’s surge pricing: a case study”, valuewalk.com, 21 September 2015.

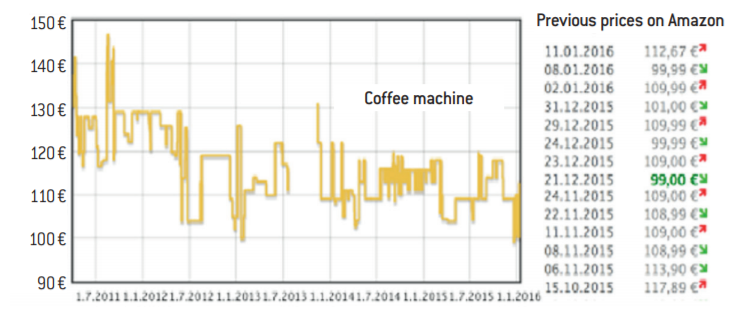

There is also a growing trend of dynamic pricing in the online sales. Thus, a company like Amazon practices price changes, with large variations on particular days such as Valentine’s Day or holiday periods. Thus, according to a study from 2016, Amazon.de’s price algorithm can change more than one million prices on Valentine’s Day alone, with fluctuations of up to 240% for the same product. For example, the same “Nikon D610 SLR” camera has seen its price fluctuate between 700 and 1,687 euros in a day. Beyond these very short-term adjustments, there is also a trend towards price fluctuations over a longer period: for example, the price of the same Nespresso coffee machine sold on Amazon fluctuated between 100 and 145 euros during the 2011/2016 period.

Price variation of the same Krups XN 2006 Nespresso Pixie Electric Red coffee machine on Amazon (2011-2016)

Source :

Andreas Krämer and Regine Kalka, “How digital disruption changes pricing strategies and price models”, in Anshuman Khare, Brian Stewart and Rod Schatz (dir.), Phantom Ex Machina. Digital Disruption’s Role in Business Model Transformation, Springer, 2017, p. 87-103.

Competition and Markets Authority (CMA), “Pricing algorithms. Economic working paper on the use of algorithms to facilitate collusion and personalised pricing”, 8 October 2018.

These fluctuating pricing practices, which are mainly observed on the Internet, could also spread to physical shops through the use of digital technologies in stores. According to a study by the Competition and Markets Authority from 2018, the major food distribution chains (which are also present online today) are launching into dynamic pricing12. For a long time, it was costly to make frequent label changes in the physical stores, which would have required a “manual” adjustment on several thousand products: this practice mainly concerned the fresh produce department (meat, fish, fruit and vegetables), whose prices were generally changed daily, according to the supply costs on wholesale markets. Price differentiation in physical stores was quite limited and was mainly achieved through promotions, sometimes targeted (“discount coupons”) on customer loyalty cards. Food distributors have built their reputation on price stability: the implicit promise is that if the customer composes the same basket of goods from one week to the next, they will spend roughly the same amount (except for fresh products). This promise of stability is a way to build customer loyalty and discourage price comparisons between stores.

However, dynamic pricing experiments have recently emerged in physical retail stores using electronic labels: retailers such as Tesco or Marks & Spencer in the United Kingdom are testing evolving pricing strategies based on demand or stock levels, although these practices remain anecdotal at this stage.

Its acceptability to customers should be analysed when it is caused by unforeseen events such as strikes. Thus, in 2017, a London Underground strike led Uber to raise prices by 400%.

How to assess price discrimination over time and how does the digital boom change the situation? Thanks to digital technology, customers now know that prices can vary, sometimes significantly. They can see for themselves, by connecting several times a day to an online sales website, ticket booking or price comparison website. In the case of air travel, customers even know the distribution of prices around their preferred departure date: when they look for a flight on a specific date, a calendar is displayed with different dates and different prices, around the selected date. In the case of Uber, the surge pricing rule also leads to the display of the multiple of the price, based on a reference price 13. This readability in the price display allows the consumer to make a more informed choice, especially if they use a price alert to buy “at the right time”.

However, while customers can now “visualise” price volatility, they are not always aware of the rules that govern its evolution. In the case of Uber, the rule remains fairly simple to understand and anticipate: the evolution of the price depends on the interplay between supply and demand in a given location. Customers can anticipate it with recurring and predictable “peak” periods, excluding in unforeseen circumstances (strikes, accidents, etc.).

In air travel, the situation is more complex to decipher. If the ticket price changes according to the booking date, multiple factors also come into play: the season in which the flight takes place, the duration of the stay, the time and day of departure, the level of demand, an event taking place at the destination, the intensity of competition on that route, etc.

In online commerce – and especially on websites like Amazon – the price volatility, while it can be observed by Internet users, remains difficult to anticipate and decipher: it does not follow a simple and clear rule. No one knows exactly which criteria (and their respective weights) are used by a price algorithm: at most, it can be assumed that prices vary according to factors such as supply and demand, stock levels, competitors’ prices or external factors (weather, festive events, for example).

See Marc Möller and Makoto Watanabe, “Advance Purchase Discounts Versus Clearance Sale” The Economic Journal, vol. 120, n° 547, September 2010, p. 1125-1148.

See Oren Etzioni, Craig A. Knoblock, Rattapoom Tuchinda and Alexander Yates, “To buy or not to buy: mining airfare data to minimize ticket purchase price”, in Proceedings of the Ninth ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, ACM, 2003, p. 119-128.

While it is difficult for Internet users to understand the reasons for price volatility, they can nevertheless try to take advantage of it by developing strategies to optimise purchasing decisions, thanks in particular to price alert tools: for example, the Camelcamelcamel.com application monitors price trends on the Amazon website and warns the customer of a possible price decrease. Many websites also provide advice on the “right” departure or return dates to buy a cheaper air ticket: for example, The Conversation recommends that travellers leave in mid-September and on Saturday mornings very early. A study from 2010 concluded that, for example, it is better to book a ticket in the afternoon than in the morning as businesspeople are used to booking their tickets in the morning14. An interesting exercise then consists in identifying the best times to book a cheaper ticket. With the rise of artificial intelligence and data mining techniques, some researchers have even used algorithms to optimise the purchase of airline tickets: for example, in 2003, researchers showed that the use of their Hamlet algorithm, applied to a sample of 4,488 passengers, allows customers to save an average of 4.4% on the price of a ticket15.

Big data could lead companies to evolve towards personalised prices

See Frédéric Marty, “Plateformes numériques, algorithmes et discrimination”, Revue de l’OFCE, 2019.

So far, we have studied two fairly old and widespread forms of price discrimination, i.e. the variation of prices over time and across location. However, another form of price discrimination, which is less widespread, consists in differentiating prices according to the customers and their personal characteristics and behaviour16.

Discrimination based on the profile of individuals is not new, but for a long time it has taken a rather basic form, consisting of classifying individuals into broad categories: their age and professional situation, for the most part. In particular, we know the practice of preferential prices offered to young people, the elderly or people with low incomes (for instance, those who are unemployed), particularly in the access to cultural goods or collective transportations. This price discrimination, described in economics as “thirddegree discrimination”, is based on fairly simple variables, which are clearly displayed (“youth fare”) and are quite justifiable from a normative point of view: thanks to price discrimination, young and unemployed people, who often have low incomes, will access the market.

A more subtle and less transparent form of price discrimination is to go beyond classifying individuals into broad categories and to offer personalised prices. Until now, this form of price discrimination has remained relatively rare: it mainly concerned price negotiation practices, most often at the customer’s initiative and on the basis of a reference price. Thus, in sectors such as real estate or car sales, it is common for the customer to negotiate a discount, which will depend on their bargaining power.

Thanks to Big Data, companies can better understand their customers’ willingness to pay and offer personalised prices

Andreas Krämer and Regine Kalka, “How digital disruption changes pricing strategies and price models” in Anshuman Khare, Brian Stewart and Rod Schatz (dir.), Phantom Ex Machina. Digital Disruption’s Role in Business Model Transformation, Springer, 2017, p. 87-103.

Companies did not wait for the rise of the Internet to collect individual information on their customers, particularly in the retail and personal service sectors. Indeed, the major physical distribution chains (food or cultural) and airlines have had access for a long time, via their loyalty programmes, payment or subscription cards, to accurate information about their customers. Similarly, retail banks and telephone operators have precise and recurrent data, whether on customers’ revenues, their purchasing behaviour or their geographical location. This information, however, has two limitations:

– they concern partial characteristics of individuals. The “composite drawing” of the customer includes few contextual elements about the environment in which they evolve (what are their hobbies? Their interests?);

– they mainly concern historical purchasing or consumption behaviour: for example, a food distribution chain has little information on what its customer could buy or has considered buying. Behaviour prediction is therefore based first and foremost on a historical approach.

It should also be noted that companies with these databases have so far made relatively limited use of them, mainly by offering targeted discount coupons, depending on volumes or purchasing history.

However, the development of Big Data since the 2000s could radically change this situation. Firstly, Big data results in a considerable increase in the volume and quality of data, which can vary greatly. Indeed, when an Internet user browses the web, they leave many traces that will allow companies, directly or indirectly (through the purchase of third-party databases), to better understand their behaviour and preferences. Traces can be voluntary, for example when the customer evolves in a “logged” universe such as Facebook, LinkedIn or Twitter, when they do not navigate in “private” mode or when they decide to “like” a content. In the particular case of Facebook, the Internet user offers declarative data on its objective situation (gender, age, place of residence, etc.) but also on their preferences, depending for example on the subjects they like to discuss. It is also possible to know all of their contacts and their geographical location. When the customer browses the Internet without logging on to to a website, they also transmit multiple data, via cookies in particular, on their browsing behavior to the search engine (mainly Google Search) and/or to the websites visited involuntarily: for example, their browsing history, the time spent on each website, the products viewed or purchased, etc.17 The value of Big data lies not only in the accumulation of data but also in their crossreferencing, which makes it possible to draw up a fairly precise “composite drawing” of a customer.

Examples of traces left when surfing the Internet

IDC, “IDC Forecasts Revenues for Big Data and Business Analytics Solutions Will Reach $189.1 Billion This Year with Double-Digit Annual Growth Through 2022”, April 2019.

See Autorité de la concurrence, “Avis n° 18-A-03 du 6 mars 2018 portant sur l’exploitation des données dans le secteur de la publicité sur internet” .

Let’s take the example of an airline that sells its tickets directly on its website. Quite simple but relevant data can be collected when the Internet user navigates the website:

– Navigation history: a destination that is often searched or purchased indicates that the person has a strong preference for that destination;

– connection time: the longer the connection time to a travel destination, the more it reveals the individual’s interest in that destination;

– the multiplicity of selected destinations: an Internet user who selects very different destinations travels for recreational reasons. They will therefore be more price sensitive.

Beyond the connection behaviour on the website, airlines can also crossreference customer information with their Facebook profile to better understand their preferences, habits and interests, particularly in terms of destinations or places of residence. For example, knowing the location of the consumer’s family and friends provides valuable information about their travel motives: it is likely that a VFR (Visiting Friends and Relatives) customer’s willingness to pay will be higher than that of a tourist, who arbitrates between different destinations.

Similarly, in the automobile insurance sector, the use of Big Data makes it possible to better assess a customer’s risk profile, for example by analysing the use they make of their vehicle, whether in terms of frequency of use or location: which roads do they use most often? Which routes do they regularly take? Insurers could then develop insurance policies that are more based on usage (“usage based insurance”) rather than solely on the characteristics of individuals (e.g. age) or their behavioural history.

Secondly, producers have been able to directly know their customers without having to go through an intermediary or a distributor. The most exemplary case is that of airlines: all airlines now have their own booking website and are no longer dependent on travel agencies. They can now obtain more varied and richer information than that contained on their loyalty cards alone (especially if the customer connects using their Facebook account). For example, Ryanair receives more than 180 million unique visitors each year on its website; almost all customers who book a ticket with Ryanair do so directly on the company’s website, allowing Ryanair to have access to their personal profile without intermediation. Similarly, in the industry, the growth of direct sales, without going through a distributor, allows producers to collect valuable customer data.

Lastly, companies can obtain customer databases on the market. Since the 2000s, we have seen the development of a data and analysis market (called BDA: Big Data and business Analytics), with specialised players such as Acxiom, Bleukai/Oracle or Teradata. According to IDC18, the data and analysis market would represent 160 billion dollars in 2018 and should grow at a sustained rate, in the order of 12% over the period 2017-2022, to reach 260 billion dollars. This growth is mainly driven by sectors such as banking and professional services, and more than half of the market is now located in the United States (88 billion dollars), far ahead of Europe (35 billion dollars).

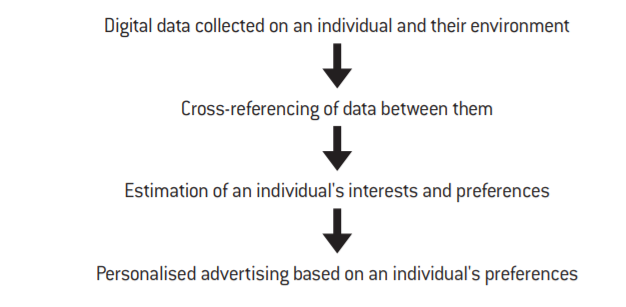

How can companies use this individual data? First, they can use it to conduct online advertising campaigns targeted at specific categories of individuals, based on their profile and behaviour. In particular, retargeting aims to solicit again, through an advertising banner, an Internet user who has shown a particular interest in a product. Online advertising, in “search” or “display” mode, has experienced a significant boom over the past 10 years, to the point of becoming the leading vector of advertising expenditure, ahead of television and the printed press 19.

From Big data to personalised advertising

See Ariel Ezrachi and Maurice E. Stucke, “The rise of behavioural discriminations”, European Competition Law Review, vol. 37, n° 12, 2016, p. 485-492.

See Nir Vulkan and Yotam Shem-Tov, “A note on fairness and personalised pricing”, Economic Letters, vol. 136, November 2015, p. 179-183.

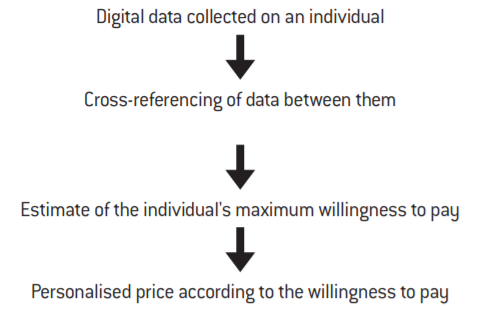

A second step could be taken tomorrow, consisting of personalised prices: on the basis of the individual’s data and their cross-referencing, a company could estimate their maximum willingness to pay and propose a particular price 20. In extreme cases, the company could even set a price equal to the maximum willingness to pay. In practice, however, it is unlikely that it will do so: if Big

data makes it possible to better understand the individual’s willingness to pay, it is always an estimate, subject to uncertainty. The risk is to set a price higher than the willingness to pay of the individual, who will give up buying. In this respect, a laboratory experiment on personalised prices showed that players set a price on average equal to 64% of the customers’ maximum willingness

to pay 21.

From Big data to personalised price

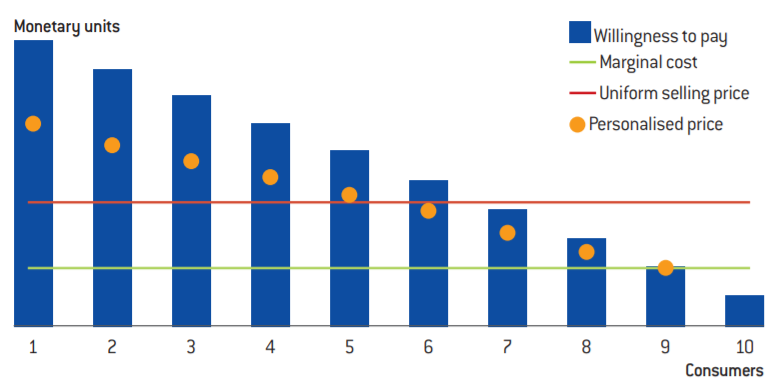

Let us explain this mechanism of personalised prices, using a simple numerical example from the OECD.

An example of customised prices

Source :

OECD, “Personalised Pricing in the Digital Era”, 28 November 2018, p. 10.

See Benjamin Reed Shiller, “First degree price discrimination using big data”, Working Paper n°58, Brandeis University, Department of Economics and International Businesss School, 2014.

See Ben Shiller and Joel Waldfogel, “Music for a song: an empirical look at uniform pricing and its alternatives”, The Journal of Industrial Economics, vol. 59, n° 4, December 2011, p. 630-660.

See Jean-Pierre Dubé and Sanjog Misra, “Scalable price targeting”, Working Paper n° 23775, National Bureau of Economic Research, September 2017.

Ten clients, numbered 1 to 10, have a different maximum willingness to pay. Client 1’s willingness to pay is very high, while Client 10’s is very low. The company produces with a constant production cost. If the company decides to apply a uniform selling price, it sets it at a level higher than its cost of production (the red line on the graph). At this price, only customers 1 to 6 buy the product, insofar as their maximum willingness to pay is higher than the price. Customers 7 to 10 do not buy. However, the company can also apply personalised prices (yellow dots on the graph), which are related to the maximum willingness to pay of each customer (without going so far as to set a price equal to the willingness to pay): customer 1 will pay more than before, as will customers 2 to 5. For customer 6, the personalised price is identical to the uniform price. Customers 7, 8 and 9 now buy the good, as the company charges them a lower price than the uniform price. Only customer 10 does not buy anything, given that their willingness to pay is lower than the cost of

production.

This pricing policy is possible because customers are not aware of the price paid by other customers, except if they communicate amongst one another on social media. In the case of digital content, arbitration is technically complicated since the customer must first identify themselves before they can “consume”. Similarly, in the case of personal services such as real estate loans or insurance contracts, arbitrage behaviour is impossible, given that the contracts are registered and therefore cannot be transferred to another agent.

It is true, however, that in the case of physical products such as perfumes or clothing, arbitrage strategies are always possible: customers who pay high prices online will choose to buy from other sellers in order to benefit from a better price, for example through a platform such as e-Bay or LeBonCoin.

The “personal” price discrimination strategy makes it possible to increase companies’ profits in two ways:

– customers who highly value the good or service pay a higher price, which increases the margin per unit sold; in the previous graph, this is the case for customers 1 to 5;

– customers who did not buy the good or service when the price was uniform are now willing to buy it at a personalised price: this is the case for customers 7, 8 and 9. The company therefore increases its profit by increasing its volumes (when the selling price is higher than the marginal cost).

The rare empirical studies on the profitability of personalised pricing confirm the relevance of this strategy. Thus, a study from 2014 showed that if Netflix only mobilised demographic variables, its profit would only increase by 0.8%22. On the other hand, if Netflix used 5,000 variables related to the Internet user’s behaviour (and in particular the time spent watching movies) and applied differentiated prices according to customers, its profits could increase by 12.2%. In particular, some customers may be charged twice as much as the current price. Similarly, another study from 2012 showed that Apple could increase its revenues by 50 to 66% if it implemented a strategy of price discrimination on iTunes, depending on customer profiles23. A recent experiment was conducted by two researchers on the ZipRecruiter recruitment website24: the website applied a uniform pricing policy, consisting of a $99 monthly subscription for companies wishing to access job applications.

After collecting information on client companies – including their location – the authors proposed to implement, through an algorithm, customised prices, ranging from $119 to $489. The result was quite impressive as profits increased by 84%.

Yet personalised prices also present some risks for companies

These anecdotes are included in the OECD document “Personalised Pricing in the Digital Era”, 28 November 2018, p. 10.

“‘IP Tracking’ : conclusions de l’enquête conjointe menée par la Cnil et la DGCCRF”, 27 January 2014

The survey simply notes some rather unsophisticated discrimination practices:

– the booking fees are adjusted according to the time at which the Internet user makes their reservation. During “off-peak hours”, the application fees are lower;

– the price depends on the website previously visited. Especially if the customer has gone to a price website comparator before, they are offered a more attractive price.

See Jenny Schrader and Efthymios Constantinides, “Price discrimination in online airline tickets: the role of customer profiling”, 2014.

See Thomas Vissers, Nick Nikiforakis, Nataliia Bielova and Wouter Joose, “Crying Wolf? On the price discrimination of online airline tickets”, 7th Workshop on Hot Topics in Privacy Enhancing Technologies(HotPETs 2014), Amsterdam, July 2014.

See Patrick Coen and Natalie Timan, “The economics of online personalised pricing”, May 2013.

“Pricing Algorithms, economic working paper on the use of algorithms to facilitate collusion and personalised pricing”, Competition and & Markets Authority, p.38, 8 October 2018.

Aniko Hannak, Gary Soeller, David Lazer, Alan Mislove and Christo Wilson, “Measuring Price Discrimination and Steering on E-commerce Web Sites, Federal Trade Commission”, p. 305-318, November 2014.

See Timothy Richards, Jura Liaukonyte and Nadia A. Streletskaya, “Personalized pricing and price fairness”, International Journal of Industrial Organization, vol. 44, issue C, 2016, p. 138-153.

See Andreas Krämer and Regine Kalka, “How digital disruption changes pricing strategies and price models”, in Anshuman Khare, Brian Stewart and Rod Schatz (dir.), Phantom Ex Machina. Digital Disruption’s Role in Business Model Transformation, Springer, 2017, p. 87-103.

See the European Commission, “Consumer market study on online market segmentation through personalised pricing/offers in the European Union”, 2018.

However, these strategies, known as “identity management strategies”, are time-consuming.

Despite many “anecdotes”, few empirical studies have proven the existence of personalised online prices 25. It is not excluded that it may be difficult for an external observer to identify these practices and distinguish them from dynamic pricing. Thus, in the case of airlines, studies did not show that fares were modulated according to the Internet user’s IP address (so-called IP tracking practice)26. Other studies conducted on passenger air transport confirm the low prevalence of personalised pricing. For example, a study looked into the price differences on four airlines using two different computers and IP addresses27. The experiment consisted in connecting every day at the same time on both computers: one on which cookies and other “fingerprints” are activated; the other does not allow to follow the browsing behaviour. The experiment, conducted over a period of 1 month, covered 3,465 observations. The author concluded that there is no significant difference in results between the two computers, which means that navigation history and individual characteristics are not taken into account by airlines when pricing a ticket.

In the same vein, a study from 2014 analysed the prices of 25 airlines over several weeks, using several criteria28:

– the search engine and OS used;

– the type of customers, approximated by the type of websites visited on the Internet: wealthy customers go to luxury product websites and read financial information; price-sensitive customers visit product promotion and comparison websites more frequently; travellers often visit travel agency websites;

– the types of cookies, in particular according to their origin (collected on the booking website or collected when surfing the Internet);

– the location of the individual booking (New York or Leuven, in Belgium).

The authors conclude that, for the same search made at the same time, there is no significant difference in the prices according to the profiles. The OFT, the British competition authority confirmed the previous results 29: it is not possible to identify personalised pricing practices that go beyond the classification of individuals into large groups. The OFT’s successor, the Competition and Market Authority, updated the 2013 study based on 2017 data and came to a similar conclusion: “There was no evidence of pricing being different or personalised for different consumers”30.

However, some empirical studies have been able to identify personalised pricing practices. A study from 2014 shows that some websites such as Home Depot or Sears have different prices for the same product, but these practices remain quite marginal: they concern between 0.5 and 3.6% of the products tested31. On the other hand, price differences can be quite significant, and can reach, in absolute terms, several hundred euros. For example, the authors of this study showed that for the same hotel room in Paris, the price can vary from $565 to $633, a difference of 12%, depending on the profile of the person booking.

If we assume that the low occurrence of personalised prices is due to the caution of companies, the reasons for this phenomenon remain to be explained. Three main obstacles to the use of personalised prices can be identified.

The first obstacle is found on the side of consumers. They do not know the individual criteria on which the personalisation is based. Companies may then expose themselves to revenge, particularly via social media: a consumer who realises after purchasing a given product that they have paid a higher price for it (for example by talking to other consumers on social media), will stigmatise the company by accusing it of “theft”. Behavioural economics has indeed highlighted that consumer behavior is biased:

– an “asymmetrical aversion to inequity”: the consumer is reluctant to pay more than others, even if they accept that others pay more than they do. They feel like they “got screwed”, even if the price is in absolute terms lower than they expected32.

– a dualism in the perception of price movements (“dual entitlement”): if a price increase results from an increase in costs, it will be perceived as more justifiable than if it results from an increase in demand;

– an “anchoring bias”: the consumer values the existence of a reference price, from which a personalised price is calculated. It is not equivalent to offer the customer a discount on a starting price, known to all, and to directly offer a personalised price without any reference system: a price of 70 euros is not perceived in the same way as a discount of 30% on a reference price of 100 euros.

The rare empirical studies on the perception of personalised prices show that these practices remain unacceptable to customers.

For example, in 2016, a survey was conducted on customers’ acceptability of personalised pricing on the Amazon website33. Their result was clear: while customers accept certain forms of discrimination based on volumes or booking date, 87% of them consider that personalised prices are a problem. Moreover, 54% of them consider that if Amazon applies personalised prices, particularly according to the type of device used (PC or smartphone), this would be a sufficient reason not to purchase from the Amazon website. In fact, in 2000, Amazon conducted an experiment, consisting in randomly selling the same DVD for $3 to $4 more than the standard price, quickly provoking a negative reaction from consumers. While this is not a personalised pricing practice, it shows that price differentiation is not well received by customers. Amazon’s boss himself, Jeff Bezos, had to apologise, explaining that this was just an experiment, and made a solemn commitment not to set prices based on individual variables.

Similarly, a recent European Commission survey on consumer attitudes towards personalisation practices on the Internet reveals a clear rejection of personalised prices: only 8% of respondents believe that personalised prices are “beneficial” and 36% that they have advantages and disadvantages34.

The second obstacle is on the side of Internet users, who may decide to react to personalised prices by trying to circumvent them. A real game of hide and seek may then be set up, in which companies’ efforts to personalise prices will be circumvented by Internet users in different ways:

– by limiting the information available to companies: private browsing, use of browsers such as Qwant or Duckduckgo that guarantee the anonymity of Internet users, refusal of cookies;

– by trying to trick algorithms, for example by creating several profiles, changing devices, using different credit cards or IP addresses or by waiting before finalising a shopping basket35;

– making greater use of price comparators before buying in order to obtain a reliable price reference;

– by using competing websites that do not offer personalised prices;

– by developing secondary transactions through resale platforms such as e-Bay: people who are able to pay less for a product could buy it in order to resell it to others.

The last obstacle is on the part of public authorities, which have significantly strengthened the rules on personal data protection, such as the DGPR in Europe, which came into force in May 2018. It should be noted that the DGPR reinforces the obligation of information and transparency in the collection, use and storage of personal data: companies must obtain the explicit consent of individuals, who can consult, rectify or even delete the data concerning them. In particular, Article 4 of the European Regulation addresses the issue of “profiling”, a technique consisting in collecting information on an individual or group: any individual who is “profiled” must be informed and has a right of opposition “for reasons relating to their particular situation”. Failure to

comply with the provisions of the DGPR may lead to penalties of up to €20 million or 4% of the company’s worldwide annual turnover: in other words, companies will look twice before engaging in personalised pricing practices on the basis of sensitive information.

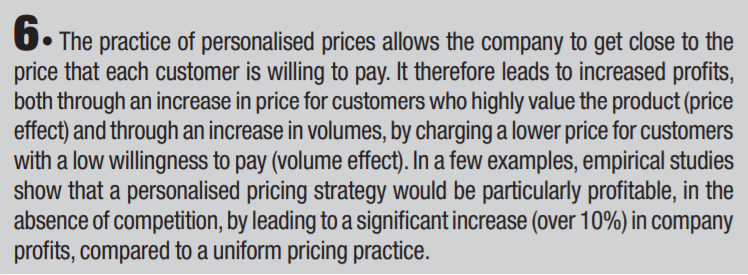

Given these different obstacles, it is likely that companies will engage in personalised pricing with the greatest caution, using techniques that are less “visible” than the direct display of different prices: different ancillary costs, targeted discount coupons, etc.

Some indirect personalised price practices

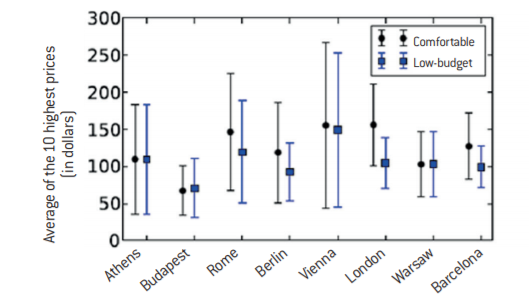

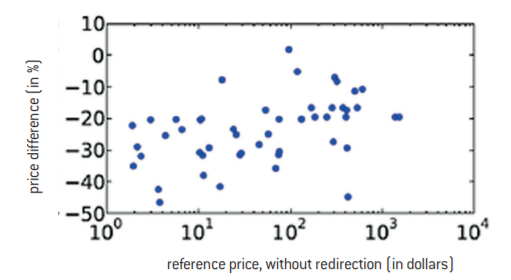

In particular, companies can differentiate the display of the results (“search discrimination” or “price steering”), when the products are both very numerous and very differentiated, as is the case in the hotel industry: depending on the customer’s profile, the products displayed on the first page are not the same according to Internet users (see graph below).

Similarly, researchers developed three different customer profiles and confirmed the existence of discrimination in the display of results: for the same search, customers with high revenues (“affluent consumer”) are offered, on average, hotels at higher prices than customers with a low budget (“budget conscious consumer”) for the first ten hotels displayed on the page..

Hotel room prices for the first 10 results displayed, based on two customer profiles

Source :

Jakub Mikians, László Gyarmati, Vijay Erramilli and Nikolaos Laoutaris, “Detecting price and search discrimination on the Internet”, Proceedings of the 11th ACM Workshop on Hot Topics in Networks, HotNets-XI, October 2012, p. 79-84.

See Aniko Hannak, Gary Soeller, David Lazer, Alan Mislove and Christo Wilson, art. cit.

Consumer and Markets Authority (CMA), “Pricing algorithms. Economic working paper on the use of algorithms to facilitate collusion and personalised pricing”, 8 October 2018, p. 63.

Other researchers conducted a study on sixteen e-commerce websites in the United States and also found a differentiated display of the results according to customers: in nine cases out of sixteen (four e-commerce websites and five ticket reservation websites), the order of results differed according to factors such as browsing and purchase history 36. More recently, the 2018 survey of the British competition authority, the CMA, confirmed, on the basis of a test on 10 major online sales websites (Amazon, Ryanair, Booking etc.) the existence of a differentiated order of results according to the operating system used or the fact of being “logged in” or not 37: for example, on the Opodo website, the fact of identifying oneself leads to more expensive hotel recommendations. Similarly, companies can display a reference price and then target discount coupons to specific customers based on their browsing experience or purchase history. Thus, researchers compared the price offered on the Shoplet.com e-commerce website, when the customer accesses it directly and when they first go through a promotional website, thus indicating their high price sensitivity. The website systematically offers a promotion to the customer through a promotional website, with an average reduction of 23% of the price displayed on the website and up to 50%.

Percentage price reduction when the Internet user first goes through a promotional website

Source :

Jakub Mikians, László Gyarmati, Vijay Erramilli and Nikolaos Laoutaris, “Detecting price and search discrimination on the Internet”, Proceedings of the 11th ACM Workshop on Hot Topics in Networks, HotNets-XI, October 2012, p. 79-84.

See Arvind Narayanan, “Personalized Coupons as a Vehicle for Perfect Price Discrimination”, 33bits. wordpress.com, 25 June 2013.

Geofencing allows companies to send messages or offer services to their customers, based on the location of their smartphone when they are in a certain geographical area (around a store, for example).

See Timothy Richards, Jura Liaukonyte and Nadia A. Streletskaya, art. cit.

According to a study from 2013 based on American data, the practice of differentiated promotions is accepted by a third of customers, probably because it is based on a reference price to which a discount is applied, i.e. a price differentiation mechanism that is, as we have seen, more acceptable to the consumer38.

The real-time sending of discount coupons could also be developed tomorrow in physical stores, thanks to geofencing39: thus, a customer shopping at the supermarket can be offered a discount in real time, during their trip to the store, if the application detects, for example, that they have not bought a product that they used to buy.

Companies can also discriminate between prices from one individual to another by offering them the possibility to participate in the formation of the price, for example with an auction. An empirical study from 2016 showed that customers are more willing to pay a price that is different from other customers when it is determined in a “playful” and participatory way40. Indeed, when the customer participates in the formation of the price, they are less inclined to contest the result, even if it is unfair to them, insofar as they have the feeling of a certain “control” over its formation.

Should consumers be concerned about personalised prices?

For a discussion of the different effects of discrimination on the market, see Chapter 12 of Ezrachi & Stucke’s book (2016).

The Council of Economic Advisers, Big data and Differential Pricing, Executive Office of the President of the United States, February 2015, p. 16.

Cited in Sam Thielman, “Acting Federal Trade Commission head: internet of things should self-regulate”, theguardian.com, 14 March 2017.

New York City Department of Consumer Affairs, “From Cradle to Cane: the Cost of Being a Female Consumer; A Study of Gender Pricing in New York City”, December 2015, p. 76.

An empirical study on France (2015) on price differences between certain products and services fails to identify a systematic bias against women, even if it finds differences on products for women and those for men.

See Casey Bond, “7 Weird Examples Of How Women Pay More Than Men For The Same Products”, huffpost.com, 10 juillet 2019.

See Emily Tess Katz, “Why Women Are Paying $1,300 More A Year For The Same Exact Products As Men”, Huffington Post, 20 November 2014.

See Tamar Kricheli-Katz and Tali Regev, “How many cents on the dollar? Women and men in product markets”, Science Advances, vol. 2, n° 2, 19 February 2016.

This is a reading and scoring test of a text: when the reader is informed that the text has been written by a woman rather than a man, the text is not evaluated as positively. See Philip Goldberg, “Are women prejudiced against women?”, Transaction, n° 5, April 1968, p. 316-322.

To verify this explanation, Kricheli-Katz and Regev (2016) conduct a small experiment: they ask a panel of customers how much they would be willing to pay for a $100 Amazon gift card, sold by Alison (female first name) or Brad (male first name). The result is clear: customers are willing to pay $87.42 if the card is sold by Brad and $83.34 if it is offered by Alison.

See Ian Ayres and Peter Siegelman, “Race and Gender Discrimination in Bargaining for a New Car”, The American Economic Review, vol. 85, n° 3, June 1995, p. 304-321.

See Benjamin Edelman, Michael Luca and Dan Svirsky, “Racial discrimination in the sharing economy: evidence from a field experiment”, American Economic Journal: Applied Economics, vol. 9, n° 2, April 2017, p.1-34.

AirBnB acknowledged the problem in 2016, following the publication of scientific articles on the subject, by entrusting a report to Laura Murphy, a personality committed to the fight against discrimination. Several recommendations from the study have been implemented by AirBnB, including:

– the signature of a commitment by landlords to ensure equal treatment for all customers;

– a service to assist clients who are victims of discriminatory behaviour;

– an incentive to use “instant booking”, consisting in accepting the rental request before even seeing the client’s profile.

See Benjamin Edelman and Michael Luca, “Digital discrimination: the case of Airbnb.com”, Working Paper n°14-954, 14 January 2014, Harvard Business School.

See Yanbo Ge, Christopher R. Knittel, Don MacKenzie and Stephen Zoepf, “Racial and Gender Discrimination in Transportation Network Companies”, Working Paper n° 22776, National Bureau of Economic Research, October 2016.

See Cathy O’Neil, Weapons of Math Destruction: How Big Data Increases Inequality and Threatens Democracy, Crown, 2016.

Assuming that custom pricing practices will develop tomorrow, should consumers really worry about them? The natural reflex would be to condemn these practices, on the grounds that they are “unfair” because they take advantage of individual differences. Yet, in reality, things are more complex. Discrimination in the form of personalised prices can have the effect of widening the size of the market 41. Indeed, a personalised price certainly means that those who are willing to pay high prices will pay more than the uniform price; but conversely, an individual with a low willingness to pay will be offered a preferential rate and will therefore be able to access the market. In other words, personalised prices increase the profit of the companies that charge them, but they also benefit certain consumers, as pointed out in an economists’ report from 2015: “Economists typically see value-based pricing as a tool for expanding the size of the market by charging more to those willing to pay and less to those who are not”42.

More recently, in 2017, FTC Commissioner Maureen Ohlhause reiterated this argument: “Information can be used to target some consumers with higher prices but the same information can be used to target consumers with a better deal”43.

It is true that personalised prices operate a double redistribution of wealth:

– between consumers: some will pay more than before, while others, who did not have access to the market, will be offered an attractive price. In our numerical example, customers 1 to 5 pay a higher personalised price than if the company had applied a uniform price. The acceptability of such a redistribution of wealth between consumers is complex to analyse: on the one hand, personal discrimination can be considered as leading to “making the rich pay”, while it favours market access for those with the fewest means. However, things are not that simple: an individual’s maximum willingness to pay depends not only on their income level but also on their preferences and constraints. For example, being willing to pay more for gasoline does not necessarily result from a higher income, but simply reveals that you live in a rural area and that the use of a car is essential. A differentiated fuel pricing strategy would then lead to higher prices for people with an imperative need for their cars and not necessarily for the wealthiest people;

– from consumers to businesses: discrimination leads in principle to an increase in profit, to the detriment of a certain section of consumers. More fundamentally, personalised prices challenge an essential principle on which the entire retail trade has been based for more than a century: the existence of a reference price (which can be, for example, an average observed price or a maximum recommended price), on the basis of which customers can position themselves and make a choice. By pushing the logic of the personalised price to the extreme, the notion of a reference price disappears: for the same product, the number of prices would become equal to the number of customers. The risk is then that of a generalised mistrust against companies that will engage in this type of practice.

It should be noted, however, that the existence of a “reference price”, while common in the distribution of physical goods, is less frequent in the field of personal services, such as real estate loans or insurance: it can therefore be assumed that personalised prices, which already exist in practice, will be more acceptable in services, given the absence of a single reference frame and the need to take into account each client’s risk profile.

Moreover, it remains to be seen what criteria companies will use tomorrow to differentiate prices among individuals.

Two main types of criteria could be used in this regard:

– criteria that are mainly linked to individuals’ incomes: for example, being young or in a delicate professional situation (unemployment, precariousness). In this case, the personalised price on the Internet, if it takes the form of a preferential rate, will be socially acceptable, insofar as it is based on an objective factor: it is displayed as a price reduction and it is linked to an income

constraint;

– criteria over which individuals have no real control: gender or skin colour are particularly important. The personalised price, especially if it takes the form of a higher price (or even a refusal to contract), will provoke violent reactions.

This second case cannot be excluded in principle: although it remains rare, price discrimination based on gender or skin colour already exists in the world of physical commerce and on the Internet. For example, women are sometimes victims of a “pink tax”. A study by the city of New York in 2015 on 800 products available in male and female versions revealed that a systematic price differential persists to the disadvantage of women, averaging around 7%44. For some products such as shampoos, the price difference, for the same quality, can reach up to 48%45. In general, this distinction between generic products is noticeable for items such as clothing and beauty products/services, such as razors, soaps or haircuts, but extends to medicine, children’s toys, etc.46 In

the United States, women spend about $1,300 more than men on the same products and services each year 47.

E-commerce does not escape price discrimination on the basis of gender. For example, a 2016 study showed that when a woman sells a product on eBay, the final price is lower than that of a male seller, for a product and a reputation of the same sellers 48. This difference is explained by the presence of a stereotype, known as the Goldberg paradigm49: a product sold by a woman is systematically less valued than the same product sold by a man. In the case of eBay, this means that the bidding rises lower when the seller is a woman50.

Price discrimination based on skin colour also exists in physical commerce and on the Internet, although examples remain rare. For example, a study found that people of colour pay a higher average price when buying a new car 51. Online commerce is not immune to these behaviours, particularly on reservation websites that require users to log in before concluding a transaction. For example, researchers created several customer profiles on the AirBnB housing reservation website, some with African-American sounding first names, and then sent email for a housing rental request 52. It appears that, all other things being equal, a person with an African-American sounding first name has a 16% lower chance of being accepted than a client with an Anglo-Saxon sounding first name 53. Another study showed that black AirBnB guests have more difficulty finding a customer for their apartment, which translates into a price decrease of around 12%, all other things being equal 54. Racial discrimination can also result in longer waiting times. A study of four American cities found that waiting times for a taxi in Seattle were 35% higher for black people than the average. In Boston, the rate of cancellation of trips by the driver is higher when the reservation has been made by a black person55.

Without even going so far as to establish explicitly discriminatory criteria based on skin colour or gender, a price algorithm can unintentionally produce a result that is discriminatory: the crossing of seemingly harmless or “neutral” variables can lead to an outcome that is not. For example, a study by proPublica shows that Princeton Review’s strategy of setting prices according to post codes leads in practice to higher prices for people of Asian origin. One can imagine all the possible excesses of this “spatial” discrimination, which could in practice lead a company to systematically disadvantage certain members of the population: for example, a recruitment or apartment rental agency could prioritise requests according to the Internet user’s post code or residential area, leading statistically to always discriminate against the same type of individuals.

Similarly, customised prices can lead a company to use variables that are not directly related to the usual price determination criteria. The case of car insurance is interesting in this respect: the price of an insurance policy is supposed to reflect a driver’s degree of risk, which is itself a function of factors such as their observed driving behaviour (bonus-malus system). With Big Data, an insurer could set the price of their car insurance according to a “composite portrait” of the customer (through an “e-scoring”) and not their risk level. Cathy O’Neil showed that in the United States the use of “e-scoring” can lead to surprising situations: a driver who has never had an accident but with a low “e-score” will be offered a more expensive insurance policy than a driver

who has been prosecuted for driving under the influence of alcohol but who has a good “e-score”56.

See Kevin Hogan, “Consumer Experience in the Retail Renaissance: How Leading Brands Build a Bedrock with Data”, deloittedigital.com, 6 June 2018.

For companies, the temptation of personalised prices is very strong, insofar as it leads to a substantial increase in profits. It can be seen that companies are fully aware of this potential leverage: according to a recent Deloitte survey of 500 large companies, the primary motivation for brands to develop the use of artificial intelligence is to move towards personalised prices and promotions 57.

Yet, on the other hand, personalised discrimination can create distrust among customers, especially when it is not based on transparent and objective criteria, and can lead to a drop in profits in the future. In this respect, it should be noted that food retail giants, who have long held valuable information about their customers through loyalty cards, have never really gone to the field of personalised prices, beyond discount coupons, even though electronic labels now allow it: they probably fear losing the trust and therefore the loyalty of customers to their brand, if prices were to be differentiated according to individuals.

Summary of the study in eight points

No comments.